Motor insurance quotes are estimates of policy costs based on information provided by the individual seeking coverage. These quotes are not final and can change depending on various factors. The actual cost of the policy may differ from the initial quote as insurers may consider additional information or factors not initially accounted for.

Typical motor insurance quotes include details about coverage options, deductibles, and premiums. It is crucial to carefully review and comprehend each component of the quote to ensure adequate coverage at an affordable price. Motor insurance quotes can be complex, often containing various terms and conditions that may be challenging to understand.

Thoroughly reviewing each quote and seeking clarification on any unclear points is essential. Understanding the policy’s terms and conditions is vital to ensure appropriate coverage. Comparing quotes from multiple insurance companies is recommended to secure the best coverage at the most competitive price.

By investing time in understanding motor insurance quotes, individuals can make informed decisions about selecting the most suitable policy for their needs.

Key Takeaways

- Understanding motor insurance quotes is essential for making an informed decision about coverage options and costs.

- Factors to consider when comparing quotes include the level of coverage, deductibles, and any additional benefits or discounts offered.

- To obtain and compare quotes, it is important to gather information about your driving history, vehicle details, and desired coverage limits.

- Tips for getting the best deal on motor insurance include shopping around, asking about discounts, and considering bundling options with other insurance policies.

- Common mistakes to avoid when comparing quotes include not considering the full cost of coverage, overlooking important coverage options, and not reviewing policy terms and conditions.

- The importance of reviewing policy coverage cannot be overstated, as it ensures that you have the protection you need in the event of an accident or other unforeseen circumstances.

- Making an informed decision about motor insurance quotes involves carefully considering all aspects of the coverage and costs before selecting a policy.

Factors to Consider When Comparing Quotes

Coverage Options: Meeting Your Specific Needs

One of the most critical factors to consider is the coverage options included in each quote. It’s vital to carefully review the coverage options to ensure they meet your specific needs. This may include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

Deductibles: Weighing the Costs

Another crucial factor to consider is the deductibles associated with each quote. A higher deductible may result in lower premiums, but it’s essential to consider whether you can afford the out-of-pocket expense in the event of a claim.

Premiums and Discounts: Finding the Best Fit

When comparing motor insurance quotes, it’s also important to consider the premiums associated with each policy. Carefully review the premiums to ensure they fit within your budget. Additionally, look for discounts or incentives that may be available through each insurance company, such as discounts for safe driving, bundling policies, or having certain safety features installed in your vehicle. By carefully considering these factors, you can ensure you’re getting the best possible coverage at a price that fits your budget.

How to Obtain and Compare Quotes

Obtaining and comparing motor insurance quotes is a relatively straightforward process, but it’s important to take the time to gather and review quotes from multiple insurance companies to ensure that you are getting the best possible coverage at the most competitive price. One of the easiest ways to obtain quotes is by using online comparison tools. These tools allow you to input your information once and receive quotes from multiple insurance companies, making it easy to compare coverage options and premiums.

Additionally, you can contact insurance companies directly to request quotes. It’s important to provide accurate and consistent information when obtaining quotes to ensure that the estimates are as accurate as possible. Once you have obtained multiple quotes, it’s important to carefully review and compare each one.

This may include reviewing the coverage options, deductibles, premiums, and any discounts or incentives that may be available. It’s also important to consider any additional factors that may be important to you, such as customer service ratings or the financial stability of the insurance company. By taking the time to carefully review and compare quotes, you can make an informed decision about which policy is right for you.

Tips for Getting the Best Deal

| Tip | Description |

|---|---|

| Research | Take the time to research prices and compare deals from different sources. |

| Negotiate | Don’t be afraid to negotiate the price, especially for big-ticket items. |

| Timing | Look for deals during off-peak seasons or special sales events. |

| Bundle | Consider bundling products or services to get a better overall deal. |

| Check Reviews | Read reviews and ratings to ensure you’re getting a good quality product or service. |

When it comes to getting the best deal on motor insurance, there are several tips that can help you save money while still getting the coverage you need. One of the most effective ways to save money on motor insurance is by bundling policies. Many insurance companies offer discounts for bundling multiple policies, such as auto and home insurance.

Additionally, maintaining a clean driving record can help lower your premiums, as insurance companies often offer discounts for safe driving. Installing safety features in your vehicle, such as anti-theft devices or airbags, can also help lower your premiums. Another tip for getting the best deal on motor insurance is to consider raising your deductible.

A higher deductible typically results in lower premiums, but it’s important to carefully consider whether you can afford the out-of-pocket expense in the event of a claim. Additionally, it’s important to regularly review your coverage options and premiums to ensure that you are getting the best possible deal. By taking the time to explore these tips, you can save money on motor insurance while still getting the coverage you need.

Common Mistakes to Avoid When Comparing Quotes

When comparing motor insurance quotes, there are several common mistakes that should be avoided to ensure that you are getting the best possible coverage at the most competitive price. One common mistake is not providing accurate or consistent information when obtaining quotes. It’s important to provide accurate information about your driving history, vehicle, and coverage needs to ensure that the estimates are as accurate as possible.

Additionally, it’s important to avoid only considering the cost of the premiums when comparing quotes. While cost is an important factor, it’s also crucial to carefully review the coverage options and deductibles associated with each quote. Another common mistake when comparing motor insurance quotes is not taking advantage of discounts or incentives that may be available.

