Compliance risk refers to the potential for legal penalties, financial forfeiture, and material loss an organisation may face when it fails to adhere to laws, regulations, and internal policies. This risk is not merely a theoretical concern; it manifests in real-world consequences that can significantly impact an organisation’s reputation, operational efficiency, and financial stability. Compliance risk encompasses a wide array of regulations, including those related to financial reporting, data protection, environmental standards, and workplace safety.

As businesses operate in increasingly complex regulatory environments, understanding compliance risk becomes paramount for sustainable operations. The landscape of compliance risk is continually evolving, influenced by changes in legislation, technological advancements, and shifts in societal expectations. For instance, the introduction of the General Data Protection Regulation (GDPR) in the European Union has heightened the focus on data privacy and security, compelling organisations to reassess their compliance frameworks.

Similarly, the rise of digital currencies and fintech has prompted regulators to develop new guidelines to mitigate risks associated with money laundering and fraud. As such, organisations must remain vigilant and proactive in identifying and managing compliance risks to safeguard their interests and maintain stakeholder trust.

Summary

- Compliance risk refers to the potential for financial loss, legal penalties, or damage to reputation resulting from failure to comply with laws, regulations, and company policies.

- Factors contributing to compliance risk include complex and changing regulations, lack of employee awareness, and inadequate monitoring and reporting systems.

- Non-compliance can lead to fines, legal action, loss of business opportunities, and reputational damage, impacting the overall financial health of the organisation.

- Effective compliance risk management involves implementing robust policies and procedures, conducting regular risk assessments, and providing ongoing training and education to employees.

- Regulatory bodies play a crucial role in managing compliance risk by setting and enforcing industry standards, conducting audits, and providing guidance to organisations.

Identifying Compliance Risk Factors

Identifying compliance risk factors is a critical step in developing an effective compliance programme. These factors can be broadly categorised into internal and external elements. Internal factors include an organisation’s culture, governance structures, and operational processes.

For example, a company with a weak ethical culture may inadvertently encourage non-compliance among its employees. Conversely, a robust governance framework that promotes transparency and accountability can significantly mitigate compliance risks. Additionally, the complexity of an organisation’s operations—such as the number of jurisdictions in which it operates or the diversity of its product offerings—can also heighten compliance risk.

External factors encompass the regulatory environment, industry standards, and market dynamics. Changes in legislation or regulatory expectations can create new compliance challenges for organisations. For instance, the financial services sector is subject to stringent regulations that are frequently updated in response to emerging risks.

Furthermore, industry-specific standards, such as those set by the International Organisation for Standardisation (ISO), can also influence compliance risk. Market dynamics, including competitive pressures and consumer expectations, may compel organisations to adopt practices that could inadvertently lead to non-compliance. Therefore, a comprehensive assessment of both internal and external factors is essential for accurately identifying compliance risks.

Consequences of Non-Compliance

The consequences of non-compliance can be severe and multifaceted, affecting not only the organisation but also its stakeholders. Financial penalties are among the most immediate repercussions; regulatory bodies often impose hefty fines on organisations that fail to comply with applicable laws. For instance, in 2020, British Airways faced a record £20 million fine for failing to protect customer data adequately, highlighting the financial implications of non-compliance with data protection regulations.

Beyond fines, organisations may also incur costs related to legal fees, remediation efforts, and potential compensation claims from affected parties. The reputational damage resulting from non-compliance can be equally detrimental. A company found to be non-compliant may experience a loss of customer trust and loyalty, which can have long-lasting effects on its market position.

For example, Volkswagen’s emissions scandal not only led to significant financial penalties but also severely tarnished its brand image, resulting in a decline in sales and market share. Additionally, non-compliance can disrupt business operations, leading to increased scrutiny from regulators and stakeholders alike. In extreme cases, persistent non-compliance may even result in the revocation of licences or permits necessary for conducting business.

