Land Securities is the UK’s leading property company. It is quoted on the London Stock Exchange and is a member of the FTSE 100. Land Securities owns more than £12 billion worth of property across the UK. The company is responsible for over seven million square metres of commercial accommodation. Its main objective is to maximise returns for shareholders on the money they have invested through buying, developing and managing commercial property. It must ensure that the income it generates through these activities will provide a healthy return on the original investment.

Empty space means the asset is not generating income which could potentially impact on the return to the Land Securities’ investor. Fully let buildings mean healthy income generation.

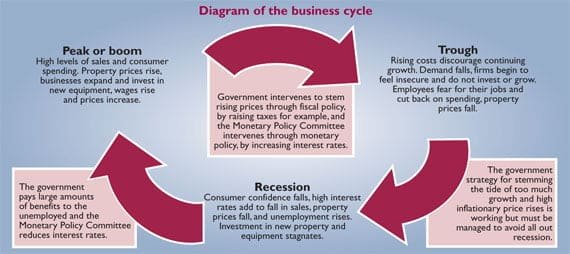

The commercial property market is cyclical. The demand for rented commercial property is set by the health of the economy and future expectations of economic growth. A growing economy means that firms expand which increases their requirements for business accommodation. An economy in recession means firms try to cut back and save costs. Land Securities relies on high levels of occupation of its properties to make sure maximum returns are made for shareholders.

The UK economy has experienced an unusually long period of growth over the past few years, following a period of serious decline in the early 1990s. Businesses have generally enjoyed a robust period of growth on the back of strong growth in sales. However many economists and financial analysts are now predicting that we are about to experience a downturn with the worst predicting a global recession. Where a recession exists incomes and outputs can fall.

The result of a recession is that businesses have lower outputs and in order to maintain profitability companies look to reduce costs by making people redundant. Suppliers to businesses lose orders and may also have to make employees redundant. Employees out of work have less money to spend and this vicious cycle means the economy is in a state of decline.

When the economy experiences a boom, businesses see the increased demand for products and services- in response to increased demand prices can rise. Inflation is the enemy of most businesses. It drives up costs and discourages customers from buying items that are too highly priced. It indicates the beginning of a new downturn or recession.

Land Securities’ main business is acquiring, developing and managing commercial property. Commercial property does not react in the same way as other goods and services to the business cycle. The property cycle is longer. When Land Securities is developing a property it generally takes three years to finish a project. Negotiations take a lot of time. The legalities of obtaining planning permission and building the development take time. Added to this is the process of buying, renting or selling the property which can also take time.

Property is an inflation hedge as property prices generally move in line with inflation. When inflation is high rental growth also tends to be high. Theoretically, when other businesses are trying to cut back to offset the difficulties of recession, Land Securities buys property and land at much lower prices. When the economy is booming, property prices rise and Land Securities takes advantage of this positive economic environmentto sell property. The profit made releases capital in order to be ready for further investments in the next downturn in the economy. The assets in any business are more important to long-term financial stability than short-term profits. So Land Securities must concentrate on growing a large asset base through buying property in a downturn. This allows it to buy at a relatively low price, develop to meet demand and sell at peak times.

Land Securities is a Public Limited Company quoted on a regulated exchange and owned by shareholders. The shareholders provide capital to buy properties and Land Securities works on behalf of the shareholders to increase the asset value of the business through its commercial activities of buying, selling, developing and managing property. Shareholders are individual investors, other businesses, or pension funds, who all look for a good return on their investments. Property is a long-term investment, and over the long-term, changes in the business cycle are less likely to impact on property values. In addition, property is a scarce resource since there is a limit to the amount of land in the UK which can be developed which also helps protect the value of property in the longer term.

Land Securities Retail Operations

Land Securities owns many shopping centres, the majority of which lie in major city and town centres in the UK. The Bull Ring in Birmingham; St David’s Shopping Centre in Cardiff; Whitefriars in Canterbury, and the White Rose, Leeds are a few examples. Land Securities recognises it is important to anticipate trends and has identified certain destinations with a lot of consumerswho want to shop there but with insufficient shops to satisfy that demand. As a result Land Securities will invest in these destinations, through development, to improve the retail offer. This helps maximise the number of visitors who return time and again to help the city or town gain in reputation.

