The Cost of Goods Sold (COGS) is a critical financial metric that represents the direct costs attributable to the production of goods sold by a company. This figure encompasses all expenses directly tied to the manufacturing of products, including raw materials, labour costs, and overhead expenses that are directly associated with the production process. For businesses that deal in physical products, understanding COGS is essential, as it provides insight into the efficiency of production and the overall health of the business.

COGS is typically recorded on the income statement and is subtracted from revenue to determine gross profit, making it a pivotal element in financial analysis. In essence, COGS reflects the costs incurred during the production of goods that are sold within a specific period. It does not include indirect expenses such as sales and marketing costs or administrative expenses, which are accounted for separately.

The calculation of COGS can vary significantly depending on the nature of the business and its accounting practices. For instance, a manufacturing company will have a different COGS structure compared to a retail business, as the former will include costs related to production processes while the latter will focus on the purchase price of inventory sold. Understanding these nuances is vital for accurate financial reporting and analysis.

Summary

- Understanding COGS is essential for businesses to accurately assess their profitability and make informed financial decisions.

- Calculating COGS helps businesses determine the direct costs associated with producing goods, allowing for better pricing strategies and cost control.

- Components of COGS include direct materials, direct labour, and overhead costs directly related to production.

- Methods of calculating COGS include the specific identification method, first-in, first-out (FIFO) method, and weighted average method.

- COGS directly impacts profitability, as it is subtracted from revenue to determine gross profit, making it crucial for businesses to manage and control their COGS effectively.

Importance of Calculating COGS

Calculating COGS is fundamental for several reasons, primarily because it directly affects a company’s gross profit margin. Gross profit is calculated by subtracting COGS from total revenue, and this figure is crucial for assessing a company’s profitability. A precise calculation of COGS allows businesses to understand their cost structure better and make informed decisions regarding pricing strategies, inventory management, and overall financial health.

For instance, if a company notices that its COGS is rising disproportionately compared to revenue, it may need to investigate potential inefficiencies in its production process or supply chain. Moreover, accurate COGS calculations are essential for tax purposes. In many jurisdictions, businesses can deduct COGS from their taxable income, which can significantly impact their overall tax liability.

Therefore, maintaining precise records and calculations of COGS not only aids in financial reporting but also ensures compliance with tax regulations. This aspect underscores the importance of having robust accounting practices in place to track all relevant costs associated with goods sold.

