The role of the accountant

In today’s increasingly competitive and uncertain business environment, organisations fighting for customers face a number of factors and issues which they may not be able to control and which affect performance. Professional accountants have a vital role to play in commercial success, by using their increasingly valuable knowledge in a way which gives their organisations or clients a competitive advantage.

But it is critical that this information is used in a way which is both fair and honest. This case study demonstrates how a professional body like ACCA (Association of Chartered Certified Accountants) has the responsibility for defining best business practices and supporting its members; helping them to use their knowledge for the benefit of their employers, clients, and other stakeholders. It also illustrates how ACCA provides a knowledge base for over 300,000 members and students in 160 countries worldwide and encourages its members to operate commercially but within well-defined ethical standards.

An organisation’s managers and other stakeholders (shareholders, suppliers, customers, the government, lenders, employees) will have differing concerns about how an organisation is performing e.g. its sales and profitability. They may also be interested in the organisations:

- level and type of debt

- order book

- development plans, given current market conditions

- value and type of assets.

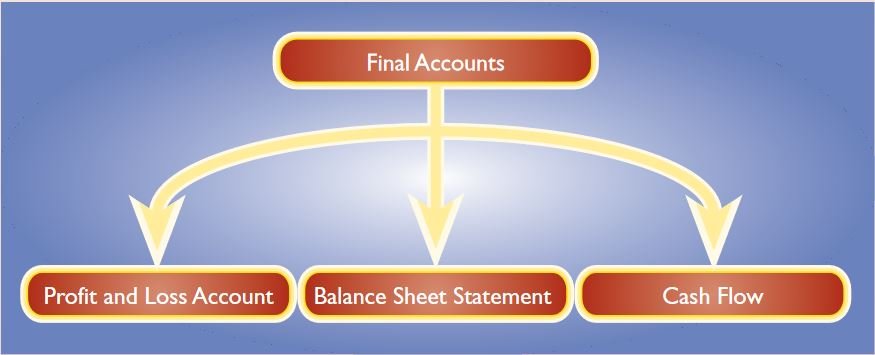

To satisfy these concerns and make decisions based on them, these stakeholders require information. Much of the information supplied by accountants appears in the form of final accounts, which are subject to independent scrutiny (by independent external accountants acting as auditors) prior to public release. These audited accounts are used to assess performance over an accounting period.

For large organisations, they will include:

- a profit and loss account. This compares an organisation’s outgoings (expenditures) with its income. In effect, it records the outcome of everything the business has done over a measured period of time.

- a balance sheet. This provides a snapshot of what a business owns and owes on a particular date.

- a cash flow statement. This reviews past cash movements, indicating when and how profits have been earned and whether the business has enough money to continue trading.

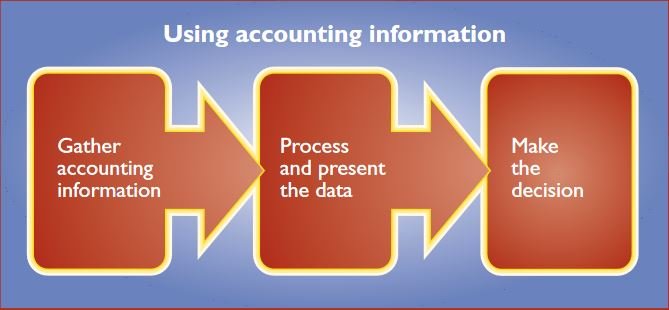

Accounting activities collate data into standard, intelligible formats. An organisation’s decision-takers can then use this to:

- understand how well or badly the organisation is performing

- form a view on how the organisation, in whole or in part, is likely to perform in the future.

This information enables managers to consider the vital question “What is likely to happen if we take a certain action or no action at all?” The answer to this provides insights into what actions to take. In the modern world, accountants are likely to have an input into almost all areas of business activity. Many accountants work in audit, providing advice and services to all sizes and types of businesses, while others work on non-financial matters, many of which involve strategic decisions which affect the long-term health of their own organisations.

Accountants operate at many levels and in several different roles within all types of organisations. Although some accountants operate in an advisory role to management, others go on to managerial positions, within firms of accountants which they themselves may own, on the board of public limited companies, or in the public or voluntary sector. An accounting background has proved invaluable to many people who have progressed to be directors and chief executives of large multinational companies or their own companies, as it provides them with crucial knowledge and insight into the business.

The need for accountants to be qualified

Reputable organisations want to work with reputable accountants. That means dealing only with accountants who have an officially recognised qualification. To be properly qualified, accountants must have passed examinations that make them eligible for membership of one or more professional accounting bodies, such as ACCA.

Qualified accountants can specialise in many areas, including:

- taxation

- insolvency

- corporate finance

- auditing

- management accounting.

Some accountants become specialists in the concerns of particular industries, such as sports, entertainment and farming, or types of organisations – charities, multi-national companies or hospital trusts.

They are able to apply their accounting skills to businesses with which they are familiar and whose particular needs they understand, meaning they can do a better job and add more value through the services they give their clients. Some accountants now specialise in new areas of business interest such as the pursuit of sustainability, and social and environmental reporting. Accountants have a big contribution to make in showing that a ‘green’ approach towards production need not reduce profitability.

