Every year thousands of entrepreneurs decide to set up their own businesses, anticipating great financial rewards. However, over half of new business start-ups fail in their first year. So what makes the difference between those and profitable business ventures? What makes an entrepreneur extraordinary? This case study focuses on Duncan Bannatyne, one of the UK’s best-known entrepreneurs. His career shows that there is no single factor that makes an entrepreneur. As he says, ‘Anyone can do it’.

Duncan Bannatyne grew up in Clydebank, Scotland in poor circumstances, the second of seven children. He spent the first few years after leaving school serving in the Royal Navy. In his twenties, he moved through a range of jobs, including taxi driving and selling ice cream in Jersey. However, he realised he wanted more out of life. At an early age, he experienced his first taste of entrepreneurship. In order to earn money for a much-wanted bike, he applied for a newspaper round. Being told there were no rounds available, he went door-to-door to ask if people in the neighbourhood wanted papers delivered. This research established that there was demand and enabled him to get the job.

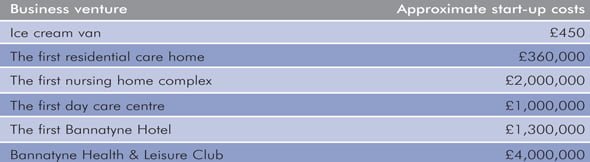

One key factor in building his businesses is Duncan’s ability to recognise and seize opportunities. In his early thirties, he bought an ice cream van for £450. He built this into Duncan’s Super Ices, with a fleet of vans and a business turnover of £300,000 per year. During the 1980s, he spotted that the government was helping unemployed people by paying their rent. He used surplus profits from the ice cream business to buy and convert houses into bedsits for rent. This guaranteed revenue from the government. To finance setting up a chain of care homes, he sold his ice cream business and almost every other asset owned. The homes eventually sold for £46 million. Duncan’s business empire now includes the Bannatyne Health Club chain, Bannatyne Hotels, Bar Bannatyne and more recently a chain of spas.

His empire is now valued at over £310 million (according to The Sunday Times Rich List), making him one of the wealthiest people in the UK. In recent years, Duncan Bannatyne has become a household name due to his role in the BBC series ‘Dragons’ Den’.

Starting a business

What makes an idea grow into a business? Duncan’s ventures into the ice cream business, bedsits, nursing homes, day nurseries, health clubs, hotels and spas highlight many of the key elements:

- Identify a gap in the market and do research. What do people need, and what is missing from the market? Proving there was a demand for a paper round enabled Duncan to get a job. Many of Duncan’s business enterprise ideas have come from reading the local and national press and watching news programmes.

- Do something better than or different to competitors. Duncan improved ice cream sales by using a new scoop that speeded up serving and made a shape like a smile in the ice cream. This meant he could charge a little more for these special ices.

- Have a business plan. This is a key tool when starting a business. It shows what start-up and running costs will be, what resources are needed, the estimated value of sales and whether the business will give the right return on investment.

- Know where finance will come from and when. A business needs good cash flow to keep running.

- Ensure the people in the business have the necessary skills. For example, Duncan had the experience to start up Duncan’s Super Ices from his time selling ice cream in Jersey.

- Be prepared to delegate work and responsibility but be clear about standards. Duncan’s ethos is to provide quality products and services for customers.

- Commit to the business. When building costs for the first residential home almost bankrupted the company before the project was finished, Duncan, his partner, friends and family completed the work. This saved money as well as demonstrating commitment to the venture.

- Pay attention to detail and understand what affects the business. Duncan increased sales for his ice cream business by buying an exclusive position in a local park for £2,000. This gave him profits of £18,000 in one summer – a huge return on his investment.

- Be prepared to take risks. To set up the new care home business Duncan had to sell his ice cream business, as well as his house, his car and his colour television.

Sources of finance

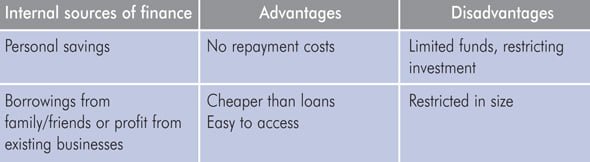

Choosing the most appropriate source of finance for the size and needs of the enterprise is important:

- Sole traders: Duncan’s first ice cream van was an example of this type of business – owned and run by just one person who takes all responsibility and all the profit. The small investment for the van was covered by personal funds. This is typical of many start-up businesses.

- Partnership: This is usually owned by between 2 and 20 people. The joint owners share responsibility and profits. Duncan went into partnership with the first care home. The investment was much bigger and needed borrowing from a bank.

- Limited companies may be private, for example, a family business, or public, where anyone can buy shares in the company. To build more care homes, Duncan used a mix of profits, borrowings and offering shares in the company. This was achieved by ‘going public’ and floating the company on the stock exchange.

The start-up costs of Duncan’s business ventures varied in size. There are several options available for financing new business start-ups and expanding established businesses. Duncan believes entrepreneurs must demonstrate commitment to the business. When assessing whether to invest in new enterprises such as those in Dragons’ Den, Duncan wants to know how much of their own money new entrepreneurs are willing to put in. If they are not willing to risk their own money, Duncan almost always declares himself out.

