Fiscal deficit is a critical economic indicator that reflects the financial health of a government. It occurs when a government’s total expenditures exceed its total revenues, excluding money borrowed. In simpler terms, it signifies that the government is spending more than it earns through taxes and other income sources.

This imbalance necessitates borrowing to cover the shortfall, which can lead to an increase in national debt. The fiscal deficit is typically expressed as a percentage of a country’s Gross Domestic Product (GDP), providing a relative measure of the deficit’s size in relation to the overall economy. Understanding fiscal deficit is essential for evaluating a government’s fiscal policy and its implications for economic stability.

A persistent fiscal deficit can signal underlying issues within an economy, such as inefficient tax collection, excessive public spending, or economic downturns that reduce revenue. Policymakers and economists closely monitor fiscal deficits as they can influence interest rates, inflation, and overall economic growth. A high fiscal deficit may lead to concerns about a government’s ability to manage its finances sustainably, potentially affecting investor confidence and economic stability.

Summary

- Fiscal deficit refers to the difference between the government’s total expenditure and its total revenue

- Causes of fiscal deficit include excessive government spending, low tax revenue, and economic recession

- Fiscal deficit can lead to inflation, higher interest rates, and reduced private investment in the economy

- Government policies to address fiscal deficit include reducing government spending, increasing taxes, and implementing austerity measures

- Fiscal deficit contributes to the national debt and can lead to higher borrowing costs for the government

Causes of Fiscal Deficit

Several factors contribute to the emergence of a fiscal deficit, each interlinked with broader economic conditions and government policies. One primary cause is the imbalance between government revenue and expenditure. Governments often face pressures to increase spending on public services, infrastructure, and social welfare programmes, especially during economic downturns or crises.

For instance, during the COVID-19 pandemic, many governments worldwide ramped up spending to support healthcare systems and provide financial assistance to individuals and businesses, leading to significant fiscal deficits. Another significant factor is the structure of taxation within a country. Inefficient tax systems, characterised by low compliance rates or inadequate tax bases, can severely limit government revenue.

In many developing nations, a large informal economy means that a substantial portion of economic activity goes untaxed. Additionally, tax evasion and avoidance can further exacerbate revenue shortfalls. On the expenditure side, rising costs associated with public sector wages, pensions, and interest payments on existing debt can also contribute to fiscal deficits.

As these costs grow, they consume an increasing share of government budgets, leaving less room for investment in growth-promoting initiatives.

Impact of Fiscal Deficit on the Economy

The implications of a fiscal deficit extend far beyond mere numbers on a balance sheet; they can significantly influence an economy’s overall health and stability. One immediate effect is the potential rise in interest rates. When a government borrows to finance its deficit, it competes with the private sector for available funds in the financial markets.

This increased demand for capital can lead to higher interest rates, which may discourage private investment. Consequently, businesses may delay or reduce their capital expenditures, stifling economic growth. Moreover, persistent fiscal deficits can lead to inflationary pressures.

When governments finance deficits by printing money rather than borrowing from financial markets, it can increase the money supply without a corresponding increase in goods and services. This scenario can lead to demand-pull inflation, where too much money chases too few goods. Over time, high inflation erodes purchasing power and can destabilise an economy, leading to uncertainty among consumers and investors alike.

Additionally, if inflation expectations become entrenched, it may necessitate tighter monetary policy measures that could further slow economic growth.

Government Policies to Address Fiscal Deficit

Governments have various tools at their disposal to address fiscal deficits, ranging from adjustments in taxation to changes in public spending priorities. One common approach is to implement austerity measures aimed at reducing government expenditure. These measures may include cuts to public services, reductions in social welfare benefits, or freezes on public sector wages.

While such policies can help restore fiscal balance in the short term, they often face significant public opposition due to their immediate impact on citizens’ livelihoods. On the revenue side, governments may seek to enhance tax collection through reforms aimed at broadening the tax base or improving compliance rates. This could involve simplifying tax codes, reducing loopholes that allow for tax avoidance, or increasing enforcement against tax evasion.

