Property portfolio management is a multifaceted discipline that involves the strategic oversight and administration of a collection of real estate assets. This practice is essential for investors, property managers, and real estate firms aiming to maximise the value and performance of their holdings. The concept encompasses various activities, including acquisition, leasing, maintenance, and disposition of properties, all of which require a keen understanding of market dynamics, financial analysis, and risk management.

As the real estate landscape continues to evolve, the importance of effective property portfolio management has become increasingly pronounced. In recent years, the rise of technology and data analytics has transformed the way property portfolios are managed. With the advent of sophisticated software tools and platforms, property managers can now analyse vast amounts of data to make informed decisions regarding their assets.

This technological shift has not only streamlined operations but has also enhanced the ability to forecast market trends and tenant behaviours. As a result, property portfolio management has emerged as a critical function within the broader context of real estate investment and development.

Summary

- Property portfolio management involves the management and optimization of a collection of properties owned by an individual or organisation.

- Effective property portfolio management is important for maximising returns, minimising risks, and achieving long-term financial goals.

- Components of property portfolio management include property acquisition, financing, leasing, maintenance, and disposal.

- Strategies for effective property portfolio management include diversification, risk management, and regular performance evaluation.

- Benefits of property portfolio management include increased cash flow, asset appreciation, and a hedge against inflation, but it also comes with challenges such as market volatility and regulatory changes.

Importance of Property Portfolio Management

The significance of property portfolio management cannot be overstated, particularly in an environment characterised by fluctuating market conditions and evolving tenant expectations. Effective management ensures that properties are not only maintained to a high standard but also positioned strategically within the market to attract and retain tenants. This is crucial for generating consistent rental income and achieving long-term capital appreciation.

A well-managed portfolio can provide a buffer against economic downturns, as diversified holdings across different asset classes or geographical locations can mitigate risks associated with market volatility. Moreover, property portfolio management plays a vital role in aligning investment strategies with broader financial goals. Investors often have specific objectives, whether they are seeking immediate cash flow or long-term growth.

By employing sound management practices, property managers can tailor their strategies to meet these objectives while also considering factors such as market trends, tenant demographics, and regulatory changes. This alignment not only enhances the performance of individual properties but also contributes to the overall success of the investment portfolio.

Components of Property Portfolio Management

Property portfolio management comprises several key components that work in tandem to ensure optimal performance. One of the primary elements is asset acquisition, which involves identifying and purchasing properties that align with the investor’s strategic goals. This process requires thorough market research, financial analysis, and due diligence to assess potential risks and returns.

Understanding local market conditions, property values, and emerging trends is essential for making informed acquisition decisions. Another critical component is property leasing and tenant management. Effective leasing strategies are vital for maximising occupancy rates and minimising vacancy periods.

This involves not only marketing properties to attract suitable tenants but also negotiating lease terms that are favourable for both parties. Additionally, maintaining strong relationships with tenants is crucial for ensuring tenant satisfaction and retention. Regular communication, prompt responses to maintenance requests, and proactive engagement can significantly enhance tenant loyalty and reduce turnover rates.

Financial management is also a cornerstone of property portfolio management. This includes budgeting, forecasting, and monitoring financial performance across the portfolio. Property managers must analyse income statements, cash flow projections, and expense reports to ensure that each asset is performing as expected.

Furthermore, effective financial management allows for timely decision-making regarding capital improvements or divestitures when necessary.

Strategies for Effective Property Portfolio Management

Implementing effective strategies is essential for successful property portfolio management. One widely adopted approach is diversification, which involves spreading investments across various types of properties or geographical locations. By diversifying a portfolio, investors can reduce their exposure to risks associated with specific markets or asset classes.

For instance, a portfolio that includes residential, commercial, and industrial properties may be better positioned to weather economic fluctuations than one concentrated in a single sector. Another strategy is the use of technology and data analytics to inform decision-making processes. Advanced property management software can provide insights into market trends, tenant behaviours, and operational efficiencies.

By leveraging data analytics, property managers can identify opportunities for improvement, optimise rental pricing strategies, and enhance overall portfolio performance. For example, predictive analytics can help forecast tenant demand in specific areas, allowing managers to adjust their leasing strategies accordingly. Regular performance reviews are also crucial in effective property portfolio management.

By conducting periodic assessments of each asset’s performance against established benchmarks, property managers can identify underperforming properties and implement corrective actions. This may involve repositioning assets through renovations or rebranding efforts or even considering divestiture if a property consistently fails to meet performance expectations.

Benefits of Property Portfolio Management

The benefits of effective property portfolio management extend beyond mere financial returns; they encompass a range of advantages that contribute to the overall success of real estate investments. One significant benefit is enhanced operational efficiency. By streamlining processes such as tenant onboarding, maintenance requests, and financial reporting through technology, property managers can reduce administrative burdens and focus on strategic decision-making.

Additionally, effective property portfolio management fosters improved tenant relationships. By prioritising tenant satisfaction through responsive communication and proactive maintenance efforts, property managers can cultivate a positive living or working environment that encourages long-term occupancy. Satisfied tenants are more likely to renew leases and recommend properties to others, thereby reducing vacancy rates and associated costs.