Components of COGS

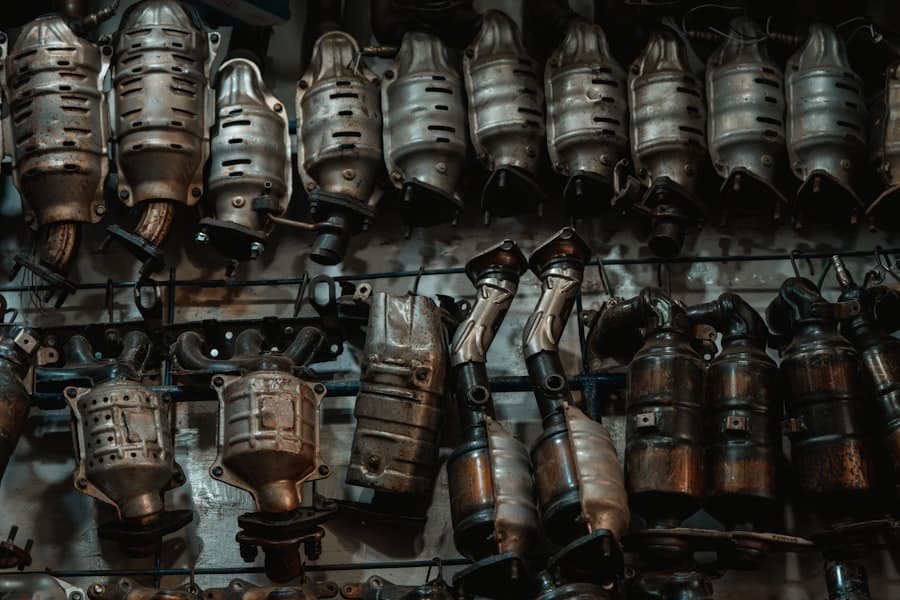

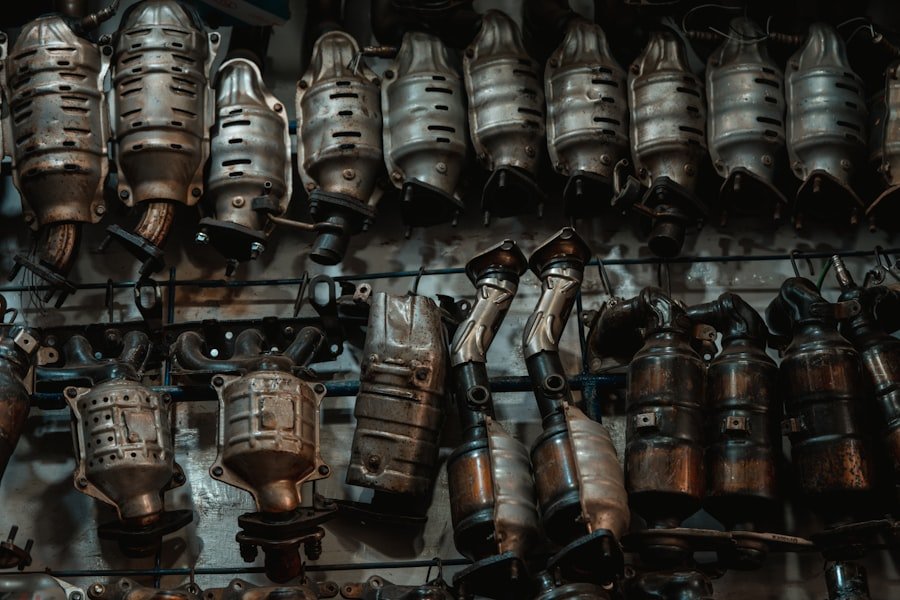

The components of COGS can be broadly categorised into three main areas: direct materials, direct labour, and manufacturing overhead. Direct materials refer to the raw materials that are used in the production of goods. For example, a furniture manufacturer would include the cost of wood, fabric, and other materials used to create its products as part of its COGS.

These costs are typically variable, fluctuating with production volume. Direct labour encompasses the wages paid to workers who are directly involved in the manufacturing process. This includes not only the salaries of factory workers but also any benefits or payroll taxes associated with their employment.

For instance, if a company employs skilled craftsmen to assemble products, their wages would be included in COGS. Manufacturing overhead includes all other costs that are necessary for production but cannot be directly traced to specific units produced. This might include utilities for the manufacturing facility, depreciation on equipment, and maintenance costs.

Understanding these components allows businesses to identify areas where they can potentially reduce costs and improve efficiency.

Methods of Calculating COGS

There are several methods for calculating COGS, each with its own implications for financial reporting and tax obligations. The most common methods include First-In-First-Out (FIFO), Last-In-First-Out (LIFO), and the Weighted Average Cost method. FIFO assumes that the oldest inventory items are sold first; thus, in times of rising prices, this method results in lower COGS and higher profits on paper.

Conversely, LIFO assumes that the most recently acquired inventory is sold first, which can lead to higher COGS and lower taxable income during inflationary periods. The Weighted Average Cost method calculates an average cost for all inventory items available for sale during a period and applies this average cost to determine COGS. This method smooths out price fluctuations over time and can be beneficial for businesses with large volumes of similar products.

Each method has its advantages and disadvantages depending on market conditions and business strategy; therefore, companies must choose a method that aligns with their operational realities and financial goals.

Impact of COGS on Profitability

The impact of COGS on profitability cannot be overstated. A higher COGS directly reduces gross profit margins, which can lead to decreased net income if not managed properly. For instance, if a company experiences an increase in raw material prices without adjusting its selling prices accordingly, its gross profit will diminish.

This scenario highlights the importance of monitoring COGS closely and understanding how fluctuations in costs can affect overall profitability. Furthermore, COGS plays a significant role in pricing strategies. Businesses must ensure that their pricing covers not only the cost of goods sold but also other operating expenses and desired profit margins.

If a company sets its prices too low without considering COGS adequately, it risks operating at a loss. Conversely, setting prices too high may drive customers away. Therefore, understanding the relationship between COGS and pricing is crucial for maintaining healthy profit margins.

