A trust account is a financial arrangement in which one party, known as the trustee, holds and manages assets on behalf of another party, referred to as the beneficiary. This legal structure is designed to ensure that the assets are safeguarded and used according to the specific terms set forth in a trust agreement. Trust accounts can encompass a wide range of assets, including cash, securities, real estate, and other valuable items.

The trustee has a fiduciary duty to act in the best interests of the beneficiary, which means they must manage the assets prudently and transparently. The concept of a trust account is rooted in the principles of trust law, which has evolved over centuries. Trusts can be established for various reasons, including estate planning, charitable giving, or managing funds for minors or individuals who may not be capable of managing their own finances.

The legal framework surrounding trust accounts varies by jurisdiction, but the fundamental principles remain consistent: the separation of ownership and control of assets, and the obligation of the trustee to act in good faith.

Summary

- A trust account is a financial account held by a trustee on behalf of a beneficiary, where the trustee manages the funds for a specific purpose.

- The purpose of a trust account is to safeguard and manage funds for the benefit of a specific individual or organisation, ensuring that the funds are used as intended.

- There are different types of trust accounts, including escrow accounts, client accounts, and security deposit accounts, each serving a specific purpose and governed by specific regulations.

- Trust account regulations vary by jurisdiction and may include requirements for record-keeping, reporting, and the handling of funds to protect the interests of beneficiaries.

- Trust accounts are important for maintaining transparency, accountability, and legal compliance in managing funds for the benefit of others.

Purpose of Trust Account

The primary purpose of a trust account is to provide a secure and structured way to manage assets for the benefit of another individual or entity. This arrangement is particularly beneficial in situations where the beneficiary may not be able to manage their own financial affairs due to age, incapacity, or lack of experience. For instance, parents often set up trust accounts for their children to ensure that funds are available for education or other significant life events while maintaining control over how and when those funds are accessed.

Additionally, trust accounts serve a crucial role in estate planning. By placing assets into a trust, individuals can dictate how their wealth will be distributed after their death, potentially avoiding the lengthy and often costly probate process. This can lead to a more efficient transfer of assets to heirs and can also provide tax benefits.

Trust accounts can also be used to protect assets from creditors or legal claims, ensuring that beneficiaries receive their intended inheritance without undue interference.

Types of Trust Accounts

There are several types of trust accounts, each designed to meet specific needs and objectives. One common type is the revocable living trust, which allows the grantor to retain control over the assets during their lifetime. This type of trust can be altered or revoked at any time, providing flexibility for the grantor as their circumstances change.

Upon the grantor’s death, the assets in a revocable living trust typically pass directly to the beneficiaries without going through probate. Another prevalent type is the irrevocable trust, which cannot be modified or dissolved without the consent of the beneficiaries. Once assets are transferred into an irrevocable trust, the grantor relinquishes control over them.

This type of trust is often used for estate tax planning purposes, as it removes assets from the grantor’s taxable estate. Special needs trusts are also noteworthy; they are designed to provide for individuals with disabilities without jeopardising their eligibility for government benefits. Charitable trusts represent another category, allowing individuals to donate assets to a charitable organisation while retaining some benefits during their lifetime.

These trusts can provide tax deductions and ensure that charitable intentions are fulfilled. Furthermore, there are spendthrift trusts that protect beneficiaries from creditors by restricting their access to trust funds until certain conditions are met.

Trust Account Regulations

Trust accounts are subject to a variety of regulations that govern their establishment and management. These regulations can differ significantly depending on the jurisdiction in which the trust is created. In many countries, trust law is primarily governed by statutes and case law that outline the rights and responsibilities of trustees and beneficiaries.

For instance, trustees are typically required to keep accurate records of all transactions and provide regular accountings to beneficiaries. In addition to general trust law, specific regulations may apply based on the type of trust account established. For example, financial institutions that manage trust accounts must adhere to strict fiduciary standards and regulatory requirements set forth by financial regulatory bodies.

These regulations often include guidelines on investment strategies, reporting obligations, and conflict-of-interest policies. Failure to comply with these regulations can result in legal repercussions for trustees and financial institutions alike. Moreover, tax implications play a significant role in the regulation of trust accounts.

In many jurisdictions, trusts are treated as separate taxable entities, meaning they must file tax returns and pay taxes on income generated by trust assets. Understanding these regulations is crucial for both trustees and beneficiaries to ensure compliance and optimise tax outcomes.

