Few organisations operate in a static environment. As we move toward the last years of the 20th century, the pace of change in Markets across the globe has accelerated with the result that products have shorter life-cycles. An innovation or a new product development can make other products obsolete overnight. It is said that the research and development of new products is both creative and destructive. As new products are launched others fall by the wayside. The major effect of this pace of development is that Successful businesses have to invest in technological change. If they do not, they risk their products being overtaken by the products of their competitors. Nowhere is this more the case than in the pharmaceutical industry. For organisations in this industry good marketing involves:

- Looking outwards in order to respond to changes in markets, business conditions and competition

- Looking inwards in order to develop both the organisation and its products to meet consumer needs which have been identified through the marketing process.

American home products corporation is a global, Innovation-driven company focusing upon discovering and developing cost-effective health care products. Each year, the company commits approximately $1 billion to investment in pharmaceutical research to make it one of the world leaders in research and development investment. This process helps to ensure that the company is well positioned for future growth in an industry which is constantly providing new life-improving products.

This case study focuses upon just one of the many products from the diverse businesses of American home products – ChapStick. From its early origins as a simple health care product, it has become, today, a highly sophisticated and successful product in an extremely competitive market.

When we think of products, we tend to think of brands representing those products. A brand identifies the products from an organisation through specific features such as a name, sign, term, symbol or other creative element. ChapStick has a distinct advantage as a brand. The advantage is that the name ChapStick has become increasingly associated with the product. Today people refer to the vacuum cleaner as the Hoover, clear sticky-tape as Sellotape and when referring to lip balm – they say ChapStick.

The brand

ChapStick has come a long way since a certain Mrs Morton melted the pink ChapStick mixture on her kitchen stove and poured the liquid through a small funnel into brass tubes. The rack was then moved to the porch for cooling, after which, the moulded ChapStick was cut into sticks and placed in containers for shipping. All of this was made possible in 1912 after Mrs Morton’s husband John had bought the rights to the product from a local chemist for $5.

Today the brand is owned by American Home Products Corporation and manufactured on a modern production line. During a typical shift, 85,000 units of the product are made.

Today’s product range

In the UK, Whitehall Laboratories (owned by American Home Products) makes a range of ChapStick which all contain a sunscreen. The product range is comprised of:

PRODUCT RETAIL PRICE

Original 1.05p

Strawberry 1.05p

Cherry 1.05p

Mint 1.05p

Orange 1.05p

Medicated £1.39

Medicated Gel £1.62

Sunblock 15 £2.45

The market

The market in which ChapStick sells is a growing one as it becomes normal practice for people to take more care of their lips. Sales continue to be highly seasonal as consumers see more of a need for the product in poor weather, i.e. when it is wet and cold in autumn and winter. However, this picture does not tell the whole story. Market research has shown that whilst:

- 47% of consumers use ChapStick for treating dry/sore lips,

- there are, in addition, 32% who use it to protect or moisturise their lips.

The target market for ChapStick is predominantly:

- Females aged 16 – 34 years.

There is also an increasing male market for ChapStick, especially amongst the young who are less conservative in their ways. 59% of young females claim to use ChapStick to “treat dry lips” by which they imply moisturising lips rather than treating sore ones. Whilst there are an increasing number of consumers who purchase ChapStick as a regular part of their lifestyle, i.e. to moisturise their lips, it seems that many buyers purchase a lip balm on impulse. This means that they see the product on display and say to themselves – “That’s a good idea, I could use that!”

This may be because they have dry or chapped lips at the time, or more likely because they feel that buying a lip moisturiser is going to make them feel good. The nature of the product and of purchasing patterns, mean that it is not particularly price sensitive. Consumers are just as likely to buy a Strawberry ChapStick at £1.03p or £1.07p as they are at £1.05p.

Market research in 1994 indicated that only 7% of consumers buy lip balm each month. The reality was that the majority of people bought lip balm only once a year or less often – this was the case for 79% of men and 56% of women. Therefore the product had not yet become a major part of the lifestyle of most people. However, amongst current consumers the product is widely used, i.e. 42% claim to use their lip balm at least once a week. Women consumers typically make frequent use of lip balm. In developing the market presence of a product, it is always helpful to examine what is happening in other markets where the product has been established for a longer period of time. For example, in the United States, several applications a day of lip balm are commonplace.

The competition

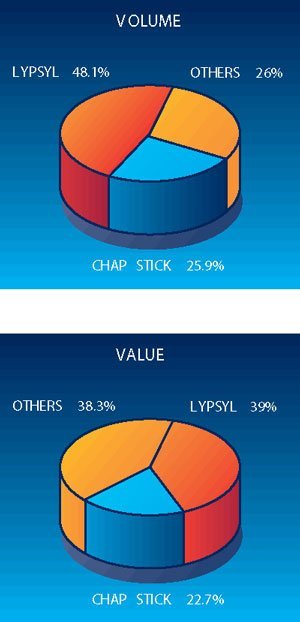

In the UK market ChapStick currently has the second highest market share. The current market leader is Lypsyl which has 48.1% of the market share through chemists, compared with ChapStick at 25.9%.

