Intercompany loans are financial arrangements between entities within the same corporate group, allowing one subsidiary or affiliate to lend money to another. These transactions are a common practice in multinational corporations, where capital needs can vary significantly across different jurisdictions and business units. The flexibility of intercompany loans enables companies to optimise their capital structure, manage liquidity, and allocate resources efficiently.

As businesses expand globally, understanding the intricacies of intercompany lending becomes increasingly vital for financial management and compliance. The mechanics of intercompany loans can be complex, involving various factors such as interest rates, repayment terms, and currency considerations. These loans can take many forms, including short-term loans for immediate cash flow needs or long-term financing for strategic investments.

The terms of these loans are often influenced by the prevailing market conditions, the creditworthiness of the borrowing entity, and the overall financial strategy of the corporate group. As such, intercompany loans serve not only as a means of financing but also as a tool for strategic financial planning.

Summary

- Intercompany loans are loans between companies within the same group, often used for cash management and financing purposes.

- The purpose of intercompany loans is to provide funding for subsidiaries, manage cash flow, and facilitate investment and expansion within the group.

- Initiating and managing intercompany loans involves setting clear terms, documenting the loan agreement, and ensuring compliance with transfer pricing regulations.

- Accounting and tax implications of intercompany loans include interest income, transfer pricing rules, and potential tax implications in different jurisdictions.

- Advantages of intercompany loans include centralised cash management, flexibility, and potential tax benefits, while disadvantages include transfer pricing risks and potential conflicts between subsidiaries.

Understanding the Purpose of Intercompany Loans

The primary purpose of intercompany loans is to facilitate the efficient allocation of capital within a corporate group. By allowing subsidiaries to borrow from one another, companies can ensure that funds are directed to where they are most needed, thereby enhancing operational efficiency. For instance, a subsidiary in a high-growth market may require additional capital to expand its operations, while another subsidiary in a mature market may have excess cash reserves.

Intercompany loans enable the transfer of these funds without the need for external financing, which can be more costly and time-consuming. Moreover, intercompany loans can serve as a mechanism for managing risk within a corporate group. By centralising funding in a parent company or a financially stronger subsidiary, businesses can mitigate the risks associated with individual entities facing financial difficulties.

This approach not only protects the overall financial health of the group but also allows for better control over cash flows and investment strategies. Additionally, intercompany loans can be structured to take advantage of favourable interest rates or tax benefits, further enhancing their appeal as a financial tool.

The Process of Initiating and Managing Intercompany Loans

Initiating an intercompany loan typically begins with a thorough assessment of the borrowing entity’s financial needs and creditworthiness. The lending entity must evaluate whether it has sufficient liquidity to provide the loan without jeopardising its own financial stability. Once both parties agree on the terms, including the loan amount, interest rate, and repayment schedule, a formal agreement is drafted.

This agreement should outline all relevant details to ensure clarity and compliance with internal policies and external regulations. Managing intercompany loans requires ongoing monitoring and communication between the involved entities. Regular reviews of the loan’s performance are essential to ensure that repayment schedules are adhered to and that any changes in market conditions or business circumstances are addressed promptly.

Additionally, companies must maintain accurate records of all intercompany transactions to facilitate transparency and compliance with accounting standards. This includes documenting interest payments, principal repayments, and any adjustments made to the loan terms over time.

Accounting and Tax Implications of Intercompany Loans

The accounting treatment of intercompany loans is governed by various international accounting standards, such as IFRS and GAAP. These standards require that intercompany transactions be recorded at arm’s length, meaning that the terms should reflect what independent entities would agree upon in similar circumstances. This principle is crucial for ensuring that financial statements accurately represent the economic reality of the transactions and for maintaining compliance with regulatory requirements.

Tax implications also play a significant role in intercompany lending. Different jurisdictions have varying rules regarding the taxation of interest income and expenses associated with intercompany loans. For instance, some countries may impose withholding taxes on interest payments made to foreign entities, while others may have specific transfer pricing regulations that dictate how interest rates should be set.

Companies must navigate these complexities carefully to avoid potential tax liabilities and ensure compliance with local laws. Failure to adhere to these regulations can result in significant penalties and reputational damage.

Advantages and Disadvantages of Intercompany Loans

Intercompany loans offer several advantages that can enhance a corporate group’s financial flexibility. One notable benefit is the ability to access funds quickly without resorting to external financing sources, which may involve lengthy approval processes or higher costs. Additionally, intercompany loans can be structured to provide favourable interest rates compared to market rates, allowing subsidiaries to finance their operations more cost-effectively.