Importance of Trust Account

Trust accounts hold significant importance in both personal finance and broader financial planning contexts. They provide a mechanism for individuals to ensure that their assets are managed according to their wishes, particularly in situations where beneficiaries may lack the capacity or experience to handle financial matters independently. This is especially relevant for minors or individuals with disabilities who may require assistance in managing their inheritance.

Furthermore, trust accounts play a vital role in estate planning by facilitating the smooth transfer of wealth from one generation to another. By establishing a trust account, individuals can avoid probate delays and associated costs, ensuring that their heirs receive their intended inheritance promptly. This aspect is particularly appealing in jurisdictions where probate can be a lengthy and cumbersome process.

Trust accounts also offer protection against potential creditors or legal claims. By placing assets into a trust, individuals can shield those assets from being seized in lawsuits or bankruptcy proceedings. This protective feature is particularly beneficial for business owners or professionals who may face higher risks of litigation.

How to Open a Trust Account

Opening a trust account involves several steps that require careful consideration and planning. The first step is to determine the type of trust that best suits your needs and objectives. This decision often involves consulting with legal and financial professionals who specialise in estate planning and trust law.

They can provide guidance on the most appropriate structure based on your specific circumstances. Once the type of trust has been determined, the next step is to draft a trust agreement. This legal document outlines the terms of the trust, including details about the trustee’s powers and responsibilities, how assets will be managed, and how distributions will be made to beneficiaries.

It is essential that this document is comprehensive and clear to avoid potential disputes in the future. After finalising the trust agreement, you will need to fund the trust by transferring assets into it. This process may involve retitling property deeds, transferring bank accounts, or changing ownership of investment accounts.

It is crucial to ensure that all assets intended for inclusion in the trust are properly transferred; otherwise, they may not be subject to the terms outlined in the trust agreement.

Managing a Trust Account

Effective management of a trust account requires diligence and adherence to fiduciary responsibilities. The trustee must act in good faith and prioritise the interests of the beneficiaries at all times. This includes making prudent investment decisions that align with the goals outlined in the trust agreement while also considering factors such as risk tolerance and liquidity needs.

Regular communication with beneficiaries is also an essential aspect of managing a trust account. Trustees should provide periodic updates regarding the performance of trust assets and any distributions made. Transparency fosters trust between trustees and beneficiaries and helps prevent misunderstandings or disputes.

Additionally, trustees must maintain accurate records of all transactions related to the trust account. This includes documenting income generated by trust assets, expenses incurred in managing the trust, and any distributions made to beneficiaries. Proper record-keeping not only ensures compliance with legal requirements but also provides a clear audit trail should any questions arise regarding the management of the trust.

Common Misconceptions about Trust Accounts

Despite their growing popularity as financial planning tools, several misconceptions about trust accounts persist among the general public. One common myth is that trusts are only for wealthy individuals or families. While it is true that high-net-worth individuals often utilise trusts for estate planning purposes, trusts can be beneficial for people across various income levels.

They offer advantages such as asset protection and controlled distribution of funds that can be valuable regardless of one’s financial status. Another misconception is that establishing a trust account is an overly complicated process that requires extensive legal knowledge. While creating a trust does involve legal documentation and considerations, many professionals specialise in this area and can guide individuals through each step effectively.

With proper assistance from estate planning attorneys or financial advisors, setting up a trust can be a straightforward process tailored to meet specific needs. Additionally, some people believe that once assets are placed into a trust account, they lose all control over them. While irrevocable trusts do remove control from the grantor once established, revocable living trusts allow individuals to maintain control during their lifetime.

Understanding these nuances is crucial for anyone considering establishing a trust account as part of their financial strategy. In summary, while there are many misconceptions surrounding trust accounts, they remain an essential tool for effective asset management and estate planning across various demographics. By dispelling these myths and understanding how trusts function, individuals can make informed decisions about their financial futures.

If you are interested in learning more about boosting your website traffic, you should check out the article Boosting Your Website Traffic Fast and Easy: A How-To Guide. This article provides valuable tips and strategies for increasing the number of visitors to your website. It covers everything from search engine optimization to social media marketing. By implementing the advice in this article, you can attract more potential customers to your site and ultimately increase your online presence.

FAQs

What is a Trust Account?

A trust account is a bank account that holds funds on behalf of a third party, known as the beneficiary. These funds are typically held by a trustee, who has a legal obligation to manage the funds in the best interest of the beneficiary.

Who uses Trust Accounts?

Trust accounts are commonly used by solicitors, real estate agents, accountants, and other professionals who handle client funds. They are also used in personal finance, estate planning, and charitable giving.

What are the key features of a Trust Account?

