The cost of equity represents the return that investors expect for their investment in a company’s equity. It is a critical component of a firm’s capital structure and serves as a benchmark for evaluating investment opportunities. Essentially, the cost of equity reflects the risk associated with holding a company’s shares, as investors require compensation for the uncertainty of their investment.

This return is not guaranteed, unlike debt financing, where interest payments are obligatory. Therefore, the cost of equity is inherently tied to the perceived risk of the company and its future performance. Investors typically assess the cost of equity through various models, with the Capital Asset Pricing Model (CAPM) being one of the most widely used.

CAPM posits that the expected return on an equity investment is equal to the risk-free rate plus a risk premium, which is determined by the stock’s beta—a measure of its volatility relative to the market. This model underscores the relationship between risk and return, illustrating that higher perceived risk necessitates a higher expected return. Understanding this concept is crucial for both investors and corporate finance professionals, as it influences decisions regarding capital allocation and investment strategies.

Summary

- Cost of equity is the return a company requires to compensate its equity investors for the risk they undertake.

- Factors affecting cost of equity include risk-free rate, market risk premium, beta, and company-specific risk premium.

- Cost of equity can be calculated using the Capital Asset Pricing Model (CAPM) or the Dividend Discount Model (DDM).

- Cost of equity is important as it helps in determining the company’s investment decisions and in setting the required rate of return for projects.

- Comparing cost of equity with other financial metrics such as cost of debt and weighted average cost of capital (WACC) helps in making informed financial decisions.

Factors Affecting Cost of Equity

Several factors influence the cost of equity, each contributing to the overall risk profile of a company. One primary factor is market volatility, which can significantly impact investor sentiment and expectations. In times of economic uncertainty or market downturns, investors may demand a higher return to compensate for increased risk, thereby raising the cost of equity.

Conversely, in stable or bullish market conditions, the cost of equity may decrease as investor confidence grows and perceived risks diminish. Another critical factor is the company’s financial health and performance metrics. Companies with strong earnings growth, robust cash flows, and low levels of debt are generally perceived as less risky, leading to a lower cost of equity.

In contrast, firms with inconsistent earnings, high leverage, or poor financial management may face a higher cost of equity due to increased investor apprehension. Additionally, industry-specific risks can also play a role; for instance, companies in highly regulated sectors or those subject to rapid technological changes may experience fluctuations in their cost of equity based on external pressures.

Calculating Cost of Equity

Calculating the cost of equity can be accomplished through various methods, with CAPM being one of the most prevalent approaches. The formula for CAPM is expressed as: Cost of Equity = Risk-Free Rate + Beta × (Market Return – Risk-Free Rate). In this equation, the risk-free rate typically reflects the yield on government bonds, while the market return represents the expected return from a diversified portfolio of equities.

The beta coefficient quantifies the stock’s sensitivity to market movements; a beta greater than one indicates higher volatility than the market, while a beta less than one suggests lower volatility. Another method for calculating cost of equity is the Dividend Discount Model (DDM), which is particularly applicable to companies that pay regular dividends. The DDM posits that the cost of equity can be determined by dividing the expected annual dividend by the current share price and adding the expected growth rate of dividends.

This approach is useful for valuing mature companies with stable dividend policies but may be less effective for growth-oriented firms that reinvest profits rather than distribute them as dividends.

Importance of Cost of Equity

The cost of equity plays a pivotal role in corporate finance and investment decision-making. It serves as a critical benchmark for evaluating potential projects and investments. When assessing new projects, companies often compare the expected return on investment (ROI) against their cost of equity.

If the anticipated ROI exceeds the cost of equity, it indicates that the project is likely to create value for shareholders; conversely, if it falls short, it may signal that resources should be allocated elsewhere. Moreover, understanding the cost of equity is essential for effective capital budgeting and financial planning. Companies must ensure that they are generating returns that adequately compensate their equity investors for the risks they undertake.

A miscalculation or misunderstanding of the cost of equity can lead to poor investment decisions, potentially jeopardising a company’s financial stability and growth prospects. Additionally, it influences how companies approach financing decisions—whether to issue new equity or take on debt—thereby impacting their overall capital structure.

Comparing Cost of Equity with Other Financial Metrics

When analysing a company’s financial health and performance, it is essential to compare the cost of equity with other financial metrics such as the weighted average cost of capital (WACC) and return on equity (ROE). WACC represents the average rate that a company is expected to pay to finance its assets, weighted by the proportion of debt and equity in its capital structure. By comparing WACC with the cost of equity, investors can gauge whether a company is effectively utilising its capital sources to generate returns that exceed its overall cost of capital.

Return on equity (ROE) is another crucial metric that provides insight into how effectively a company is using shareholders’ funds to generate profits. A company with an ROE significantly higher than its cost of equity is typically viewed favourably by investors, as it indicates efficient management and strong profitability relative to shareholder expectations. Conversely, if ROE falls below the cost of equity, it may raise concerns about management effectiveness and long-term sustainability.

