Takeover bids represent a significant aspect of corporate finance and mergers and acquisitions, where one company seeks to acquire control over another. This process can be initiated by either a friendly approach, where the target company’s management is supportive of the acquisition, or a hostile bid, where the acquiring company bypasses the management and appeals directly to the shareholders. The motivations behind such bids can vary widely, ranging from the desire to expand market share, diversify product offerings, or achieve synergies that can enhance operational efficiency.

The landscape of takeover bids is shaped by various factors, including economic conditions, industry trends, and the strategic goals of the companies involved. For instance, during periods of economic growth, companies may be more inclined to pursue aggressive acquisition strategies to capitalise on emerging opportunities. Conversely, in times of economic uncertainty, firms may adopt a more cautious approach.

Understanding the dynamics of takeover bids requires a comprehensive grasp of both the strategic rationale behind them and the broader market context in which they occur.

Summary

- Takeover bids involve one company making an offer to acquire another company.

- The mechanics of a takeover bid include the bidder making an offer to the target company’s shareholders.

- Types of takeover bids include friendly bids, hostile bids, and reverse takeovers.

- Takeover bids can impact shareholders by affecting the value of their shares and potentially leading to changes in management.

- Regulatory considerations for takeover bids include compliance with takeover codes and regulations set by governing bodies.

The Mechanics of a Takeover Bid

Conducting Due Diligence

The process of a takeover bid involves several critical steps that must be meticulously executed to ensure success. Initially, the acquiring company must conduct thorough due diligence on the target firm. This process entails analysing financial statements, assessing operational capabilities, and evaluating potential liabilities.

Formulating an Offer

The insights gained from due diligence inform the acquirer’s valuation of the target and help in formulating an appropriate offer price. Once the due diligence is complete, the acquirer typically makes a formal offer to purchase shares from the target’s shareholders. This offer can take various forms, including cash, share swaps, or a combination of both.

Acquisition Process

The offer is often accompanied by a detailed explanation of the strategic benefits of the acquisition, aimed at persuading shareholders to accept the bid. If the bid is accepted by a sufficient number of shareholders, the acquiring company can proceed with the acquisition process, which may involve regulatory approvals and integration planning to ensure a smooth transition post-acquisition.

Types of Takeover Bids

Takeover bids can be categorised into several distinct types, each with its own characteristics and implications for both the acquirer and the target. One common type is the friendly takeover bid, where negotiations occur between the two companies’ management teams. In such cases, both parties work collaboratively to agree on terms that are mutually beneficial.

This type of bid often results in smoother integration processes and can foster positive relationships between the companies involved. In contrast, hostile takeover bids occur when an acquirer attempts to gain control without the consent of the target’s management. This can involve purchasing shares on the open market or launching a tender offer directly to shareholders.

Hostile bids can lead to significant conflict and resistance from the target company’s board, which may employ various defensive strategies to thwart the acquisition attempt. Additionally, there are also leveraged buyouts (LBOs), where an acquirer uses borrowed funds to finance the purchase of a company, often with the intention of restructuring it for future profitability.

The Impact of Takeover Bids on Shareholders

The impact of takeover bids on shareholders can be profound and multifaceted. For shareholders of the target company, a successful takeover bid often results in immediate financial gain, particularly if the offer price exceeds the current market value of their shares. This premium is typically seen as a reward for their investment and can lead to increased liquidity as they sell their shares in response to the bid.

However, not all shareholders may view a takeover positively; some may have concerns about potential changes in management or corporate strategy that could affect long-term value. On the other hand, shareholders of the acquiring company may experience mixed outcomes following a takeover bid. While an acquisition can lead to enhanced growth prospects and increased market share, it also carries risks associated with integration challenges and potential overvaluation of the target firm.

If the acquisition does not yield anticipated synergies or if integration proves difficult, shareholders may see a decline in their investment value. Therefore, it is crucial for both sets of shareholders to carefully evaluate the implications of a takeover bid before making decisions regarding their investments.

Regulatory Considerations for Takeover Bids

Regulatory considerations play a pivotal role in shaping the landscape of takeover bids. Various jurisdictions have established legal frameworks designed to protect shareholders’ interests and ensure fair play in the acquisition process. In many countries, regulatory bodies require that acquirers disclose specific information about their intentions and financial capabilities when making a bid.

This transparency is intended to provide shareholders with sufficient information to make informed decisions regarding their investments. In addition to disclosure requirements, regulatory authorities may impose restrictions on certain types of bids or require approval for transactions that exceed specific thresholds. For instance, competition authorities may scrutinise proposed acquisitions to prevent monopolistic practices that could harm consumers or stifle competition within an industry.

These regulatory hurdles can significantly impact the timing and feasibility of a takeover bid, necessitating careful planning and compliance by the acquiring company.

The Role of the Board of Directors in Takeover Bids

Evaluating the Merits of a Takeover Bid

The board of directors plays a vital role in navigating takeover bids, particularly for the target company. When faced with an acquisition proposal, the board is responsible for evaluating the offer’s merits and determining whether it aligns with shareholders’ best interests. This evaluation process often involves consulting financial advisers and legal counsel to assess the bid’s implications thoroughly.