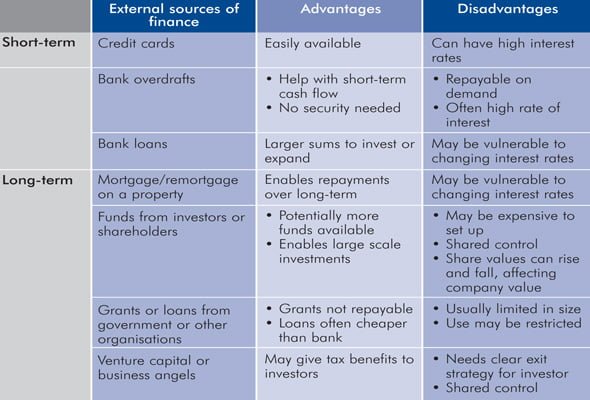

External sources of finance

Banks are a major source of finance for all businesses, providing finance for starting up, running the business and for expansion:

- loans can be short-term, medium-term or long-term, depending on need.

- mortgages are long-term loans for the purpose of buying fixed assets such as buildings and equipment.

- overdrafts are short-term loans with a limited duration which can help the day-to-day running of the business.

All financing has specific terms and conditions, for example, times for repayment and interest charges. Interest is the fee the bank takes for providing the loan. The rate of interest varies between each type of loan and according to how much risk the bank feels there is.

There is no single best source of finance and not all sources are available to all businesses. It is important to assess the advantages and disadvantages of each in the context of the business’ size, needs and intended return on investment and choose the most appropriate option. Every investment is a risk and successful investors balance the degree of risk against potential rewards.

Duncan has used most sources of finance at different times:

- When setting up Duncan’s Super Ices, he used personal savings of £450 to cover the main cost for the van itself.

- For setting up the bedsits, his main source was re-invested profits from the ice cream vans.

- He took on a bank loan and a re-mortgage on his own home to buy the land for the first nursing home. The building costs of the nursing home were to be financed by a 70% mortgage. However, the bank would only release the money once the home was finished and full.

In order to build the home:

- Duncan used profits from the ice cream business, as well as selling his car, TV and stereo

- he re-mortgaged the Scarborough residential home and took out several credit cards to cover ongoing costs

- as a last resort, he sold Duncan’s Super Ices for £28,000 to finish the nursing home.

The total set-up costs were £360,000. However, the bank valued the finished care home at £600,000. The 70% mortgage was therefore worth £420,000. This meant Duncan recovered all costs and had equity to fund the next project.

By buying larger plots of land for health club sites, Duncan has also been able to diversify his business by building Bannatyne Hotels next to health clubs. These save on costs by sharing staffing, reception and breakfast facilities whilst offering customers something different, the use of the health club when staying at the hotel. Duncan has also been able to sell spare land to finance new projects. This illustrates the importance of using fully any assets the business has.

Investors

There are different types of investor funding available to businesses. These are from:

- shares – Duncan raised funds from shareholders by floating his Quality Care Home business as a public limited company on the stock exchange. Shares are especially relevant to large projects needing several million pounds of investment.

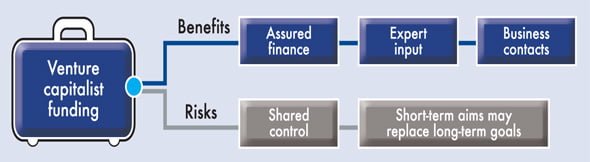

- venture capital – Venture capitalists invest in businesses by providing funds, business advice and access to contacts, in return for a share in the business. Individual venture capitalist investors such as Duncan Bannatyne are called business angels.

Before investing, Duncan Bannatyne looks for several key elements in an entrepreneur’s business plan. These reflect his own approach to investment:

- Do they understand their product, customers and the market?

- Have they worked out what the costs and projected profit will be? Clear research into the market and projections for revenues and costs are important. Duncan would not consider investing in a business which lacked a detailed business plan.

- Do they believe in their product and are they willing to work hard at it? Duncan believes entrepreneurs need to show conviction by investing their own finance into the business.

- Will it give a 20-25% return on investment? Unless the idea can yield around 25% return on the initial investment, it will not be worth the risk.

- What is the exit strategy for investors? Venture capitalists such as the Dragons usually seek to exit the business after three or four years. This enables them to recover investment costs and ideally, generate profit from the sale of their shares.

Receiving funds from venture capitalists can provide benefits for businesses but also some risks.

Conclusion

Over the past 30 years, Duncan Bannatyne has used his drive, ambition and skills to develop a business empire worth £310 million. The move from ice cream to care homes to the Bannatyne Health and Leisure chain reflects this entrepreneurial drive. He saw the potential for profits in each sector. He was willing to take risks, for example, by exiting profitable businesses like care homes in order to maximise the opportunity of the new health club venture.

During his time in the Dragons’ Den series, Duncan has invested in several entrepreneurs. He has provided venture capital and advice to help enterprise ideas develop into more profitable businesses. He only invests when there is a potential 20-25% return on capital and evidence of the entrepreneur’s clear commitment and belief in their own ideas. By using the opportunity, taking risks and having a plan, Duncan Bannatyne believes that anyone can be an entrepreneur.