Hedge fund management represents a sophisticated and dynamic segment of the financial services industry, characterised by its diverse investment strategies and a focus on absolute returns. Unlike traditional investment vehicles such as mutual funds, hedge funds are typically structured as private investment partnerships, allowing them to employ a wider array of strategies, including short selling, leverage, and derivatives trading. This flexibility enables hedge funds to pursue aggressive growth opportunities and to hedge against market downturns, making them appealing to high-net-worth individuals and institutional investors alike.

The origins of hedge funds can be traced back to the 1940s, with Alfred Winslow Jones often credited as the pioneer of the hedge fund model. His innovative approach involved using leverage and short selling to mitigate risk while seeking to generate positive returns regardless of market conditions. Over the decades, the hedge fund industry has evolved significantly, with thousands of funds now operating globally, each with its unique investment philosophy and strategy.

This evolution has led to an increasingly complex landscape where hedge fund managers must navigate not only market dynamics but also regulatory frameworks and investor expectations.

Summary

- Hedge fund management involves the management of investment funds using a variety of strategies to generate high returns for investors.

- Hedge fund managers play a crucial role in making investment decisions, managing risk, and ensuring compliance with regulations.

- Strategies used in hedge fund management include long/short equity, event-driven, and global macro, among others, with techniques such as leverage and derivatives used to enhance returns.

- Risk management is a key aspect of hedge fund management, with managers employing various tools and techniques to mitigate potential losses.

- Performance measurement and reporting are essential in hedge fund management to track the success of investment strategies and communicate with investors, regulators, and other stakeholders.

The Role of Hedge Fund Managers

Hedge fund managers play a pivotal role in the success of their funds, acting as both strategists and decision-makers. Their primary responsibility is to devise and implement investment strategies that align with the fund’s objectives while managing risk effectively. This requires a deep understanding of financial markets, economic indicators, and various asset classes.

Hedge fund managers often possess advanced degrees in finance or economics and have extensive experience in investment banking, trading, or asset management. In addition to formulating investment strategies, hedge fund managers are tasked with conducting rigorous research and analysis to identify potential investment opportunities. This involves scrutinising financial statements, market trends, and macroeconomic factors that could impact asset prices.

Furthermore, they must maintain a keen awareness of global events and geopolitical developments that may influence market sentiment. The ability to make informed decisions quickly is crucial, as hedge fund managers often operate in fast-paced environments where timing can significantly affect performance.

Strategies and Techniques Used in Hedge Fund Management

Hedge funds employ a myriad of strategies to achieve their investment goals, each with its unique risk-return profile. One of the most common strategies is long/short equity, where managers take long positions in undervalued stocks while simultaneously shorting overvalued ones. This approach allows them to profit from both rising and falling markets, providing a level of protection against market volatility.

Another prevalent strategy is event-driven investing, which focuses on specific corporate events such as mergers, acquisitions, or restructurings. Managers employing this strategy analyse the potential impact of these events on stock prices and position themselves accordingly. For instance, during a merger announcement, a hedge fund might buy shares of the target company while shorting shares of the acquiring company if they believe the deal will face regulatory hurdles or other challenges.

Global macro investing is yet another strategy that has gained traction among hedge funds. This approach involves making investment decisions based on macroeconomic trends and geopolitical developments across various countries. Managers may invest in currencies, commodities, or bonds based on their outlook for economic growth or inflation in specific regions.

For example, if a hedge fund manager anticipates rising inflation in a particular country, they might invest in commodities like gold or oil as a hedge against currency depreciation.

Risk Management in Hedge Fund Management

Effective risk management is paramount in hedge fund management due to the inherent volatility associated with many investment strategies. Hedge fund managers employ a variety of techniques to mitigate risks and protect their portfolios from adverse market movements. One fundamental approach is diversification, which involves spreading investments across different asset classes, sectors, and geographic regions.

By diversifying their portfolios, hedge funds can reduce the impact of poor performance in any single investment. In addition to diversification, hedge funds often utilise sophisticated quantitative models to assess risk exposure and forecast potential losses. These models analyse historical data and market trends to identify correlations between different assets and predict how they may react under various scenarios.

Stress testing is another critical component of risk management; it involves simulating extreme market conditions to evaluate how a portfolio would perform during periods of significant stress. Moreover, many hedge funds implement strict position limits and stop-loss orders to manage individual trade risks. Position limits ensure that no single investment can disproportionately affect the overall portfolio, while stop-loss orders automatically trigger a sale if an asset’s price falls below a predetermined level.

