Payday loans come in handy during financial hurdles you can acquire these loans to cover emergency expenses. They are easily accessible if you have proof of employment and a bank account.

You have until the following payday to pay off your payday loans and fees in most instances. However, some have longer terms that can extend beyond one month.

You need to repay your loans on time to avoid penalties. The following guidelines will help you get on top of your repayment.

How to Make Sure You Don’t Miss the Repayment

1. Pay Off The Loan in Increments

Since it’s tough to repay the whole loan amount at once, you can make small, consistent payments before the repayment date to ensure you don’t miss the due date.

For instance, if your payday loan is due in a month, you can make payments before the deadline if you get your hands on some cash before your payday.

By the time your repayment is due, it’ll be easier for you to meet the financial obligation in full. It’ll also ensure that you have enough cash left to cover your expenses and possibly save for a rainy day.

Additionally, ensure you check with your lender if there’s a penalty for early repayments, so you don’t incur extra costs.

If there are charges for early repayments, calculate the cost and compare to determine if it makes sense to repay earlier or wait it out. Then, go with the most affordable option.

In some cases, you can contact your lender to see if it’s possible to get the interest rates lowered. If it’s possible, it’ll make your loan more affordable. If you’re having financial difficulties, your lender might be willing to assist you or you can try to consolidate your finances and get cheaper loans for bad credit online.

2. Make a Monthly Budget

It’s challenging to save money at this age where spending is so easy. You can buy a brand new vehicle or make hotel reservations using a smartphone. Companies even deliver products at your doorstep—you don’t have to lift afoot to purchase anything.

Consequently, a good percentage of the population shops online because it’s affordable and fast and getting deals, is easy, especially for loans.

If you take out a payday loan, you should organise your monthly expenditure to avoid overspending. You can cut back on some expenses to ensure you don’t spend beyond your budget. Try to pick cheaper and affordable options like coupons to minimise your grocery spending. You can do away with your expensive phone to reduce your payments or cable for a Netflix account and a cheaper phone.

Draw a monthly budget that covers all your essential expenses for the whole month and stick to it until you pay off your loan. You’ll have to make sacrifices and repay your loan as soon as possible to avoid paying additional charges.

3. Consolidate Your Payday Loans

Many people usually disregard consolidating payday loans. Even though consolidating loans can be challenging, it’s achievable. Debt consolidation can be done using another financing source or a debt consolidation program.

If you choose to use a consolidation program, look for firms that collaborate with creditors. Debt management firms negotiate with payday loans UK direct lender creditors to make repayment more manageable.

Creditors work with these firms to increase their chances of getting their money back. In most instances, the balance is usually divided into monthly payments. The benefit is that you’ll be repaying a single rather than multiple loans.

If you opt for another financing source, you can get a personal or home equity loan. Use the funds to pay off your loans, and then, you’ll only be left with one loan to pay back.

4. Initiate Automatic Repayment

Set up automatic payments since you can easily forget bill dates if you don’t have a reminder. Most payday loan firms require clients to have a bank account for this purpose.

With automatic repayments, your loan is repaid immediately after your income hits your account. This will help you pay your loan on time and avoid unnecessary penalties.

You are better off repaying your loan than applying for another to cover your monthly expenses. Just take caution not to wind up in the payday loan loop, where you continuously take out loans to survive.

5. Try Renegotiating Loan Terms

If the repayment deadline is fast approaching and you can’t afford to make payments, contact your creditor to see if you can negotiate the terms. For example, you can ask your lender to extend the due date or make smaller payments.

If there’s a chance that your creditor can make the terms more flexible, it’ll be a win for both parties. Platforms such as Viva Loans can connect you with flexible lenders who are willing to renegotiate loan terms. You might even be able to get your interest and fees lowered. You’ll never know what option you have unless you ask.

6. Charge Your Payday Loan To Your Credit Card

After all the other methods have proven to be a dead-end, this should only be a last resort. This is a bad way of repaying loans, but it’s better than defaulting.

Even though credit cards have high-interest rates, they aren’t as high as payday loans. Contact your credit card issuer beforehand to determine the terms for cash advances.

Bottom Line

Getting a quick loan to pay for vacations, home renovations, or financial emergencies has never been easier. Technological advancement has made it easy to access and apply for loans. However, most online short-term loans come with high-interest rates. Therefore, make sure you repay them as early as possible.

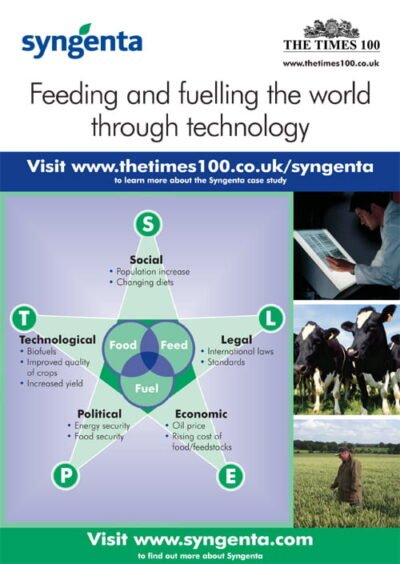

Syngenta A3 ePoster Edition 13 "Feeding and fuelling the world through technology"

Syngenta A3 ePoster Edition 13 "Feeding and fuelling the world through technology"  No 7 - the relaunch of a brand (PDF)

No 7 - the relaunch of a brand (PDF)  Enterprise Rent-A-Car A3 ePoster Edition 14 "Recruitment and selection at Enterprise Rent-a-Car"

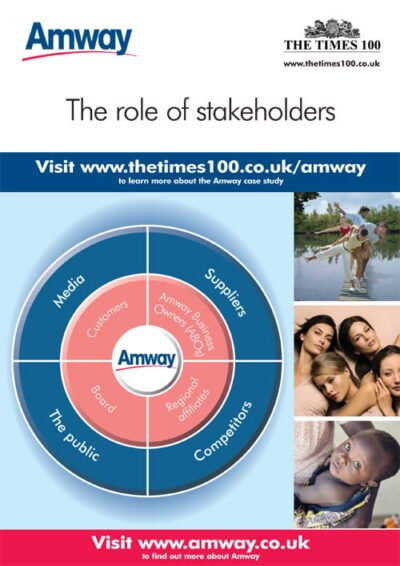

Enterprise Rent-A-Car A3 ePoster Edition 14 "Recruitment and selection at Enterprise Rent-a-Car"  Amway A3 ePoster Edition 13 "Stakeholders as partners"

Amway A3 ePoster Edition 13 "Stakeholders as partners"