An entrepreneur is someone who is prepared to take a risk by setting up and organising a new business or enterprise, without the certainty that a profit will result. Setting up and running a business is not something that everyone with a good idea should take on. It requires hard work, focus, the ability to enjoy challenges and not be put off by failure.

This case study focuses on the entrepreneur Peter Cruddas, who set up his own business CMC Markets in the early 1990s with just £10,000 of capital. The case study shows how Peter was able to spot a gap in the financial services market by using the latest technology at that time the internet. Peter took the risk, got in first and quickly took the lead. Business people refer to this as the ‘First Mover Advantage’. Another good example of this was James Dyson with his bagless vacuum cleaner. If a business gets in first with a product or service, rivals can only play ‘catch up.

Peter launched CMC’s online trading platform in 1996. This new online platform was an innovation. His business can now deal in foreign exchange and trade over 3,000 different types of financial transactions for clients, using just one account in real-time through the internet. Before developing this software, dealers in financial markets needed several different accounts, all with different types of software. This was inefficient and productivity suffered. This has given CMC a unique selling point (USP) in this industry. Through CMC’s online service, traders are able to buy and sell financial products in almost every country.

CMC is competitive because:

- it is cheaper to deal with (fees are low because activity is carried out online)

- it is easy to make transactions. Transactions are carried out immediately (in real time). Traders can even buy and sell using their mobile phones.

CMC Markets is now a global company and Peter Cruddas is the wealthiest businessman in the city of London. CMC has 18 offices around the world, employs 1,250 people and has around 250,000 clients. The business continues to grow rapidly. In 2008 CMC carried out 21 million trades (buying and selling). 98% of these trades were online.

Entrepreneurship

There are three important aspects of entrepreneurship risk-taking, innovation and organisation. Entrepreneurship exists in many different types of business:

- Risk taking and innovation is required to start up small sole trader businesses owned by one person and partnerships involving a number of partners.

- Enterprise is also necessary in big companies like Marks & Spencer, Virgin or CMC to enable the business to grow.

Peter Cruddas was born in Hackney, London and left school at 15. To get to where he is today he has worked hard and thrived on taking risks. He started out working in a bank telex room where he learned to trade in foreign exchange markets. He saved his bonuses and by the time he was 36, he owned his own home (having paid off the mortgage). It was at this point that he began to develop as an entrepreneur by investing personal savings of £10,000 in his own business, Currency Management Consultants (CMC).

People start their own businesses for a variety of reasons. Some have a bright idea they want to develop; others become unemployed and start their own business to survive. Some set up to be their own bosses. Many, like Peter, spot a gap in the market where they can do something innovative that has not been done before. This requires a willingness to take a risk to introduce the new idea. In the mid-1990s Peter saw that many UK banks would not supply foreign exchange currencies to Middle East banks due to the Gulf War with Iran. Peter used his consultancy business CMC to fill this gap.

After five years he saw another opportunity when a software developer explained how he could use the internet to transform his business. Having worked in the foreign exchange markets, he understood how this superfast technology would enable traders to make financial exchanges at the touch of a computer key. Despite opposition from his finance director and company secretary, Peter invested £500,000 over two years in the technology. This allowed potential traders to buy and sell commodities such as shares, oil and currencies instantly. Peter Cruddas had developed an innovative service that financial traders across the globe wanted to use.

The third element of entrepreneurship is organisation. CMC is a large organisation built on a strong organisational platform. A good organisation depends on effective planning and monitoring and involves:

- obtaining the finance to support your organisation

- creating the systems, for example, having the right software

- employing the right people to ensure the company reputation is secure. Although Peter Cruddas is the Chair of CMC, he relies on people at every level within his organisation to think for themselves to be enterprising rather than to wait to be told what to do.

Why be an entrepreneur?

Anita Roddick, co-owner of the Body Shop and one of the UK’s great entrepreneurs said: ‘Nobody talks of entrepreneurship as survival, but that’s exactly what it is and what nurtures creative thinking. Running that first shop taught me business is not financial science, it’s about trading: buying and selling. It’s about creating a product or service so good that people will pay for it .’

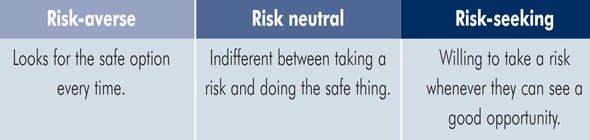

This approach reflects the way in which many of the UK’s best-known entrepreneurs take risks. These include Virgin’s Richard Branson, Dragon’s Den’s Theo Paphitis, and CMC’s Peter Cruddas. The business world consists of many risk-takers. Individuals have different attitudes to risk:

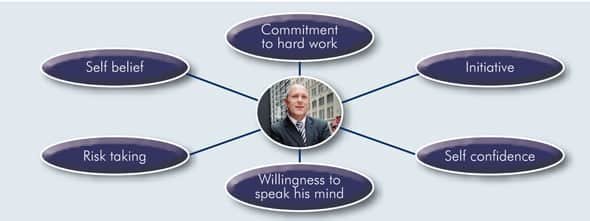

Willingness to take a risk is one of the ‘traits’ or personality characteristics of an entrepreneur. However, there are other traits that help Peter Cruddas to develop his business. When explaining why he opened a new office in Vancouver, Canada, he said: ‘I think the biggest asset I have as an entrepreneur is that I absolutely love business. For me, business is not difficult, it’s not a hardship. I don’t get out of bed every morning to make money. I get out of bed every day to do business. ‘

Additional traits include:

Peter believes that having a single focus is important. Unlike other entrepreneurs, he does not build or buy and sell other businesses just to make a profit. He finds work a pleasure and the success of his business is recognition of his achievement. For him, being an entrepreneur gives him control over his business and future.

