The concept of unfunded pensions has garnered significant attention in recent years, particularly as governments grapple with the financial implications of ageing populations and increasing life expectancies. Unfunded pension schemes, which rely on current contributions to pay for current benefits rather than being pre-funded through investments, present a unique set of challenges and opportunities. As the demographic landscape shifts, understanding the intricacies of unfunded pension systems becomes crucial for policymakers, employees, and employers alike.

This article delves into the definition, types, advantages, disadvantages, and broader implications of unfunded pension plans, providing a comprehensive overview of this complex financial mechanism. The growing prevalence of unfunded pension schemes raises important questions about sustainability and fiscal responsibility. With many countries facing mounting public debt and budgetary constraints, the viability of these pension systems is under scrutiny.

As we explore the various facets of unfunded pensions, it is essential to consider their impact on both government finances and the workforce. By examining the challenges and risks associated with these plans, we can better understand their role in the broader context of retirement security and economic stability.

Summary

- Unfunded pension refers to a pension plan where the employer does not set aside funds to cover future pension obligations

- Unfunded pension plans are typically used by government and public sector employees

- Advantages of unfunded pension plans include flexibility for the government and immediate access to funds, while disadvantages include the risk of underfunding and potential burden on future generations

- Unfunded pension plans can impact government budgets and employees’ retirement security

- Challenges and risks of unfunded pension plans include demographic changes, economic downturns, and political pressures

Definition and Explanation of Unfunded Pension

An unfunded pension plan is a retirement scheme where the benefits promised to employees are not backed by a dedicated pool of assets. Instead, these plans operate on a pay-as-you-go basis, meaning that current workers’ contributions are used to pay the pensions of retirees. This system contrasts sharply with funded pension plans, where contributions are invested to generate returns that will eventually cover future liabilities.

The unfunded model is often employed by government entities and some private organisations, particularly in jurisdictions where immediate cash flow is prioritised over long-term financial planning. The mechanics of unfunded pensions can be illustrated through a simple example: consider a public sector employee who is promised a pension based on their salary and years of service. When this employee retires, their pension payments are drawn from the contributions made by current employees rather than from a pre-existing fund.

This arrangement can create a sense of immediacy in funding but also introduces significant risks, particularly if the number of retirees begins to outpace the number of active contributors. As such, unfunded pension plans require careful management to ensure that they remain solvent over time.

Types of Unfunded Pension Plans

Unfunded pension plans can be categorised into several distinct types, each with its own characteristics and operational frameworks. One common type is the defined benefit plan, where employees receive a predetermined amount upon retirement based on factors such as salary history and length of service. These plans are often found in public sector employment, where governments promise specific benefits without setting aside funds in advance.

The reliance on current contributions to meet these obligations can lead to significant financial strain if not managed properly. Another type of unfunded pension plan is the defined contribution plan, which, while typically funded, can also operate in an unfunded manner under certain circumstances. In this scenario, employers may promise to match employee contributions up to a certain limit but do not invest those contributions in advance.

Instead, they commit to providing benefits based on the contributions made during an employee’s tenure. This model can be more flexible but also places greater risk on employees, as their retirement income is directly tied to market performance and employer contributions.

Advantages and Disadvantages of Unfunded Pension

Unfunded pension plans offer several advantages that can make them appealing to both employers and employees. One significant benefit is the immediate cash flow advantage for employers. By not having to set aside large sums for future liabilities, organisations can allocate resources more flexibly in the short term.

This can be particularly advantageous for governments facing budgetary constraints or private companies looking to invest in growth opportunities rather than locking funds away in pension reserves. However, the disadvantages of unfunded pension plans are equally pronounced. The most glaring issue is the inherent risk associated with relying on current contributions to meet future obligations.

