In the rapidly evolving landscape of entrepreneurship, the valuation of startups has emerged as a critical component for investors, founders, and stakeholders alike. Traditionally, this process has relied heavily on qualitative assessments and subjective judgement, often leading to inconsistencies and inaccuracies. However, the advent of artificial intelligence (AI) has begun to transform this domain, offering a more data-driven approach to valuation.

AI-powered startup valuation leverages advanced algorithms and machine learning techniques to analyse vast amounts of data, providing insights that were previously unattainable through conventional methods. The integration of AI into startup valuation is not merely a trend; it represents a paradigm shift in how businesses are assessed. By harnessing the power of big data, AI can evaluate numerous variables simultaneously, including market trends, financial performance, and competitive positioning.

This capability allows for a more nuanced understanding of a startup’s potential value, enabling investors to make informed decisions based on empirical evidence rather than intuition alone. As the startup ecosystem continues to grow and evolve, the importance of AI in this context cannot be overstated.

Summary

- AI-powered startup valuation is revolutionizing the way we assess the worth of new businesses, using advanced technology to provide more accurate and efficient results.

- Artificial intelligence plays a crucial role in startup valuation by analysing large volumes of data, identifying patterns and trends, and making predictions based on complex algorithms.

- Using AI for startup valuation offers benefits such as improved accuracy, faster decision-making, reduced bias, and the ability to process vast amounts of data in real-time.

- Despite its advantages, AI-powered startup valuation also presents challenges and limitations, including the need for high-quality data, potential algorithmic biases, and the inability to account for human intuition and qualitative factors.

- AI-powered startup valuation differs from traditional methods by leveraging machine learning and predictive analytics to provide more objective and data-driven insights, rather than relying solely on human judgement and historical financial metrics.

The Role of Artificial Intelligence in Valuing Startups

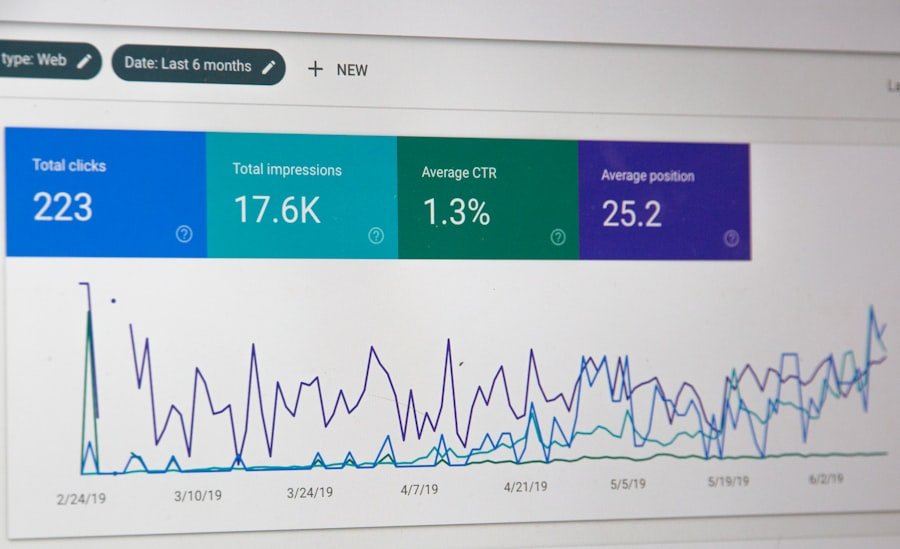

Artificial intelligence plays a multifaceted role in the valuation of startups, primarily through its ability to process and analyse large datasets with remarkable speed and accuracy. Machine learning algorithms can identify patterns and correlations within data that may not be immediately apparent to human analysts. For instance, AI can sift through historical financial records, market reports, and even social media sentiment to gauge a startup’s performance and potential trajectory.

This comprehensive analysis enables a more holistic view of a startup’s value proposition. Moreover, AI can enhance predictive analytics, allowing for more accurate forecasting of future performance. By employing techniques such as regression analysis and time-series forecasting, AI can project revenue growth, customer acquisition rates, and other key performance indicators.

This predictive capability is particularly valuable in the startup realm, where uncertainty is often high and traditional forecasting methods may fall short. As a result, investors can gain a clearer picture of a startup’s future potential, leading to more strategic investment decisions.

Benefits of Using AI for Startup Valuation

The benefits of utilising AI for startup valuation are manifold. One of the most significant advantages is the increased accuracy and objectivity that AI brings to the process. Traditional valuation methods often rely on subjective assessments that can vary widely between analysts.

In contrast, AI algorithms operate on data-driven principles, reducing the influence of personal bias and providing a more consistent valuation framework. This objectivity is particularly crucial in an environment where valuations can significantly impact funding rounds and investor confidence. Additionally, AI can significantly expedite the valuation process.

In traditional settings, gathering and analysing data can be time-consuming and labour-intensive. AI automates many of these tasks, allowing analysts to focus on interpreting results rather than getting bogged down in data collection. This efficiency not only saves time but also enables investors to respond more swiftly to emerging opportunities in the fast-paced startup landscape.

Furthermore, the ability to conduct real-time valuations means that stakeholders can make timely decisions based on the most current data available.

Challenges and Limitations of AI-Powered Startup Valuation

Despite its numerous advantages, AI-powered startup valuation is not without its challenges and limitations. One significant concern is the quality and availability of data. For AI algorithms to function effectively, they require access to high-quality datasets that accurately reflect market conditions and startup performance.

