This case study focuses on how Cadbury Schweppes acquired the American-based company Dr Pepper/Seven-Up. Of particular interest is the thinking and purpose behind the acquisition, and how the acquired company will be managed in the future.

Dr Pepper/Seven-Up is not a very familiar name in the UK, although many people will have heard of or purchased the 7-Up product. Dr Pepper/Seven-Up owns the 7-Up brand in the USA and the Dr Pepper brand worldwide. Created in 1885, Dr Pepper is the oldest, nationally distributed soft drink in the US. The 7-Up brand was introduced in 1929. Within the US carbonated soft drinks’ market, Dr Pepper/Seven-Up is one of the fastest growing companies.

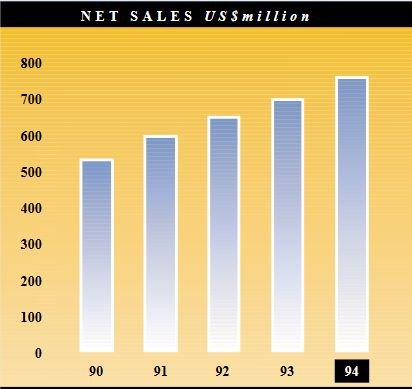

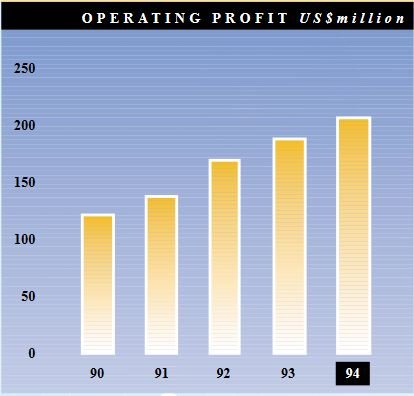

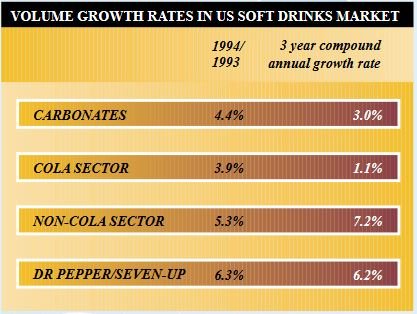

In 1994 Dr Pepper/Seven-Up brands had an 11.6 market share in the US. Sales volumes over the previous five years grew by 5 per cent per annum, more than double the industry average.

The Cadbury Schweppes Group

The origins of the Group go back over 200 years. Jacob Schweppe perfected his process for manufacturing mineral water in Geneva in 1783. In Birmingham, John Cadbury first started selling tea and coffee in 1824, then cocoa and chocolate, which was soon to become the main business. The two companies – Cadbury and Schweppes – merged in 1969. Since then there has been a continuous programme of expansion worldwide.

The Group has undergone major changes during its development and since 1984 its structure has been based on its two business streams of Beverages and Confectionery.

The range of companies and countries through and in which the Group operates is vast; for instance, it owns Stani, a leading confectionery company in Argentina, and it has an interest in Camelot (the company which runs the UK National Lottery).

Cadbury Schweppes describes itself as a ‘British-based but internationally-focused food and drinks business operating primarily in the ‘impulse purchase’ or ‘informal consumption’ segment. Following on from this, the company has a stated commitment to:

- Continue to focus operations in the market sub-sector of confectionery and soft drinks, and specifically consolidate its soft drinks position worldwide as the largest and most successful non-cola brand owner

- Aim for a ‘top three’ position in the global confectionery market

- Aim for profitable growth via a flexible but carefully selected use of organic development, acquisitions and alliances

- Monitor positively and regularly growth opportunities in adjacent market sectors where acquisition or alliance could bring real gain through synergy.

In summary, the company is ambitious. It will achieve its aims via growth, acquisition and alliances whilst maintaining its profitability. If acquisition or alliances are deemed to be necessary, the company will look for synergy, i.e. consider the strengths of Cadbury Schweppes and the acquired/partner company to assess the benefits produced by the two merging together, the result of which must be greater than that which either of the two could achieve if they remained separate. (This is often referred to as 2 + 2 = 5).

The acquisition of Dr Pepper/Seven-Up

Knowing the strategy of the company helps to put the acquisition of Dr Pepper/Seven-Up into context. There has to be clear evidence, prior to the purchase of such a company, which shows that it will help push the group towards its intended targets.

Many companies have found to their cost that the take-over of another company can lead to disaster. For instance, when the acquired company does not complement the parent company’s activities; or the parent company has no understanding of how to run the acquired company; or when predictions of market growth and improvements in profitability were hopelessly optimistic.

