Life in the UK isn’t simple when it comes to coping up with daily life expenditures. People working at lower wages have to worry a lot about their major outlay, especially when they have a family to feed. It also includes sundry taxes, which are to be paid being UK residents. Payments of tax in the UK are considered to be a complex process. No doubt, it is a time taking proceeding at the start, but once you acknowledge the whole procedure and start paying your taxes regularly, all of it would appear as a piece of cake. You may have known the basics about the tax payments and the issues that come with it. But, being a UK native, you should know your tax amounts depends upon your income, the property you own, and your individual circumstances. Not everyone has to pay these taxes in the UK until they reach a level where they have a certain amount of possessions.

Take-Home Payment

Take-Home pay is basically the amount that is awarded to workers after all the deductions. This also includes tax charges. Tax income is compulsory to be paid on a monthly basis, but by utilizing some tax-free allowances, one can minimize the tax deductions from his income. There are various ways through which one can get benefits and enjoy his maximum part of income; if you are looking for the perfect calculation to minimize your tax expenditures, then maybe you have landed in the right place.

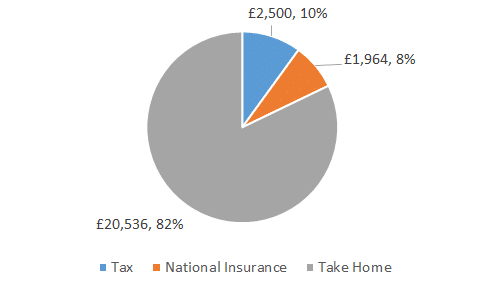

Income tax on £25,000

Are you earning £25000 annually? Do you also want to know how much income tax you need to pay for £25,000? Let me tell you if your salary is £25,000, and then after paying the tax and national insurance, you will be left with the amount of £29,380.89. This amount equals to £1.698.41 per month and £391.94 per week that you will take home with you. It also equals £78.39 per day, and if you are working 40 hours per week, your hourly rate will be £9.80. This is the amount that you will be left with after paying all the income taxes and deductions. £25000 after tax in the UK is very easy to calculate, and you should also get a calculation to pay the tax according to it.

Get the exact amount with an income calculator

There are many income calculators that tell you the net amount of your income or allowance that you are left with after paying all the income tax and national issuance. They use a formula that takes the variable and applies the selected options from the tax calculator form to calculate your £25,000 income.

The income calculators are able to provide the exact £25000 after-tax payment for the current and previous years by using only up-to-date HM revenue data. You can determine your take-home pay for every year by using the income calculators. These calculators also help you compare the results to observe the tax charges over the years.

These calculators are also able to calculate the income that will go towards national insurance using the same data source as the tax calculator. So, if you want to get the exact amount of your income tax according to your income or allowance, it is better to get the results with a tax income calculator.

Is paying tax necessary in the UK?

Paying taxes no matter in which country you are living in makes you a responsible citizen. UK employees pay tax according to their annual allowance, and they pay their taxes after reductions. Being a responsible citizen, you should pay your tax on time and accurately according to your PAYE demands.

So, not only in the UK but in every country of the world, paying taxes is essential. It comes with a number of responsibilities, and you should stand straight on these. Calculate your income tax today and pay them according to the calculation.