Subscribe | Write for Us | Advertise | Contact | Terms of Service | Privacy Policy | Copyright | Guest Post | © Copyright 1995 - 2025 GC Digital Marketing

The acquisiton of Dr Pepper/Seven-Up company inc in full in PDF format taken from edition 1 of Business Case Studies.

Read the case study online here

Enjoy Unlimited Access To All Our Case Studies

Read the case studies online, download PDF’s and access lesson plans, worksheets and MP3 audio files for each case study with one of our subscriptions.

All of the levels include:

- No advertisements

- Unlimited access

- 600+ case studies to view online

- downloadable worksheets

- downloadable lesson plans

- Audio MP3 case studies

- 600+ PDF case studies to download

- discounted ebooks in our eBook shop

- Early access to new content

Academic User Site License

The academic user license once set up allows easy access for all teachers and students at one academic site with our IP-based login making it easier as there is no requirement to have separate logins and passwords. If you require access to more than one site then a separate license is required for each site, for multiple sites please contact us for pricing.

Providing a customer-centric service (MP3)

Providing a customer-centric service (MP3)  Investing in people and in brands (PDF)

Investing in people and in brands (PDF)  Growing a brand in an unbranded market (PDF)

Growing a brand in an unbranded market (PDF)  Fuelling the digital revolution (PDF)

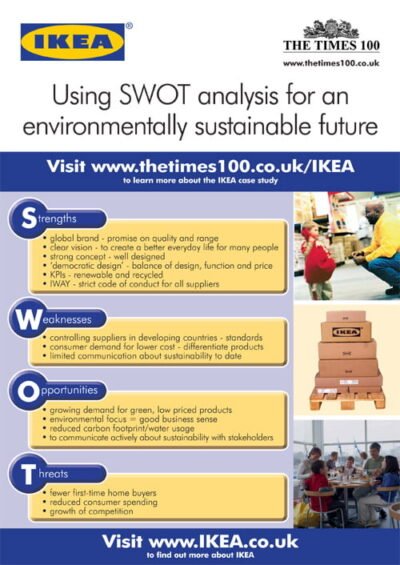

Fuelling the digital revolution (PDF)  IKEA A3 ePoster Edition 14 "SWOT analysis and sustainable business planning"

IKEA A3 ePoster Edition 14 "SWOT analysis and sustainable business planning"  Bernard Matthews A3 ePoster Edition 16 "Communicating with stakeholders"

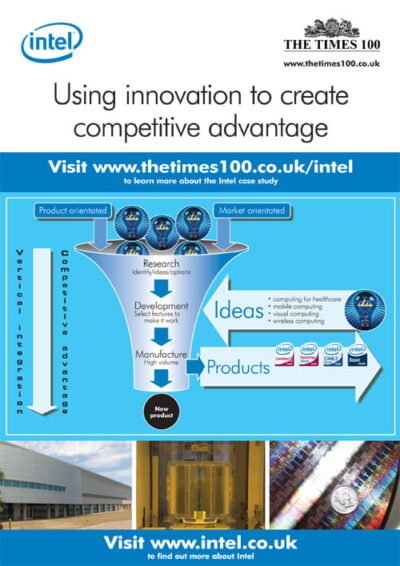

Bernard Matthews A3 ePoster Edition 16 "Communicating with stakeholders"  Intel A3 ePoster Edition 13 "Using innovation to create competitive advantage"

Intel A3 ePoster Edition 13 "Using innovation to create competitive advantage"  CMI A3 ePoster Edition 16 "Using teamwork to build a better workplace"

CMI A3 ePoster Edition 16 "Using teamwork to build a better workplace"  Intellectual Property Office A3 ePoster Edition 13 "Intellectual property rights and entrepreneurship"

Intellectual Property Office A3 ePoster Edition 13 "Intellectual property rights and entrepreneurship"  Ben Sherman A3 ePoster Edition 13 "Use of the marketing mix in the fashion industry"

Ben Sherman A3 ePoster Edition 13 "Use of the marketing mix in the fashion industry"  Achieving career results for young people (PDF)

Achieving career results for young people (PDF)  UNISON A3 ePoster Edition 18 “Providing support through the phases of the business cycle”

UNISON A3 ePoster Edition 18 “Providing support through the phases of the business cycle”