You’ve been lied to.

Trading isn’t exciting but boring.

Trading isn’t easy but difficult.

Trading isn’t about profitability but, survivability first.

And do you know why it’s so damn difficult?

Here’s why…

- You’re rewarded for doing the wrong things

- It’s the hardest game in the world

- You’ve no idea where to start

- You’re stuck at “breakeven” for the longest time

- Your fear is holding you back

- You’ve been fooling yourself

But don’t worry.

Because in today’s post, you will learn how to overcome all of these problems (step by step).

Are you ready?

Let’s go.

You’re rewarded for doing the wrong things

There are 4 kinds of trades:

- Winning trade

- Losing trade

- Good trade

- Bad trade

Your job as a trader is to focus on making good trades, and nothing else.

You’re probably wondering:

- Rayner, why not focus on winning trades?

- Well, that’s because you could do the wrong things and still end up with a winner.

Examples:

- Averaging into your losers and hope the market turns back in your favour

- Widening your stops to prevent taking a loss

But do you know what the problem is?

You end up with a profit by doing the wrong things. Because it’ll reinforce your bad habits, and lead you to think it’s the correct way to trade.

So, what can you do?

Stop focusing on the money. Focus on your thought process and actions.

This means to follow your trading plan, risk 1% your account, trade with a stop loss, never average into losers, never widen your stops etc.

For a complete

list of good habits, go download the 8 step trading checklist. Then print it and stick it everywhere in your house.

It’s the hardest game in the world

Go read this below. It’s brilliant.

Welcome to the hardest game in the world.

Unfortunately, you’re playing with some of the sharpest, fastest, most intelligent, well informed, stubbornly irrational, and in many cases, unethical minds in the world.

You’re up against:

- The computer can react faster than you

- The trader with more experience than you

- The fund with more money than you

- The insider with more information than you

- The others that will misinform you

- The inner voice that will do its best to undo you

So, leave all your dreams of making quick and easy money behind.

The first aim is survival. Your absolute first goal is to learn how to stay in the game. – Tom Dante

Are you convinced now?

Good.

Then get ready for war because it will require everything you’ve got.

Let’s move on…

You’ve no idea where to start

If you google “how to trade the markets”, you’re responded with 62,700,000 results.

You’ll come across stuff like indicators, MACD, Stochastic, Moving average, trend lines, Support & Resistance, ADX, CCI, volume, force index, breakouts, pullbacks, day trading, swing trading, position trading, trend following, binary options, futures, forex, stocks, indices…

Where do you even begin?

Here’s what I’ll suggest…

- Learn the basics of technical analysis

This includes Support & Resistance, Moving average, trends, and range. You can get a comprehensive trading education at TradingwithRayner’s Academy (it’s free).

- Read the Market Wizards series by Jack Schwager

You’ll learn different trading styles adopted by other successful traders. The aim of this step is to understand the different trading styles out there and find one that resonates with you.

- Pick a trading style and learn all you can about it

You’re going to be a specialist. This means learning everything about your chosen trading style. You can do so by reading books, Youtube, and following traders on social media (who trades in a similar fashion).

- Develop a trading plan

A trading plan defines how you’re trading the markets. You’ll know the conditions of your trading setups, entry trigger, exit, risk management, and trade management.

- Execute your trading plan consistently

To be a consistent trader, you need a consistent set of actions. And the only way to do it is to follow your trading plan.

Next…

You’re stuck at breakeven for the longest time

Okay… perhaps you know the basics of trading.

You know Support & Resistance. You follow your trading plan. You apply proper risk management.

But, you’re still stuck at breakeven.

So, what do you do?

Here’s what I’ll suggest…

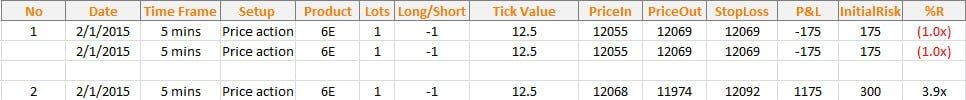

Record every single trade you take

This is the most important part of your trading. If you don’t record your trades, it’s impossible to know what you’re doing right or wrong.

To get started you need to record:

- Date – Date you entered your trade

- Time Frame – Time frame you entered on

- Setup – Trading setup that triggers your entry

- Market – Markets you’re trading

- Lot size – Size of your position

- Long/Short – Direction of your trade

- Tick value – Value per tick

- Price in – Price you entered

- Price out – Price you exited

- Stop loss – Price where you’ll exit when you’re wrong

- Profit & Loss in $ – Profit or loss from this trade

- Initial risk in $ – Nominal amount you’re risking

R – Your initial risk on the trade, in terms of R. If you made two times your risk, you made 2R.

An example below:

Review the trades you’ve taken

Once you’ve got executed 25 trades, go do a trade review (although your sample size may be small).

Here are some questions to ask yourself…

- Did you follow your trading plan?

- What’s your average win-loss ratio?

- What’s your average risk to reward?