Many insurance companies offer discounts for safe driving, bundling policies, or having certain safety features installed in your vehicle. By not exploring these discounts, you may be missing out on potential savings. Additionally, it’s important to avoid making a decision based solely on price without considering other factors such as customer service ratings or the financial stability of the insurance company.

By avoiding these common mistakes, you can ensure that you are getting the best possible coverage at a price that fits your budget.

The Importance of Reviewing Policy Coverage

Liability Coverage and Collision Coverage

This may include liability coverage, which protects you in the event that you are at fault in an accident and cause injury or property damage to another party. Additionally, it’s important to consider collision coverage, which helps pay for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object.

Comprehensive Coverage and Additional Options

Comprehensive coverage is also important to consider, as it helps pay for repairs or replacement of your vehicle if it is damaged by something other than a collision, such as theft or vandalism. It’s also important to carefully review any additional coverage options that may be available through each insurance company.

Uninsured/Underinsured Motorist Coverage and Peace of Mind

This may include uninsured/underinsured motorist coverage, which helps protect you in the event that you are involved in an accident with a driver who does not have sufficient insurance coverage. By taking the time to review policy coverage, you can ensure that you are getting the protection you need in the event of an accident.

Making an Informed Decision

Making an informed decision about which motor insurance policy is right for you is crucial to ensuring that you are getting the best possible coverage at a price that fits your budget. It’s important to carefully review and compare quotes from multiple insurance companies to ensure that you are getting the best possible deal. This may include considering factors such as coverage options, deductibles, premiums, and any discounts or incentives that may be available.

Additionally, it’s important to consider any additional factors that may be important to you, such as customer service ratings or the financial stability of the insurance company. By taking the time to carefully review these factors, you can make an informed decision about which policy is right for you. It’s also important to regularly review your coverage options and premiums to ensure that you are still getting the best possible deal.

By making an informed decision about your motor insurance policy, you can have peace of mind knowing that you are protected in the event of an accident while still saving money on your premiums.

If you’re interested in learning more about essential strategies for financing your business, check out this article on Business Case Studies. It provides valuable insights into the various options available for financing a business, which can be helpful when considering the financial implications of motor insurance.

FAQs

What is motor insurance quote comparison?

Motor insurance quote comparison is the process of comparing the costs and coverage of different motor insurance policies from various insurance providers. This allows individuals to make an informed decision when choosing the best insurance policy for their vehicle.

Why is it important to compare motor insurance quotes?

Comparing motor insurance quotes is important because it helps individuals find the best coverage at the most affordable price. It allows them to evaluate different options and choose a policy that meets their specific needs and budget.

How can I compare motor insurance quotes?

Motor insurance quotes can be compared by using online comparison websites, contacting insurance providers directly, or working with an insurance broker. These methods allow individuals to receive multiple quotes and compare them based on coverage, cost, and other factors.

What factors should I consider when comparing motor insurance quotes?

When comparing motor insurance quotes, it’s important to consider factors such as the level of coverage, deductibles, premiums, discounts, customer service, and the reputation of the insurance provider. These factors can help individuals make an informed decision when choosing an insurance policy.

Are there any risks involved in not comparing motor insurance quotes?

Not comparing motor insurance quotes can result in individuals paying higher premiums for less coverage. It can also lead to missed opportunities for discounts and benefits that may be available through other insurance providers. Therefore, comparing quotes is essential to ensure that individuals are getting the best value for their money.

Competitive advantage through sustainable product development in construction (PDF)

Competitive advantage through sustainable product development in construction (PDF)  How HMRC collects tax revenue to support Government policy (PDF)

How HMRC collects tax revenue to support Government policy (PDF)  First Direct A3 ePoster Edition 13 "Using market research to relaunch a brand"

First Direct A3 ePoster Edition 13 "Using market research to relaunch a brand"  Motivational theory in practice at Tesco (PDF)

Motivational theory in practice at Tesco (PDF)  Organisations and unions (PDF)

Organisations and unions (PDF)  Syngenta A3 ePoster Edition 15 "Product design through research and development"

Syngenta A3 ePoster Edition 15 "Product design through research and development"  Creating world class quality standards (MP3)

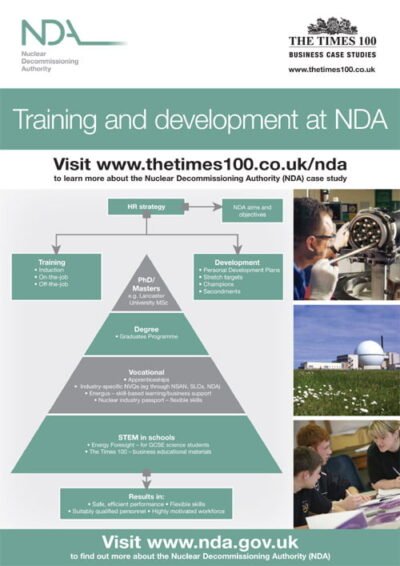

Creating world class quality standards (MP3)  NDA A3 ePoster Edition 15 "Training and development at NDA"

NDA A3 ePoster Edition 15 "Training and development at NDA"  Intellectual Property Office A3 ePoster Edition 15 "Intellectual property and the external environment"

Intellectual Property Office A3 ePoster Edition 15 "Intellectual property and the external environment"  KBR A3 ePoster Edition 14 "Roles and responsibilities within an organisational structure"

KBR A3 ePoster Edition 14 "Roles and responsibilities within an organisational structure"  Stakeholders in recycling and re-use (PDF)

Stakeholders in recycling and re-use (PDF)