CIMA is the Chartered Institute of Management Accountants. Its members are trained and qualified in the vital area of management accountancy. Businesses can only compete effectively if they have the best financial information and the best people to make decisions based on that information.

CIMA is the world”s leading and largest professional body of management accountants. Its training means it produces financial managers with the many and varied skills necessary to handle global competition. From its headquarters in London and 11 offices outside the UK, CIMA supports over 172,000 members and students in 168 countries.

The CIMA qualification is recognised internationally as the most relevant financial qualification for business. Many senior managers running global companies are, or are supported, by CIMA-trained accountants. Management accountants are, or advise, key decision makers in businesses. They have a key role in ensuring that businesses are not only competitive, but also financially secure. This means looking to the future and predicting what might happen based on current figures.

This case study looks at how management accountants forecast, monitor and control cash flow in order to maintain the ongoing financial health of businesses.

The importance of cash flow

Cash flow is of vital importance to the health of a business. One saying is: “revenue is vanity, cash flow is sanity, but cash is king”. What this means is that whilst it may look better to have large inflows of revenue from sales, the most important focus for a business is cash flow.

Many businesses may continue to trade in the short- to medium-term even if they are making a loss. This is possible if they can, for example, delay paying creditors and/or have enough money to pay variable costs. However, no business can survive long without enough cash to meet its immediate needs.

Cash inflow and outflow

Cash comes into the business (cash inflows), mostly through sales of goods or services and flows out (cash outflows) to pay for costs such as raw materials, transport, labour, and power. The difference between the two is called the net cash flow. This is either positive or negative. A positive cash flow occurs when a business receives more money than it is spending. This enables it to pay its bills on time.

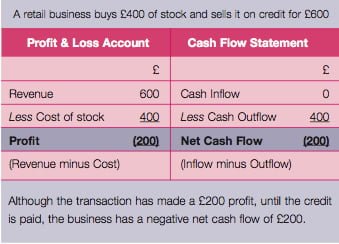

A negative cash flow means the business is receiving less cash than it is spending. It may struggle to pay immediate bills and need to borrow money to cover the shortfall. The distinction between cash flow and profit is shown in the example. In accounting, negative figures are shown in brackets.

Liquidity

Businesses aim to provide greater financial returns than the level of interest earned by simply placing the cash in a bank. They can also hold too much cash. Cash does not earn anything so holding too much cash could mean potential losses of earnings. The cash situation is referred to as the liquidity position of the business. The closer an asset is to cash, the more ‘liquid’ it is. A deposit account at a bank or stock that can easily be sold are liquid. Assets such as buildings are the least liquid. Liquid assets are those that are most easily turned into cash.

Cash flow is always important, but especially when it is not easy to obtain credit. When the economy is in recession, financial service providers are reluctant to lend money. Borrowing also becomes more expensive as interest rates are raised to partially offset the risk of borrowers not paying back loans.

Controlling cash

Controlling cash is essential and management accountants deal with a range of cash issues:

- ensuring that sufficient cash is available for investment by not tying up cash in stock unnecessarily

- putting procedures in place for chasing up outstanding debts

- controlling different levels of cash outflows in relation to the size of the business.

For example, a car repair garage buys parts and tyres whilst a hairdresser buys shampoos, equipment and pays for power. In each case, if the business has cash problems it may be slow to pay its bills to suppliers. This creates further cash problems which spread throughout the economy. If small suppliers are not paid they may go out of business. This in turn may affect businesses further up the ladder.

The cash flow cycle

CIMA-trained management accountants are involved in all sectors of industry – from government departments to well-known names such as Rolls-Royce and Tesco. Each organisation has to manage and monitor its cash flows carefully. Cash does not just arrive; it must be chased, recorded and managed. At all times, there must be enough cash to pay bills. For a retail business like Tesco, the main cash inflows or receipts will be from sales; the main cash outflows or payments will be for supplies and overheads associated with its stores, such as rents, rates, wages, power or transport.

If there is too much cash in any organisation, it needs to be put to work for instance, in a deposit account or investments where it will earn interest. If there is too little, the business needs to know how much it will have to borrow to cover the shortfall and for how long. Borrowing money also has costs which need to be managed. Good cash flow management requires good information, professional training and good management decision making.

CIMA-qualified management accountants learn to forecast flows of cash so that such problems do not arise. A basic cash-flow forecast might look like the example shown. For a business the size of Tesco, the figures are likely to be in millions of pounds.

