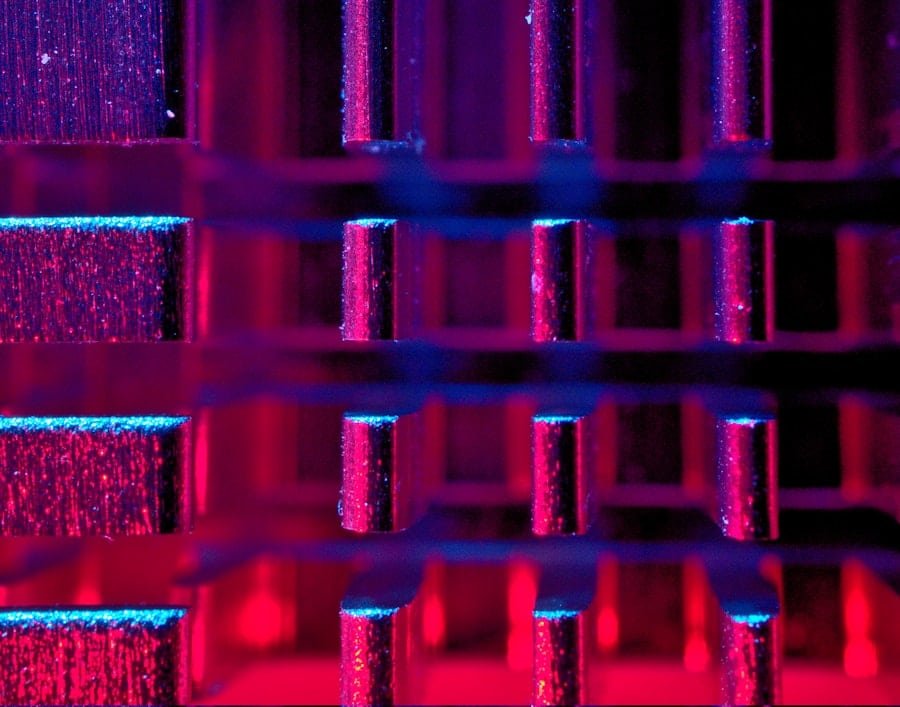

Quantum computing represents a paradigm shift in computational capabilities, harnessing the principles of quantum mechanics to process information in ways that classical computers cannot. In the realm of finance, where vast amounts of data and complex calculations are the norm, the advent of quantum computing holds the promise of revolutionising traditional methodologies. The financial sector, characterised by its reliance on sophisticated algorithms and models, stands to benefit immensely from the enhanced processing power and efficiency that quantum systems can provide.

As financial institutions grapple with the challenges posed by big data, market volatility, and the need for rapid decision-making, quantum computing emerges as a beacon of innovation. The potential applications of quantum computing in finance are vast and varied, ranging from improved risk assessment to more accurate pricing models. Financial analysts and institutions are beginning to explore how quantum algorithms can be integrated into existing frameworks to enhance performance and drive better outcomes.

As research progresses and quantum technology matures, it is becoming increasingly clear that the financial industry must adapt to this new technological landscape or risk being left behind. The intersection of quantum computing and finance is not merely a theoretical exercise; it is a burgeoning field that promises to reshape how financial services are delivered and consumed.

Summary

- Quantum computing has the potential to revolutionize the financial industry by offering unprecedented computational power and speed.

- Financial modelling and analysis can benefit from quantum computing’s ability to process vast amounts of data and solve complex mathematical problems more efficiently.

- Quantum computing can play a crucial role in risk management and portfolio optimization by enabling more accurate and real-time risk assessments and asset allocation strategies.

- The use of quantum computing in cryptography and cybersecurity can enhance data encryption and protect financial institutions from cyber threats.

- Quantum computing can significantly impact algorithmic trading and market prediction by providing more accurate and faster analysis of market trends and patterns.

Quantum Computing’s Impact on Financial Modelling and Analysis

Limitations of Traditional Models

Traditional models often rely on linear assumptions and simplifications that can lead to inaccuracies, particularly in complex scenarios involving multiple variables.

Quantum Computing: A New Approach

Quantum computing offers a new approach by enabling the simulation of intricate systems with a level of detail and accuracy previously unattainable. For instance, quantum algorithms can process vast datasets simultaneously, allowing for the exploration of numerous potential outcomes in real-time. This capability is particularly beneficial for derivative pricing, where the valuation of options and other financial instruments can be influenced by a multitude of factors.

Advantages and Future Developments

One notable example is the use of quantum Monte Carlo methods, which leverage quantum superposition to evaluate multiple paths simultaneously. This technique can significantly reduce the time required for simulations compared to classical methods, which often rely on sequential processing. By applying these advanced modelling techniques, financial analysts can gain deeper insights into market dynamics and make more informed decisions. Furthermore, as quantum computing technology continues to evolve, we can expect even more sophisticated models that incorporate machine learning and artificial intelligence, further enhancing predictive accuracy and analytical capabilities.

