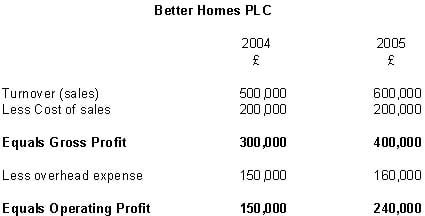

The profit of a business is the difference between its revenues and its costs. It is important to consider two main types of profit:

1.Gross profit – this is calculated by deducting the cost of sales of a business from its sales revenue (turnover).

2.Operating profit – is calculated by then taking away overhead expenses from gross profit.

Given the above figures it is possible to analyse the profitability of Better Hotels Plc in the two years. To do this we need to calculate how much of every pound spent by customers in the hotels is profit. This is calculated in the following way:

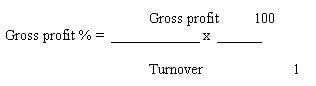

1. Gross profit % (i.e. how many pence in each £1 of customer spending is profit). This is calculated by:

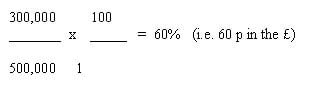

For Better Hotels in 2004 this is:

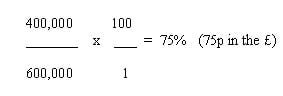

For Better Hotels in 2005 this is:

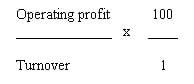

The profit margin i.e. operating profit %

is calculated by:

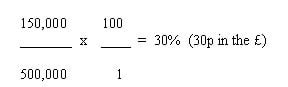

For Better Hotels in 2004 this is:

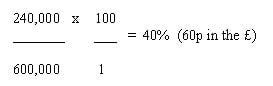

For Better Hotels in 2005 this is:

By examining the profit figures you can see that Better Hotels is more profitable in 2005 than it was in 2004.

Gross profit % has gone up from 60% to 75%, and Operating profit % has increased from 30% to 40%.

Profitability

Using these profitability calculations you are able to compare business profits in one year compared with others, and also compare the profitability of different businesses.

Another important measure of how well a business is being run is how liquid it is. To do this you need to look at the current assets and current liabilities in the balance sheet.

The following shows part of the balance sheet for Better Hotels in 2004 and 2005:

Extract from Balance Sheet 31st Dec 2004 by examining the two balance sheets it is possible to see that in 2005, Better Hotels has a more liquid assets relative to current liabilities.

In 2004 the ratio of current assets to current liabilities was:

80:40 (i.e. £2 for every £1)

In 2005 the ratio was:

90:40 (i.e. £2.50 for every £1)

It is important for businesses to have a good liquidity position because, should people that the business owes money to (current liabilities) press for payment it is essential to have the liquidity to pay up. A liquid asset is one that can quickly be turned into cash.

Working capital

We use the term working capital to describe the difference between current assets and current liabilities. A business has working capital if its current assets are greater than its current liabilities. Working capital is required for the day-to-day running of a business – paying bills, wages etc.

A business performs well when it has:

*high and rising sales

*high and rising profits

*good control over its costs

*a good liquidity/working capital position.