Robo whats? I hear you ask. Good question. A third option has arisen when making investments and participating in the Stock market. It’s exciting and completely democratizes investing using technology and algorithms.

You had two choices if you wanted to work at the stock exchange in the past.

Either you entrusted a broker to invest for you based on their experience and qualifications. You relied on their understanding of stocks and the markets to take your money and invest it for you based on their judgment of what stocks would perform.

The other option was to spend considerable time and effort learning about investing. In all likelihood, you would pay quite a few “school fees” on the way to developing your skills.

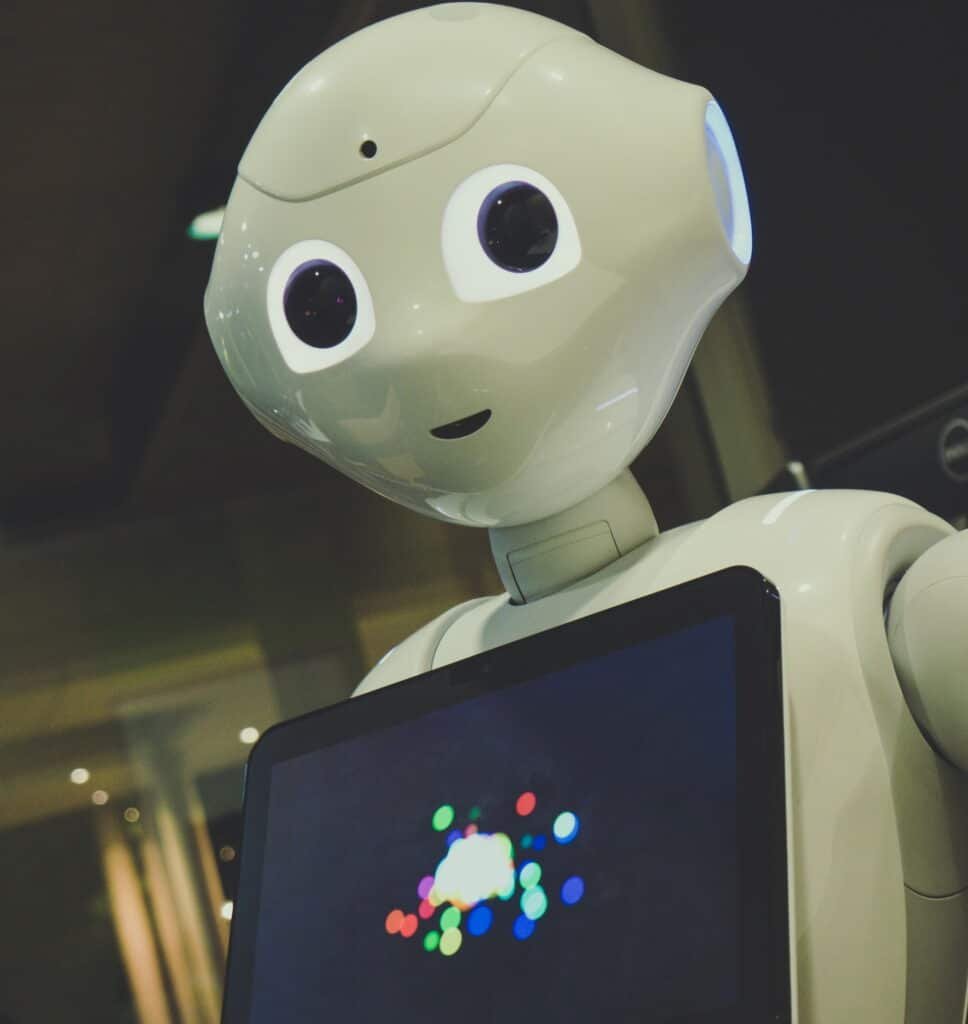

And then, voila, there it was. This new animal is called a robo-advisor.

Together, let’s try and dig a little deeper.

What is a Robo-Advisor?

A robo-advisor application uses artificial intelligence to create an automated investment portfolio for you. Using computerized algorithms based on masses of historical data helps you invest your money to get excellent medium to long-term returns.