Quantum Computing’s Role in Risk Management and Portfolio Optimization

Risk management is a critical function within financial institutions, as it involves identifying, assessing, and mitigating potential losses. Quantum computing has the potential to transform this area by providing tools that can analyse risk factors with unprecedented precision. Traditional risk assessment models often struggle with the complexity of interrelated variables and non-linear relationships.

Quantum algorithms can tackle these challenges by processing vast amounts of data in parallel, allowing for a more comprehensive understanding of risk exposure across various asset classes. In portfolio optimisation, quantum computing can facilitate the development of more efficient investment strategies. Classical optimisation techniques often rely on heuristics or approximations that may not yield the best possible outcomes.

Quantum algorithms, such as the Quantum Approximate Optimisation Algorithm (QAOA), can explore a broader solution space more effectively, identifying optimal asset allocations that maximise returns while minimising risk. This capability is particularly valuable in volatile markets where rapid adjustments to portfolios are necessary to maintain performance. As financial institutions begin to adopt quantum technologies, we can expect a significant shift in how portfolios are constructed and managed.

Quantum Computing’s Potential in Cryptography and Cybersecurity

The financial sector is heavily reliant on secure transactions and data protection, making cryptography a fundamental aspect of its operations. Quantum computing poses both challenges and opportunities in this domain. On one hand, quantum computers have the potential to break traditional cryptographic schemes that underpin secure communications and transactions.

For instance, Shor’s algorithm can efficiently factor large integers, rendering widely used encryption methods like RSA vulnerable to attacks by sufficiently powerful quantum machines. Conversely, the rise of quantum computing has spurred the development of quantum-resistant cryptographic protocols designed to withstand potential threats posed by quantum attacks. These new cryptographic methods leverage principles of quantum mechanics to create secure communication channels that are theoretically impervious to eavesdropping.

Financial institutions are increasingly investing in research and development of post-quantum cryptography to safeguard their systems against future vulnerabilities. As this field evolves, it will be crucial for financial organisations to stay ahead of the curve by adopting robust security measures that can withstand the challenges posed by emerging quantum technologies.

Quantum Computing’s Influence on Algorithmic Trading and Market Prediction

Algorithmic trading has transformed the landscape of financial markets by enabling rapid execution of trades based on predefined criteria. The integration of quantum computing into this domain could lead to significant advancements in trading strategies and market prediction models. Quantum algorithms can process vast datasets at unprecedented speeds, allowing traders to analyse market trends and execute trades with greater precision than ever before.

For example, quantum-enhanced machine learning techniques can identify patterns in historical data that may not be apparent through classical analysis. Moreover, the ability to simulate various market scenarios using quantum computing could provide traders with insights into potential future movements, enabling them to make more informed decisions. The combination of quantum computing with high-frequency trading strategies could lead to a new era of market efficiency, where trades are executed based on real-time analysis of complex market dynamics.

As financial institutions continue to explore these possibilities, we may witness a fundamental shift in how trading strategies are developed and implemented.

Quantum Computing’s Implications for Banking and Payment Systems

The banking sector stands to gain significantly from the advancements brought about by quantum computing. One area where this technology could have a profound impact is in payment systems. Traditional payment processing relies on centralised systems that can be slow and susceptible to fraud.

Quantum computing has the potential to streamline these processes by enabling faster transaction verification and enhanced security measures. For instance, quantum key distribution (QKD) allows for secure communication between parties by using quantum mechanics principles to create encryption keys that are virtually unbreakable. This technology could revolutionise how banks handle transactions, ensuring that sensitive information remains protected from cyber threats.

Additionally, the ability to process transactions at lightning speed could lead to real-time settlement systems that enhance liquidity and reduce counterparty risk. As banks begin to integrate quantum technologies into their operations, they will need to navigate regulatory challenges and ensure compliance with existing frameworks. The transition towards quantum-enabled banking systems will require collaboration between financial institutions, technology providers, and regulatory bodies to establish standards that promote security and efficiency while fostering innovation.