Cadbury Schweppes has established certain strategic priorities to ensure that any acquisition is a success. In essence, these focus on the need to maintain strong links with the consumer, with products being freely, widely and obviously available. In addition, the trends of closer customer relationships will be given a high priority, particularly when looking at retailing and the factors influencing those retailers who will be stocking the company’s products.

To make sure that any acquisition will work to the benefit of Cadbury Schweppes, a great deal of research will be undertaken, looking at market dynamics, the position of the targeted company in the market, plus forecasts for future development both within the market and by the company. This is exactly what happened with Dr Pepper/Seven-Up, and shows that every effort was made to make sure that Cadbury Schweppes got it right, as any mistake would be costly to rectify and could ultimately threaten the future of the whole group.

Researching the market

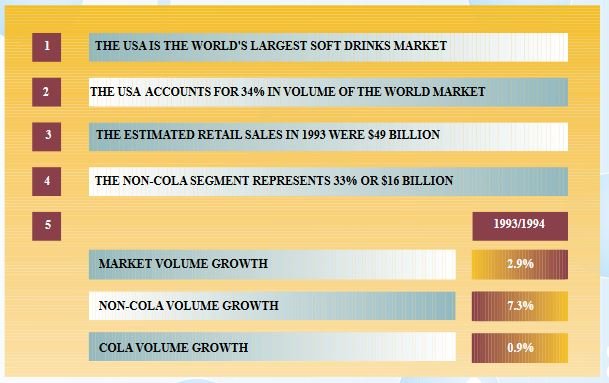

Some basic facts about the US carbonated beverage market, based on data available at the time the tender offer was announced, are contained in the table.

In 1993 Cadbury Schweppes had a 4.9 per cent share of the US market, whilst Dr Pepper/ Seven-Up had 11.4 per cent. Combining these would produce a significant share of the market (16.3 per cent). It should be remembered that a 16.3 per cent share of the world’s largest market would be a considerable boost to Cadbury Schweppes, providing it with an increase in i

ts global volume of over 75 and, more importantly, leadership in the non-cola segment in the US.

Other benefits of combining the two companies would be the economics of scale in selling, purchasing, marketing and administration as well as enhanced marketplace opportunities in

- Vending

- End of aisle displays

- Supplying soft drinks to restaurants, fast food chains and other outlets

- Foodservice

- Combined brand promotion

- Opportunities to develop Dr Pepper internationally, as Cadbury Schweppes has a strong presence in Europe, Mexico, Australia etc.

- A larger pool of employees from which to draw for new initiatives in future.

Alternative strategies

Although the intention to purchase Dr Pepper/Seven-Up fitted in with the overall strategy of the company, there is always the need to look at alternatives. One clear option would be to go for organic growth, i.e. the gradual build-up of market share by using existing brands and operating competitively in the market. This was a serious option as the company had been trading in the USA for some time.

However, trading in such a large market, both in geographic size and by volume, presents problems in terms of bottling and distribution. Likewise, brand recognition takes time and money to build especially in a country which virtually created the idea of the soft drink. It would raise questions as to whether the time and effort required to build up the brands would help to achieve the company’s objectives within a reasonable length of time.

Another alternative would have been to look at other partnerships, alliances and acquisitions. Given that the company had acquired a significant stake in Dr Pepper some years ago, it would be sensible to look at this investment against other possible targets to make sure that the acquisition would provide the best possible investment.

The performance of Dr Pepper/Seven-Up suggested that this was a company whose trading performance was improving and would be further enhanced by the merger. Also, Cadbury Schweppes had recognised the attraction of Dr Pepper. It had held an interest in Dr Pepper since l986 and, prior to the acquisition, held 25.3 per cent of Dr Pepper/Seven-Up.

The corporate strategy entails taking risks. Research into the options open to the company is a way of seeking to reduce the risk, but cannot eradicate it completely.

It would always have been possible to ‘do nothing’ i.e. to stay with the existing brands and approach, a strategy which may appear to be the least risky. However, the move towards globalisation, which means that markets show similar consumer behaviour, whether the consumer lives in North America, Europe or in Asia, has been a trend for some time and particularly in the beverages market.

A ‘do nothing’ strategy could leave the company vulnerable to pressure from the bigger companies which could squeeze the smaller players by aggressive pricing and promotional strategies – an approach which a smaller regional company would not have the financial muscle to counter. Customer loyalty could collapse in the face of such an aggressive approach.

Financing the acquisition

With the take-over helping the company achieve its goal, the next step was to organise it. This was a major project, and as with many projects it was given a code name – ‘Potato’. This was devised from Dr Pepper/Seven-Up in the form of an anagram – DPSU = SPUD= POTATO!

