A budget is a plan, which is set out in numbers. It sets out figures that an organisation like a company hopes to achieve in the future. For example, a company like Kraft will create budgets for:

- Budgeted sales

- Budgeted production figures

- Budgeted costs, etc.

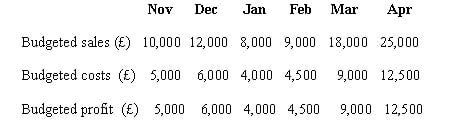

Here is a sales, costs and profits budget for the supply of chocolate eggs in the six months leading up to Easter:

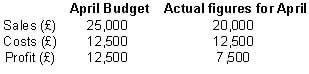

Note that the actual figures achieved by the company may be different from the budgeted ones. For example sales

figures may be £20,000 because demand is less than expected. However, costs may be the same because the firm may have already produced £12,500 worth of eggs to sell. If that were the case then actual profit would only be £7,500, which would be really short of the budgeted figures.

A budget is a plan for the future set out in numbers dealing with quantities such as sales, costs and production.

Cash flow forecast

A cash flow forecast is an estimate of future figures based on experience. You can make forecasts about all sorts of events e.g. the weather, the likely result of a sports fixture, etc. In business, you can forecast future sales figures, or the likely cash flow into and out of a business. A business often prepares a cash flow forecast showing the money likely to flow into and out of its bank account in a given period.

A retailing business typically makes sales of 500 items a month at £5 each. It buys each item that it resells for an average cost of £2.50 each. The running costs of the business are typically £1,000 per month. We can now calculate the cash flow of the business and set it out in a chart. The ‘bottom line’ of each monthly column shows the forecast bank balance at the end of that month.

Forecasts are based on past experience, whereas budgets are based on active plans for the future.