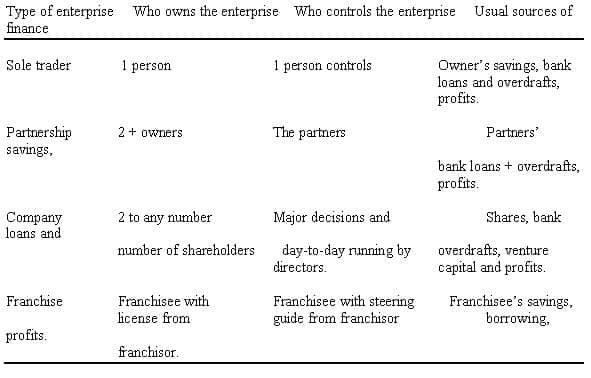

The main types of business organisation in the private sector are illustrated in the chart below:

Criteria For Judging The Success Of Business

Businesses come in a variety of forms. For example, one important distinction is between private and public sector businesses. Then within each sector, there are a number of different types of business.

In the public sector, public corporations are government-owned businesses such as the BBC, which are then managed independently of the government but to pre-set aims and objectives. Municipal enterprises are local government enterprises.

In the private sector, there are sole traders, partnerships, private companies, public companies, and franchise organisations.

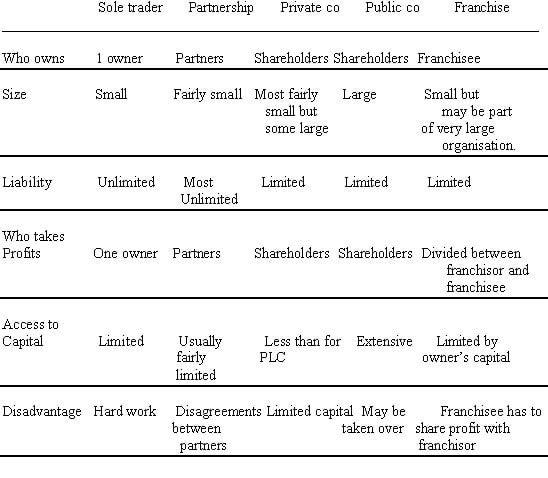

The following table compares these different types of private sector organisations:

Every company must register with the Registrar of Companies and must have an official address.

Private companies have Ltd after their name. They are typically smaller than public companies although some like Portakabin and Mars are very large. Shares in a private company can only be bought and sold with the permission of the Board of Directors. Shareholders have limited liability.

A public company like Cadbury Schweppes has their shares traded on the Stock Exchange. The main advantage of having shares traded on the Stock Exchange is that large amounts of capital can be raised very quickly. One disadvantage is that control of a business can be lost by the original shareholders if large quantities of shares are purchased as part of a takeover bid. In order to create a public company, the directors must apply to the Stock Exchange Council, which will carefully check the accounts.

Franchising

In the United States, almost half of all retail sales are made through firms operating under the franchise system like McDonald’s which has a brand franchise. Franchising is becoming increasingly popular in this country.

Franchising is really the ‘hiring out or licensing of the use of ‘good ideas to other companies.

A franchise grants permission to sell a product and trade under a certain name in a particular area. If I have a good idea, I can sell you a licence to trade and carry out a business using my idea in your area. The person taking out the franchise puts down a sum of money as capital and is issued with equipment by the franchising company. The firm selling the franchise is called the franchisor and the person paying for the franchise is called the franchisee.

Where materials are an important part of the business (e.g. confectionary, pizza bases, hair salons) the franchisee must buy an agreed percentage of supplies from the franchisor, who thus makes a profit on these supplies as well as ensures the quality of the final product. The franchisor also takes a percentage of the profits of the business, without having to risk capital or become involved in the day-to-day management.

The franchisee benefits from trading under a well-known name and enjoys a local monopoly. Training is usually arranged by the franchisor. The franchisee is his or her own boss and takes most of the profits.

Typical samples of the different types of business organisations outlined above are:

Sole traders – like small corner stores and newsagents. If you call out a plumber or electrician they have a good chance of being a sole trader. Although they may also be part of a franchise arrangement or a partnership.

Partnership – your doctor or dentist may well be in partnership, as well as solicitors that help your family to buy a house or to make out a will.

Private companies – are typically small family businesses that want to keep control of the business within the family.

Public companies – are well-known national and international companies like Vodafone and Corus.

Franchises – are commonly found in Quick Service Restaurants such as McDonald’s as well as in other food outlets, and services such as 24-hour plumbing.

Limited liability – is a form of business protection for company shareholders and some limited partners. For these individuals the maximum sum they can lose from a business venture into which they have contributed going bust is the sum of money that they have invested in the company – this is the limit of their liability.