Building societies date back to the late eighteenth century. The first known building society was set up in 1775. This was to enable people to pool savings together and to build their own homes. However, once they had built their houses, this particular society closed.

In the 1840s, societies began to accept savings from members who were not necessarily potential home owners. It was then that the permanent societies that we have today were formed. In 1869, the Building Societies Association was set up to provide national representation for the industry.

The Building Societies Association (BSA) is the trade association for all the UK”s building societies. It now has 59 members and together they have assets worth over £350 billion.

A building society is a distinctive business form governed by the Building Societies Act 1986. Building societies are mutual organisations. This means that its borrowers and savers have membership and are joint owners of the society. The building society receives deposits from savers and then uses the funds to make loans for its members for house purchase.

Until the 1980s, only building societies, generally, could offer loans for houses. From the early 1980s, banks quickly became competitors.

Following the Building Societies Act 1986, societies were also free to ‘demutualise’ to become banks. The members of each building society had to agree to this change. Several building societies offered windfall payments to members to persuade them and some big names became banks, for example, Abbey National, Halifax and Alliance & Leicester.

Mortgages

Buying a house is usually the most costly purchase an individual ever makes. People buy a house or flat to get a permanent home and a stake in the property market. Very few first-time buyers have enough cash to buy a property, so they take a long-term secured loan called a mortgage.

A mortgage has two elements the amount of the original loan (the capital) and the interest which is charged on the loan. A repayment mortgage means that each month’s payment pays off the interest and a small part of the loan. By the end of the loan period, the borrower will have paid off the entire loan.

When an owner buys a house he or she has a valuable asset. If the value of the house increases, this can give them a profit if they choose to sell the house. Loans typically last for 25 years and are secured on the property. This means that if buyers do not keep up the regular monthly payments, the bank or building society could take the property back to sell it to pay off the debt.

There are two main providers of mortgages:

- banks like Lloyds TSB, the Halifax or Bradford & Bingley. These are public limited companies (plcs) and are owned by their shareholders.

- building societies like Nationwide and Britannia.

This case study outlines different types of business organisations and their purpose. It highlights the similarities and differences between other types of business and building societies.

Types of organisation

There are several different types of organisation:

- The simplest way to start up a business is to be a sole trader. One person provides the funds, makes the decisions and keeps any profit. The owner is also the boss and controls the business. The main disadvantage is that the owner is also totally responsible for any debts and has unlimited liability for these debts.

- An alternative is to form a partnership. This involves between 2 and 20 people combining their finances and expertise. They run the business with joint powers and responsibility. They make decisions and share profits according to the legal terms of the partnership. The advantages are that the responsibilities are shared and more capital can be released to invest in the business. The owners can specialise in their area of expertise, improving the efficiency of the business. The disadvantages are that partners can disagree on important decisions and consulting all partners takes time. All partners have unlimited liability for debts and so selecting a partner needs to be done carefully. Many partnerships break up because the partners cannot agree.

Bigger companies

If a business expands, it needs more capital. The opportunities for profit grow but so do the risks of failure. The solution to these challenges may be to form a company.

A company enjoys privileged status in law. It exists as a legal entity that can own property and be named in legal actions. It also enjoys the privilege of limited liability. This means that only the company’s assets are at risk to settle debts, not the individuals employed by, or the investors in, the company.

- A private limited company (Ltd) involves a group of between 2 and 50 people supplying capital finance and sharing in the management of the organisation. This capital is divided into shares. These represent units of ownership units (for example £1 shares) that individuals in the company can hold. Shareholders elect directors to run the company according to their wishes. Shareholders hold voting power in the company’s decision-making process depending on the number of shares they hold and receive profits in the same proportion in the form of dividends.

- Some enterprises outgrow this format and need access to much wider sources of share capital. This may mean becoming a public limited company (plc). This involves offering shares to the general public and to financial institutions. Shareholders enjoy voting rights on a ‘one share, one vote’ basis, so larger shareholders have more power. The directors employ professional managers to run the business. The company may retain profits or distribute it as dividends for each share held. The selling of shares in a private company needs the directors’ approval. The shares in a plc can be bought and sold on the Stock Exchange where their value will rise or fall according to the performance of the market.

A mutual organisation is organised differently to this.

Benefits of mutual organisations

A building society is a mutual organisation. This means that instead of having shareholders, it has members who collectively own the business and are also its customers. The main examples of this type of organisation in the UK are co-operative societies, mutual insurance companies and building societies. Members have the right to vote for directors regardless of how much or how little money they have with the society.