Key features of a trust account include the separation of client funds from the trustee’s own funds, the requirement for accurate record-keeping, and the legal obligation to use the funds only for the benefit of the beneficiary.

How are Trust Accounts regulated?

Trust accounts are regulated by specific laws and regulations that vary by jurisdiction. These regulations are designed to protect the interests of the beneficiary and ensure that the trustee manages the funds responsibly.

What are the risks associated with Trust Accounts?

The main risks associated with trust accounts include mismanagement of funds, fraud, and embezzlement. It is important for trustees to maintain accurate records and adhere to legal and ethical standards to mitigate these risks.

How are Trust Accounts different from regular bank accounts?

Trust accounts are different from regular bank accounts in that they hold funds on behalf of a third party, and the trustee has a legal obligation to manage the funds in the best interest of the beneficiary. Regular bank accounts are typically used for personal or business finances and do not have the same legal obligations.

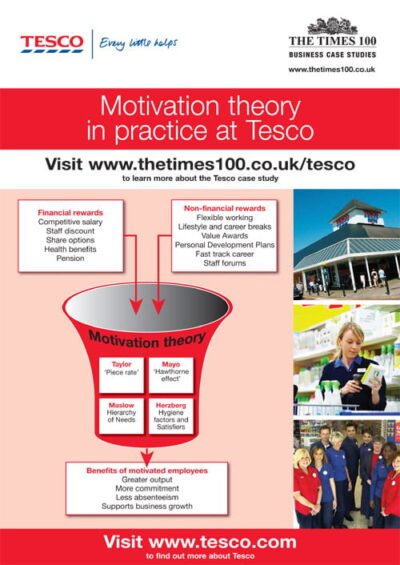

Tesco A3 ePoster Edition 15 "Motivation theory in practice at Tesco"

Tesco A3 ePoster Edition 15 "Motivation theory in practice at Tesco"  Legal Services Commission A3 ePoster Edition 15 "The advantages of centralisation"

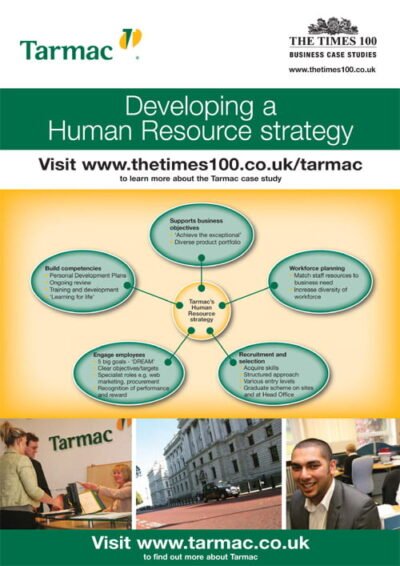

Legal Services Commission A3 ePoster Edition 15 "The advantages of centralisation"  Tarmac A3 ePoster Edition 15 "Developing a Human Resource strategy"

Tarmac A3 ePoster Edition 15 "Developing a Human Resource strategy"  Parcelforce A3 ePoster Edition 14 "Using the marketing mix to drive change"

Parcelforce A3 ePoster Edition 14 "Using the marketing mix to drive change"  Tesco A3 ePoster Edition 18 "Visions, values and business strategies"

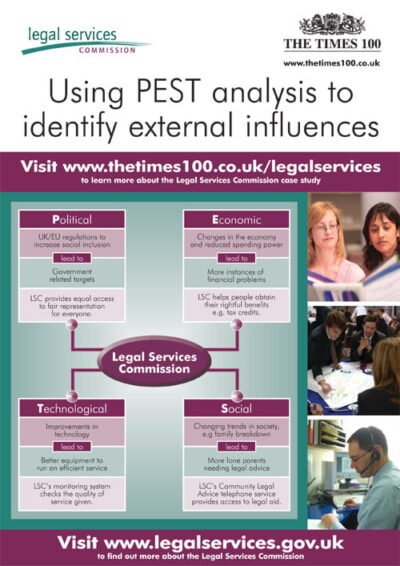

Tesco A3 ePoster Edition 18 "Visions, values and business strategies"  Legal Services Commission A3 ePoster Edition 13 "Using PEST analysis to identify external influences"

Legal Services Commission A3 ePoster Edition 13 "Using PEST analysis to identify external influences"  Building a multi-utility business (PDF)

Building a multi-utility business (PDF)  Foreign Commonwealth Office A3 ePoster Edition 15 "Meeting business needs through workforce planning"

Foreign Commonwealth Office A3 ePoster Edition 15 "Meeting business needs through workforce planning"