A Deed of Guarantee is a formal legal document that serves to assure one party (the creditor) that another party (the guarantor) will fulfil the obligations of a third party (the principal debtor) in the event of default. This instrument is particularly prevalent in financial transactions, where lenders seek additional security against the risk of non-payment. The essence of a Deed of Guarantee lies in its ability to provide a safety net for creditors, thereby facilitating trust and confidence in commercial dealings.

The document is executed as a deed, which means it must meet specific legal requirements, including being signed, witnessed, and delivered to be enforceable. The structure of a Deed of Guarantee typically includes the identification of the parties involved, a clear statement of the obligations being guaranteed, and the conditions under which the guarantee will be invoked. It is crucial for the language used in the deed to be precise and unambiguous, as any vagueness can lead to disputes regarding its interpretation.

The guarantee can be either unconditional or conditional; an unconditional guarantee obligates the guarantor to pay upon demand, while a conditional guarantee may require certain preconditions to be met before the guarantor is liable.

Summary

- A Deed of Guarantee is a legal document that outlines the responsibilities of a guarantor in the event that the primary party fails to fulfil their obligations.

- The Deed of Guarantee is important as it provides security to the lender and reassurance to the borrower, reducing the risk of default.

- The parties involved in a Deed of Guarantee typically include the guarantor, the lender, and the borrower, each with their own set of rights and obligations.

- The legal implications of a Deed of Guarantee can be significant, as it is a legally binding document that can be enforced in court if necessary.

- Types of guarantees covered in a Deed of Guarantee can include performance guarantees, payment guarantees, and advance payment guarantees, each serving a different purpose in securing the obligations of the borrower.

Importance of the Deed of Guarantee

The significance of a Deed of Guarantee cannot be overstated, particularly in commercial transactions where large sums of money are at stake. It acts as a risk mitigation tool for creditors, allowing them to extend credit with greater confidence. By having a guarantor in place, lenders can reduce their exposure to potential losses arising from defaults.

This assurance can lead to more favourable lending terms, such as lower interest rates or increased credit limits, as the lender perceives a reduced risk profile. Moreover, a Deed of Guarantee can enhance the creditworthiness of a borrower. For businesses seeking financing, having a reputable guarantor can bolster their application and improve their chances of securing loans.

This is particularly relevant for small and medium-sized enterprises (SMEs) that may lack sufficient credit history or collateral. In such cases, the presence of a guarantor can serve as a testament to the borrower’s reliability and financial stability, thereby facilitating access to necessary funds for growth and expansion.

Parties Involved in a Deed of Guarantee

In any Deed of Guarantee, there are typically three primary parties: the creditor, the principal debtor, and the guarantor. The creditor is the entity that extends credit or provides goods and services on credit terms. This could be a bank, financial institution, supplier, or any other party that has a financial interest in ensuring that obligations are met.

The principal debtor is the individual or entity that owes the debt or obligation to the creditor. This party is directly responsible for fulfilling the terms of the agreement. The guarantor plays a pivotal role in this triad; they are essentially providing a promise to cover the debt or obligation should the principal debtor fail to do so.

The choice of guarantor is often critical; creditors typically prefer individuals or entities with strong financial backgrounds and good credit ratings. In some cases, personal guarantees may be required from business owners or directors, especially when dealing with small businesses where corporate assets may not provide sufficient security. The relationship between these parties is governed by the terms outlined in the Deed of Guarantee, which delineates their respective rights and responsibilities.

Legal Implications of a Deed of Guarantee

The legal implications surrounding a Deed of Guarantee are significant and multifaceted. Once executed, the deed creates binding obligations for the guarantor, who becomes liable for the debts or obligations of the principal debtor under specified conditions. This liability can arise even if the creditor has not pursued all available remedies against the principal debtor first.

In many jurisdictions, this principle is known as “primary liability,” which means that the guarantor’s obligation is not contingent upon the creditor exhausting all avenues for recovery from the principal debtor. Furthermore, it is essential for all parties involved to understand that a Deed of Guarantee is enforceable in a court of law. Should disputes arise regarding its interpretation or execution, courts will typically uphold the terms as long as they are clear and lawful.

This enforceability underscores the importance of careful drafting and consideration during the creation of such documents. Additionally, certain statutory protections may apply to guarantees, particularly those involving consumers or small businesses, which can limit liability or impose additional requirements on creditors.

Types of Guarantees Covered in a Deed of Guarantee

A Deed of Guarantee can encompass various types of guarantees, each serving different purposes depending on the context of the transaction. One common type is a performance guarantee, which assures that a party will fulfil their contractual obligations. This is particularly prevalent in construction contracts where contractors may be required to provide guarantees to ensure project completion according to specified standards.

Another prevalent form is a financial guarantee, which specifically relates to monetary obligations. In this scenario, if the principal debtor defaults on loan repayments or other financial commitments, the guarantor is obliged to cover those payments. This type of guarantee is often seen in lending agreements where banks require personal guarantees from business owners or directors to secure loans for their companies.

Additionally, there are also specific guarantees such as bid bonds and advance payment guarantees used in procurement processes. Bid bonds ensure that bidders will enter into contracts if awarded, while advance payment guarantees protect buyers by ensuring that advance payments made to suppliers are returned if contractual obligations are not met.

