PricewaterhouseCoopers was created in 1998 by the merger of two firms – Price Waterhouse and Coopers & Lybrand – each with historical roots going back some 150 years and originating in London.

PricewaterhouseCoopers, the world’s largest professional services organisation, helps its clients build value, manage risk and improve their performance. Drawing on the talents of more than 140,000 people in 152 countries, it provides a full range of business advisory services to leading global, national and local companies and to public institutions. These services include audit, accounting and tax advice; management, information technology and human resource consulting; financial advisory services including mergers & acquisitions, business recovery, project finance and litigation support; business process outsourcing services; and legal services through a global network of affiliated law firms.

The new, combined organisation is the result of the continuing growth in the international economy. Companies are constantly seeking to re-define themselves to thrive in the market-place where mergers & acquisitions are increasingly important and many companies now operate without geographical boundaries. Their commitment to refining all available technology allows them to operate a global information and support network to both their advisers and their clients, anywhere in the world.

They offer businesses around the world both a wider range of services and a more integrated service than has ever been possible. This service also provides solutions to business problems, the scale and complexity of which are greater than ever before. At PricewaterhouseCoopers, there are six service lines or departments which cover different areas of specialisation. These are:

- Assurance & Business Advisory Services

- Management Consulting Services

- Tax & Legal Services

- Financial Advisory Services

- Global Human Resource Solutions

- Business Process Outsourcing.

PricewaterhouseCoopers may work on one of these areas and find that the client requires help and solutions to issues in other areas. They are able to provide an integrated team of experts to give this advice and offer a range of possible solutions.

In this case study, the role of Financial Advisory Services is explored with a focus on private finance initiatives. The Financial Advisory Services team offers financial, economic and strategic advice to household names around the world.

The five departments or service areas within Financial Advisory Services are:

- Business Recovery Services

- Dispute Analysis & Investigations

- Mergers & Acquisitions

- Project Finance & Privatisation

- Valuations & Shareholder Value.

The Conservative Government launched the Private Finance Initiative (PFI) in 1992 in a bid to deliver high quality and cost-effective public services whilst avoiding the need to raise taxes in the short-term. PFI allows the public sector service providers to obtain or ‘procure’ those services while placing the risks of buying and maintaining the asset with the private sector.

In a PFI, the Government body sets up a contract with a private company. The private company buys, builds and services the asset. The Government has use of the fully serviced asset for the period of the contract and at the end of this period, the Government will own the asset. The Government uses the fully serviced asset in exchange for a rental payment.

Typical examples of PFI are projects requiring large investments such as schools, hospitals, road and rail links, waste disposal services and prison services. A recent example is that of Falkirk schools. This contract is a good example of the types of risks that are transferred through the procurement process (see right). Substantially, these risks are the construction, operating and financing costs.

Risks

Private Finance Initiatives are also utilised in building new schools. In the case of Falkirk, Scotland, a 25 year contract was signed between Falkirk Council and a company called Class 98 to provide three new secondary schools, a major secondary school extension and a special needs school at a cost of £70 million. This was the first PFI project involving the provision of a number of schools to be undertaken.

The risks for the private sector in undertaking a PFI are many and it is the role of the negotiating team to assess how great are these risks and whether they would affect the completion of the project. In some contracts this risk may be split between the public and private sector. For the Falkirk PFI, Class 98 carries the risk of an increase in construction costs through any delays. The Council retains the risks associated with any changes in legislation and education which may, for example, change how children are taught in 20 – 25 years’ time.

PricewaterhouseCoopers is also experienced in helping to compile the submissions, arranging the finance to back the bid and negotiating the contract on behalf of the private sector.

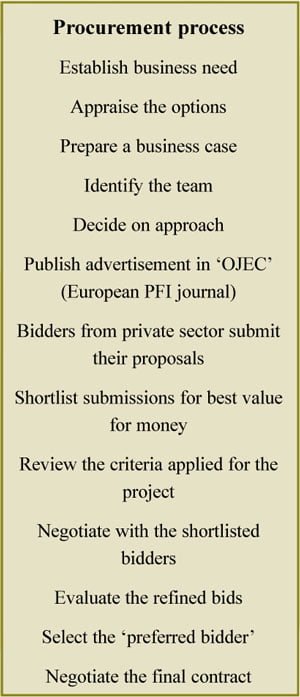

The key components in negotiating a contract are extensive and it is important that they are fully comprehensive: [diag]

A number of different companies were involved in the disposal of waste in Hereford and Worcester and in 1998 a number of their contracts were up for renewal. The local authorities decided to review the management of the waste services and ensure that this public service was cost-effective and complied with environmental targets.

The arrangements for disposal of the waste were almost exclusively through landfill, with a very low percentage of the waste committed to recycling or other forms of recovery (5-6%) and no incentives to improve on these levels. In a bid to reduce the level of landfill, the Labour Government substantially increased taxes levied on this form of waste disposal.

This cost incentive, along with the requirement to meet environmental targets and the benefits of an integrated contract, encouraged Hereford and Worcester local authorities to review PFI as a new means of procuring their waste disposal services. The local authorities were also keen to take advantage of ‘PFI credits’ which provided local authorities with a financial incentive to identify opportunities for a PFI.

Waste management consists of:

- Refuse collection from homes and industry

- Transportation of waste to the disposal sites

- Waste treatment and disposal

- Recycling and energy recovery

- Landfill management.

The global drive to improve the management of waste and increase the amount of recycling has generated new global targets. The following apply in the UK:

- > 25% waste recycled by 2000

- > 40% waste recovered by 2005

- < 60% waste buried in landfill sites by 2005.

Landfill sites are the primary means of disposing of waste in the UK. However there is less land available and the effects of landfill on the environment remain unclear. In addition, the amount of waste is increasing as the number of households grows.

The use of ‘waste to energy’ incinerator plants is also increasing. These plants burn certain types of waste and require capital investment and planning permission. However, uncertainty exists over the effect of incineration on the environment and these plants may be redundant in 25 years’ time. These are all major concerns for the environmental lobby groups.

Hereford and Worcester were also the first local authorities to consider a PFI in fully-integrated waste management and the process involved a highly complex series of contractual obligations for the public and private sector. This unprecedented action met with some concerns – there were no previous examples to follow and procurement processes are a costly exercise. This PFI also tied the authority into a long-term contract of 25 years during which time environmental laws may change.

An integrated waste management contract was agreed for 25 years, with key recycling and recovery targets set. A minimum number of household waste tips for public access and a minimum number of treatment facilities (landfill, ‘waste to energy’ plants, recycling stations) were agreed and ‘risks’ identified and retained or transferred to the private sector.

- Facility design and construction by agreed deadline

- Quality of service provided

- Contamination of the environment

- Increase in waste tonnage above estimate and ability to handle demand

- Achievement of recycling/recovery targets

- Increase in landfill tax

- Change in interest rates.

The arrangements for payment by Hereford and Worcester local authorities were included in the contract. These payments were based on the tonnage of waste processed with a supplement for recycling and recovery. Additional concerns to the local authorities include the threat of protestor action and whether a PFI provides a cost-effective solution.

The completion of the PFI means that Hereford and Worcester were the first local authorities to negotiate a PFI for a fully-integrated waste management service. The contract is now in place to run for 25 years.

The Financial Advisory Services at PricewaterhouseCoopers advised the local authority and managed the procurement process for the PFI. Advisers at PricewaterhouseCoopers are experienced in representing the public and private sectors and in all cases are committed to establishing the best deal possible for their clients.