Limited companies (those owned by shareholders) are required by law to produce Financial Statements. These statements must be published and made available to shareholders as part of a company report. Cadbury Schweppes aims to produce clear financial statements that give a valuable insight into the company’s strategy and performance.

Cadbury Schweppes is a major international company that manufactures, markets and sells confectionery and non-alcoholic beverages. With origins stretching back over 200 years, Cadbury Schweppes’ brands are enjoyed today in almost every nation in the world. They include regional and local favourites such as Cadbury Dairy Milk, Trident, Halls, Dentyne, Bubblicious, Bassett’s and Trebor in confectionery and Dr Pepper, Schweppes, Snapple and 7Up in beverages. The company employs around 50,000 people.

Cadbury Schweppes’ Head Office accounts team collects the information required to create these statements from the company’s accountants and finance teams around the world. The legal responsibility for producing financial statements that present an accurate picture of the company’s performance over the period lies with the company’s directors.

These statements must be checked by an external audit, where the company hires a firm of accountants to verify that it provides a true and fair record and complies with legal requirements. The exact statutory requirements for limited companies to prepare and publish accounts are laid down for limited companies through the Companies Act 1985, regulated by Companies House, and for publicly listed companies through European law, the Listings Rules, regulated by Financial Services Authority (FSA).

Some leading public companies, like Cadbury Schweppes, include reports to shareholders on their success in meeting self-set financial goals within their financial statements. The three main Financial Statements are:

- Profit and Loss Account

- Balance Sheet

- Cash Flow Statement.

Establishing financial goals

Businesses need to have a clear direction to work towards so that their employees know what they are seeking to achieve and what they need to do. The directors of a company (with the Finance Director or Chief Financial Officer playing a prominent role) establish financial goals which are used by investors, financial analysts and other external parties to monitor the performance of a company.

Because these financial goals can be set out in numbers, it is relatively easy to compare actual performance against the set targets. For example, by setting sales growth goals, it is possible to check progress in meeting sales targets.

Cadbury Schweppes has established three performance goal ranges for the period 2004-2007. These are:

- Net Sales Value (NSV) growth of between 3% and 5%. NSV growth refers to the growth in sales of the company – for example by selling more soft drinks, chocolate or chewing gum to supermarkets, which in turn sell to consumers.

- Operating margin growth of between 50 and 75 basis points per year. Operating margin growth refers to making more profit for each £1 of sales made – for example by buying ingredients and packaging materials as efficiently as possible.

- Free cash flow of £1.5 billion over the four-year period. Free cash flow reflects how much cash is generated within the business, for example by increasing profits. Free cash flow is important to enable the company to have the money available to meet its financial commitments.

Cadbury Schweppes’ Profit and Loss Account

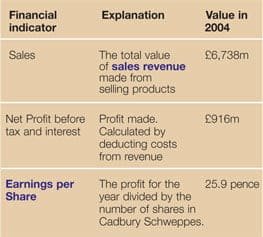

A Profit and Loss Account is a table compiled at the end of an accounting period, to show gross and net profit or loss. It is very useful for helping readers to understand the financial performance of a company. A review of the Profit and Loss Account will help shareholders and other users to see how the company is performing. The table shows three key figures for 2004.

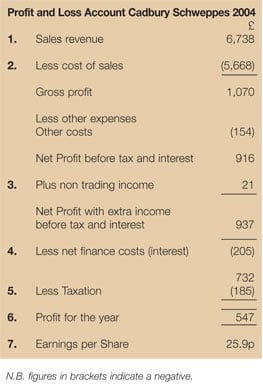

A simplified version of Cadbury Schweppes’ Profit and Loss Account for 2004 is set out here. When reading a Profit and Loss Account, it is easier to understand a company’s financial performance by comparing the latest figures with the previous years. To help you do this, the 2005 results will be included in our online version, when they are published in February.

The Profit and Loss Account shows a summary of the transactions of the business for a period of one year.

1. The top line shows that the sales revenue from products such as Dr Pepper, Halls, Schweppes, Trident and Cadbury Dairy Milk, came to £6,738 million. This can be called either ‘revenue’ or ‘sales’ historically called turnover).

2. Costs were involved in making these products – the cost of raw materials such as cocoa, packaging, transport, staff salaries, advertising, etc. The production costs added up to £5,668 million. These are deducted from revenue because they are paid out. It is common to show negative values in brackets in financial statements.

3. Cadbury Schweppes owns a share of some other companies – raising additional income.

4. Cadbury Schweppes has borrowed money, for example, to buy new companies. It must pay interest payments on these loans.

5. Cadbury Schweppes must pay Corporation Tax to the government (£185 million, which goes towards helping to pay for items such as education and health spending). This is a tax on profits. Once tax has been deducted the profit for the year is £547 million.

6. The profit for the year is the amount of profit after all external costs are deducted. The profit for the year is then used to either pay a dividend to shareholders or is retained by the company in its reserves, for future use.

7. Finally, a calculation is set out of Earnings per Share – the profit divided by the number of shares in the company. This is 25.9p. Investors will want to see this figure rising over time, as it indicates the return on their investment into the company, and they will measure percentage increases and compare the growth rates of different companies.

The Balance Sheet

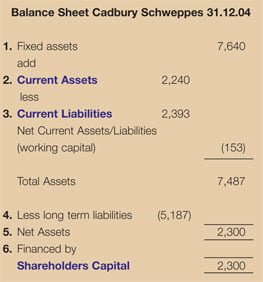

To understand the financial position of Cadbury Schweppes at a moment in time, it is necessary to ‘freeze’ the values of various financial components. These values, or balances, are used to set out the Balance Sheet.