Managing COGS to Improve Profit Margins

Effective management of COGS is essential for improving profit margins and ensuring long-term sustainability. One approach to managing COGS involves negotiating better terms with suppliers to reduce material costs or seeking alternative suppliers who offer more competitive pricing without compromising quality. Additionally, businesses can explore bulk purchasing options or long-term contracts that lock in lower prices for essential materials.

Another strategy involves optimising production processes to enhance efficiency and reduce waste. Implementing lean manufacturing principles can help identify areas where resources are being wasted or where processes can be streamlined. For example, a company might invest in technology that automates certain aspects of production, thereby reducing labour costs and increasing output without sacrificing quality.

By focusing on these areas, businesses can effectively manage their COGS and improve their overall profit margins.

Common Mistakes in Calculating COGS

Despite its importance, many businesses make common mistakes when calculating COGS that can lead to inaccurate financial reporting and misguided decision-making. One prevalent error is failing to account for all relevant costs associated with production. For instance, some companies may overlook indirect costs such as utilities or maintenance expenses when calculating their COGS, leading to an inflated gross profit figure.

Another frequent mistake is not updating inventory records regularly or accurately tracking inventory levels throughout the accounting period. Inaccurate inventory records can result in miscalculations of both ending inventory and COGS, which can distort financial statements and mislead stakeholders about the company’s performance. Regular audits and reconciliations of inventory records are essential practices that can help mitigate these errors.

Strategies for Controlling COGS

Controlling COGS requires a multifaceted approach that encompasses various strategies aimed at reducing costs while maintaining product quality. One effective strategy is implementing just-in-time (JIT) inventory management systems that minimise excess inventory and reduce holding costs. By synchronising production schedules with demand forecasts, companies can lower their inventory levels and associated carrying costs.

Additionally, investing in technology such as enterprise resource planning (ERP) systems can provide businesses with real-time data on production costs and inventory levels. This information enables more informed decision-making regarding purchasing and production processes. Furthermore, conducting regular reviews of supplier contracts can uncover opportunities for renegotiation or consolidation with fewer suppliers to achieve better pricing terms.

Training employees on cost-saving measures and fostering a culture of efficiency within the organisation can also contribute significantly to controlling COGS. Encouraging staff to identify inefficiencies or suggest improvements can lead to innovative solutions that reduce waste and enhance productivity across various departments. In conclusion, understanding and managing the Cost of Goods Sold is vital for any business involved in manufacturing or retailing products.

By accurately calculating COGS and implementing effective strategies for control and management, companies can significantly enhance their profitability and ensure long-term success in an increasingly competitive marketplace.

Understanding the Cost of Goods Sold (COGS) is crucial for any business looking to accurately assess its financial performance. In a related article on businesscasestudies.co.uk, the focus shifts to the importance of avoiding landing page mistakes that can hinder the return on investment of an online marketing strategy. Just as COGS plays a key role in determining a company’s profitability, ensuring a well-designed landing page is essential for maximising the effectiveness of digital marketing efforts. By understanding both concepts, businesses can make informed decisions that drive success in today’s competitive market.

FAQs

What is the Cost of Goods Sold (COGS)?

The Cost of Goods Sold (COGS) is the direct costs associated with producing goods or services that a company sells during a specific period. These costs include the cost of materials, labour, and overhead expenses directly related to the production of the goods or services.

Why is COGS important?

COGS is important because it is a key component in determining a company’s gross profit and, ultimately, its net profit. It is also used in calculating the company’s inventory turnover and is a crucial factor in determining the company’s financial performance.

How is COGS calculated?

COGS is calculated by adding the beginning inventory for the period to the cost of goods purchased or manufactured during the period and then subtracting the ending inventory for the period.

What is included in COGS?

COGS includes the direct costs of producing goods or services, such as the cost of raw materials, direct labour, and manufacturing overhead.

What is not included in COGS?

COGS does not include indirect costs such as marketing expenses, administrative expenses, or other overhead costs not directly related to the production of goods or services.

How does COGS affect a company’s financial statements?

COGS is subtracted from a company’s revenue to calculate its gross profit. It is then used to calculate the company’s net profit by subtracting operating expenses from the gross profit. Therefore, COGS has a direct impact on a company’s income statement and overall financial performance.

Creating shared value in the supply chain (PDF)

Creating shared value in the supply chain (PDF)