Lypsyl also has a strong presence through supermarkets and other retail outlets. Other competitors include Blisteze (sold largely for cold sores), Labello and own brands such as those at Boots and Superdrug, together with Body Shop products. The last twelve months has seen the emergence of two new competitors – Neutragena and E45. Competition has never been so fierce.

The marketing mix

The marketing mix is made up of four main ingredients which an organisation combines in order to ensure that marketing objectives are achieved. The mix is usually analysed on the basis of the four Ps. To meet customer needs, an organisation must develop products to satisfy them, charge them the right price, get the goods to the right place and make the existence of the product known through its promotion.

“Mix” is an appropriate word to describe the marketing process. A mix is a composition of ingredients blended together to fulfil a common purpose. Every ingredient is vitally important and each depends on the other for its contribution. Just as with a cake, each ingredient is insufficient on its own – but blended together they produce something very special. In the same way as there are various cakes to suit various tastes, a mix can be designed to meet the precise requirements of the market.

In terms of product, ChapStick meets a variety of needs. Its main benefits are in protecting and moisturising lips. However, it has a number of other marketing features including flavourings, a sunscreen, a convenient to carry around shape and a ‘sporty’ healthy image.

Price When ChapStick is an infrequent purchase, consumers are not especially influenced by its price. However, for frequent users, price is an important consideration, particularly when trying to attract frequent users. In a market with alternative products available, it is important to charge a price which is broadly similar to other competitors.

Promotion During the 1990s, ChapStick has been advertised in women’s and teenage magazines. In addition, ChapStick has been promoted in chemists where prominent display is encouraged close to the till. The main emphasis on advertising in recent years has been on the ‘kiss’. However, the new emphasis in promotional activity has been on point of sale material, rather than on press advertising, which has focused on active lifestyles. ChapStick is portrayed as being a lively brand for a modern lifestyle as well as having functional benefits in protecting lips. Advertising and sales literature have depicted outdoor activities and situations involving both males and females.

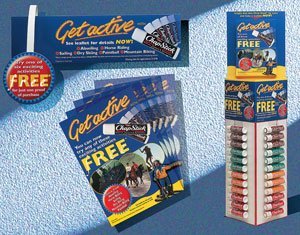

1995/96 Promotion – Get Active with ChapStick.

To gain impact in 1996, ChapStick has been promoted in chemists, again close to the till, using the “Get Active” advertising. The promotion was consistent with outdoor lifestyle activities. To be appealing to the primary target market of 16-34 year old females, the offer was based on recreational activity rather than outdoor pursuits. The promotion included an offer – for proof of purchase, the consumer could experience one of several activities when accompanied by a paying person and the list included activities such as horse riding, dry skiing and sailing.

Place It is most important to promote ChapStick into chemists and retailing outlets. A recent solution to winning sales in a number of smaller retail outlets has been the ChapStick Tent Card. The Card has been designed to be colourful and visual and to show a full range of flavours, thus gaining a key advantage over rival cards. In Cash and Carry stores, the Tent Card fits easily on shelves and has greater impact as it is ‘tall and thin’ rather than ‘short and fat’. An important thrust in the development of ChapStick involves widening the distribution network, so that it is sold in more shops and chemists and improving impact at point of sale, i.e. making sure that people who go into a chemists or other shop are made aware of the product.

Repositioning the mix

Every product has a unique marketing mix which is used to place a product in a market position relative to other brands, by taking into account the needs and perceptions of customers. The product’s position is dependent upon how it is perceived in the minds of customers. Positioning involves emphasising the attributes and strengths of a product over its competitors in order to move the brand forward and develop a better market position.

During 1995/6, ChapStick was positioned as “A practical product for everyday lip protection, ideal for people with active outdoor lifestyles.” The latest promotions emphasise that ChapStick is a brand for today’s lifestyles. The emphasis is upon ‘lifestyle’ – there are many occasions when ChapStick will prove invaluable, e.g. when outdoors and exposed to the elements. In positioning the product, although emphasis is placed on it as an outdoor product, it is not positioned as one which is only useful in ‘extreme’ conditions.

Conclusion

ChapStick is an important product in that it provides a range of benefits of which consumers are becoming increasingly aware. ChapStick is no longer just a healthcare product – the repositioning process has helped to reinforce its role and distinctive image for active people who are young, sporty and healthy.

It has become increasingly popular amongst those who play tennis, football or cricket and who may train and play outdoors for considerable periods of time. As a lip balm, the brand offers the basic requirements: it provides protection and moisturises lips. It also offers the added value ingredients of choice of flavours and sunscreen. The 1995/96 ‘Get Active’ Promotion helped to develop positioning activities which:

- raised the overall consumer brand profile and sales over the peak selling period

- gained extra distribution and trade support for ChapStick

- gained display and impact at the point of sale.

The next stage for this highly successful brand leader in the United States is to increase its market share in the UK, to become the UK’s brand leader. More and more, ChapStick the name is becoming equated with the product. An increasing number of people are using the product as part of their everyday lives – for these people it is no longer just a seasonal or impulse purchase, it has become a necessity.