Governments have no money of their own. They must raise it in ways that are efficient and also acceptable to citizens. That means having a tax system that really works. It would be hard to overstate just how crucial an efficient, well run, widely accepted system of taxation is to a country’s economic well-being.

This case study looks at the central role of the Inland Revenue in helping to ensure that the government is adequately funded. It also examines the work of the Inland Revenue as service-provider, enabler and regulator and the steps the Inland Revenue has taken to become more customer focused.

Where the Inland Revenue fits in

Overall responsibility for the economic health of the UK lies with the Chancellor of the Exchequer and various government departments, including:

The Treasury

Responsible for developing the government’s economic and financial policy. The Treasury Ministers make critical decisions about policies and practices affecting the Inland Revenue and HM Customs and Excise. These decisions include agreeing how best to balance tax revenues against planned government expenditure. All government departments spend money and need to obtain Treasury approval for any proposed major expenditure.

The Inland Revenue

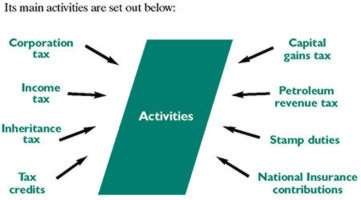

Responsible for administering direct taxes, student loans, paying tax credits and enforcing the national minimum wage. The Inland Revenue exists to ensure that everyone understands and claims what they are entitled to and understands and pays what they owe, so that everyone contributes to the UK’s needs. It has strong regulatory powers including the power to impose financial penalties and to take people or companies to court.

HM Customs and Excise.

Collects a range of indirect taxes and duties including VAT, taxes on alcohol and tobacco, and import duties. It also seeks to prevent undesirable items such as drugs and weapons entering the UK.

Some key Inland Revenue stakeholders

Enlightened organisations identify the individuals and groups to whom they must be accountable if they are to continue to exist. These individuals and groups are the organisation’s stakeholders. Like any other organisation, the Inland Revenue has stakeholders whose needs and requirements it must identify and look to satisfy.

The Inland Revenue’s key stakeholder is the government of the day, which will make its expectations clear, and will require the Inland Revenue to:

- collect all tax revenues due

- pay the right entitlements to individuals and organisations

- enable citizens to get things right first time

- minimise the costs associated with collecting tax revenues and distributing entitlements.

These requirements become indicators against which the performance of the Inland Revenue can be assessed with a view to achieving improvement year on year.

Other major stakeholders are the individuals and organisations with whom the Inland Revenue deals in the course of collecting tax due and giving out entitlements. The UK government has made clear that the Inland Revenue should be a customer focused public service, from which those who deal with it deserve and are entitled to a high level of service. This makes good sense – a well-run tax system that the business community supports will help sustain economic activity.

Good customer service is delivered by its employees through many channels. In a service delivery organisation, customer service skills where the customer can access the information/advice they need is critical. The Inland Revenue must therefore ensure it recruits and maintains the right skills, experience and technical knowledge to meet these demands. In reality, every citizen is a stakeholder of the Inland Revenue. If citizens are to continue to enjoy reasonable standards of living and a good quality of life in a well ordered society, they need an effective government with adequate funding. The Inland Revenue plays a vital role in ensuring that the necessary funds are available, in line with Treasury forecasts.

The Inland Revenue as an enabler

Enablers make things possible, through for example, assisting and supporting. Where there are obstacles, enablers help people and organisations to overcome them. In its role as enabler, the Inland Revenue has committed itself to making it as easy as possible for tax payers to understand their rights and obligations and, in their dealings with the Inland Revenue, to experience success at their first point of contact, be it by telephone, e-mail, personal visit, or via the Inland Revenue website.

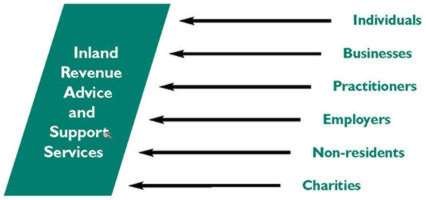

As part of a planned programme of improved customer service, the Inland Revenue has studied its market and divided tax payers into groups based on their characteristics and type of need.

