When we visit a shopping centre or go into the centre of a modern city, we take for granted all the services and facilities that are available. The skyline of almost every city within the UK is dotted with new developments designed to serve the needs of modern consumers. These building and property developments have changed the towns and cities and improved our everyday lives. At the heart of such initiatives have been creative projects designed to revitalise urban areas. Examples of these are the new Bullring in Birmingham, the Cardinal Place re-development at Victoria in London and the new shopping quarter in Canterbury.

Land Securities, the UK’s leading property company, played a key role in each of these developments. It has had a huge influence on the day-to-day lives of people living across the UK. Quoted on the London Stock Exchange, it is a member of the FTSE 100. Land Securities owns property worth more than £15 billion across the UK. Its core purpose is to make the best use of all its property in order to deliver results.

Land Securities has a rolling five-year plan that helps it to look forward in order to meet its customers’ future needs. This case study focuses on Land Securities’ business strategy. It describes how the company uses planning processes to provide a clear direction for the organisation.

Planning

Planning helps to identify how business objectives are achieved. One of the most important functions of management is planning. Planning helps to identify how business objectives are achieved. It involves thinking ahead, setting objectives and creating the means to achieve them. It also involves setting up the processes needed to measure how well an organisation is performing against its business objectives. Planning provides the starting point for making the decisions and taking the actions that build the organisation’s future. When plans are put together, they will usually involve an element of change. For example, the plan may involve internal or external changes for an organisation which will result in new decisions and actions. It is vital that there is effective communication with all groups of stakeholders so that they know the plan is working. Every six months, the management team at Land Securities reviews business performance against its plan and communicates these results to its stakeholders.

Business strategies and plans

In recent years Land Securities has developed a new business strategy. This is ‘to invest in property in sectors where we have expertise and operational skills which give us competitive advantage’. By using existing skills this will provide Land Securities with advantages over its competitors. In order to meet this strategy, Land Securities’ five-year plan focuses on providing a range of buildings and services where people can live, work and relax. Using existing skills will provide Land Securities with advantages over its competitors.

As a property business, Land Securities has to make the properties it owns work effectively in order to generate good results. It focuses on creative and customer-focused developments to improve the value of the properties that it owns through property management, development and other activities. An example of this is the Bullring in Birmingham. This creates income for its shareholders through the profits it makes.

A rolling plan is one with a planning cycle that is regularly reviewed and refined based on performance. For the plan to be successful, it is important that the company has business objectives which are measurable and that it regularly reviews its progress against these objectives.

Key Performance Indicators

Land Securities calls these business objectives key performance indicators (KPIs). The KPIs are very specific and clearly defined, so they can be used to measure the performance of the organisation. By monitoring whether the business meets its KPIs, Land Securities gains valuable feedback. This helps it to adjust and refine its business strategies and set new KPIs/business objectives.

KPIs and stakeholders

Some of Land Securities’ KPIs or business objectives are financial, while others are non-financial. A financial example is ‘to create sustainable, long-term returns for shareholders. (Sustained real growth in earnings per share to be at least 3% per annum over rolling three-year periods, with annual revenues and profits to exceed targets)’. KPIs or business objectives provide a series of precise measures against which business decisions and further action might need to be taken. A non-financial example is to ‘ensure high levels of customer satisfaction with overall customer satisfaction in retail and London to exceed targets’.

Measuring performance

These KPIs or business objectives provide a series of precise measures against which business decisions and further action might need to be taken. They also help to show how well the business is meeting the needs of its stakeholders.

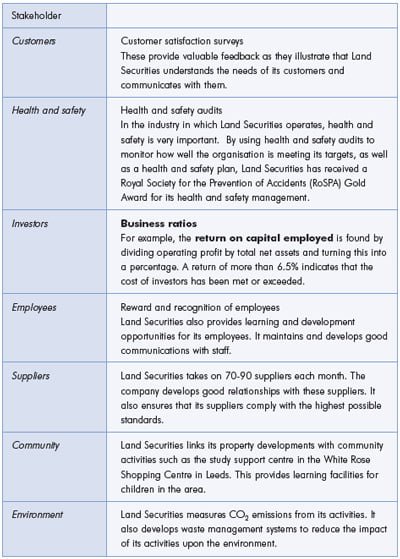

The table shows how the various business objectives or KPIs measure the impact of the business on each stakeholder group. Objective setting through KPIs is viewed as extremely important by Land Securities. By evaluating its performance each year against these objectives, new targets can be set, which enables the business to grow further.

Exercising corporate responsibility

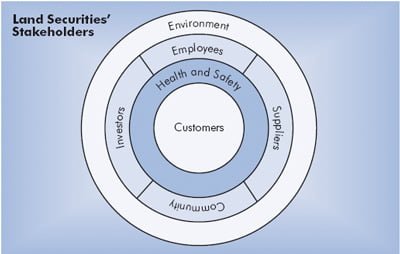

The process of using business strategy and planning to measure and meet the needs of stakeholders is called corporate responsibility. At Land Securities, corporate responsibility is about taking a wide view of everything it does. This provides positive benefits for stakeholders and helps to reduce negative influences.

Corporate responsibility helps Land Securities to achieve a balance between the requirements of the property industry and the responsibilities that it has to its seven key stakeholder groups.

Objective setting through the use of KPIs is important for Land Securities. Evaluating its performance each year against these objectives helps new objectives to be set. This moves the business forward. Corporate responsibility helps Land Securities to achieve a balance between its work in the property industry and all its other responsibilities.

Financial/non-financial reporting

Land Securities reports on both the financial and non-financial aspects of its performance to each of seven stakeholder groups. This is part of its corporate responsibility role. For example, Land Securities uses Customer Relationship Management programmes to manage relationships with its customers. Customer visits are also used as part of the reporting process. Land Securities uses the ways in which it deals with its customers to differentiate and distinguish itself from its competitors.

- Health and safety: Regular articles about health and safety appear in Landmark, the in-house magazine. The company produces a health and safety plan each year and reports progress against objectives.

- Shareholders: Land Securities communicates with its shareholders through its annual and corporate responsibility reports. Its website also plays an important role. Senior management meet regularly with investors to update them on the performance of the business.

- Employees: Employees are kept informed about events within the business in many ways. Its in-house magazine, Landmark, deals with a whole range of business issues. Other means of communication are internal poster campaigns, employee conferences, intranet, weekly newsletters and mini campaigns. These are all designed to keep employees informed and up-to-date.

- Suppliers: Suppliers are key stakeholders. In order to listen to their views, Land Securities holds supplier conferences. It also keeps suppliers up-to-date about developments within the industry. It uses a brochure outlining some of the approaches that Land Securities is taking on development issues.

- Local communities: Land Securities consults with local communities throughout a development project. This goes from the earliest stage right through all the processes of construction. It communicates with local communities, local and national government representatives and pressure groups.

- Environment: A recent conference reported the progress made by Land Securities in managing the environment. The conference helped it to share its good practices and consider new ways of taking responsibility for the environment.

Conclusion

Land Securities takes a wide view of its responsibilities for developing and improving the UK’s urban areas. The need for planning is at the heart of this process. Land Securities develops creative projects and sets rigorous financial and non-financial objectives called Key Performance Indicators. It is therefore able to exercise corporate responsibility in order to meet the needs of its seven different stakeholder groups. Reporting on such developments enables Land Securities to inform its stakeholders about what is happening within the business. It also enables its stakeholders to provide valuable feedback for use within its planning cycle. This helps Land Securities to plan ahead.