Execution and Registration of a Deed of Guarantee

Reaching Consensus and Signing the Deed

The execution of a Deed of Guarantee involves several critical steps that must be adhered to for it to be legally binding. Firstly, all parties must agree on the terms outlined within the deed. Once consensus is reached, it must be signed by all parties involved; this includes not only the guarantor but also the principal debtor and creditor.

Witnessing and Authenticating the Signatures

The signing process typically requires witnesses to ensure that there is an independent verification of signatures, which adds an additional layer of authenticity to the document.

Registration and Enforceability

In some jurisdictions, registration may also be necessary for certain types of guarantees to ensure their enforceability against third parties. For instance, if a guarantee relates to real property or significant financial transactions, registering it with relevant authorities can provide public notice and protect against competing claims. Failure to register when required could result in the guarantee being deemed ineffective against other creditors or parties with interests in the same assets.

Breach of a Deed of Guarantee

A breach of a Deed of Guarantee occurs when either the principal debtor fails to meet their obligations or when there are violations related to the terms set forth in the deed itself. In such instances, creditors have recourse against the guarantor for recovery of amounts owed. The process typically begins with notifying the guarantor about the default and demanding payment or performance as stipulated in the deed.

The legal ramifications for breaching a Deed of Guarantee can be severe for both parties involved. For creditors, pursuing recovery through legal channels may involve litigation costs and time delays; however, they retain rights under contract law to seek damages or specific performance from the guarantor. For guarantors, being called upon to fulfil obligations can lead to significant financial strain, especially if they had not anticipated such liabilities.

It is essential for all parties involved to understand their rights and responsibilities under such circumstances and seek legal counsel if disputes arise.

Alternatives to a Deed of Guarantee

While a Deed of Guarantee serves as an effective tool for securing obligations, there are several alternatives that parties may consider depending on their specific needs and circumstances. One such alternative is collateral agreements where tangible assets are pledged as security against debts. This method provides creditors with direct recourse to specific assets should defaults occur without relying on third-party guarantees.

Another option is insurance products designed specifically for credit risk mitigation. Credit insurance can protect lenders against losses resulting from borrower defaults by compensating them for unpaid debts up to certain limits. This approach allows creditors to manage risk without placing additional burdens on individuals or entities acting as guarantors.

Additionally, letters of credit can serve as an alternative mechanism in international trade transactions where banks provide guarantees on behalf of buyers to sellers. This instrument ensures that sellers receive payment upon fulfilling their contractual obligations while providing buyers with assurance regarding product quality and delivery timelines. In conclusion, while a Deed of Guarantee remains an essential instrument in commercial transactions for securing obligations and mitigating risks associated with defaults, understanding its intricacies and exploring alternatives can provide parties with tailored solutions that best fit their unique circumstances and requirements.

A Deed of Guarantee is a legally binding document that outlines the responsibilities of a guarantor in the event that a borrower defaults on a loan. This article on marketing small businesses through social marketing discusses the importance of effective marketing strategies for small businesses, which could include securing financial backing through guarantees. By utilising social marketing techniques, small businesses can reach a wider audience and attract potential investors or guarantors. This highlights the interconnected nature of legal and marketing aspects in business operations.

FAQs

What is a Deed of Guarantee?

A Deed of Guarantee is a legal document in which a person or entity (the guarantor) agrees to take on the responsibility of fulfilling the obligations of another party (the debtor) in the event that the debtor is unable to do so.

What is the purpose of a Deed of Guarantee?

The purpose of a Deed of Guarantee is to provide security to a lender or creditor by ensuring that they will be repaid in the event that the debtor is unable to fulfil their obligations. It is commonly used in situations such as loans, leases, and contracts where there is a risk of non-payment.

What are the key elements of a Deed of Guarantee?

A Deed of Guarantee typically includes the names and details of the guarantor and the debtor, the specific obligations being guaranteed, the conditions under which the guarantee will be triggered, and any limitations on the guarantor’s liability.

Is a Deed of Guarantee legally binding?

Yes, a Deed of Guarantee is a legally binding document that creates a contractual obligation for the guarantor to fulfil the obligations of the debtor in the event of default. It is enforceable in a court of law.

What are the risks of signing a Deed of Guarantee?

The main risk of signing a Deed of Guarantee is that the guarantor becomes liable for the debtor’s obligations, which could result in financial loss or legal action if the debtor defaults. It is important for the guarantor to fully understand the implications and seek legal advice before signing.

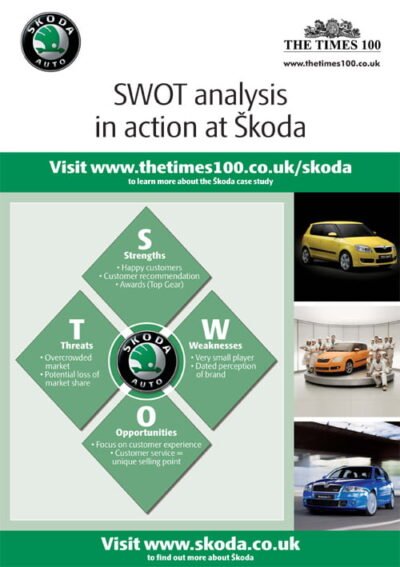

Skoda A3 ePoster Edition 13 "SWOT analysis in action at Skoda"

Skoda A3 ePoster Edition 13 "SWOT analysis in action at Skoda"  Tesco A3 ePoster Edition 13 "Recruitment and selection at Tesco"

Tesco A3 ePoster Edition 13 "Recruitment and selection at Tesco"