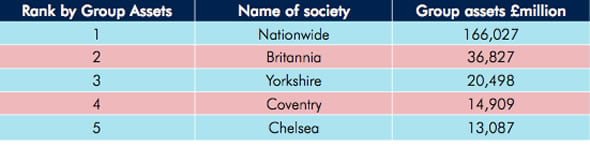

To compare the scale of mutual organisations, the assets of the UK”s top five building societies amounts to £250 billion. Lloyds TSB, a bank, alone has assets of £350 billion.

Large businesses like banks may enjoy economies of scale. By having more customers and so lower unit costs, they might appear to outperform building societies in attracting customers. However, this is not the case. So why do people choose a building society over a bank?

- Each building society invests its profit back into the society’s business. Unlike banks, mutuals do not pay dividends (for example, Lloyds TSB pays out nearly £2 billion each year in dividends to shareholders). This enables the building society to offer competitive rates of interest on both savings and mortgages. It sets the rates it pays savers at just less than the rate charged to borrowers. This margin gives the society a profit.

- Customers choose to do business with a building society because many find them more personal, approachable and more trustworthy than banks. An independent survey during 2007 found significantly higher levels of saver and borrower satisfaction with customer service in building societies.

- Borrowers often rely on advice about mortgages or other financial services. Many banks have closed local branches or replaced personal counter service with call centres. The personal service gives customers a sense of value for money.

Shareholders and stakeholders

Shareholders

The shareholders in a plc own shares which pay dividends; shareholders are able to vote on major company decisions. Shareholders may include customers, employees, other businesses and the wider public.

Stakeholders

A business’ stakeholders include anyone with an interest in the company and its activities, financial or otherwise.

Banks set their strategy to maximise profit to increase the share value and give shareholders the best dividends. They aim to achieve this by giving lower interest rates for savers and taking higher rates from borrowers. Customers of course would prefer high saving rates and low borrowing rates. This can mean a conflict of interest between the bank’s shareholders and its customers.

A building society’s primary stakeholders are its members. Members collectively own the business and are entitled to information on the business and to vote on important issues, such as who is on the board of directors, or whether to merge with another society.

Members want the highest possible interest rates on their savings and the lowest possible interest rates on their mortgages. Building society rates are carefully set for each type of customer account. Their level depends on interest rates in the economy (set by the Bank of England) and the rates and terms offered by competitors.

Because they are run for their members, building societies also have a focus on corporate social responsibility (CSR) that is integral to their business. Most societies have a strong regional identity and many are committed to assisting community initiatives and local charities.

Raising finance

Every business needs finance:

- As a plc, a bank raises part of its long-term capital from selling shares. It rewards shareholders with dividends. Funds also come from savers who are not usually shareholders.

- As a mutual, a building society”s owners and customers (members) are the same. Savers provide the society’s long-term capital and its main source of funding for its mortgage services.

In both cases, people depositing money as savings expect to be able to withdraw their money at short notice. Lending money against the security of a property is long-term. In order to meet withdrawals from savings accounts, there must be enough cash readily available. Building societies keep about 20% of all money they raise in cash or in assets they can easily sell so that they can repay any savers who need to withdraw their savings.

Banks and building societies both raise money from wholesale money markets. This is where banks borrow and lend money between themselves. Building societies, by law, may borrow only up to 50% of their total funding from money markets. The average amount societies fund themselves from the money markets is around 30%.

Banks are not constrained in the same way. For example, in 2007 the Northern Rock bank had taken this ratio of borrowing to 75%. It faced collapse when the amount of credit available in the money markets dried up.

Building societies keep the margin between saving and borrowing rates narrow. This allows them to compete for funds and continue to offer competitive rates to their members.

Conclusion

There are different types of organisations, from sole trader to plc. Each has different levels of liability, risk and benefits.

Banks are typical plc organisations, which source funds from shares and pay dividends to shareholders.

Building societies are mutual organisations. Their members are both owners and customers. They compete with banks for their share of the market in savings and mortgages by highlighting their advantages as mutuals.

There is a growing emphasis on the values of participation, personal service and locality in their brands. By not paying dividends to shareholders, they are able to provide more favourable interest rates and better terms for their members. To continue serving their members, building societies need to differentiate themselves from the high street banks.