‘Practitioners’ are professional tax accountants who specialise in helping individuals and businesses to fulfil their tax obligations and to claim their entitlements. Most businesses are also employers: they have employees in addition to the owners. As employers, they need specialist advice for example, on operating payroll correctly. Charities need special assistance because their tax liabilities, obligations and rights are affected by their charitable status. Having identified each segment of its market and created this helpful framework, the Inland Revenue has set about creating support packages that meet each segment’s particular need. It is also taking steps to ensure that its staff have the necessary expertise to deal with the detailed enquiries they will inevitably face.

The Inland Revenue as a regulator

As a regulator, the Inland Revenue seeks to ensure that people or organisations do not and cannot evade their obligations (e.g. to pay a tax) or falsely claim entitlements (e.g. to a particular grant, allowance, or tax credit). The Inland Revenue has a social responsibility to help those willing to meet their obligations. It also operates procedures designed to detect and penalise cheats who fail to pay what they owe, or try to claim more than they are entitled to. This is a vital part of the Inland Revenue’s work; it should ensure fairness and a level playing field. Heavy fines and even imprisonment for tax evaders and cheats have a part to play in sustaining overall public confidence in, and support for, the tax system.

Changing the image

Most of us can think of organisations about which people have negative perceptions. In some instances, the perception may also be the reality, but in others it may be seriously wrong and outdated. People’s views may display lack of current knowledge (ignorance), lack of interest in finding out the real position (apathy), and a determination to continue to think and believe the worst, based perhaps on past experience (prejudice). For any organisation faced with negative perceptions, changing the image and establishing the new reality is vital and hard work.

In seeking to encourage a greater level of compliance the Inland Revenue needed to improve its customer service to a more positive experience, which would in turn create a more positive perception amongst those who came into contact with the organisation.

To help with this change of image, the Inland Revenue appointed a Marketing and Communications Director, Ian Schoolar. To achieve this, the Inland Revenue has concentrated on improving its performance at the point of contact with citizens through a customer focused strategy developed by Ian Schoolar. This has meant:

- adopting an appropriate response to customer behaviour

- understanding the needs and behaviours of different groups of taxpayers and meeting those needs

- promoting customer co-operation by offering help and support

- continuing to tackle non-compliance effectively

- working co-operatively and in teams towards common aims.

The Inland Revenue is a service delivery organisation. As such it has to consider how its every action affects its relationships with tax payers. If it is successful in understanding and delivering what citizens need, this will lead to them being more satisfied and more willing to co-operate. This greater level of customer compliance and co-operation will help the Inland Revenue become more cost effective and efficient, which in turn will lead to it being more highly regarded; and a continuous cycle of improvement will have been created. In its drive to become more customer focused, the Inland Revenue has conducted research to discover what tax payers expect. It found that they want all Inland Revenue staff to be:

- knowledgeable

- objective

- human

- clear

- reasonable

- efficient.

These findings are hardly surprising, but are important, and have led to the Inland Revenue working hard to change its culture. In particular, it has established performance standards against which to measure how well it is doing.

Creating a new way of doing business

The Inland Revenue is looking to deliver a customer-oriented level of performance by which it:

- responds to 80of all post within 15 working days

- sees everyone who calls at Inland Revenue Enquiry Centres by appointment within 15 minutes of their agreed arrival time

- answers telephone calls within 30 seconds

- gives full and correct answers first time

- processes a self-assessment tax return correctly first time by making full and correct use of available information

- extends the availability of e-services

- establishes e-mail as a form of customer contact

- makes best use of available technologies

- modernises systems for receiving and paying money

- offers taxpayers a wide range of payment methods

- develops a standard approach to managing taxpayers’ debts.

Conclusion

Public sector organisations are as capable of being market-oriented and customer focused as those in the private sector. In a changing business environment, with increasing pressures to become more cost effective and rising customer expectations the Inland Revenue has set about creating a new customer-oriented business culture. All its employees have the opportunity to relate their own performance and their sources of job satisfaction to improve and meet the needs of taxpayers.