Accounting principles involve the recording and interpretation of business activity in figures (recording accounts). Records are kept of business transactions and full sets of accounts are produced at regular intervals using these records. From a set of accounts, it is possible to use ratios and percentages to analyse the behaviour of the firm, detect difficulties and take action to improve efficiency. All transactions are recorded by a bookkeeper.

Accounting companies will first assess the profitability of the firm by drawing up a trading account and a profit and loss account, and will then produce a balance sheet. These are drawn up using figures obtained from the trial balance.

Double-entry Bookkeeping

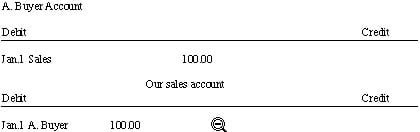

Most businesses employ the double-entry system, whereby with each transaction one account is debited and another account is credited. This means that for every entry on the left-hand side of one account, there is always a corresponding entry on the right-hand side of another account.

Suppose, for example, that our firm sells goods to A. Buyer on credit on the 1st January. A. Buyer’s account is debited because he now owes us money. Our sales account is credited as goods have gone from the business.

All these accounts are kept in a series of ledgers. When the financial accountant visits the business to produce a set of final accounts, the

balances of each account are listed in the form of a trial balance. This is a summary of all of the balances and acts as a check on the arithmetical accuracy of the accounts. As all the debit entries correspond to all the credit entries, the two sides of the trial balance should agree. The accountant will first assess the profitability of the firm by drawing up a trading account and a profit and loss account, and will then produce a balance sheet. These are drawn up using figures obtained from the trial balance.

Accounting Standards

There are a number of standards for account keeping in this country which have been established to create confidence in accounts. Accounts must provide a ‘true and fair picture of the financial affairs of a business. In other words, they need to be accurate and use the same methods each year so that one year can be compared with another. Accounts must also be verified by an independent auditor who needs to state the accounts provide a true and fair picture. Accounts form the basis for managing businesses effectively and so accuracy is essential. They also provide the means of submitting tax returns to Her Majesty’s Revenue & Customs (HMRC) and any errors can result in financial penalties which need to be avoided. Read how the HMRC collects income taxes and administers benefits