How much is the business worth? Are sales growing or declining? What about cash flow? These and many other vital questions are regularly tackled by qualified accountants of the Association of Chartered Certified Accountants (ACCA). Some of the answers are found fairly easily, others are much tougher to uncover and need the skills and expertise of a qualified accountant.

ACCA is the largest professional body for accountants and its qualified accountants work in over 170 countries. For ACCA qualified accountants no two days are ever the same. Each business is unique and business performance is constantly changing. Accountants use both financial and non-financial data to investigate business performance to aid strategic decision making and help make educated forecasts for the future. In addition to their technical skills, ACCA qualified accountants to use their knowledge and professional experience every day, so they have to be complete finance professionals.

Finance is at the heart of every business

Finance is at the heart of every business so there is a constant demand for qualified accountants in all sectors. Accountancy is a highly skilled multi-disciplinary profession. ACCA qualified accountants are well equipped to cope. Established over a hundred years ago, ACCA offers qualifications that are recognised all over the world. Its global network supports over 432,000 students and 154,000 members in accounting, finance and management. Many top employers actively look for applicants with ACCA qualifications.

There are many routes to becoming an ACCA qualified accountant. ACCA’s foundation level suite of awards is ideal for non graduates with no prior accountancy experience. The ACCA Qualification is what you need to be a fully qualified accountant, and graduates may gain exemptions from some exams if they have studied a relevant degree.

These qualifications support ACCA’s mission to ensure that its qualified accountants work to the highest international professional and ethical standards. ACCA’s code of ethics and conduct are based on the principles of integrity, objectivity, professional compliance and due care, confidentiality and professional behaviour.

Accounting: the big picture

Whether it is in a high street retailer or a bespoke product store, when you walk away from the till with something you want, you have made a purchase. You have the product and the company has the revenue from the sale. Both sides have made a gain. Put another way, value has been added. The whole purpose of business activity in using resources is to add value in this way. But how much value and at what cost in resources? These questions are at the heart of what accountants must find out. As finance continues to act at the core of all organisations, the role of the finance professional in the future will grow and develop to meet these needs. The ACCA Qualification ensures the professionals of tomorrow have the skills and knowledge to lead businesses.

Accounting statements

Transactions are the heart of a business. Each one is recorded through invoices and receipts. These are carefully classified and combined to form the accounting statements that the managers and other stakeholders in a business require. A stakeholder is anyone with an interest in or an influence on the business and its activities. First, there are the owners and managers. If they are to keep adding value then they need to monitor and track every use and flow of resources. Accounts contain a detailed history of how the business has used its resources. This is part of the firm’s accountability.

The published accounts tell shareholders how their capital has been managed. They help lenders, investors and suppliers to judge the company’s reliability in keeping to agreements and meeting obligations, showcasing the company’s performance in meeting its obligations. The publication of accounts is a legal requirement. A public company (a plc) must provide a full range of accounting statements including:

- the Income Statement

- the Balance Sheet

- the Cash Flow Statement.

Private companies have slightly different reporting requirements, but many can publish summary information. A sole trader doesn’t have to publish its accounts but still produces accounts for tax and VAT purposes.

ACCA qualified accountants are often the evaluators of all this vital information. It is their job to make sure that such information is accurate and honest. They must resist any pressure towards bias and make sure that the accounts are professionally produced and in exact accordance with the law and standards. They also review, evaluate and assist with the narrative reporting of accounts. This is becoming increasingly important as a good story helps deepen the readers’ understanding of the organisation. It is a challenging job but one that is highly rewarding as it takes the accountant right inside the inner workings of a business.

The Income Statement

Profitable trading is what most business is all about. So, at regular intervals, a firm needs to know:

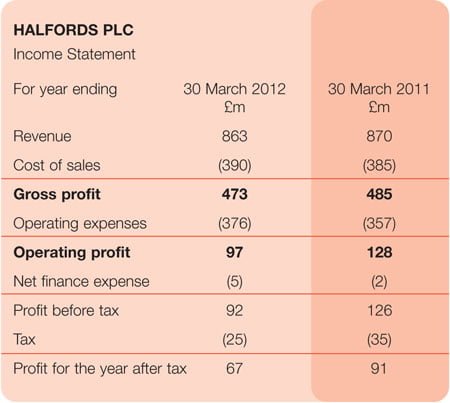

This is exactly the information that accountants, and the law, demand. The key document is called the Income Statement. Here is the Income Statement for Halfords plc. After a period as a private company, the business was floated on the stock exchange in 2004. Today it is a leading supplier of bicycles, camping equipment and car accessories as well as running a chain of Autocentres for car repairs.

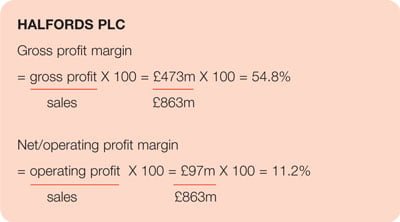

The Income Statement starts by giving the total value of sales revenue (£863m). From there the statement simply involves a series of subtractions – beginning with the cost of sales. This includes all the direct costs in bringing the product to market, for example, materials, stock and labour. What remains is the gross profit (£473m). This is always the larger of the two profit values because the overhead (or indirect) costs have not yet been subtracted. These are often called operating expenses. They include costs such as marketing, rent and insurance. The resulting total is operating profit (£97m).

