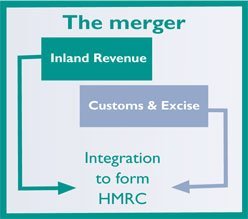

To integrate or merge means to join together. There are often advantages for two organisations to merge to become one. The most important is that it enables greater efficiency. It can also give a better service to customers. This case study looks at the recent integration of Inland Revenue and Customs & Excise to create a new, more efficient HM Revenue and Customs (HMRC).

HMRC is responsible for collecting the vast majority of taxes in the UK. It also administers Working and Child Tax Credits, distributes the Child Trust Fund, enforces payment of the National Minimum Wage and collects repayments of student loans.HMRC is a government department in the public sector. It is directly accountable to the Treasury, which is headed by the Chancellor of the Exchequer.

The public sector contains government provided services for the population e.g. building and running schools and hospitals. It requires money to do this – hence the need for taxes. HMRC is responsible for tax collection. The success of the public services depends on how well it does its job. As companies make more profit and people earn more money, they pay more taxes. This means a better service can be provided for everyone.

Why integrate the Inland Revenue and HM Customs?

Gordon Brown, The Chancellor of the Exchequer, asked for an independent review into whether this integration would be a good idea. Gus O’Donnel, a leading civil servant, produced the review. His report, ‘Financing the Future’, came to the conclusion that it would be. Gordon Brown announced the decision to merge the Inland Revenue and HM Customs in the 2004 Budget and the two departments became one on 18 April 2005. When businesses in the private sector merge, the main reasons are:

- cutting costs by operating on a large scale (economies of scale)

- reducing waste

- lower prices and faster service to consumers

- other objectives such as increasing market share and increasing profits.

- The first three of these reasons also apply to integration in the public sector. The main reason for public services is to help people rather than produce profits.

The O’Donnel review showed that integration would lead to:

- an improved level of service

- lower costs

- more efficient service for the public

- a reduction in administration for all.

The new organisation was created in April 2005 and will continue to change to become better at what it does.

Types of integration

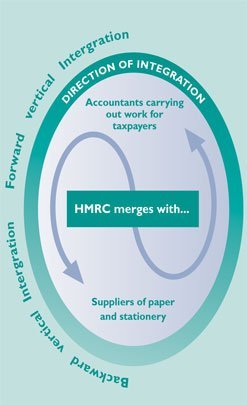

The three main types of integration for organisations are described according to the direction of the integration.

Vertical integration

This occurs when one organisation takes over another at an earlier or later stage of production or work. For example, if HMRC bought up some of the businesses that supply it with paper, this would be described as backward vertical integration. Backward means that integration is at an earlier stage of production. If HMRC was to take over some of the work carried out by accountants in calculating tax payments for taxpayers, this would be called forward vertical integration. Forward means the integration occurs in part of the process that is nearer to the customer (in this case, the taxpayer).

The main reasons for forward vertical integration are to make sure that a business:

- has somewhere to sell its product

- controls where and how it sells its product.

The main reasons for backward vertical integration are to ensure that a business:

- can get supplies

- has control over the quality of supplies.

Horizontal integration

This occurs when one organisation integrates with another business at the same stage of production or work. The creation of HMRC from two tax-collecting bodies is an example of horizontal integration. The main reasons were to:

- bring together people doing similar jobs

- give customers a better service

- achieve lower costs.

Conglomerate integration

This occurs when a business merges with another that produces a completely different product. An example might be HMRC integrating with a cake maker. A major reason for this is to try and spread risks by producing more than one product. For example, many tobacco firms have bought businesses in areas such as hotels and leisure.

The impact of integration on business operation

The integration of HMRC required a new structure. An Executive Committee similar to a Board of Directors in a public company is in control. It decides the strategy and business plan for the organisation. An executive makes decisions and ensures they are carried out. HMRC is now divided into 36 business areas, each one led by a Director and reporting to an Executive Committee Member. The integration has also changed how people find out about the tax they have to pay. It will be much easier to do this as only one organisation is involved. HMRC has set up special teams to offer more help. These examples show two of the new changes.