On a more serious note, there are many groups to take into account before the successful completion of the acquisition. There were the shareholders of both companies, managers and other employees of both companies, particularly of Dr Pepper, suppliers and distributors of Dr Pepper/Seven-Up products, and financial institutions who would help to organise and fund the take-over. These, and others, would need to be persuaded of the merits of such an approach, and ultimately consumers of the product would need to feel that this would improve rather than harm the product and service.

The offer for Dr Pepper/Seven-Up by Cadbury Schweppes was at $33 per share. The total cost of purchasing these shares would be $1.711 million (£1.076 million). This valued the company at $3 billion and allowing for the shares already held, which meant an overall cost to Cadbury Schweppes, including debt, of $2.8 billion.

This offer was recommended by John Albers, Chairman, President and Chief Executive Officer of Dr Pepper/Seven-Up, as it offered outstanding returns for shareholders and recognised that this had only come about due to the contribution of the employees, bottlers, and retailers.

With this support the American end of the deal had been largely guaranteed whilst, at the UK end, the shareholders would have to be convinced that the cost to them would be worthwhile. The total cost of purchasing the outstanding shares and assumed debt was £1.597 million, funded by debt, i.e. bank borrowing of £1.1 billion and equity, i.e. shares of £0.5 billion.

With the acceptance of the US shareholders and the raising of the required capital from the UK shareholders and the banks, the deal was finally completed on 2 March 1995.

Running the new company

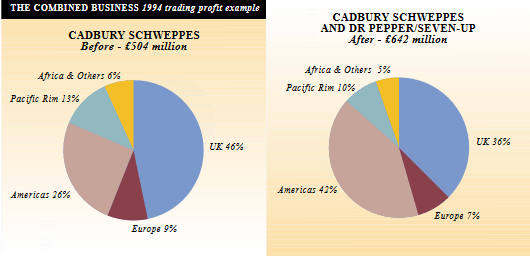

Acquiring a new company has a major impact, which can be seen by the change in the trading profit example figures and the source of these profits. (Table 5). The figures show the tip of the iceberg as issues relating to management structures and operational factors need to be addressed.

Cadbury Schweppes commits itself to the principles and practice of developing management talent. In this particular example, the company would take it as a matter of principle that the best person should be appointed to each job, so that the most appropriate managers from Dr Pepper/Seven-Up would be appointed.

With the merger and the formation of the new operating structure, many of Dr Pepper/Seven-Up employees remained in similar positions or were offered the most appropriate job and some were given very significant promotions within the new structure.

With the combined group the aim would be to realise the benefits of the merger. These would be to:

- Use the critical mass with bottlers to grow brand portfolio volume.

- Exploit the opportunities in the marketplace.

- Realise synergy benefits in purchasing, manufacturing, marketing, selling and administration.

- Develop Dr Pepper internationally.

- Maximise strong cash flow to help reduce debt.

- Optimise the use of employees’ skills.

The new management team has to ensure that these benefits are achieved and that the massive investment in Dr Pepper/Seven-Up proves to be worthwhile.

Strategic purpose

The example of Cadbury Schweppes and its acquisition of Dr Pepper/Seven-Up shows the importance of corporate strategy in influencing the decision to undertake such a major investment.

Strategic planning is often accused of being a waste of time and totally irrelevant in a quickly changing market. However, the approach used here shows that when it is undertaken with care and thought, it helps to move the company in a direction which will enhance the value to shareholders, provide a valuable product and service to customers, and help to safeguard or even create jobs and further opportunities for staff.

Even though the strategic objectives are clearly laid down, how they are to be achieved may not be so clear. With Cadbury Schweppes’ acquisition of Dr Pepper/Seven-Up, it was not just a case of looking at the opportunities offered by the purchase of the company. It also entailed a thorough appraisal of the opportunities offered, compared to other means of achieving the objectives.

Only when research had been carried out into the suitability of Dr Pepper/Seven-Up, the market potential, synergy benefits and future growth opportunities could a final decision be taken. Even then, financing the deal, along with persuading others of the wisdom of the move, was necessary prior to the successful completion of the take-over.

Cadbury Schweppes’ vision is that it can become the number one non-cola beverage company worldwide, by capturing and integrating the best practices of the industry. With Dr Pepper, the challenge is to increase consumption among current users, whilst encouraging non-users to sample the product. To do this will require the market to think of Dr Pepper as a mainstream soft drink and its availability must be ensured to take advantage of this.

These are the challenges facing the company which, if successful would more than justify the inclusion of Dr Pepper/Seven-Up within the family of companies owned by Cadbury Schweppes.