Additionally, governments may consider introducing new taxes or increasing existing ones to generate additional revenue. For example, some countries have implemented digital taxes targeting large technology firms that benefit disproportionately from their operations within jurisdictions without paying commensurate taxes.

Relationship between Fiscal Deficit and National Debt

The relationship between fiscal deficit and national debt is intricate and often cyclical. A fiscal deficit directly contributes to national debt as governments borrow to finance their shortfalls. When a government runs a deficit, it issues bonds or takes loans from domestic or international lenders, thereby increasing its overall debt burden.

Over time, if deficits persist without adequate measures to curtail them, national debt can escalate to unsustainable levels. However, it is essential to differentiate between productive and unproductive debt. If borrowed funds are invested in infrastructure projects or initiatives that stimulate economic growth, they may yield returns that exceed the cost of borrowing.

Conversely, if debt is used primarily for consumption or inefficient expenditures without generating future income streams, it can lead to a vicious cycle of increasing debt levels without corresponding economic benefits. This distinction is crucial for policymakers as they navigate the delicate balance between financing current needs and ensuring long-term fiscal sustainability.

Role of Fiscal Deficit in Economic Stability

The Stimulative Effect of Fiscal Deficits

In times of recession or economic stagnation, running a fiscal deficit can be a deliberate strategy employed by governments to boost demand through increased public spending. This Keynesian approach posits that government intervention can help mitigate the effects of economic downturns by providing jobs and stimulating consumption.

The Risks of Excessive Fiscal Deficits

However, excessive reliance on fiscal deficits can undermine long-term economic stability if not managed prudently. A high and persistent fiscal deficit may lead to loss of investor confidence and increased borrowing costs. Furthermore, if markets perceive that a government is unable or unwilling to address its fiscal challenges effectively, it may result in credit rating downgrades or reduced access to capital markets.

The Consequences of Fiscal Mismanagement

Such outcomes can create a self-reinforcing cycle where rising borrowing costs further exacerbate fiscal deficits.

Examples of Countries with High Fiscal Deficits

Several countries have experienced high fiscal deficits at various points in their histories, often leading to significant economic consequences. For instance, Greece faced an acute fiscal crisis in the late 2000s when its fiscal deficit soared above 15% of GDP due to excessive public spending and inadequate tax revenues. The ensuing crisis led to severe austerity measures imposed by international creditors as part of bailout agreements, resulting in widespread social unrest and economic contraction.

Another notable example is the United States during the COVID-19 pandemic when the federal fiscal deficit reached unprecedented levels due to extensive stimulus packages aimed at supporting individuals and businesses affected by lockdowns. The deficit peaked at approximately 15% of GDP in 2020 as the government sought to mitigate the economic fallout from the pandemic. While these measures were necessary for immediate relief, concerns about long-term sustainability have emerged as national debt levels surged.

Measures to Reduce Fiscal Deficit

Addressing fiscal deficits requires a multifaceted approach that balances revenue generation with prudent expenditure management. One effective measure is implementing comprehensive tax reforms aimed at enhancing efficiency and equity within the tax system. This could involve closing loopholes that allow for tax avoidance or introducing progressive taxation structures that ensure higher earners contribute a fair share.

On the expenditure side, governments can conduct thorough reviews of public spending programmes to identify areas where efficiency gains can be made without compromising essential services. This might include streamlining bureaucratic processes or prioritising investments that yield high social returns over less impactful projects. Additionally, fostering economic growth through policies that encourage private sector investment can help increase tax revenues over time without raising tax rates.

In conclusion, addressing fiscal deficits is crucial for ensuring long-term economic stability and sustainability. By adopting a balanced approach that combines revenue enhancement with prudent expenditure management, governments can work towards reducing fiscal deficits while promoting growth and maintaining public trust in their financial stewardship.