This proactive approach helps hedge fund managers maintain control over their risk exposure and safeguard investor capital.

Performance Measurement and Reporting in Hedge Fund Management

Measuring performance in hedge fund management is complex due to the diverse strategies employed and the varying risk profiles of different funds. Hedge fund managers typically report performance using metrics such as absolute returns, relative returns against benchmarks, and risk-adjusted returns. Absolute return measures the total return generated by the fund over a specific period, while relative return compares the fund’s performance against a relevant benchmark index.

One widely used metric for assessing risk-adjusted performance is the Sharpe ratio, which evaluates the excess return per unit of risk taken by the fund. A higher Sharpe ratio indicates that a fund has generated more return for each unit of risk, making it an attractive option for investors seeking efficient portfolios. Other metrics include the Sortino ratio, which focuses specifically on downside risk, and the Alpha coefficient, which measures a fund’s performance relative to its expected return based on its beta.

Transparency in reporting is also crucial for maintaining investor trust and confidence. Hedge funds are often required to provide regular updates on performance, portfolio composition, and risk exposure. Many funds now utilise technology platforms that allow investors to access real-time data on their investments, enhancing transparency and facilitating informed decision-making.

Regulatory and Compliance Considerations in Hedge Fund Management

The regulatory landscape for hedge funds has evolved significantly over the past decade, particularly following the 2008 financial crisis. Regulatory bodies worldwide have implemented stricter rules aimed at increasing transparency and reducing systemic risk within the financial system. In the United States, for instance, the Dodd-Frank Wall Street Reform and Consumer Protection Act introduced new registration requirements for hedge funds with assets exceeding $150 million.

Compliance with these regulations necessitates robust internal controls and reporting mechanisms within hedge funds. Managers must ensure that they adhere to anti-money laundering (AML) laws, know-your-customer (KYC) requirements, and other regulatory obligations designed to prevent fraud and protect investors. Failure to comply with these regulations can result in severe penalties, including fines and reputational damage.

In addition to regulatory compliance, hedge funds must also navigate complex tax considerations that vary by jurisdiction. Tax treatment can significantly impact net returns for investors; thus, understanding local tax laws is essential for effective fund management. Many hedge funds engage legal and tax advisors to ensure compliance with applicable laws while optimising tax efficiency for their investors.

Challenges and Opportunities in Hedge Fund Management

The hedge fund industry faces numerous challenges that can impact performance and investor sentiment. One significant challenge is increased competition from both traditional asset managers and alternative investment vehicles such as exchange-traded funds (ETFs). As more investors seek low-cost options for portfolio diversification, hedge funds must differentiate themselves by demonstrating their value proposition through consistent performance and innovative strategies.

Market volatility also poses a challenge for hedge fund managers who rely on precise timing for their trades. Sudden market shifts can lead to significant losses if positions are not managed effectively. Additionally, geopolitical tensions and economic uncertainties can create unpredictable market conditions that complicate investment decisions.

Despite these challenges, there are ample opportunities within the hedge fund space. The growing demand for alternative investments among institutional investors presents an avenue for hedge funds to attract new capital. Furthermore, advancements in technology have enabled hedge funds to leverage data analytics and artificial intelligence for improved decision-making processes.

By harnessing these tools, managers can enhance their research capabilities and identify emerging trends more effectively.

The Future of Hedge Fund Management

Looking ahead, the future of hedge fund management appears poised for transformation driven by technological advancements and evolving investor preferences. The integration of artificial intelligence (AI) and machine learning into investment processes is likely to become increasingly prevalent as managers seek to enhance their analytical capabilities and improve predictive accuracy. These technologies can assist in processing vast amounts of data quickly, enabling managers to make more informed decisions based on real-time insights.

Moreover, as environmental, social, and governance (ESG) considerations gain prominence among investors, hedge funds may need to adapt their strategies to incorporate sustainable investing principles. Funds that prioritise ESG factors may attract a broader base of investors who are increasingly concerned about ethical investing practices. The regulatory environment will continue to evolve as well; thus, hedge fund managers must remain vigilant in adapting their compliance frameworks to meet new requirements while maintaining operational efficiency.

As competition intensifies within the industry, those firms that embrace innovation while adhering to regulatory standards will likely emerge as leaders in this dynamic landscape. In conclusion, hedge fund management is a multifaceted discipline that requires expertise across various domains including investment strategy formulation, risk management, performance measurement, regulatory compliance, and technological adaptation. As the industry continues to evolve amidst challenges and opportunities alike, successful hedge fund managers will be those who can navigate this complexity while delivering value to their investors.