Cost of Equity in Different Industries

The cost of equity can vary significantly across different industries due to varying levels of risk and market dynamics. For instance, technology companies often exhibit higher costs of equity compared to more established sectors like utilities or consumer staples. This disparity arises from the inherent volatility and rapid innovation characteristic of technology firms, which can lead to fluctuating earnings and heightened investor uncertainty.

Conversely, industries such as utilities tend to have lower costs of equity due to their stable cash flows and regulated environments. Investors perceive these companies as less risky because they provide essential services with predictable demand patterns. However, even within these industries, individual company performance can lead to variations in cost of equity; for example, a utility company facing regulatory challenges or operational inefficiencies may experience an elevated cost of equity compared to its peers.

Managing and Minimizing Cost of Equity

Effectively managing and minimising the cost of equity is crucial for companies seeking to enhance shareholder value and optimise their capital structure. One strategy involves improving financial performance through operational efficiencies and revenue growth initiatives. By demonstrating consistent earnings growth and maintaining strong cash flows, companies can reduce perceived risk among investors, thereby lowering their cost of equity.

Another approach is to maintain an optimal capital structure that balances debt and equity financing. While excessive debt can increase financial risk and elevate the cost of equity, a well-structured mix can enhance returns without unduly increasing risk exposure. Companies may also consider engaging in shareholder-friendly practices such as share buybacks or dividend increases, which can signal confidence in future performance and potentially lower the cost of equity by improving investor sentiment.

Future Trends in Cost of Equity

As global markets evolve and new financial instruments emerge, several trends are likely to shape the future landscape of cost of equity calculations and considerations. One significant trend is the increasing focus on environmental, social, and governance (ESG) factors in investment decision-making. Investors are becoming more discerning about how companies address sustainability issues, which can influence their perceived risk profile and subsequently affect their cost of equity.

Companies that prioritise ESG initiatives may find themselves benefiting from lower costs of capital as they attract socially conscious investors. Additionally, advancements in technology and data analytics are transforming how companies assess their cost of equity. The rise of big data allows firms to analyse vast amounts of information regarding market conditions, investor behaviour, and economic indicators more effectively than ever before.

This capability enables more accurate estimations of risk premiums and better-informed decisions regarding capital allocation. In conclusion, understanding and managing the cost of equity remains a fundamental aspect of corporate finance that influences investment decisions and overall company performance across various industries. As market dynamics continue to shift in response to economic conditions and societal expectations, companies must remain agile in their approach to evaluating and minimising their cost of equity while ensuring they meet investor expectations for returns on their investments.

If you are interested in learning more about investing, you may want to check out the article on investing with Bitcoin Loophole. This article provides valuable insights into the world of cryptocurrency and how you can potentially earn profits through trading. Understanding different investment options, such as Bitcoin, can help you make informed decisions when calculating the cost of equity for your business.

FAQs

What is cost of equity?

Cost of equity is the return a company requires to compensate its equity investors for the risk they assume by investing in the company. It is one of the key components used in calculating the cost of capital for a company.

How is cost of equity calculated?

The cost of equity can be calculated using the Capital Asset Pricing Model (CAPM) formula, which takes into account the risk-free rate, the equity risk premium, and the company’s beta.

Why is cost of equity important?

Cost of equity is important because it is used to determine the minimum rate of return that a company should earn on its equity investments in order to satisfy its shareholders and attract new investors.

How is cost of equity used in financial decision making?

Cost of equity is used in financial decision making to evaluate potential investments, determine the company’s overall cost of capital, and assess the feasibility of new projects or ventures.

What factors affect the cost of equity?

The cost of equity is affected by factors such as the risk-free rate, the company’s beta, the equity risk premium, and market conditions. Changes in these factors can impact the cost of equity for a company.

Developing an effective organisational structure (MP3)

Developing an effective organisational structure (MP3)  Intellectual Property Office A3 ePoster Edition 13 "Intellectual property rights and entrepreneurship"

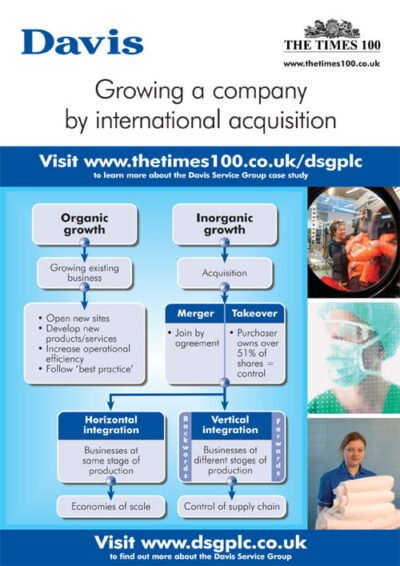

Intellectual Property Office A3 ePoster Edition 13 "Intellectual property rights and entrepreneurship"  Davis Service Group A3 ePoster Edition 13 "Growing a company by international acquisition"

Davis Service Group A3 ePoster Edition 13 "Growing a company by international acquisition"  Corporate Citizenship and the community (PDF)

Corporate Citizenship and the community (PDF)