Accountants are often called on to give advice on particular projects e.g. an organisation’s plan to automate production, or to diversify its operations. Qualified accountants who have taken rigorous exams and belong to professional bodies are therefore at the heart of decision-taking. They have a responsibility to ensure that the accounting functions are carried out to the highest possible standards. They must do all they can to ensure that the information which an organisation provides for its stakeholders really is a ‘true and fair account’ of the organisation, its activities, and its current financial health.

For much of the time, accountants can be sure of the full cooperation of organisations in achieving this goal, but there are other occasions when accountants may find themselves being asked to perform accounting and auditing services for an organisation which is attempting, if it can, to mislead its stakeholders.

ACCA and standards

As a global organisation and the largest international accounting body ACCA’s mission is to:

“provide professional opportunities for its full members and student members pursuing qualification“.

In doing so it aims to be:

“a leader of the global accountancy profession“.

At the heart of this is the need to promote the highest ethical and governance standards, and to work in the public interest. Governance standards are at the heart of the accountancy profession. This is because accounting information is vital to a range of different users to make financial decisions. If this information has been prepared or presented in inconsistent ways, any decisions taken may be ill-advised and inappropriate with potentially damaging consequences.

In recent years the corporate world has been shaken by the accounting irregularities associated with Enron and WorldCom. Both cases highlighted the need to constantly monitor and develop accounting standards. First, there is a need to create robust internationally recognised procedures. Then there is a need to ensure that every accountant follows them.

In the cases of Enron and WorldCom, accountants and consultants were criticised for not carrying out their professional duties properly. Since these scandals, ACCA has played a major role in advising governments and regulators across the world on how to improve accounting regulation. The need for common accounting standards was first identified in the late 1960s. In 1970 the first Statement of Standard Accounting Practice (SSAP) was introduced. This was done to prevent accountants from using diverse accounting procedures that caused confusion and meant that accounts from different organisations could not be compared on a like-for-like basis.

In recent years the International Accounting Standards Board (IASB) has been introduced to provide a more independent process for setting International Financial Reporting Standards (IFRS). These accounting standards define best practices for all financial statements, and ACCA was the first body to base its syllabus on international standards.

As well as accounting standards produced by the IASB, ACCA also has its own code of ethics for its members. The fundamental principles of this code require ACCA members to:

- behave with integrity in all professional, business and personal financial relationships

- strive for objectivity in all professional and business judgements

- only accept or perform work which they are competent to undertake

- carry out their professional work with due skill, care and diligence and with proper regard for the technical and professional standards expected of them as members

- behave with courtesy and consideration towards anyone with whom they come into professional contact.

ACCA’s code of ethics provides standards for its members to follow and reflects the expectations of any civilised society operating under the rule of law. Applying the code also enables stakeholders to understand the performance of an organisation, based on the fairest and most truthful portrayal of its affairs.

Supporting members

ACCA’s emphasis upon high standards for and expectations of its members starts with its qualification requirements. Qualifying as an accountant is tough. ACCA qualified accountants have taken rigorous examinations and must obtain a minimum of three years’ work experience in order to qualify. They are then authorised to offer a full range of business accountancy, auditing, financial and taxation services.

ACCA recently relaunched its website to improve its services to members and other users. Through it, members can plan their own professional development, while other users can access research reports, keep up to date on responses to the consultation, and also learn about the latest legal and regulatory requirements.

Ethical business practice

ACCA members have gained the benefit of their qualifications to further their careers in their chosen fields. There are ACCA trained accountants working at the highest level in national governments, for example, as auditor generals, chief executives or as managing directors in leisure, fashion and entertainment. They also specialise in a number of areas, including in audit, forensic accounting – financial detective work, the public sector or providing advice to small businesses or individuals.

To help dispel the myths often associated with accountancy and to give students the opportunity to show they have what it takes to succeed in business, ACCA organises a series of Schools Business Challenges around the UK.

The challenges are aimed specifically at sixth form students interested in a career in business and finance and are run in partnership with universities as part of the open day or widening participation programmes. One of the challenges is a computerised business simulation based on running a commercial radio station. Teams of pupils make a series of business decisions and compete to run the most profitable and successful station. They assess the business risks and commercial issues facing them and identify new opportunities.

ACCA is concerned that too many teenagers may be ignoring accountancy as a possible career because they still have a traditional view of the profession. It uses this competition to show them how much has changed and how accountants now have a vital role to play in the success of modern, fast-moving businesses, which range from radio stations to football clubs, and Internet firms to car manufacturers.

For those who are interested in entering the accountancy profession, there are a number of ways to become eligible for the ACCA Accountancy qualification. These include gaining two or more A levels or the equivalent, taking ACCA’s Certified Accounting Technician (CAT) qualification or completing a degree course. The qualification offers an opportunity for students to obtain a BSc honours degree in applied accounting after they have successfully completed two thirds of the professional examination scheme.

Conclusion

In an increasingly knowledge-based world, the most important resource for any organisation is the people who work for it. They are the key asset that enables an organisation to create and sustain a competitive advantage. Success in the knowledge-driven economy involves using the expertise and professional skills of employees and specialist consultants to develop business opportunities that meet the needs of global customers. Accountants have a vital role to play in this process.

At the same time, there are also higher expectations of how both individuals and organisations should behave. ACCA is constantly striving to define best practices and promote higher standards for its members, and this has involved the constant evolution of accounting practices.