A Balance Sheet shows the relationship between the assets of the business (what the business owns or is owed), and the liabilities of the business (what the business owes). When liabilities are taken away from assets this gives a figure for net assets, which provides an indication of the health of the business at a point in time.

The chart shows a summarised Cadbury Schweppes Balance Sheet for 2004. It sets out the overall structure of the Balance Sheet, but simplifies some of the individual balances. Here is a simple explanation of the Balance Sheet.

1. Fixed assets consist of two main elements.

- Intangible Assets are ones that help to generate wealth for the business over time but don’t have a physical presence. For example, a major intangible for Cadbury Schweppes is the ‘goodwill’ associated with brands that it has acquired, such as Halls. The fact that Halls is an existing high profile brand that consumers recognise and connect with gives Cadbury Schweppes a valuable asset that will generate sales and profits over a long period. Internally generated brands, like Cadbury Dairy Milk, are not on the balance sheet as they have not been purchased at a known cost.

- Tangible assets are those that exist physically; these include the costs of factories and machinery used to make the products and the offices that the staff work in around the world.

2. Current assets consist of stock (Inventories), trade and other receivables (Debtors, i.e. amounts of money customers owe for goods that they have not yet paid for), and cash. After production, supplies of chocolate and sweets are stored for a short period of time until a customer makes an order when they are delivered to wholesalers and supermarket chains such as Tesco. Stocks are counted as current assets because they are quickly turned into cash. Tesco and others typically buy from Cadbury Schweppes on credit – the money owed is counted as a current asset, and the company owing it is a debtor.

We then deduct the liabilities (see point 3) from the assets.

3. Current liabilities consist of any payments that Cadbury Schweppes must pay out in the short-term (typically under a year) such as payments to suppliers for cocoa and sugar. In addition, it would include short-term borrowings and overdrafts.

4. Non-current liabilities consist primarily of bank loans, money owed to employees to pay their pensions, etc.

5. The net assets/liabilities figure is then calculated by deducting the two main types of liabilities from the two main categories of assets.

6. The final section of the Balance Sheet shows the amount of shareholders’ funds. This is the price paid by the shareholders for their initial share capital and the retained profits made by the company.

At the end of 2004 the net assets of Cadbury Schweppes and thus the total equity (shareholders’ capital) was £2,300m. Visit The Times 100 website for updates, which will be released as soon as the results for 2005 are available.

Ratio analysis (Profitability analysis)

Financial statements can be analysed by shareholders, the financial press, and others to check how well a company is performing.

Operating profit

Ratios are determined from a company’s financial information and used for comparison purposes, e.g. operating profit to sales. This can be set out in the form: Operating Profit : Revenue. Alternatively, it can be set out as a percentage.

This is very helpful because it shows how much profit is made for each £1 of sales made. An improvement in Operating Profit margin would see this figure rising over time – showing that Cadbury Schweppes’ customers are prepared to pay more for their purchases and/or that the company has made savings by improving the way it makes or ships its products. The operating profit margin of Cadbury Schweppes can be compared from year to year e.g. comparing 2005, 2006 etc, with 2004. Cadbury Schweppes’ profit margin can also be compared with that of other companies.

If you refer back to the Profit and Loss Account, you can see the operating profit margin shown in the chart. This figure is crucial to Cadbury Schweppes as it relates to the second performance goal.

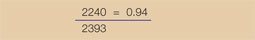

Current ratio

Here is another ratio you will find in your current course. This ratio shows whether the company owes more money to its suppliers and bankers than the assets it holds in the form of stocks, debtors and cash. If this number is less than 1, then the company’s short-term or liquid assets are greater then its short-term liabilities.

If you refer back to the Balance Sheet, you can see that the current ratio for Cadbury Schweppes is as shown in this diagram.

This ratio is used in different ways for small and large companies. Businessmen and women considering whether to trade with a new small company would prefer to see this figure at 1.5 or above – as an indication that the company is solvent and will be able to pay its debts. For large established companies with good credit ratings, a lower ratio indicates an efficient use of capital.

Cash flow statement

In addition to the Balance Sheet and Income Statement, Cadbury Schweppes values the information provided in its Cash Flow Statement. This statement simply sets out the incomings and outgoings of cash in a business during a particular period of time e.g. one year. It shows how the main categories of cash flow have changed the cash balance in particular periods.

In 2004, Cadbury Schweppes achieved a free cash flow generation of £265 million. Cash flow is very important to the company because cash enables the business to pay its bills, pay dividends to its shareholders and, in addition, make acquisitions.

In recent times Cadbury Schweppes has focused on acquiring new businesses, increasing sales and innovation, cutting costs, and integrating existing businesses to achieve its aims of:

- higher sales growth

- improved operating profit margins

- higher levels of free cash flow.

Through efficient financial management, Cadbury Schweppes is able to continually invest in making sure that customers are supplied with the brands that they enjoy.

Conclusion

Cadbury Schweppes prepares financial statements because:

- As a listed company, it is legally required to do so.

- Cadbury Schweppes wants to communicate a true and fair picture of the financial state of the company to its shareowners and external analysts.

- The company values transparency and honesty and aims to reflect this is all its communications, both internally and externally.

Cadbury Schweppes won the Communication of Corporate Strategy Award at the PricewaterhouseCoopers ‘Building Public Trust’ awards in 2005. This publicly recognised the high standards of the company’s reporting: ‘a highly accessible overview of its short-term strategy, major markets and measurable targets.’