Since the crash of 2008, the real estate market has rebounded and more investors are interested in adding property to their portfolio. Transaction volumes have eclipsed peaks prior to the crash and growth has become more stabilized. If you’re just starting out in real estate investment, what is the best course of action? Is it worth sinking all your hard-earned dollars into a flat and becoming a traditional landlord? Or is there an alternative investment method that requires less cash upfront but still provides a start in the real estate world?

We’ve assembled a short list of five ways you can start investing in real estate right away – often with relatively small amounts of money upfront. These tips will help you expand your portfolio with new investments while simultaneously teaching you about the world of real estate.

-

Make a Plan

Before adopting any of these options, be sure to do your due diligence. Carefully evaluate how much money you have available to invest, how much time you can afford to spend, and how long you can afford to keep your money invested. Investment methods differ by various characteristics, such as risk and liquidity, and may require varying amounts of time or capital investment. Investors must make sound investment decisions at the beginning of the acquisition as it will set the tone for the deal going forward.

-

Find an ETF

Exchange-traded funds (ETFs) are a simple way to get started with real estate investing. ETFs are traded like stocks and have low associated fees. To get started in ETFs, you will only need the investment capital itself and a platform to purchase the security. Real estate mutual funds also offer the advantages of real estate investment with liquidity and without the hassle of handling properties and tenants from a direct investment.

-

Start Small

Fancy the idea of being a landlord? Stick with Step 1 and make a solid plan – research and find a property that works best for you. Go with a property that is local and on the smaller end; you should also have a clear plan of how to realize an income stream from it. You can purchase a home from a wholesaler or off of the court steps that may require some minor rehabbing. Another alternative is to purchase property in an up-and-coming neighborhood and plan to resell as soon as possible. You could also choose to purchase the property with the intent of renting it out. Either way, be sure to have a clear plan before the acquisition. Start with something you can afford and work on building your revenue.

-

Invest Online

Today there are a growing number of ways to invest in real estate online without ever dealing with properties or needing to hire a property manager. Much of the ETF trading can be done online; in recent years, we’ve seen a rise in online real estate investment trusts (REITs). REITs do the research, purchase, and management of a portfolio of properties and allow individuals to set up investment accounts with the REIT. Most REITs are young with early positive returns and have accounts that can be opened within minutes. Some REITs accept entry investment sizes from $500-$1,000, making these trusts an appealing form of investment for anyone just starting to dip into real estate investing.

-

Real Estate Trading

Real estate trading is a highly profitable method of real estate investing which doesn’t always require a lot of money up-front. This involves buying houses below market and selling them quickly at a profit – also known as flipping. Nevertheless, the method isn’t without risks. Purchase the wrong properties and you can quickly be overwhelmed by the capital needed for expensive renovations, delays, and other expenses. Selling properties as-is in the hopes of at least breaking even isn’t always a viable option and should be considered a last resort.

The best flippers are investors who know exactly what to look for – properties that are inexpensive relative to the market and only require modest or moderate repairs to get them into prime selling position. Ideally, the flipper will also have some repair knowledge and should be able to do much of the work or contract it out, further cutting down on capital expenditure. Real estate trading is fraught with risks, but in the right hands, it can be an effective means of generating investment returns.

From purchasing options to investing in construction companies, individuals have various ways of getting into real estate investing. Above are just five of the most common methods.

Jake Marmulstein is the Founder and CEO of Groundbreaker. Groundbreaker is an all-in-one real estate investment software to automate fundraising, investment management and investor relations for real estate syndicators.

Intellectual Property Office A3 ePoster Edition 15 "Intellectual property and the external environment"

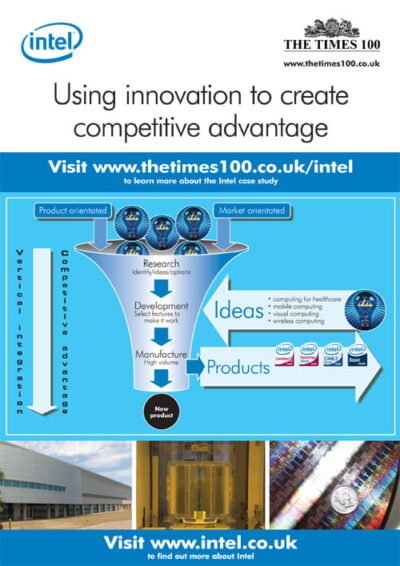

Intellectual Property Office A3 ePoster Edition 15 "Intellectual property and the external environment"  Intel A3 ePoster Edition 13 "Using innovation to create competitive advantage"

Intel A3 ePoster Edition 13 "Using innovation to create competitive advantage"  Unison A3 ePoster Edition 17 "Developing responsiveness through organisational structure"

Unison A3 ePoster Edition 17 "Developing responsiveness through organisational structure"  The Complete Collection Business Case Studies eBook

The Complete Collection Business Case Studies eBook  CEMEX A3 ePoster Edition 13 "Sustainable performance in the construction industry"

CEMEX A3 ePoster Edition 13 "Sustainable performance in the construction industry"  The contribution of the FTSE4Good Index to socially responsible investment (PDF)

The contribution of the FTSE4Good Index to socially responsible investment (PDF)  Creating shared value in the supply chain (MP3)

Creating shared value in the supply chain (MP3)