However, there are also disadvantages associated with intercompany lending that companies must consider. One significant concern is the potential for regulatory scrutiny, particularly regarding transfer pricing practices. Tax authorities may closely examine intercompany transactions to ensure that they are conducted at arm’s length and do not result in tax avoidance strategies.

Furthermore, if not managed properly, intercompany loans can lead to cash flow issues within the corporate group, especially if one entity struggles to meet its repayment obligations.

Risks and Challenges Associated with Intercompany Loans

Credit Risk: A Primary Concern

One primary risk is credit risk, which arises when the borrowing entity is unable to repay the loan due to financial difficulties or poor performance. This situation can have cascading effects on the lending entity’s financial health and overall liquidity position.

Currency Risk: A Multinational Concern

Another challenge is currency risk, particularly for multinational corporations operating in multiple currencies. Fluctuations in exchange rates can impact the value of repayments and interest payments, potentially leading to losses for the lending entity. To mitigate this risk, companies may consider hedging strategies or structuring loans in stable currencies.

Regulatory Challenges and Ongoing Vigilance

Additionally, regulatory changes in different jurisdictions can pose challenges for intercompany lending practices, necessitating ongoing vigilance and adaptability from corporate finance teams.

Regulatory Compliance and Legal Considerations for Intercompany Loans

Navigating the regulatory landscape surrounding intercompany loans is crucial for ensuring compliance and minimising legal risks. Various jurisdictions have specific laws governing transfer pricing, which dictate how intercompany transactions should be priced to reflect market conditions accurately. Companies must ensure that their intercompany loan agreements comply with these regulations to avoid potential audits or penalties from tax authorities.

Furthermore, legal considerations extend beyond tax compliance; companies must also be aware of any restrictions on cross-border lending imposed by local laws or regulations. For instance, some countries may have limitations on the amount of debt that can be incurred by foreign subsidiaries or may require specific documentation for intercompany transactions. Engaging legal counsel with expertise in international finance can help companies navigate these complexities effectively.

Best Practices for Intercompany Lending

Implementing best practices in intercompany lending can significantly enhance the effectiveness and compliance of these transactions. One key practice is establishing clear policies and procedures governing intercompany loans, including guidelines on interest rates, repayment terms, and documentation requirements. These policies should be regularly reviewed and updated to reflect changes in market conditions or regulatory requirements.

Additionally, maintaining transparency in intercompany transactions is essential for fostering trust among stakeholders and ensuring compliance with accounting standards. Companies should implement robust record-keeping practices that document all aspects of intercompany loans, including agreements, payment schedules, and any communications between entities involved in the transaction. Regular audits of intercompany lending practices can also help identify potential issues early on and ensure adherence to established policies.

Finally, fostering open communication between finance teams across different subsidiaries can facilitate better decision-making regarding intercompany loans. By sharing insights on cash flow needs and financial performance, companies can optimise their lending strategies and ensure that funds are allocated efficiently within the corporate group. This collaborative approach not only enhances financial management but also strengthens relationships among different business units within the organisation.

An interesting related article to the topic of intercompany loans is Promoting the Brand. This article discusses the importance of creating a strong brand identity and how it can impact a company’s success. Just like how intercompany loans can affect the financial health of a business, branding plays a crucial role in shaping consumer perceptions and driving sales. By promoting a brand effectively, companies can differentiate themselves from competitors and attract loyal customers.

FAQs

What is an intercompany loan?

An intercompany loan is a loan agreement between two or more entities within the same corporate group. It involves one entity lending money to another entity within the group.

Why do companies use intercompany loans?

Companies use intercompany loans to efficiently manage their cash flow within the group, provide funding for subsidiaries, and facilitate the movement of funds between different entities.

How do intercompany loans work?

Intercompany loans work by one entity within a corporate group lending money to another entity, typically at an agreed-upon interest rate and repayment terms. The borrowing entity then uses the funds for its operational or investment needs.

What are the benefits of intercompany loans?

The benefits of intercompany loans include centralised cash management, tax efficiency, and the ability to provide funding to subsidiaries without the need for external borrowing.

What are the potential risks of intercompany loans?

Potential risks of intercompany loans include transfer pricing issues, currency exchange risks, and the potential for financial strain on the lending entity if the borrowing entity is unable to repay the loan.