Fiduciary Duties and Defensive Measures

The board must also consider its fiduciary duties to act in good faith and with due diligence when responding to a takeover attempt. In cases where a bid is deemed hostile, the board may implement defensive measures to protect against unwanted acquisition attempts. These strategies can include adopting poison pills—provisions that make it more difficult for an acquirer to gain control—or seeking alternative buyers who may offer more favourable terms.

The Board’s Influence on Shareholder Sentiment

The board’s response can significantly influence shareholder sentiment and ultimately determine whether a takeover bid succeeds or fails.

Defending Against a Takeover Bid

Defending against a takeover bid requires strategic foresight and careful planning by a company’s management and board of directors. One common defensive tactic is known as a “poison pill,” which allows existing shareholders to purchase additional shares at a discount if an acquirer surpasses a certain ownership threshold. This tactic dilutes the acquirer’s stake and makes it more expensive for them to gain control over the company.

Another approach involves seeking out alternative buyers who may be interested in acquiring the company at a higher price or under more favourable conditions than those offered by the initial bidder. This strategy not only provides leverage during negotiations but also demonstrates to shareholders that management is actively seeking options that align with their interests. Additionally, companies may engage in public relations campaigns to rally shareholder support against an unwanted bid, emphasising their long-term strategic vision and potential for growth independent of an acquisition.

The Future of Takeover Bids

The future of takeover bids is likely to be influenced by several evolving trends within global markets and corporate governance practices. As technology continues to reshape industries, companies may increasingly pursue acquisitions as a means of gaining access to innovative capabilities or expanding into new markets. The rise of digital transformation has led many firms to seek out tech-savvy targets that can enhance their competitive edge.

Moreover, regulatory environments are also evolving in response to changing market dynamics and public sentiment regarding corporate consolidation. Increased scrutiny from regulators concerning antitrust issues may lead to more stringent requirements for merger approvals, potentially complicating future takeover attempts. Additionally, as environmental, social, and governance (ESG) considerations gain prominence among investors, companies may need to demonstrate their commitment to sustainable practices when pursuing acquisitions.

In conclusion, while takeover bids remain a vital component of corporate strategy and growth, their execution will require careful navigation through complex regulatory landscapes and evolving market conditions. As companies adapt to these changes, understanding the intricacies of takeover bids will be essential for stakeholders across all levels of corporate governance.

A recent article on Robo Advisors: The Good, The Bad and The Ugly discusses the impact of automated financial advice on the investment industry. Just like takeover bids, robo advisors are changing the way businesses operate and make decisions. Both topics require careful consideration and strategic planning to ensure success in the ever-evolving business landscape. By exploring the pros and cons of robo advisors, companies can learn valuable lessons that can be applied to navigating takeover bids effectively.

FAQs

What is a takeover bid?

A takeover bid is an offer made by one company to purchase the shares of another company, with the aim of gaining control of the target company.

How does a takeover bid work?

In a takeover bid, the acquiring company makes an offer to the shareholders of the target company to purchase their shares at a specified price. If the offer is accepted by the majority of the shareholders, the acquiring company gains control of the target company.

What are the reasons for a takeover bid?

There are various reasons for a company to make a takeover bid, including the desire to expand its market share, gain access to new technologies or products, or to eliminate competition.

What are the different types of takeover bids?

There are two main types of takeover bids: friendly takeovers, where the target company’s management supports the bid, and hostile takeovers, where the target company’s management opposes the bid.

What are the legal requirements for a takeover bid?

In the UK, takeover bids are regulated by the Takeover Code, which sets out the rules and procedures that companies must follow when making a bid for another company. This includes requirements for making a formal offer to the target company’s shareholders and providing them with all relevant information.

Developing responsiveness through organisational structure (MP3)

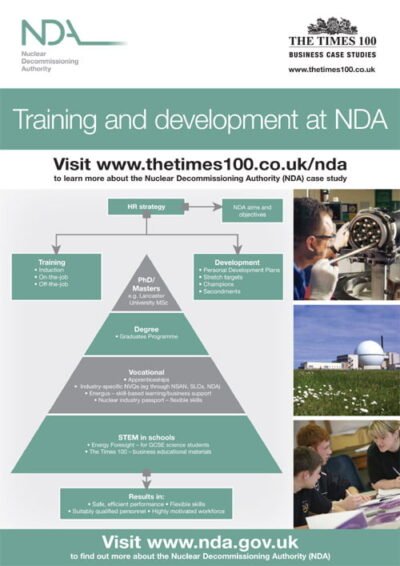

Developing responsiveness through organisational structure (MP3)  NDA A3 ePoster Edition 15 "Training and development at NDA"

NDA A3 ePoster Edition 15 "Training and development at NDA"  Enterprise Rent-A-Car A3 ePoster Edition 13 "Using a range of management styles to lead a business"

Enterprise Rent-A-Car A3 ePoster Edition 13 "Using a range of management styles to lead a business"