Your credit score is, in part, a reflection of your ability to handle money responsibly. A poor credit score can indicate that your money habits need work. Lenders may avoid working with you if your payment history is irregular.

How to Overcome a Poor Credit Score

You can apply to get a car loan even if you have a poor credit score, but it will be expensive. The significant difference between a good and poor credit score can be up to 10% over the life of the loan. In addition, a poor credit score could make your insurance more expensive.

If boosting your score isn’t an option, you can get a better rate with a down payment to the lender; taking public transportation for a short time and putting yourself on a strict money diet even for six months can help you build up a down payment. You might also consider getting a co-signer for those who have family or friends who are willing to help you out. Be aware that co-signers will suffer financial limitations for the life of the loan; if they co-sign for you and then need to purchase a car themselves, they may have to pay higher interest. If you have a co-signer, do everything you can to make the minimum payment (and more if possible) to pay that loan off quickly.

A Car Loan Can Help Your Credit Score Over Time

If all of your debt is tied only to credit cards, your credit score may be negatively impacted by poorly balanced debt. A car loan is a secured debt or debt that has collateral. Credit cards are unsecured debt; for example, you may have used a credit card for a vacation. Since your vacation can’t be repossessed, that debt is unsecured.

It may be best to choose a used car for your first car loan. New cars depreciate rapidly. If you can’t make a down payment, you may soon struggle to find a loan. Should you find that your income changes and payments are hard to make, you will not be eligible to refinance your auto loan for a lower payment.

Work With a Lender Who Will Consider Your FICO Auto Score

Many people have had some hard hits to their credit rating; it’s been a rough couple of years. If your payment history on your home wasn’t good, but you always made your car payment, you may be able to get a better rate with a lender who will consider your FICO auto score. Be aware that this is a weighted credit score; if you have had a vehicle repossessed in the past, this number may not work in your favor.

Protect Your Score by Getting Pre-Approved

According to Lantern by SoFi, hard pulls can impact your credit rating. To avoid paying higher rate of interest on your auto refinance, consider getting pre-qualified by several lenders before choosing a trusted lender for a hard pull. If you already have a bank account that pays your insurance via auto-draft for the best insurance rates, starts with them on your auto refinance.

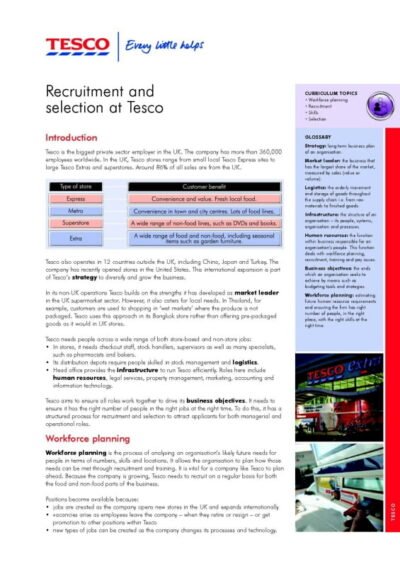

Recruitment and selection (PDF)

Recruitment and selection (PDF)