How are intercompany loans accounted for?

Intercompany loans are accounted for in the financial statements of the lending and borrowing entities as a liability and an asset, respectively. Interest income and expense are also recognised in the respective entities’ income statements.

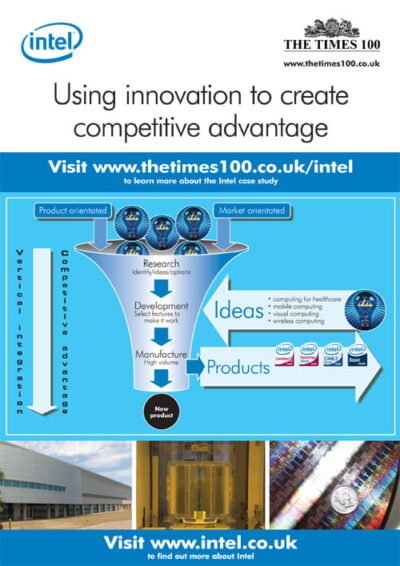

Intel A3 ePoster Edition 13 "Using innovation to create competitive advantage"

Intel A3 ePoster Edition 13 "Using innovation to create competitive advantage"  Live, breathe and wear passion (MP3)

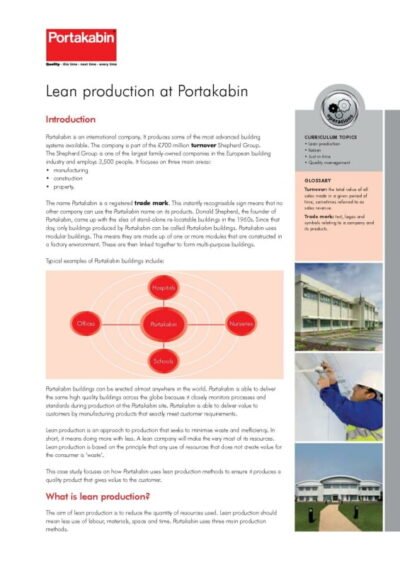

Live, breathe and wear passion (MP3)  Lean production at Portakabin (PDF)

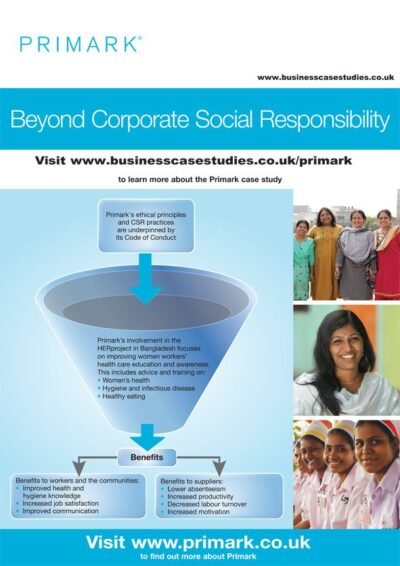

Lean production at Portakabin (PDF)  Primark A3 ePoster Edition 17 "Beyond corporate social responsibility"

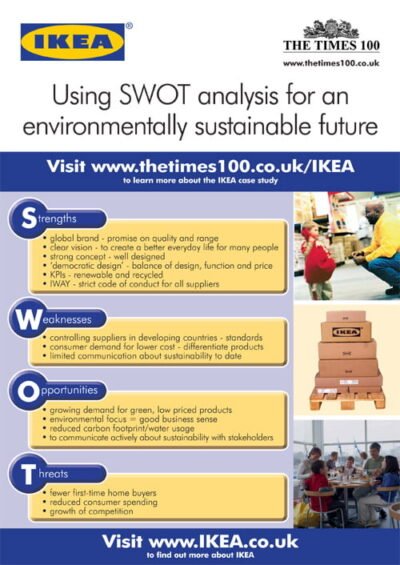

Primark A3 ePoster Edition 17 "Beyond corporate social responsibility"  IKEA A3 ePoster Edition 14 "SWOT analysis and sustainable business planning"

IKEA A3 ePoster Edition 14 "SWOT analysis and sustainable business planning"  Planning for quality and productivity (PDF)

Planning for quality and productivity (PDF)  Intellectual Property Office A3 ePoster Edition 15 "Intellectual property and the external environment"

Intellectual Property Office A3 ePoster Edition 15 "Intellectual property and the external environment"