There has been a huge impact on every sector during the pandemic. Many have struggled as revenue is cut short, while others have thrived. The financial sector is one that has piqued the interest of a recent study.

The full results of the study can be seen here https://www.awaken.io/blog/boom-or-bust. Trustpilot reviews were taken for varying services within the financial sector for the months of the pandemic and compared with the same months of 2019 to gain an insight into the demand for these providers during COVID-19 within the UK and the USA.

Both nations tackled the virus in different ways, the UK held strict lockdown rules in March, however, England, Ireland, Scotland and Wales all held their own set of guidelines.

The USA also varied between states, with some stricter than others.

We take a look at the results of the study below.

Accounting Saw The Highest Demand

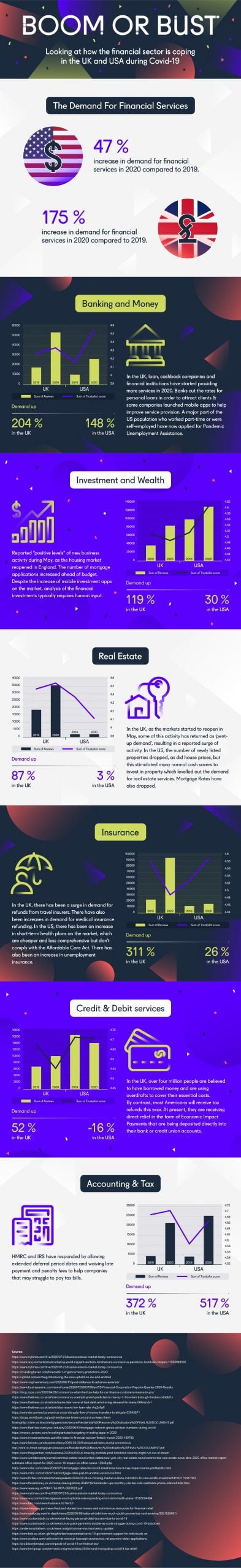

Accounting and tax services grew by 372% in the UK and 517% in the USA during the pandemic.

Both the HMRC and IRS provided aid to businesses and individuals by extending deferral periods when it can to payments and removing late fees and penalties.

However, if not properly dealt with, those who are seeking these benefits could suffer from consequences in the future. Similarly, without expert knowledge, some businesses may miss out on this assistance.

This is why financial professionals have seen a surge in demand as their clients want to ensure everything is properly applied for and all procedures are correctly followed.

Insurance Varied Greatly Between The Two Nations

The insurance sector saw the biggest gap in growth between the USA and the UK. The USA has seen an increase of 26% while the UK rose by 311%.

In the UK, the public has benefited from free healthcare in the form of the NHS. At the start of the pandemic, there was huge media coverage regarding the strain on the National Health Service.

Individuals began to seek private healthcare for many reasons such as reducing the strain on the NHS should they become ill or be able to have access to medical attention for pre-existing conditions and surgeries that have been posted or cancelled by the free service.

Most Americans already have health insurance in place, whether through their employment or paid for by themselves.

Another reason for growth within both countries is the demand for customer service centres within the travel insurance sector. As more holidays were cancelled or postponed this year, holidaymakers were making increasing claims with their providers to receive financial compensation.

The Housing Market Booms in the UK

The UK housing market has had its ups and downs over the past decade but in 2020 there was an increase of 87%, despite COVID-19.

The initial months of the pandemic saw a complete closure of the housing market and completions were banned by the government. However, when this was reinstated in June, there was a backlog of eager movers that increased demand.

The government announced that stamp duty would no longer be applicable until Spring 2021, saving buyers thousands of pounds and many who were not actively looking to move found the perfect opportunity to do so.

Mortgage lenders also dropped their rates, which led to an even bigger surge in the market as many first time buyers were now able to invest in their first home.

Despite many states in the USA never closing the housing market, many homeowners have been reluctant to sell during an economic crisis, this has led to very few properties being listed for sale.

The USA and UK Request Help From Their Banks

The banking and money sector saw a rise of 204% in the UK and 148% in the USA. In the UK, banks offered payment holidays for mortgages, loans and credit cards at the beginning of the first lockdown.

This led to increasing numbers of individuals contacting their banks to apply for this and have some financial respite during the pandemic. A large portion of the nation have lost their jobs or been furloughed during 2020, so these services were essential for many to be able to continue with an acceptable quality of life. To cope with this rise in demand, many providers launched new apps and online services to ease the pressure on call centre agents.

Payment holidays were not as common in the USA, however, the public was not better off in terms of finances. Increasing numbers of Americans were seeking loans, increased credit card limits and even remortgaging so they were able to survive financially during COVID-19.

It can be argued that as the general population of both nations begin to struggle with finances, the financial sector will increase in demand. Whether this is from more money being borrowed or trying to alter terms and conditions within contracts to reduce monthly repayments.