In this example:

- The opening balance is the amount carried forward from the last period. In January this is £10,000, in February £2,000 and by March is a negative balance of £5,000

- Receipts are inflows from, for example, sales, interest on investments, payment of outstanding customer accounts

- Payments show amounts coming due e.g. rents, tax payments, interest on loans, supplier contracts etc

- Net cash flow shows the cash position forecast for that month. In both January and February, this is negative, so this would ring warning bells.

- The closing balance forms the opening balance for the next period.

Cash flow management is about forecasting these flows and balancing the cash flowing in with that flowing out.

Managing cash flow

Managing cash flow is vital both to the survival of a business and to its long-term well-being. CIMA-qualified management accountants often hold key positions in organisations, such as Finance Director or Financial Manager. Their thorough knowledge of the industry in which the business operates allows them to forecast, monitor and control cash flows using key indicators for that business, such as sales trends. For example, Tesco would expect to sell more just before Christmas and in the January sales. A carpet manufacturer might look how many new houses were being built in the area, whilst an organic farmer could look at how consumer tastes and needs are changing.

Often cash inflows lag behind outflows, so a business may need to borrow or use cash from a previous period to cover the shortfall. For example, a farmer who sells potatoes to Tesco will want paying as soon as the sale takes place. However, Tesco does not receive the cash for these potatoes until they arrive and have been sold in its stores.

Improving cash flow

A business can look for imaginative ways to improve cash flow or manage credit:

- Making better use of assets empty warehouse space or unused transport could be hired to other businesses.

- Make sure as little interest as possible is being paid on borrowing pay debts early if possible and consolidate debts into one long term, low interest rate package.

- Negotiate payment dates with suppliers, perhaps paying later, or in instalments.

- Avoid offering discounts for early payment (an effective but expensive way to get more cash in sooner).

If a business is profitable, this should mean a little more cash comes in each time the cash flow cycle turns. This can then be used to cover those periods where there is a shortfall. Careful management by a trained management accountant will ensure that the business is aware of possible future shortfalls so that it has these planned into its business strategy. This will mean that there is always enough cash to pay creditors.

Benefits of effective management accounting

The Confederation of British Industry (CBI) is the group that represents the interests of many British businesses. It sees cash flow as crucial to the survival of businesses. Richard Lambert, CBI Director-General, says: ‘We need to keep business working to safeguard jobs and we need to act now. The biggest threat hanging over businesses is cash flow. If they cannot get their hands on the cash and credit they need to go about their day-to-day business, there is a real risk we could see healthy firms going under.’

In a recent CIMA survey, medium-sized organisations in the UK cited cash flow as a key area of concern:

- 50% of the mid-sized businesses said that it is more challenging now than 12 months ago to access capital

- 66% stated that it is more difficult to receive payments from customers.

According to the late George Moore, founder member of the Society of Turnaround Professionals, the cash forecast is especially vital in a recession:

‘A realistic and well-researched cash flow forecast 13 weeks out will pick up sudden increases in sales and costs. It”s pretty straightforward to work in the payments side the salaries, taxes, leases and supplier invoices. All you have to do then is estimate the collections you”re sure about and you”ll see straight away what you”ve got to do in terms of sales and improved collections.’

Lack of cash means inability to pay creditors and if this does not lead directly to business failure, it still makes trading more difficult. It may harm the reputation of the business, may make it harder for it to obtain credit (for example, from suppliers) or make it difficult to pay wages and therefore keep experienced staff.

Conclusion

Even though a business may be trading profitably, it can still fail if cash is not available. Premier League football club (and FA Cup winners) Portsmouth FC is a recent example of a business with liquidity issues.

It continued trading playing games, charging entrance fees, selling programmes and all its other activities producing cash inflows, but it failed to keep control of its cash position. It often paid its players late and eventually it was not able to pay its current debts. One of the biggest of these was to the tax authorities. This meant the club went into administration. Its position appears to be the result of poor financial management and insufficient attention given to ‘what might happen’.

Managing cash flow through the business cycle

The future for all businesses is uncertain tastes change, suppliers increase prices, interest rates go up or down, the economy itself presents uncertainty as the business cycle changes. An effective management accountant takes all these possibilities into account not just once, but on a dynamic basis, continually monitoring trends and predicting what might happen. He or she may use software or spreadsheets to play out “what if” scenarios so that the business is ready for any future changes. This information helps in planning strategic decisions for the future of businesses.

Although no-one can predict the future, management accountants have the training, confidence and knowledge of which factors have most impact to help remove or reduce uncertainties. They make sure that the business always has enough, but never too much cash.

CIMA provides the training to equip businesses with management accountants capable of leading ongoing long-term growth.