Compound interest is a fundamental concept in finance that plays a pivotal role in wealth accumulation and investment growth. Unlike simple interest, which is calculated solely on the principal amount, compound interest takes into account not only the initial sum but also the interest that has been added to it over time. This means that as interest is earned, it becomes part of the principal, leading to exponential growth.

The principle of compounding can be likened to a snowball effect; as the snowball rolls down a hill, it gathers more snow, increasing in size and momentum. Similarly, with compound interest, the longer one invests or saves, the more significant the growth of their investment becomes. The concept of compound interest is not merely an abstract financial principle; it has real-world implications for individuals and businesses alike.

For instance, when individuals save for retirement or invest in stocks, they are often relying on the power of compounding to grow their wealth over time. Financial institutions also utilise this principle to encourage saving and investing, offering various products that leverage compound interest to maximise returns. Understanding how compound interest works is essential for anyone looking to make informed financial decisions, as it can significantly impact one’s financial future.

Summary

- Compound interest is the interest on both the initial principal and the accumulated interest from previous periods.

- Compounding allows for exponential growth of wealth over time, as the interest is calculated on the increasing balance.

- The formula for calculating compound interest is A = P(1 + r/n)^(nt), where A is the amount, P is the principal, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the time in years.

- Compound interest differs from simple interest in that simple interest is calculated only on the principal amount, while compound interest includes interest on interest.

- Compound interest offers the benefit of building wealth over time, making it a powerful tool for long-term saving and investing.

The Power of Compounding: How it Works

Compounding operates on a simple yet powerful principle: the idea that money can earn interest on itself. When an individual invests a sum of money, that amount generates interest over a specified period. In subsequent periods, the interest earned is added to the principal, and the new total earns interest in the next cycle.

This process continues indefinitely, leading to a situation where the growth of an investment accelerates over time. The frequency of compounding—whether annually, semi-annually, quarterly, or monthly—can also influence the total amount accrued. To illustrate this concept further, consider an example where an individual invests £1,000 at an annual interest rate of 5%, compounded annually.

After the first year, the investment grows to £1,050. In the second year, interest is calculated on the new total of £1,050 rather than just the original £1,000. By the end of the second year, the investment would be worth £1,102.50.

This cycle continues, and over a span of 20 years, the initial investment would grow significantly due to the compounding effect. The longer the money remains invested, the more pronounced the impact of compounding becomes, demonstrating its power in wealth accumulation.

Calculating Compound Interest: Formulas and Examples

The calculation of compound interest can be accomplished using a straightforward formula: A = P(1 + r/n)^(nt), where A represents the amount of money accumulated after n years, including interest; P is the principal amount (the initial sum of money); r is the annual interest rate (decimal); n is the number of times that interest is compounded per year; and t is the number of years the money is invested or borrowed. This formula allows individuals to project their potential earnings based on different variables. For example, let’s say an investor puts away £5,000 in a savings account with an annual interest rate of 4%, compounded monthly.

Using the formula, we can calculate how much money will be in the account after 10 years. Here, P = 5000, r = 0.04, n = 12 (since it’s compounded monthly), and t = 10. Plugging these values into the formula gives us A = 5000(1 + 0.04/12)^(12*10).

After performing the calculations, we find that A equals approximately £7,389. This example highlights how even a modest initial investment can grow substantially over time through the power of compounding.

The Difference Between Compound and Simple Interest

Understanding the distinction between compound and simple interest is crucial for anyone involved in financial planning or investment strategies. Simple interest is calculated only on the principal amount throughout the entire investment period. The formula for simple interest is I = PRT, where I represents interest earned, P is the principal amount, R is the rate of interest per year, and T is time in years.

This means that if an individual invests £1,000 at a simple interest rate of 5% for three years, they would earn £150 in interest (£1,000 x 0.05 x 3). In contrast, compound interest takes into account not just the principal but also any previously earned interest. This leads to a greater accumulation of wealth over time compared to simple interest.

For instance, using the same initial investment of £1,000 at a 5% annual rate compounded annually for three years results in a total amount of £1,157.63 (£1,000 x (1 + 0.05)^3). The difference between these two methods becomes even more pronounced over longer periods; thus, understanding this distinction can significantly influence investment choices and savings strategies.

The Benefits of Compound Interest: Building Wealth Over Time

The benefits of compound interest are manifold and can lead to substantial wealth accumulation over time. One of its most significant advantages is its ability to generate returns on returns; this characteristic allows investments to grow at an accelerated pace compared to linear growth models like simple interest. For individuals saving for long-term goals such as retirement or education funds for children, harnessing compound interest can make a considerable difference in achieving those financial objectives.

Moreover, compound interest encourages early investing and saving habits. The earlier one begins to invest or save money, the more time their funds have to grow exponentially through compounding. For example, if two individuals start saving for retirement at different ages—one at 25 and another at 35—the individual who starts earlier will likely accumulate significantly more wealth by retirement age due to an additional decade of compounding growth.

This principle underscores the importance of starting early and remaining consistent with contributions to savings or investment accounts.

