Decision trees are graphical representations of alternative choices that can be made by a business, which enable the decision maker to identify the most suitable option in a particular circumstance.

For example, they will be used when oil and gas exploration companies have to decide whether to invest in a particular gas field or in choosing to allocate resources to exploit one gas field rather than another.

Decision trees are a helpful visual tool when it is possible to measure the probability of an event occurring and the likely financial outcomes of making a particular decision.

An oil exploration company has £100 million available in cash. It can invest the money in a bank at 10% yielding a return of £150 million over five years (ignore compound interest).

Alternatively, it can invest in an oil exploration project, of which there are currently two available.

If it invests in Project A there is a 0.5 chance of the project being a success yielding £200 million, and a 0.5 chance of the project failing to lead to a loss of £50 million. (over the five year period)

If it invests in Project B there is a 0.6 chance of the project being a success yielding £300 million and a 0.4 chance of the project failing to lead to a loss of £20 million. (over the five year period)

We can now work out the likely expected values:

Invest in bank: 1.0 x £150m

= £150m

Project A

0.5 x 200 = £100m

0.5 x -50 = £25m

= £100m

Project B

0.6 x 300 = £180m

0.4 x -20 = -£8m

= £172m

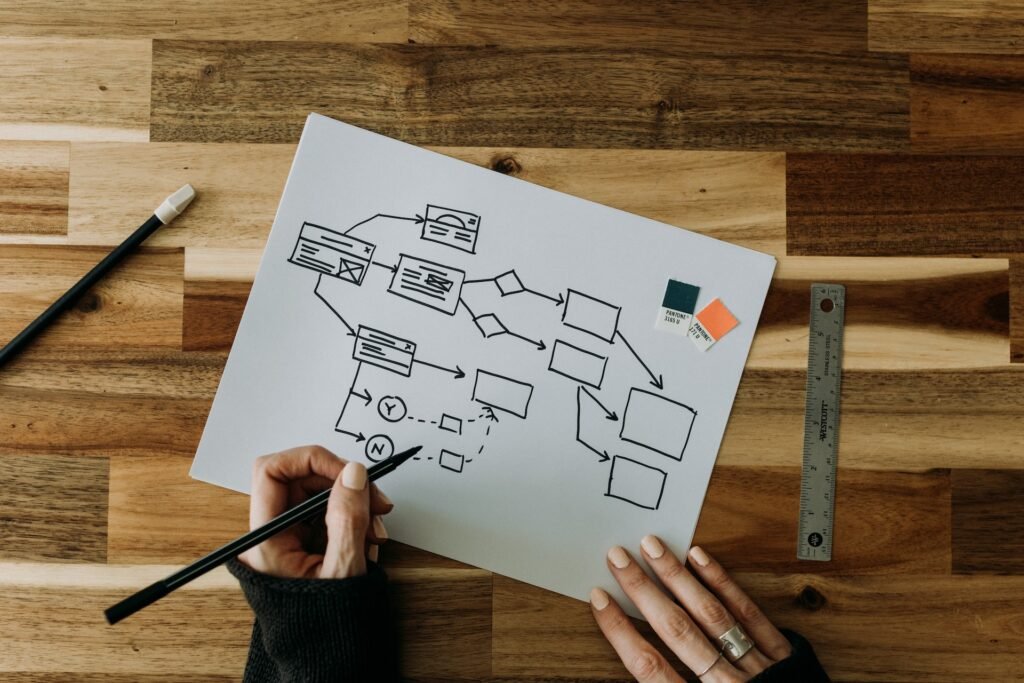

You can see that Project B yields the best result. We can illustrate this information on a decision tree. We set out the tree initially by working from left to right, the decision fork is to invest, or go for Project A or B.

There are then chance forks where probabilities are involved. When we have set out the tree we can prune it back by cutting off the branches which yield the worst results.

This leaves us with the final expected value – £172m which we put in the box at the start of the diagram.