Compliance Risk Management Strategies

Effective compliance risk management strategies are essential for organisations seeking to mitigate potential risks associated with non-compliance. One fundamental approach is the establishment of a comprehensive compliance programme that includes clear policies and procedures tailored to the specific regulatory environment in which the organisation operates. This programme should encompass regular risk assessments to identify potential vulnerabilities and ensure that policies remain relevant in light of changing regulations.

Training and awareness initiatives play a crucial role in fostering a culture of compliance within an organisation. Employees at all levels should receive training on relevant laws and regulations as well as the organisation’s internal policies. This not only equips them with the knowledge necessary to make informed decisions but also reinforces the importance of compliance as a core organisational value.

Furthermore, organisations should implement robust monitoring and reporting mechanisms to track compliance performance and identify areas for improvement. Regular audits can help ensure adherence to established policies while providing insights into potential gaps in compliance efforts.

Role of Regulatory Bodies in Managing Compliance Risk

Regulatory bodies play a pivotal role in managing compliance risk by establishing frameworks that govern organisational behaviour across various sectors. These bodies are responsible for creating regulations that protect public interests, promote fair competition, and ensure ethical business practices. For instance, the Financial Conduct Authority (FCA) in the United Kingdom oversees financial markets and firms to ensure they operate fairly and transparently.

By enforcing compliance with established regulations, these bodies help mitigate risks associated with fraud, misconduct, and other unethical practices. Moreover, regulatory bodies often provide guidance and resources to assist organisations in understanding their compliance obligations. This may include issuing best practice guidelines or conducting outreach programmes aimed at educating businesses about regulatory changes.

In some cases, regulatory bodies may also engage in collaborative efforts with industry stakeholders to develop sector-specific compliance frameworks that address unique challenges faced by particular industries. By fostering open communication between regulators and businesses, these bodies contribute to a more effective compliance landscape that benefits both organisations and society at large.

Compliance Risk in Different Industries

Compliance risk manifests differently across various industries due to the unique regulatory requirements and operational challenges each sector faces. In the financial services industry, for example, organisations must navigate a complex web of regulations designed to prevent money laundering, protect consumer rights, and ensure market integrity. The consequences of non-compliance can be particularly severe in this sector; financial institutions may face substantial fines or even criminal charges if found guilty of regulatory breaches.

In contrast, industries such as healthcare are subject to stringent regulations aimed at protecting patient privacy and ensuring the quality of care provided. The Health Insurance Portability and Accountability Act (HIPAA) in the United States serves as a prime example of legislation designed to safeguard patient information while imposing significant penalties for non-compliance. Similarly, manufacturing industries must adhere to safety standards that protect workers and consumers alike; failure to comply with these regulations can result in workplace accidents or product recalls that jeopardise public safety.

Importance of Compliance Risk Training and Education

Training and education are integral components of an effective compliance risk management strategy. By equipping employees with the knowledge necessary to understand their compliance obligations, organisations can foster a culture of accountability and ethical behaviour. Training programmes should be tailored to address specific regulatory requirements relevant to each employee’s role within the organisation.

For instance, employees handling sensitive customer data should receive training on data protection laws such as GDPR or HIPAA. Moreover, ongoing education is essential for keeping employees informed about changes in regulations or organisational policies. Regular refresher courses can help reinforce key concepts while ensuring that employees remain aware of their responsibilities regarding compliance.

Additionally, organisations should encourage open dialogue about compliance issues by creating channels for employees to report concerns or seek clarification on regulatory matters without fear of retaliation. This proactive approach not only enhances compliance awareness but also empowers employees to take ownership of their role in maintaining organisational integrity.

Future Trends in Compliance Risk Management

As the regulatory landscape continues to evolve, several trends are emerging that will shape the future of compliance risk management. One notable trend is the increasing reliance on technology to enhance compliance efforts. Advanced analytics and artificial intelligence (AI) are being utilised to monitor transactions and identify potential compliance breaches more effectively than traditional methods allow.