Factors Affecting Compound Interest: Time, Rate, and Frequency

Several key factors influence how effectively compound interest can work in favour of an investor or saver: time, rate of return, and frequency of compounding. Time is perhaps the most critical element; as previously mentioned, the longer money remains invested or saved, the more pronounced the effects of compounding become. Even small differences in time can lead to significant variations in total returns.

The rate of return also plays a vital role in determining how much wealth can be accumulated through compounding. Higher rates lead to greater returns over time; however, they often come with increased risk. Investors must balance their desire for higher returns with their risk tolerance and investment strategy.

Lastly, the frequency with which interest is compounded can affect overall returns as well. More frequent compounding periods—such as monthly instead of annually—allow for more opportunities for interest to be calculated on previously earned interest.

Utilizing Compound Interest: Strategies for Saving and Investing

To effectively utilise compound interest for wealth building, individuals should adopt strategic approaches to saving and investing. One effective strategy is to automate contributions to savings or investment accounts. By setting up automatic transfers from checking accounts to savings accounts or investment portfolios on a regular basis—be it monthly or quarterly—individuals can ensure consistent contributions without having to think about it actively.

Another strategy involves taking advantage of tax-advantaged accounts such as Individual Savings Accounts (ISAs) or pensions in the UK. These accounts often provide tax benefits that enhance overall returns while allowing investments to grow tax-free or tax-deferred until withdrawal. Additionally, reinvesting dividends from stocks or mutual funds can further amplify compounding effects by allowing investors to purchase more shares without needing additional capital.

Common Misconceptions About Compound Interest

Despite its significance in personal finance and investing, there are several misconceptions surrounding compound interest that can lead individuals astray in their financial planning efforts. One common myth is that compound interest only benefits those who are wealthy or have large sums to invest initially. In reality, even small amounts can grow significantly over time if invested wisely and consistently due to compounding effects.

Another misconception is that individuals need to achieve high rates of return to benefit from compounding effectively. While higher rates do lead to greater returns, even modest rates can yield substantial growth when combined with time and consistent contributions. Lastly, some people believe that they can only benefit from compound interest through traditional savings accounts or fixed deposits; however, various investment vehicles—including stocks, bonds, and mutual funds—also harness this powerful principle.

Understanding these misconceptions is crucial for making informed financial decisions and maximising potential returns through compound interest strategies. By dispelling these myths and embracing sound financial practices centred around compounding principles, individuals can set themselves on a path toward greater financial security and wealth accumulation over time.

Compound interest is a powerful financial concept that can greatly benefit investors over time. As explained in the article Investing with Bitcoin UP, understanding how compound interest works can help individuals make informed decisions when it comes to investing in cryptocurrencies like Bitcoin. By reinvesting the interest earned on an initial investment, investors can see their money grow exponentially over time. This is just one example of how compound interest can be utilised to maximise returns on investments.

FAQs

What is compound interest?

Compound interest is the interest calculated on the initial principal and also on the accumulated interest of previous periods. In other words, it is interest on interest.

How does compound interest work?

When you invest money or take out a loan with compound interest, the interest is added to the principal amount, and the interest for the next period is calculated on the new total. This leads to exponential growth of the investment or debt over time.

What is the formula for compound interest?

The formula for compound interest is: A = P(1 + r/n)^(nt), where A is the amount of money accumulated after n years, including interest, P is the principal amount, r is the annual interest rate, n is the number of times that interest is compounded per year, and t is the time the money is invested for.

What is the difference between compound interest and simple interest?

Simple interest is calculated only on the principal amount, while compound interest is calculated on the principal amount and also on the accumulated interest from previous periods. This means that compound interest grows at a faster rate than simple interest.

What are the benefits of compound interest?

Compound interest allows investments to grow exponentially over time, as the interest is continually added to the principal amount. This can lead to significant growth of wealth over the long term.

What are some examples of compound interest in real life?

Examples of compound interest in real life include savings accounts, investment portfolios, and loans. When you save money in a savings account, the interest is compounded over time, leading to growth of your savings. Similarly, when you take out a loan with compound interest, the amount you owe grows over time due to the compounding of interest.

Competitive advantage through diversity (MP3)

Competitive advantage through diversity (MP3)  Launching a new cinema (PDF)

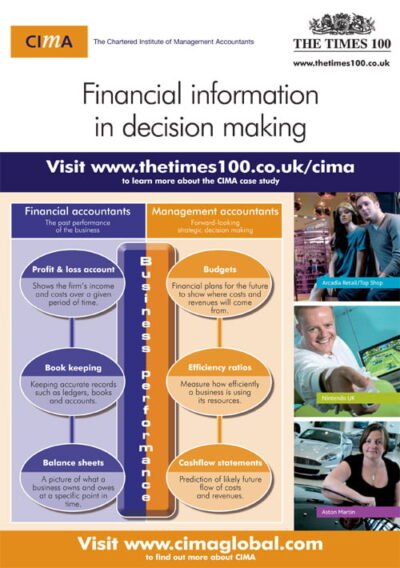

Launching a new cinema (PDF)  CIMA A3 ePoster Edition 13 "Financial information in decision making"

CIMA A3 ePoster Edition 13 "Financial information in decision making"  British Gas A3 ePoster Edition 13 "Workforce planning at British Gas Services"

British Gas A3 ePoster Edition 13 "Workforce planning at British Gas Services"