Foreign currencies are traded every single day for a whole host of reasons. Whether it’s a family heading off on holiday or an investor looking to make a speculative profit, there are plenty of people swapping pounds and dollars for yen and euros every moment of the day. It’s believed that over $5tn gets traded on the speculative forex markets every day, which is almost twice the size of a year’s output here in Britain!

Types of forex transactions vary. It’s possible, for example, to buy currency at the current price and hang on to it until the prices change. Futures contracts, meanwhile, allow exchanges to be set in stone well in advance in the hope that the price will shift in the new seller’s favour by then. However, for a business, there are other reasons why the forex market makes a lot of strategic sense. It can be a good way to avoid losing profit due to fluctuations, for example – and provided you take steps to avoid forex fraud happening to you, there’s no reason why it can’t work out in your favour.

More profit in other currencies

The simplest reason why a business would seek the services of a forex broker is to change profits made in one currency into a currency that makes more commercial sense for a certain reason. Say your Britain-based firm makes a significant profit from operations in mainland Europe, and that the earnings come in the form of euros. In some circumstances, it might make sense to leave the profit in euros and store it in a European bank account. You may want to reinvest it in the European enterprise, for example.

However, there may also be significant commercial reasons why those euros should be converted into pounds. Rates may be such that you have more spending power if the profit is in pounds, say. If you’re expecting more profits next year, meanwhile, then you may also want to get this profit declared in this year’s British corporation tax bill in order to spread the tax burden – and so the speed of conversion may become more important than rates and fees. In these circumstances, businesses often engage the service of a bank or other institution with a foreign exchange trading desk to arrange the process for them.

Hedging your bets

As a business, it’s also possible to use forex trading to deal with the inherent risk of doing business across a range of currency zones. If a business is counting on the value of a currency to go one way in order to help, say, a product launch or another investment, then they may also buy a range of forwards which predict that the currency will move the other way; that way, they’ll be able to cash in to some extent no matter what happens. However, this may soon become less common in Europe, where new rules are limiting the ease with which those who buy forex forwards can get their hands on them.

Beware of scams

As with any form of investment, it’s important to always be aware that the foreign exchange market does contain its fair share of scam artists. The case of Cairn Energy should serve as a warning to all businesses looking to hire an institution to help them with their foreign exchange conversions. Back in 2011, the firm engaged the services of HSBC to change some profits they had made in North America from dollars into pounds. However, Cairn suddenly found that they were paying higher prices for their pounds. That was because traders at HSBC were buying up currency themselves on behalf of the bank because they knew that a large order from Cairn was about to come in and push up the price – a practice known as front-running. In the end, some of those involved were sent to prison.

In addition to staff from large companies such as HSBC finding themselves guilty of forex fraud, smaller forex brokers can also fail to act in your best interests – meaning that name recognition is no protection. In any case, it’s still a wise idea to head over to a well-researched list of brokers and check the regulatory status of your chosen one: that way, you can at least be sure that their proceedings are subject to some sort of scrutiny and that safe forex trading is a bit more likely.

While forex trading may be something that retail investors or even holidaymakers regularly do, there’s a whole other foreign exchange world beyond that. For businesses, forex trading is a good way to both protect against uncertainty and place profits in a useful denomination. With resources available to help prevent your business going down the same route as Cairn Energy and other firms that have fallen victim to forex scams, it’s possible to protect yourself and your investments.

Developing responsiveness through organisational structure (MP3)

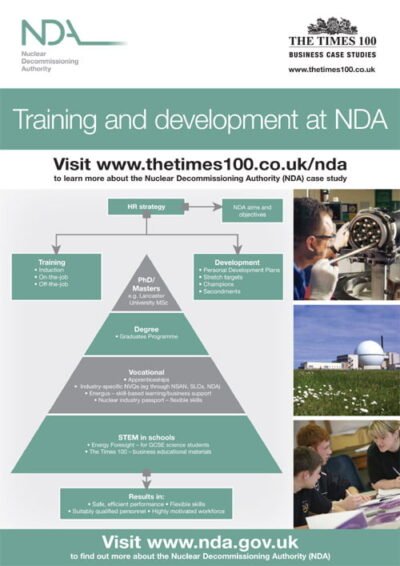

Developing responsiveness through organisational structure (MP3)  NDA A3 ePoster Edition 15 "Training and development at NDA"

NDA A3 ePoster Edition 15 "Training and development at NDA"