Some entrepreneurs are described as ‘serial entrepreneurs’. They take and develop a business to sell it on quickly for profit in order to move on to something else. For example, in recent years some entrepreneurs have set up themed restaurant chains to sell on.

In contrast, Peter has stuck with the business he believes in. He makes the business work. Money doesn’t control him. His view is that if something is ‘good for the business, then it is good for the entrepreneur’.

Risk and reward

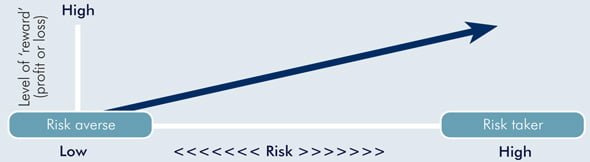

Often in business, there is a positive relationship between risk and reward. In simple terms, the greater the risk you take the more potential there is for high profits. However, there is also the possibility of making spectacular losses. The graph illustrates this relationship.

The risk-averse person does not take many risks and is unlikely to make a large profit or loss. The risk-taker is likely to make a much larger profit but may also make a larger loss.

Peter took on an enormous risk when he left his secure job to set up his own business. He took another risk in using his own capital in his new venture. However, Peter lowered the risk by conducting market research. He talked to potential customers to see if they were willing to subscribe to his service and how much they were willing to pay. Peter was used to managing risk. For nearly 20 years he had been operating as a foreign exchange trader. He was used to making instant decisions involving risk and often found common sense the best method. To take too big a risk was foolish.

Peter believes the secret of balancing risk and reward to achieve business growth lies in a number of key factors:

- Take risks but spread them. CMC offers many types of financial trading opportunities in addition to foreign exchange.

- Make sure to have a regular income coming in.

- Work hard.

- Keep control of the business.

- Have as wide a customer base as possible.

- Keep introducing and pushing through new ideas.

- Think laterally new and non-conventional ideas.

Peter also considers the opportunity cost in making high-risk decisions. The real cost of making any decision is the value of what must be given up to fulfil that decision (the next best alternative). For example, when Peter chose to set up CMC Markets, he gave up the opportunity of promotion and secure income. He believed that by setting up in business he would gain rewards that would more than compensate for the alternative sacrifice.

Support for business start-up

Many businesses and new ideas do not get past the drawing board. This may be because the potential entrepreneur is risk-averse. Another reason is that the entrepreneur does not know who to turn to for advice and support.

Peter Cruddas believes in supporting those seeking to set up a new and exciting enterprise of their own. He is a great supporter of the work of organisations like the Prince’s Trust and the Duke of Edinburgh Award schemes. The Duke of Edinburgh scheme provides bronze, silver, and gold challenges for young people. To win the awards, they carry out activities that take them out of their ‘comfort zone. These include, for example, outward bound activities, like abseiling or canoeing, or voluntary work in the community.

The Prince’s Trust was set up by Prince Charles and provides advice, support and also financial help to young people wanting to set up businesses of their own. It particularly helps young people in communities where there is deprivation and hardship. In addition, it provides mentoring and advice through people like Peter. Peter Cruddas is the biggest single personal donor to the Prince’s Trust. He finds giving back to the type of community from which he came very rewarding. Recently, at an award ceremony, he met a girl who had set up a flower business with help from the Prince’s Trust. She hugged Peter, which gave him a real sense of pride and achievement.

The government also provides a range of grants and subsidies for new business start-ups. These include direct, non-repayable cash grants for activities such as training or export development. Subsidies take the form of the government paying part of the cost of a particular activity that a business carries out. Other money can be borrowed in the form of ‘soft’ loans. These are repayable at a low rate of interest, with repayments spread out over time.

Young people setting up in business, therefore, do not have to feel that they are on their own. Many new businesses are benefiting from entrepreneurs like Peter to ease the way for the next generation of entrepreneurs.

Conclusion

Becoming an entrepreneur is not for everyone. It involves considerable challenges. Peter Cruddas provides an example of someone who has risen from a relatively humble background to set up a business and grow into a large enterprise.

Peter possesses a number of traits that have enabled him to achieve his objectives. His business would not have grown without hard work and careful planning and some risk-taking. However, he is not just a risk-taker. He is also an innovator with an eye for the detail of what works. Now he is able to share some of that expertise, as well as provide financial support, to entrepreneurs of the future.