In many cases, especially with early-stage startups, such data may be sparse or unreliable. This lack of comprehensive data can hinder the effectiveness of AI models and lead to skewed valuations. Another challenge lies in the interpretability of AI-driven results.

While machine learning algorithms can produce highly accurate predictions, understanding the rationale behind these predictions can be complex. Investors may find it difficult to trust valuations generated by “black box” models without clear explanations of how conclusions were reached. This opacity can create hesitance among stakeholders who prefer traditional methods where the reasoning behind valuations is more transparent and understandable.

How AI-Powered Startup Valuation Differs from Traditional Methods

AI-powered startup valuation fundamentally differs from traditional methods in several key aspects. Traditional valuation approaches often rely on established frameworks such as discounted cash flow (DCF) analysis or comparable company analysis (CCA). These methods typically focus on historical financial performance and market comparables, which may not adequately capture the unique dynamics of startups, particularly those in nascent stages with little or no revenue.

In contrast, AI-driven valuation incorporates a broader range of variables beyond mere financial metrics. By analysing qualitative factors such as market sentiment, competitive landscape, and even founder characteristics, AI provides a more comprehensive assessment of a startup’s potential value. This holistic approach allows for a deeper understanding of the factors driving a startup’s success or failure, enabling investors to make more informed decisions based on a wider array of inputs.

Case Studies of Successful AI-Powered Startup Valuations

Several case studies illustrate the successful application of AI in startup valuation, showcasing its potential to revolutionise this critical aspect of investment decision-making. One notable example is the use of AI by venture capital firms like SignalFire, which employs machine learning algorithms to analyse vast datasets from various sources including job postings, social media activity, and funding history. By synthesising this information, SignalFire has been able to identify promising startups earlier than traditional methods would allow, leading to successful investments in companies that have since achieved significant growth.

Another compelling case is that of PitchBook, a financial data and software company that utilises AI to enhance its valuation models. By integrating machine learning into its platform, PitchBook has improved its ability to predict startup valuations based on real-time market data and trends. This capability has enabled investors to make quicker decisions in competitive funding environments where timing is crucial.

The success stories emerging from these case studies highlight not only the effectiveness of AI in valuation but also its potential to reshape investment strategies across the board.

The Future of AI-Powered Startup Valuation

Looking ahead, the future of AI-powered startup valuation appears promising as technology continues to advance and data becomes increasingly accessible. As machine learning algorithms evolve, they will likely become more adept at handling complex datasets and providing even more nuanced insights into startup performance. The integration of natural language processing (NLP) could further enhance these capabilities by allowing AI systems to analyse unstructured data sources such as news articles and investor reports for sentiment analysis.

Moreover, as more startups embrace transparency and share their operational data with investors, the quality of datasets available for analysis will improve significantly. This shift could lead to more accurate valuations and foster greater trust between startups and investors. Additionally, regulatory developments may encourage standardisation in how startups report their performance metrics, further enhancing the reliability of data used in AI-driven valuations.

The Impact of AI on the Valuation of Startups

The impact of artificial intelligence on the valuation of startups is profound and far-reaching. By providing a more objective, efficient, and comprehensive approach to assessing value, AI has the potential to transform how investors evaluate opportunities in the startup ecosystem. While challenges remain regarding data quality and interpretability, ongoing advancements in technology promise to address these issues over time.

As we move forward into an era where data-driven decision-making becomes increasingly paramount, the role of AI in startup valuation will likely expand further. Investors who embrace these innovations will be better positioned to navigate the complexities of the modern entrepreneurial landscape, ultimately leading to more informed investment strategies and successful outcomes for both startups and their backers alike.

In a recent article on management structure and organisation, the importance of creating a cohesive and efficient team within a startup is highlighted. This is particularly relevant when considering the valuation of AI-powered startups, as a strong management structure can greatly impact the success and growth potential of the business. By implementing effective recruitment and selection processes, as discussed in another article on recruitment and selection, startups can ensure they have the right talent in place to drive innovation and achieve their valuation goals. Additionally, hosting events such as a summer office party, as detailed in a separate article, can help foster a positive company culture and boost employee morale, further contributing to the overall success of the business.

FAQs

What is AI-Powered Startup Valuation?

AI-powered startup valuation refers to the use of artificial intelligence and machine learning algorithms to assess the value of a startup company. This technology helps investors and stakeholders make more informed decisions about investing in or acquiring a startup.

How does AI-Powered Startup Valuation work?

AI-powered startup valuation works by analysing a wide range of data points, including financial metrics, market trends, and industry benchmarks. The algorithms use this data to generate a valuation for the startup, taking into account various factors that traditional valuation methods may overlook.

What are the benefits of AI-Powered Startup Valuation?

Some of the benefits of AI-powered startup valuation include more accurate and objective valuations, faster decision-making, and the ability to consider a larger volume of data than traditional methods. This can lead to better investment outcomes and reduced risk for investors.

What are the limitations of AI-Powered Startup Valuation?

While AI-powered startup valuation offers many advantages, it is not without limitations. For example, the algorithms may struggle to account for qualitative factors such as the strength of a startup’s team or the uniqueness of its technology. Additionally, the accuracy of the valuation is dependent on the quality and relevance of the data used.

How widely is AI-Powered Startup Valuation used?

AI-powered startup valuation is becoming increasingly popular, particularly among venture capital firms, private equity investors, and corporate development teams. As the technology continues to improve and demonstrate its value, its adoption is likely to grow.