Initially, you feed in information. The robo-advisor then builds a profile of you as a client and then applies the algorithms to your profile to cater to your investment needs, risk appetite, and budget.

It is generally free or comes at a nominal rate, making it extremely popular.

The Good Bits About Robo-Advisors

Computers and AI certainly have proven better at performing many tasks than humans.

They have become a highly disruptive service in the financial services and investment industry due to their efficiencies, reliability, lack of emotion, and ability to parse vast amounts of data in analyzing stock performances over time.

A few of the benefits of using a robo-advisor are:

Very Low Fees

Automation always brings lower fees. The fewer humans involved, the cheaper it is.

In comparison to paying broker fees, robo-advisors charge significantly less.

A broker would typically charge 1 to 2 per cent of your portfolio value yearly.

A robo-advisor only charges between 0.25 and 0.5 per cent of your portfolio value.

Whereas human advisors typically charge commissions to buy or sell assets within your account or to rebalance your portfolio, robo-advisors do not charge for these services.

Removal of Emotions in Investment Decision Making

Unlike humans, robo-advisors invest based on sound, long-term investing principles rather than fear, greed, or hunches.

On the contrary, humans often base their investment decisions on their emotions. When the markets move upwards, they invest, and when the market starts to fall, they immediately panic and sell. Robots take a longer-term view and make unemotional considered decisions over time. No panic. No-fuss. Just logic and clinical analysis.

Diverse Portfolio Selection

Generally, algorithms take a medium to longer-term view to benefit from accurate data analysis.

Over time, broad market exposure gives you the benefit of high growth without high risk.

Robo-advisors operate on a fundamental principle of diversification. As a result, the risk is minimized by spreading your investments across many industries, market capitalizations, regions, and asset types.

The Robots generally follow optimized indexed strategies. These are excellent for new and intermediate investors.

Rebalancing of Your Portfolio

Your friendly robo-advisor will ensure that your portfolio is continually adjusted to reflect your initial profile.

This is done at no extra charge.

Robo-Advisors Make Investing Accessible to Everybody

Human advisors are expensive, and the barrier to investment entry is set high, generally more than $50 000, putting investment out of the reach of most people.

Most robo-advisors do not require a minimum investment and allow anyone with a few extra bucks to start investing.

Finally, it is possible for anyone who wants to invest to do so without hefty minimums and significant wealth. This is the most critical disruptive effect of the internet and robo-advisor technology.

The Bad and the Ugly

You are dealing with a humanoid, not a human, so some drawbacks exist. These are as follows:

Limited or No Human Interaction

Most robo-advisors do not offer any human contact, although some hybrids offer both.

Where a human advisor is drawn in, the fees charged always go up.

Although customer service is offered to a degree, there is no substitute for dealing with flesh and bones. A financial advisor is steeped in the industry with many years of experience.

Lack of Full Customization of Your Portfolio

Since algorithms work off averages, they are designed to provide generally good investment options for the masses.

A human would offer you a more customized strategy based on your needs and investment goals. On the other hand, a robo-advisor offers less flexible investing.

The Verdict

Robo-advisors are here to stay and have massive appeal to younger and new investors, enabling them to get their feet wet in the sea of investments.

The accessibility and convenience offered and the lack of a need for investors to micromanage their portfolios suits a particular type of investor.

If you are an experienced investor and constantly tweak your investments, a robo-advisor may not be for you. You would probably be better off with a broker. You probably are well situated and able to afford the accommodating fees.

Robo-advisors will undoubtedly provide many people with a stepping stone. As they grow their wealth, they may appoint a broker as their portfolios become worth more money and as their goals and needs crystallize.

Feeding and fuelling the world through technology (MP3)

Feeding and fuelling the world through technology (MP3)  How Lloyd's responds to changes in the business environment (PDF)

How Lloyd's responds to changes in the business environment (PDF)  Creating value - brand management (PDF)

Creating value - brand management (PDF)  CMI A3 ePoster Edition 17 "Managing change"

CMI A3 ePoster Edition 17 "Managing change"