Improve your trading performance

Here’s how you can improve your win rate:

- Trade with the trend

- Wait for the market to close in your favour before entry

- Find high probability setups (by trading from an area of value)

- Avoid trading breakouts without buildup

- Avoid trading when the market is “overextended” from the moving average

And if you need to improve your risk to reward:

- Take trades with a minimum of 1:1 (risk to reward) to the nearest swing high/low

- Trade from Support & Resistance

- Ride the trend by trailing your stops

If you want to learn more, go read How to be a profitable trader within the next 180 days.

Moving on…

Your fear is holding your back

Fear in trading can be broken down into:

- Fear of losing money

- Fear of large losses

- Fear of being wrong

- Fear of uncertainty

- Fear of missing out

If you experience none of it, then you’re probably not human.

Now, let’s see how you can overcome them…

Fear of losing money

I’ll be honest. Trading isn’t for everyone. And my mom is a perfect example.

She cannot tolerate losing money. She’d rather put her money in a fixed deposit that gets eaten up by inflation, than take a calculated risk.

And if you’re like her… stop trading.

I mean this for your own good. Trading is not for everyone.

Next…

Fear of large losses

You can solve this in 2 simple steps:

- Risk only 1% of your account

- Always have a stop loss in place

This means if you have a $10,000 account, then your maximum loss on each trade is $100 (1% of 10,000). This can be achieved using position sizing.

Go watch this video below to learn more:

Fear of being wrong

Here’s the good news…

You can be wrong more than half the time, and still be a profitable trader.

How?

By making sure your losses are smaller than your winners.

An example:

You have a trading system that wins 40% with an average risk to reward of 1 to 2.

Assuming you risk $100 per trade and over the next 10 trades, you have 6 losers and 4 winners.

Your loss = $600

Your gain = $800

Net gain = +$200

And here’s a quote that sums this up perfectly…

It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong. – Stanley Druckenmiller

Fear of uncertainty

There are 2 types of uncertainty:

- Uncertain of how much you can lose

- Uncertain of what’s going on

If you’re uncertain of how much you can lose, then refer to the section above (on the fear of large losses).

If you’re uncertain of what’s going on, then equip yourself with adequate trading knowledge.

Fear of missing out

Here’s the thing:

If you’re a day trader, you’ll be missing out on long-term trends.

And if you’re a position trader, you’ll be missing out on intraday moves.

Now… your job as a trader is not to catch every single move in the markets.

Rather, it’s to follow your trading plan and take what the market offers you.

You’ve been fooling yourself, but here’s what you can do about it

I’m talking about these 2 biases damaging your trading performance…

- Gamblers fallacy

- Small sample size

Let me explain…

Gamblers fallacy

The gambler’s fallacy is the belief that a certain outcome is more likely to occur based on recent events.

Imagine:

You notice a coin has come up heads 10 times in a row.

On the 11th toss, you believe there’s a high chance of it coming up heads once again.

However, this is wrong. Because the probability of a coin flip is 50%.

And this is what I mean by gamblers fallacy.

So the question is… how does this impact your trading?

Study the chart below:

Engulfing pattern plenty

You’ve noticed that the Engulfing pattern has worked out often.

Chances are, you will assume the next such is likely to be a winner.

Then, what do you do?

You risk big on the next trade hoping to make a killing.

And this happens…

Image of engulfing pattern that failed

So, how do you overcome the gambler’s fallacy?

Solution:

Risk 1% of your account on each trade as the outcome of a single trade is random.

You’ll never know whether it will be a winner or a loser (no matter how good the trading setup looks).

Small sample size

This bias occurs when you make conclusions based on a few probabilistic events.

Example:

You know a coin has a 50% chance of coming up heads or tails.

So, you toss a coin 10 times. It came up with 6 heads and 4 tails.

Now, are you going to conclude that the coin has a 60% chance of coming up heads? Not.

But why is that?

That’s because the number of coin tosses is too little. If you toss it 1000 times, then it’s more likely for it to be 50% and 50% tails.

Now… how does the small sample size bias impact your trading?

Imagine:

You’ve just developed a new trading system. And you want to find out whether it has an edge in the markets.

So… you test this trading system in the live markets.

After 10 trades, you had 7 losers and 3 winners. Then, you conclude this isn’t a profitable trading strategy. So you abandon it and look for the next best thing.

Now… what’s wrong with this?

This is a big mistake because you’re coming up with conclusions based on a small sample size (see our coin toss example earlier).

So, how do you avoid making this mistake?

Stop hopping from one trading strategy to the next when you have a few losing trades.

Instead, execute your trading strategy consistently for 100 times. Then, you can come up with a conclusion.

Make sense?

Summary

So, here’s what you’ve learned today…

- Focusing on the money will not improve your trading (but focusing on good trades will)

- Trading is the hardest game in the world and you must prepare yourself for it

- How to get started in trading and filter the noise out there

- How to get out of the “breakeven” stage

- How to overcome your fears in trading

- The 2 biases that fooled most traders and what to do about it

Now, a question for you…

What are your struggles in trading right now?

Leave your answer below and I’ll do my best to help.