Quantum Computing’s Challenges and Opportunities in the Financial Industry

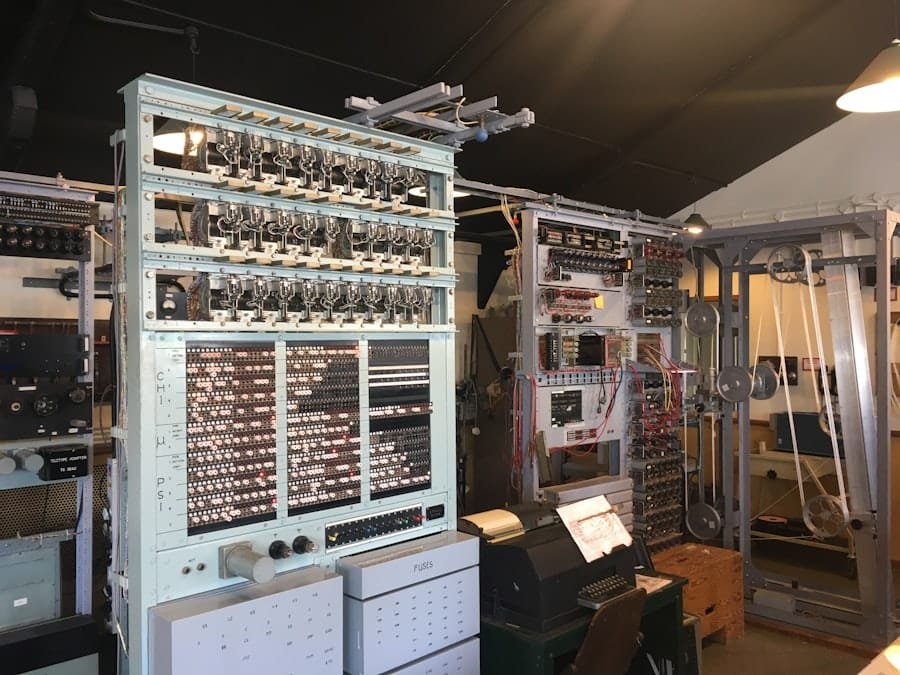

While the potential benefits of quantum computing in finance are substantial, several challenges must be addressed before widespread adoption can occur. One significant hurdle is the current state of quantum hardware; many existing systems are still in experimental stages and face limitations regarding qubit coherence times and error rates. These technical challenges must be overcome to develop practical applications that can operate reliably within financial environments.

Moreover, there is a pressing need for skilled professionals who understand both finance and quantum computing. The intersection of these fields requires expertise that is currently scarce, creating a bottleneck for innovation. Financial institutions must invest in training programmes and partnerships with academic institutions to cultivate a workforce capable of harnessing the power of quantum technologies.

Despite these challenges, the opportunities presented by quantum computing are immense. As research progresses and technology matures, we can expect breakthroughs that will enable financial institutions to operate more efficiently and securely than ever before. The ability to process complex calculations rapidly will not only enhance existing services but also pave the way for entirely new financial products and services that were previously unimaginable.

The Future of Quantum Computing in Finance: Potential Applications and Developments

Looking ahead, the future of quantum computing in finance appears promising as researchers continue to explore innovative applications across various domains. One potential area for development is in personalised financial services; leveraging quantum algorithms could enable institutions to tailor products and services based on individual customer preferences with unparalleled accuracy. This level of personalisation could enhance customer satisfaction and loyalty while driving revenue growth for financial firms.

Additionally, as regulatory frameworks evolve to accommodate emerging technologies, we may see increased collaboration between financial institutions and technology companies focused on developing quantum solutions tailored specifically for finance. This collaboration could lead to breakthroughs in areas such as fraud detection, compliance monitoring, and customer service automation through advanced predictive analytics. As we move further into the era of quantum computing, it will be essential for financial institutions to remain agile and adaptable in their approach to technology adoption.

Embracing innovation while addressing associated risks will be crucial for maintaining competitiveness in an increasingly complex financial landscape. The journey towards fully integrating quantum computing into finance is just beginning; however, its potential impact on the industry is already becoming evident as organisations prepare for a future defined by unprecedented computational power and capabilities.

Quantum computing is revolutionizing the financial industry, as discussed in the article “How Quantum Computing is Shaping the Future of Finance.” This cutting-edge technology is enabling financial institutions to process vast amounts of data at unprecedented speeds, leading to more accurate predictions and better risk management strategies. To stay ahead in this rapidly evolving landscape, companies must embrace innovation and adapt to new technologies. For further insights on strategic decision-making, I recommend reading the article “Trump’s Reaction to Recent Polling Trends: A Look at His Campaign’s Strategy” to understand how businesses can leverage data and research to make informed decisions.

FAQs

What is quantum computing?

Quantum computing is a type of computing that takes advantage of the strange ability of subatomic particles to exist in more than one state at any time. This allows quantum computers to process and store information in a way that is exponentially more powerful than traditional computers.

How is quantum computing shaping the future of finance?

Quantum computing has the potential to revolutionize the finance industry by enabling faster and more complex calculations for risk assessment, portfolio optimization, and fraud detection. It can also enhance encryption methods, making financial transactions more secure.

What are the potential benefits of quantum computing in finance?

The potential benefits of quantum computing in finance include improved risk management, more accurate pricing models, faster trading algorithms, and enhanced cybersecurity measures. It could also lead to the development of new financial products and services.

What are the challenges of implementing quantum computing in finance?

Challenges in implementing quantum computing in finance include the high cost of development and infrastructure, the need for specialized talent, and the complexity of integrating quantum algorithms with existing financial systems. Additionally, quantum computers are still in the early stages of development and are not yet widely available.

Are there any risks associated with quantum computing in finance?

One potential risk of quantum computing in finance is the potential for quantum computers to break current encryption methods, which could compromise the security of financial transactions and sensitive data. Additionally, the rapid advancement of quantum computing could lead to a widening gap between organizations that have access to the technology and those that do not.