As demographic trends shift—particularly with increasing life expectancy and declining birth rates—there may be fewer workers contributing to the system relative to the number of retirees drawing benefits. This imbalance can lead to funding shortfalls and increased pressure on government budgets or corporate finances. Furthermore, unfunded plans can create uncertainty for employees regarding their retirement security, as benefits may be subject to change based on the financial health of the sponsoring organisation.

Impact of Unfunded Pension on Government and Employees

The impact of unfunded pension plans extends beyond individual employees; it has significant implications for government finances and public policy as well. For governments operating unfunded pension schemes, the challenge lies in balancing current expenditures with future liabilities. As more individuals retire and begin drawing pensions, governments may face increasing pressure to raise taxes or cut services to meet these obligations.

This situation can create a cycle of fiscal strain that complicates long-term planning and economic stability. For employees, the implications of unfunded pensions can be profound. While they may enjoy immediate benefits during their working years, there is often a lack of certainty regarding their retirement income.

Employees may find themselves at risk if their employer faces financial difficulties or if demographic shifts lead to unsustainable pension obligations. This uncertainty can affect employee morale and retention, as workers may seek more secure retirement options elsewhere. Additionally, the potential for benefit reductions or changes in eligibility criteria can create anxiety among employees who rely on these pensions for their post-retirement financial security.

Challenges and Risks of Unfunded Pension

Unfunded pension plans are fraught with challenges that can jeopardise their long-term viability. One primary concern is demographic change; as populations age and birth rates decline, there are fewer workers contributing to the system relative to the number of retirees drawing benefits. This demographic shift can lead to significant funding gaps that may be difficult for governments or organisations to bridge without drastic measures such as tax increases or benefit cuts.

Another challenge lies in economic fluctuations that can impact employment levels and contribution rates. During economic downturns, unemployment rises, leading to fewer active contributors in the system while simultaneously increasing demand for pension payouts from newly retired individuals. This scenario creates a perfect storm for unfunded pension plans, as they may struggle to meet obligations during periods when financial resources are already strained.

Additionally, political factors can complicate matters; changes in government leadership or policy priorities can lead to shifts in how pensions are funded or managed, further exacerbating existing challenges.

Comparison with Funded Pension Plans

When comparing unfunded pension plans with funded pension schemes, several key differences emerge that highlight the strengths and weaknesses of each approach. Funded pension plans operate on a model where contributions are invested over time to build a reserve that will cover future liabilities. This pre-funding mechanism provides a level of security for both employers and employees, as it mitigates the risks associated with demographic changes and economic fluctuations.

In contrast, unfunded plans rely heavily on current contributions without any investment strategy to grow assets over time. While this may provide short-term flexibility for employers, it exposes them—and their employees—to greater risks in the long run. Funded plans also tend to offer more predictable benefits for retirees since they are based on accumulated assets rather than fluctuating contributions from active workers.

However, funded plans require careful management and investment strategies to ensure that they remain solvent over time; poor investment decisions can lead to significant shortfalls that jeopardise future payouts.

Future Outlook for Unfunded Pension Systems

The future outlook for unfunded pension systems is complex and uncertain, shaped by various factors including demographic trends, economic conditions, and political will. As populations continue to age globally, many countries will face increasing pressure to reform their pension systems to ensure sustainability. Policymakers may need to consider hybrid models that combine elements of both funded and unfunded plans to strike a balance between immediate cash flow needs and long-term financial security.

Moreover, technological advancements and changing workforce dynamics could influence how pensions are structured in the future. The rise of gig economies and remote work may lead to new models of retirement savings that diverge from traditional unfunded systems. As individuals take greater responsibility for their retirement planning, there may be a shift towards more flexible savings options that allow for personal investment strategies rather than relying solely on employer-sponsored pensions.

In conclusion, while unfunded pension systems present unique challenges and risks, they also offer opportunities for innovation and reform in response to changing economic landscapes and workforce needs. The path forward will require careful consideration of both current realities and future possibilities as stakeholders navigate the complexities of retirement security in an evolving world.