A fiscal deficit occurs when a government’s total expenditures exceed the revenue that it generates, resulting in borrowing to cover the shortfall. This can have significant implications for a country’s economy and financial stability. To understand more about how trade associations can work together to address economic challenges, check out the article on Trade Associations at Work. This case study explores how collaboration between businesses can lead to positive outcomes for the economy as a whole.

FAQs

What is Fiscal Deficit?

Fiscal deficit is the difference between the government’s total expenditure and its total revenue, excluding borrowing. It is an indicator of the financial health of a country’s government.

How is Fiscal Deficit calculated?

Fiscal deficit is calculated by subtracting the government’s total revenue (including taxes and non-tax revenue) from its total expenditure (including spending on infrastructure, social welfare, and administrative costs).

What are the causes of Fiscal Deficit?

Fiscal deficit can be caused by a variety of factors, including excessive government spending, a decline in tax revenue, economic recession, and external factors such as global economic conditions and geopolitical events.

What are the consequences of Fiscal Deficit?

Fiscal deficit can lead to higher government borrowing, which can increase the national debt and interest payments. It can also lead to inflation, reduced private investment, and a decrease in the country’s credit rating.

How can Fiscal Deficit be reduced?

Fiscal deficit can be reduced through measures such as increasing tax revenue, reducing government spending, improving efficiency in public expenditure, and implementing structural reforms to boost economic growth.

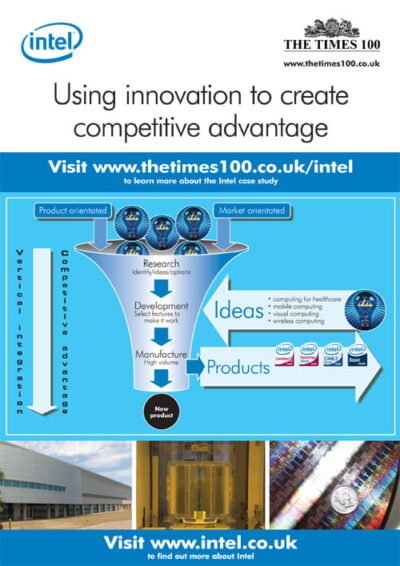

Intel A3 ePoster Edition 13 "Using innovation to create competitive advantage"

Intel A3 ePoster Edition 13 "Using innovation to create competitive advantage"  Live, breathe and wear passion (MP3)

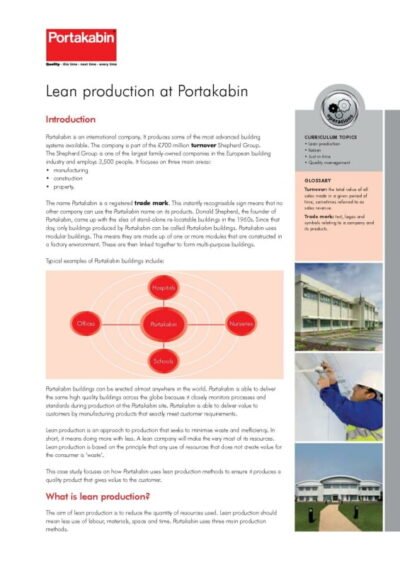

Live, breathe and wear passion (MP3)  Lean production at Portakabin (PDF)

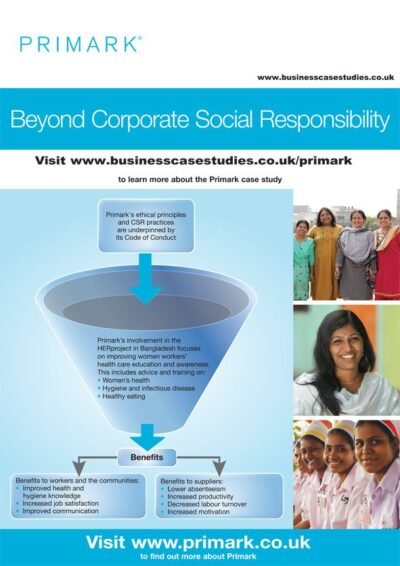

Lean production at Portakabin (PDF)  Primark A3 ePoster Edition 17 "Beyond corporate social responsibility"