Advice on tax

Miss X has graduated from university and has just started a small Internet Café. She now finds that all her tax concerns are covered by one organisation. For her, HMRC is a one-stop shop dealing with VAT payments, income tax, and the repayment of her student loan. It is much easier for her to run her business because of this. She can concentrate on essentials like market research and gaining new customers.

Advice on starting a business

Anyone who wants to start a small business will have to think about tax. HMRC has specialist Business Support Teams. They advise small businesses about tax and what they will have to pay. HMRC has a Business Start up Unit, which provides a pack of materials called ‘Working for Yourself’. It also uses state-of-the-art Internet materials, including “Now You are Self Employed”. New businesses get help from a range of easy-to-read materials. In addition, self-employed people can discuss tax issues face-to-face with specialist HMRC business advisors.

The impact and benefits of integration on stakeholders

Impact

A stakeholder is an individual or organisation that has an interest in how an organisation is run. Some of the main HMRC stakeholders and their interests are:

- employees looking for more rewarding work and seeing their organisation well run

- government looking for lower costs that are likely to result from integration.

So every stakeholder stands to benefit from the integration. This applies to people of all ages and to businesses of all different sizes. The examples in the last section show some ways the public can gain.

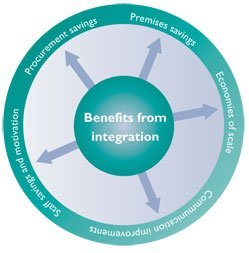

Benefits

The O’Donnel Reviewidentified lower costs that would flow from integration.

i. Communication savings

A one-stop shop with a strong Internet presence and all the latest technology makes it much easier for people and businesses to discuss the full range of tax and benefit issues affecting them.

ii. Staff savings and motivation

Staff are now trained to deal with a wider range of related issues leading to more variety of work per person and a better understanding of how to meet customers’ information needs. Employees in the new HMRC have far more opportunity to enrich their work lives by learning and developing new skills. This lowers costs and leads to faster service. Employees of HMRC carry out very specialist work. Each person will need to concentrate on what they know about e.g. a person dealing with Value added tax(VAT) needs very different knowledge from someone dealing with Tax Credits. Employees will therefore continue to need specialist training. However, in an integrated service they also need a general knowledge of how the whole organisation works and to which other people in the organisation to refer customer queries and problems to. This training will also increase motivation.

iii. Procurement or commercial savings

Procurement means obtaining resources e.g. buying stationery and materials. Cutting costs happens because large economies of scale savings can be achieved through bulk buying. It is also cheaper as purchases are made for only one larger department – HMRC.

iv. Premises savings

Instead of operating from two sets of premises, HMRC will be able to decide which premises offer most benefit to their business and their stakeholders and operate from them. This process is known as rationalisation.

v. Other economies of scale

There are various economies of scale (i.e. cutting costs by becoming larger) that result from this integration. These lead to a number of savings, including:

- information technology economies: paying for only a single one stop website

- human resource management economies: operating only one system for managing and developing people

- economies of simplification: operating with only a single name and logo.

These economies of scale will obviously benefit people and businesses. There will be a simple and easy to understand system of paying tax, and a much cheaper, cost effective and improved service.

Conclusion

The O’Donnel Review made a strong case for integrating the Inland Revenue and HM Customs and Excise. This integration is not a one off ‘Big Bang’ process. There will be change in the future to produce more savings and benefits. This enables this purpose to be carried out more effectively. HMRC must be accountable to the public and other stakeholders. A single body designed to focus on consumers and other stakeholders requires clear planning and continual training for employees.

The purpose of HMRC is to collect tax in a fair way, while making sure that individuals receive the allowances they are due. The formation of HMRC means the public gets better value for money. The public and businesses will spend less time on tax and benefit related issues. The costs of dealing with tax collection will fall and the public will have improved information and a quicker service. This leads to a win/win situation that is highly motivating for everyone.