An interesting related article to the topic of unfunded pensions is Injured on the Job? Here’s What to Do Next. This article discusses the steps that employees should take if they are injured while at work, including how to report the injury and seek compensation. Understanding the process of handling workplace injuries is crucial for both employees and employers to ensure that workers are properly taken care of in the event of an accident.

FAQs

What is an unfunded pension?

An unfunded pension is a retirement plan where the employer does not set aside funds to cover future pension payments. Instead, the pension benefits are paid out of the employer’s current operating income.

How does an unfunded pension work?

With an unfunded pension, the employer pays pension benefits directly from its current revenue, rather than investing funds in a separate pension fund. This means that the employer is responsible for ensuring there is enough money to cover pension payments when they become due.

What are the advantages and disadvantages of unfunded pensions?

Advantages of unfunded pensions include flexibility for the employer and the ability to provide pension benefits without the need for a large initial investment. However, the main disadvantage is the risk of not having enough funds to cover future pension payments, which can lead to financial strain for the employer.

Are unfunded pensions common?

Unfunded pensions are less common than funded pensions, particularly in the private sector. They are more commonly found in public sector organisations and government entities.

What are the risks associated with unfunded pensions?

The main risk associated with unfunded pensions is the potential for the employer to be unable to meet its pension obligations in the future. This can lead to financial instability and uncertainty for pensioners.

Syngenta A3 ePoster Edition 15 "Product design through research and development"

Syngenta A3 ePoster Edition 15 "Product design through research and development"  Building the Jaguar S-Type (PDF)

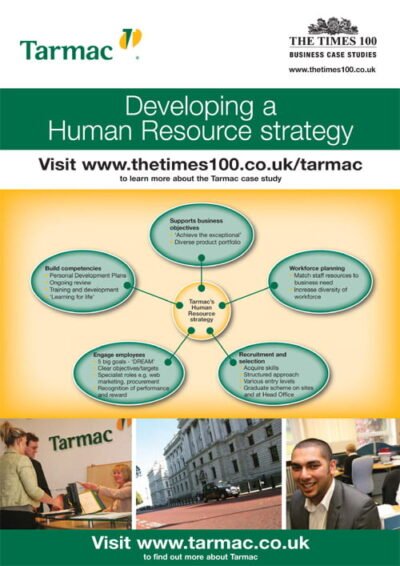

Building the Jaguar S-Type (PDF)  Tarmac A3 ePoster Edition 15 "Developing a Human Resource strategy"

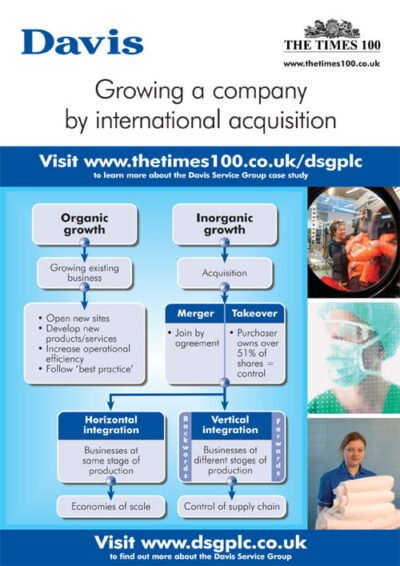

Tarmac A3 ePoster Edition 15 "Developing a Human Resource strategy"  Davis Service Group A3 ePoster Edition 13 "Growing a company by international acquisition"

Davis Service Group A3 ePoster Edition 13 "Growing a company by international acquisition"  NDA A3 ePoster Edition 13 "Meeting responsibilities to stakeholders"

NDA A3 ePoster Edition 13 "Meeting responsibilities to stakeholders"  Flexible working patterns (MP3)

Flexible working patterns (MP3)  IKEA A3 ePoster Edition 13 "Building a sustainable supply chain"

IKEA A3 ePoster Edition 13 "Building a sustainable supply chain"