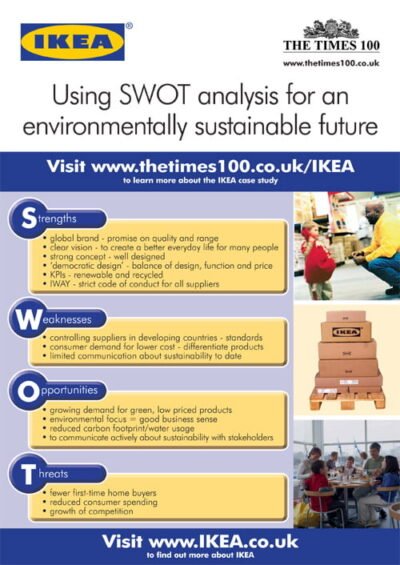

Primark A3 ePoster Edition 17 "Beyond corporate social responsibility"  IKEA A3 ePoster Edition 14 "SWOT analysis and sustainable business planning"

IKEA A3 ePoster Edition 14 "SWOT analysis and sustainable business planning"  Planning for quality and productivity (PDF)

Planning for quality and productivity (PDF)  Intellectual Property Office A3 ePoster Edition 15 "Intellectual property and the external environment"

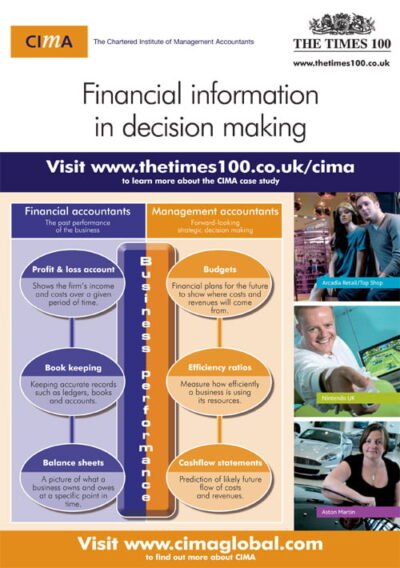

Intellectual Property Office A3 ePoster Edition 15 "Intellectual property and the external environment"  CIMA A3 ePoster Edition 13 "Financial information in decision making"

CIMA A3 ePoster Edition 13 "Financial information in decision making"  Enterprise Rent-A-Car A3 ePoster Edition 13 "Using a range of management styles to lead a business"

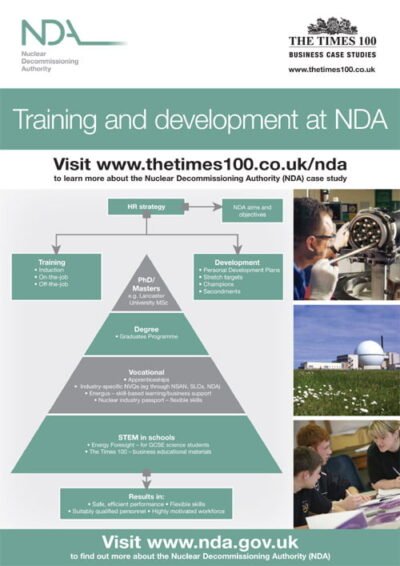

Enterprise Rent-A-Car A3 ePoster Edition 13 "Using a range of management styles to lead a business"  NDA A3 ePoster Edition 15 "Training and development at NDA"

NDA A3 ePoster Edition 15 "Training and development at NDA"  Intellectual Property Office A3 ePoster Edition 13 "Intellectual property rights and entrepreneurship"

Intellectual Property Office A3 ePoster Edition 13 "Intellectual property rights and entrepreneurship"  Parcelforce A3 ePoster Edition 13 "Customer service as strategy"

Parcelforce A3 ePoster Edition 13 "Customer service as strategy"