If you are interested in learning more about the importance of building a referral network for your business, you should check out the article Importance of Building Octopus Energy Referral Network. This article discusses the benefits of creating a strong network of referrals to help grow your business. Just like hedge fund management, building a referral network requires strategic planning and effective communication to achieve success.

FAQs

What is hedge fund management?

Hedge fund management involves the overseeing and strategic decision-making of a hedge fund’s investment portfolio. This includes making investment decisions, managing risk, and implementing trading strategies to generate returns for the fund’s investors.

What does a hedge fund manager do?

A hedge fund manager is responsible for making investment decisions, managing the fund’s portfolio, and implementing trading strategies to achieve the fund’s investment objectives. They also oversee risk management and may be involved in fundraising and investor relations.

What are the key responsibilities of a hedge fund manager?

Key responsibilities of a hedge fund manager include conducting investment research, making investment decisions, managing the fund’s portfolio, implementing trading strategies, monitoring and managing risk, and communicating with investors.

What qualifications are required to become a hedge fund manager?

Qualifications to become a hedge fund manager typically include a strong background in finance, economics, or a related field, as well as relevant work experience in investment management, trading, or financial analysis. Many hedge fund managers also hold advanced degrees such as an MBA or CFA designation.

How do hedge fund managers generate returns for investors?

Hedge fund managers generate returns for investors by making strategic investment decisions, implementing trading strategies, and actively managing the fund’s portfolio to take advantage of market opportunities. They may also use leverage and derivatives to enhance returns, although this also increases risk.

What are the challenges of hedge fund management?

Challenges of hedge fund management include navigating complex and volatile financial markets, managing risk effectively, meeting investor expectations, and staying abreast of regulatory and compliance requirements. Additionally, competition within the hedge fund industry can pose challenges for managers in generating alpha.

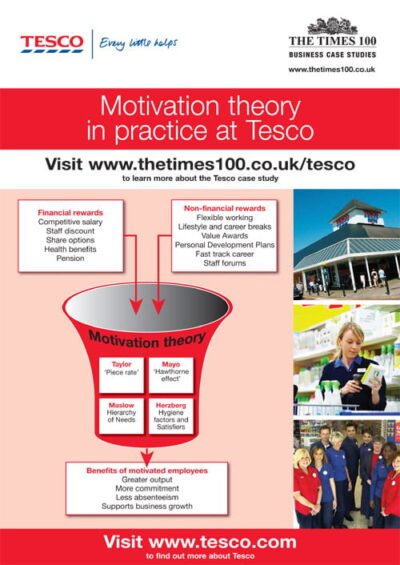

Tesco A3 ePoster Edition 15 "Motivation theory in practice at Tesco"

Tesco A3 ePoster Edition 15 "Motivation theory in practice at Tesco"  Legal Services Commission A3 ePoster Edition 15 "The advantages of centralisation"

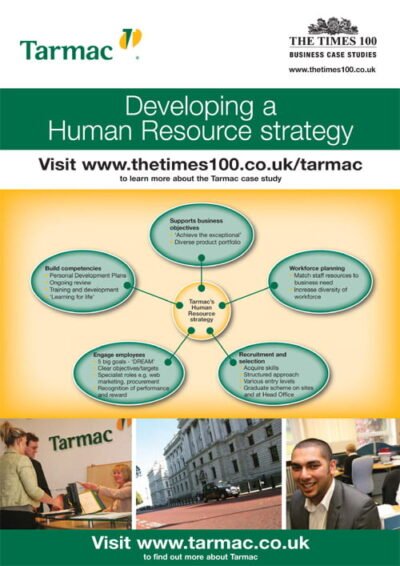

Legal Services Commission A3 ePoster Edition 15 "The advantages of centralisation"  Tarmac A3 ePoster Edition 15 "Developing a Human Resource strategy"

Tarmac A3 ePoster Edition 15 "Developing a Human Resource strategy"  Parcelforce A3 ePoster Edition 14 "Using the marketing mix to drive change"

Parcelforce A3 ePoster Edition 14 "Using the marketing mix to drive change"  Tesco A3 ePoster Edition 18 "Visions, values and business strategies"

Tesco A3 ePoster Edition 18 "Visions, values and business strategies"