From operating profit is subtracted the net cost of finance. This covers the interest paid on long term debt less any interest received from the firm’s investments. The resulting value is profit before tax (£92m). Now corporation tax is subtracted, leaving the profit for the year (£67m). This can then be divided between dividends to the shareholders and retention (retained profits) in the business to fund expansion or other investments.

The Income Statement, often issued at quarterly intervals, is important to managers in revealing trends for sales and costs – both broken down under much more detailed headings. Halfords consolidated Income Statement shows that since 2011:

- sales have fallen by 0.8%

- direct costs have risen by 1.3%

- overheads have risen by 5.3%.

These adverse trends have caused a 24.2% fall in operating profit. The organisation’s shareholders will want to know why profitability had declined. An ACCA qualified accountant would want to investigate all these changes in far more depth to make informed judgments. The Income Statement may also be studied by creditors. Creditors are other firms supplying goods or lending money. They want to see if the business looks creditworthy since limited liability means that they might not be repaid if the company collapsed.

The Balance Sheet

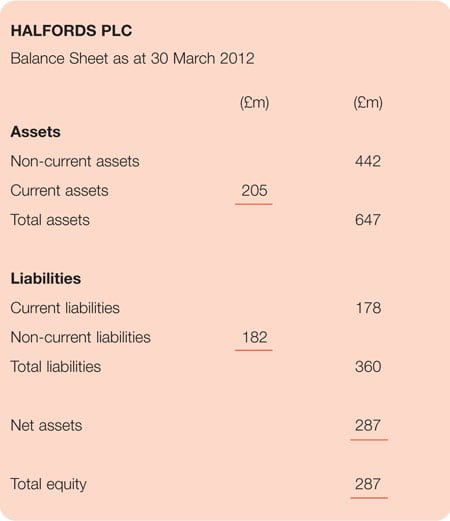

Is £1 million a good profit? The question, of course, is meaningless. For a local family firm, a million pounds would be astounding. However, for a large company like Halfords, it would be a disaster. We need to relate profit to the value of resources used in its generation. So, what is the value of the resources contained within a business? And how were they financed? These are the two essential questions answered by the Balance Sheet. They are also the questions that explain the basis of the term ‘Balance Sheet’. The total value of resources must ‘balance’ with the sources of finance used in obtaining those resources. All resources on the Balance Sheet are called assets while sources of finance are called liabilities.

This is the Balance Sheet for Halfords plc. It starts with the assets. Non-current assets (£442m) are the long-term investments made by the business in property and equipment. Also included are intangible assets that represent invisible value, for example, reputation or patents. Next, it shows the current assets (£205m), which flow through the business as sales are made. The usual items are stock, debtors and cash.

The current liabilities (£178m) are debts that must be paid in less than a year. These often relate to goods bought on credit. The non-current liabilities (£182m) are mainly long-term loans. Net assets are simply the excess of assets over liabilities (£647m minus £360m = £287m). This surplus is called total equity (also £287m). It is these two items that make the modern Balance Sheet balance.

A careful reading of a company’s Balance Sheet can be highly revealing. The difference between current assets and current liabilities is called net current assets or working capital. This indicates how much the business has everyday funding to keep trading and not run out of cash. By contrast, capital employed is a measure of the long-term resources in use by the business. It consists of the total equity plus non-current liabilities (loans). For Halfords, this is £287m + £182m = £469m. This leads us to the most important single indicator of business success, the Return on Capital Employed (ROCE). This relates operating profits to capital employed as a percentage. For Halfords, this gives (£97m/£469m) X 100 = 20.7%. This is a much better rate of return than any offered by a bank.

The Cash Flow Statement

A healthy business generates a continuous flow of cash through its trading operations. Every business needs cash to pay for its ongoing expenses and to settle debts as they arise. Running out of cash would mean being unable to make these payments. This could lead to a business entering into liquidation. The Cash Flow Statement tracks how cash has moved into and out of the business over the preceding year. It reveals how much cash was generated from inside the business (e.g. sales) and how much was obtained from external finance (e.g. loans).

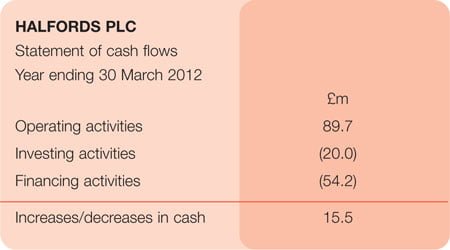

The statement starts with cash flows from operating activities. This refers to all cash movements that have arisen from the trading activity of the business itself, this includes all sales and corresponding costs, plus all payments relating to interest, tax and dividends. Following this are investing activities which are mainly concerned with buying and selling non-current assets such as property, equipment or stakes in other firms. Finally, financing activities refer to all cash flows to or from banks and shareholders.

The Cash Flow Statement is important to managers but also to shareholders, creditors and employees. Too much cash is wasteful since it should be invested for the best returns. On the other hand, running short of cash can be a threat to the very survival of the business. ACCA qualified accountants to analyse a business’ Cash Flow Statement to offer financial advice to help safeguard the future of the business.