For example, machine learning algorithms can analyse vast amounts of data to detect patterns indicative of fraudulent activity or regulatory violations. Another significant trend is the growing emphasis on corporate social responsibility (CSR) and ethical governance as integral components of compliance risk management. Stakeholders are increasingly demanding transparency and accountability from organisations regarding their social and environmental impact.

As a result, companies are recognising the importance of integrating CSR initiatives into their compliance frameworks to address not only legal obligations but also societal expectations. Furthermore, globalisation is prompting organisations to adopt more comprehensive compliance strategies that account for diverse regulatory environments across different jurisdictions. As businesses expand their operations internationally, they must navigate varying legal requirements while ensuring consistent adherence to ethical standards.

This necessitates a more holistic approach to compliance risk management that encompasses both local regulations and global best practices. In conclusion, understanding compliance risk is essential for organisations operating in today’s complex regulatory environment. By identifying risk factors, implementing effective management strategies, engaging with regulatory bodies, and prioritising training and education, businesses can navigate compliance challenges while safeguarding their reputation and operational integrity.

As trends continue to evolve, organisations must remain agile in adapting their compliance frameworks to meet emerging risks and stakeholder expectations.

Compliance risk is a crucial aspect of business operations, especially in the realm of ecommerce. Ensuring that a company adheres to all relevant laws and regulations is essential for maintaining a positive reputation and avoiding costly penalties. A related article on ecommerce operations explores the various challenges and opportunities that come with conducting business online. Understanding compliance risk in this context is vital for success in the digital marketplace.

FAQs

What is compliance risk?

Compliance risk refers to the potential for financial loss, legal penalties, or damage to an organization’s reputation resulting from failure to comply with laws, regulations, and internal policies.

What are examples of compliance risk?

Examples of compliance risk include violations of anti-money laundering laws, data protection regulations, consumer protection laws, and industry-specific regulations such as healthcare or financial services.

How is compliance risk managed?

Compliance risk is managed through the implementation of robust compliance programs, regular monitoring and auditing of processes, staff training, and the use of technology to automate compliance processes.

Why is compliance risk important?

Compliance risk is important because failure to comply with regulations can result in financial penalties, legal action, and reputational damage, which can have a significant impact on an organization’s bottom line and its ability to operate in the market.

Who is responsible for managing compliance risk?

Managing compliance risk is the responsibility of the organization’s senior management, compliance officers, legal department, and other relevant stakeholders. It is a collective effort that requires collaboration across different functions within the organization.

Syngenta A3 ePoster Edition 13 "Feeding and fuelling the world through technology"

Syngenta A3 ePoster Edition 13 "Feeding and fuelling the world through technology"  No 7 - the relaunch of a brand (PDF)

No 7 - the relaunch of a brand (PDF)  Enterprise Rent-A-Car A3 ePoster Edition 14 "Recruitment and selection at Enterprise Rent-a-Car"

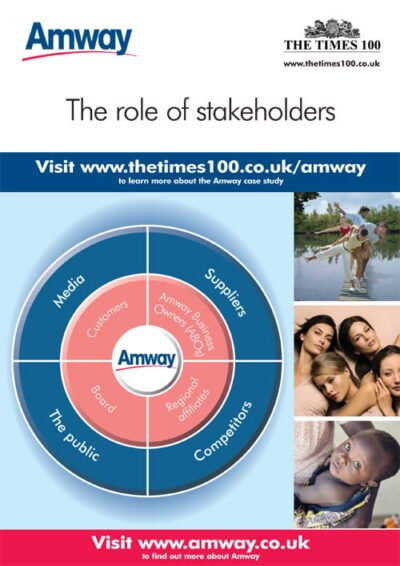

Enterprise Rent-A-Car A3 ePoster Edition 14 "Recruitment and selection at Enterprise Rent-a-Car"  Amway A3 ePoster Edition 13 "Stakeholders as partners"

Amway A3 ePoster Edition 13 "Stakeholders as partners"