Providing quality developments that attract prestigious retailers and other services can increase the prosperity of a whole region. The demand from retailers for quality space that offers a pleasant experience for shoppers and workers is high. Projects like out-of-town shopping malls are difficult to develop. This is due to issues with planning permission and government regulation on developments that require increased car use. Demand is strong and inevitably this drives up the price of the available space. Office space is a more risky prospect but as a result can be very lucrative. Finance and business users have different needs and the number of people they employ can change quickly. This can create uncertainty and therefore asset values may fluctuate more.

Land Securities has a rolling five-year plan and is therefore always looking forward. At the end of each six month period the plan is reviewed, updated, and implemented by the Board of Directors. The planning cycle draws upon information from inside and outside the business. The directors use a five year financial business planning process together with a system called ‘balance scorecard’. This is essentially a scorecard that uses financial and non-financial criteria to assess all aspects of the organisation’s performance. This gives a clear indication of how well the business is doing as a whole and provides a clear indication to employees of the performance targets set for the business. As part of the business planning process each property is reviewed to make sure that it will provide a return on the investment made by the company, which can either be a return on the amount invested to buy the property or a return on any money that has been invested in the development of a property. This means that each investment property needs to have a long-term plan, based on detailed research and analysis, to help the Board evaluate the future prospects for that property. If the research shows that the returns are slowing the directors may then decide to sell that property.

An essential part of planning is also to look closely at economic forecasts. These provide indicators that relate to the decisions the government and the Monetary Policy Committee might make together with employment and housing market factors which may impact on consumer demand. These all affect the business cycle and therefore Land Securities, its tenants and their customers. In the 2004 annual report, the Chairman Peter Birch predicts:

“future growth in asset value will be more dependent on rental growth and success in securing lettings”. He continues: “we believe that our development and asset management skills will be one of the keys to the creation of attractive returns for our shareholders”

Many retail businesses have struggled this year and are reporting or warning of lower profits. This could be a problem for Land Securities. It might face large retailers reducing demand for floor space to cut costs as sales fall or retailers going bankrupt.

Corporate Review

Land Securities completed a Corporate Review in November 2005. The results suggested the Board of Directors believe that retailers generally have adopted a strategy of taking additional floor space to grow total sales. The review says this trend,

“explains the difference between retailer negative like-for-like sales growth and the positive absolute sales growth”. The review continues “…we believe that demand for large and well- configured shops in strong trading locations will remain firm”.

Land Securities seeks to achieve long-term sustainable returns for its shareholders. It knows that to do this it must consider inherent risks. Risk management and the ability to take measured risk is the secret to the success of any business. Land Securities have a clearly defined risk management process, covering a broad spectrum of business risks. Land Securities formally reviews the performance of each of its properties at least once a year. Risk factors might include property that is unoccupied, leases due to expire, progress on rent reviews and tenant defaults.

Macro-economic forces beyond its control also lead to risk. This includes increases in tax rates and changes to VAT. Stamp duty, land tax or changing taxation of profits and capital gains from the sale or rent of property may also have an effect. Another risk is changes that may take place in planning regulation. Land Securities ensures that it complies with regulations and legislation. It actively participates in many industry organisations such as the British Property Federation. Land Securities through the Federation can talk with government about issues that relate to its future performance.

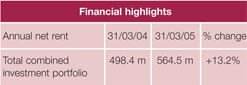

The Chairman, in his 2005 Annual Report, stated that in the past financial year performance had been outstanding with a higher level of growth than usual. The company predicts sustained demand from investors for commercial property. Clearly Land Securities will continue to monitor macro economic conditions and the progress of the business cycle. Many predict it is in a declining phase. This monitoring will help the business to plan ahead to ensure changes in the cycle have a minimum effect on the ability of the business to continue its high level of growth, thus providing high dividends for investors.