Furthermore, a well-managed property portfolio can lead to increased asset value over time. Through strategic improvements and effective marketing efforts, properties can appreciate in value, providing investors with substantial returns upon sale or refinancing. This appreciation is often bolstered by a strong rental income stream generated from high occupancy rates and well-negotiated lease agreements.

Challenges in Property Portfolio Management

Despite its many benefits, property portfolio management is not without its challenges. One significant hurdle is navigating the complexities of regulatory compliance. Real estate markets are subject to various laws and regulations that can impact property operations, from zoning laws to health and safety standards.

Staying abreast of these regulations requires ongoing education and vigilance on the part of property managers to avoid potential legal pitfalls. Market volatility presents another challenge in property portfolio management. Economic downturns can lead to increased vacancy rates and declining rental income, necessitating swift action to mitigate losses.

Property managers must be adept at adjusting strategies in response to changing market conditions while maintaining a long-term perspective on their investment goals. Additionally, managing diverse properties across different locations or sectors can complicate decision-making processes. Each asset may have unique characteristics that require tailored management approaches.

Balancing these varying needs while ensuring consistency in overall portfolio performance can be a daunting task for property managers.

Key Considerations for Property Portfolio Management

When engaging in property portfolio management, several key considerations should guide decision-making processes. First and foremost is the importance of setting clear investment objectives. Whether an investor seeks capital appreciation or steady cash flow will significantly influence acquisition strategies and operational approaches.

Establishing these objectives early on provides a framework for evaluating potential investments and measuring success over time. Another critical consideration is the role of market research in informing investment decisions. Understanding local market dynamics—such as supply and demand trends, demographic shifts, and economic indicators—is essential for identifying opportunities and mitigating risks.

Property managers should invest time in conducting thorough research to ensure that their strategies align with current market conditions. Furthermore, fostering strong relationships with stakeholders—including tenants, investors, contractors, and local authorities—is vital for successful property portfolio management. Open lines of communication can facilitate collaboration on various initiatives while also enhancing tenant satisfaction and retention rates.

Conclusion and Future Trends in Property Portfolio Management

As we look towards the future of property portfolio management, several trends are poised to shape the landscape significantly. The integration of technology will continue to play a pivotal role in enhancing operational efficiencies and decision-making processes. Innovations such as artificial intelligence (AI) and machine learning are expected to revolutionise data analysis capabilities within the sector, enabling more accurate forecasting and strategic planning.

Sustainability is another trend gaining traction within property portfolio management. Investors are increasingly prioritising environmentally friendly practices in their portfolios as awareness of climate change grows. This shift towards sustainable real estate not only aligns with ethical considerations but also appeals to a growing demographic of environmentally conscious tenants.

Finally, the rise of remote work has altered demand patterns in commercial real estate sectors. Property managers must adapt their strategies to accommodate changing tenant needs while remaining agile in response to evolving market dynamics. By embracing these trends and remaining proactive in their approach, property managers can position themselves for success in an ever-changing real estate landscape.

Property portfolio management is a crucial aspect of maintaining and growing a successful investment strategy. It involves overseeing a collection of properties to maximise returns and minimise risks. A related article that delves into the importance of understanding the popularity of online gambling in the business world can be found here. This article sheds light on how online gambling has become a lucrative industry and how businesses can capitalise on this trend.

FAQs

What is property portfolio management?

Property portfolio management involves the strategic management of a collection of properties owned by an individual or a company. It includes activities such as acquisition, maintenance, leasing, and disposal of properties to maximize their value and achieve the owner’s investment goals.

What are the key components of property portfolio management?

Key components of property portfolio management include property acquisition and disposal, property maintenance and improvement, tenant management, lease administration, financial analysis and reporting, risk management, and strategic planning.

Why is property portfolio management important?

Property portfolio management is important because it helps property owners to maximize the value of their investments, minimize risks, and achieve their financial goals. It also ensures that properties are well-maintained and generate a steady income stream.

What are the benefits of property portfolio management?

The benefits of property portfolio management include increased property value, better tenant retention, improved cash flow, reduced vacancy rates, effective risk management, and overall better performance of the property portfolio.

Who can benefit from property portfolio management?

Property portfolio management can benefit individual property owners, real estate investors, property developers, and companies with a large portfolio of properties such as real estate investment trusts (REITs) and property management firms.

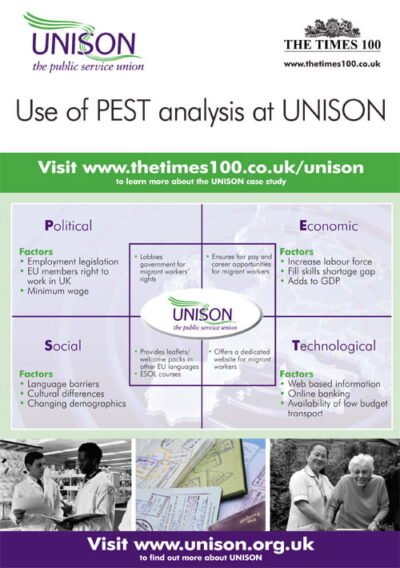

UNISON A3 ePoster Edition 14 "Use of PEST analysis at UNISON"

UNISON A3 ePoster Edition 14 "Use of PEST analysis at UNISON"  Using a range of management styles to lead a business (PDF)

Using a range of management styles to lead a business (PDF)