Business growth

Many business owners regard business growth as desirable. So, too, do governments. There are many ways in which businesses can grow e.g. by:

- increasing the value and volume of their sales

- employing more people

- producing a wider range of goods and services

- expanding to larger and better premises

- starting to export to other countries.

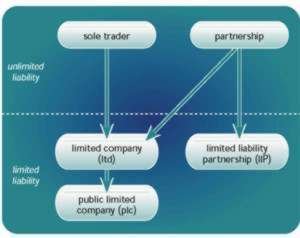

Another possible route to growth is for a business to change its ownership structure e.g. by becoming a company or a limited partnership. In the UK, large numbers of small enterprises operate as sole traders (one owner), or ordinary partnerships (small number of partners). These forms of business are easy to set up but are faced with having unlimited liability. This means that their owners are personally liable for all debts incurred by the business. They may have to sell off personal possessions to cover business debts.

For limited companies and limited liability partnerships, their owners’ liability extends only to the amount they have invested in a company or limited partnership.

By growing, businesses give themselves several advantages.

- by producing and selling on a larger scale, businesses can reduce their average costs and thereby increase profitability

- seeing their business grow motivates the owners towards even greater effort

- larger companies can raise finance more easily. For example, by becoming a public limited company (PLC) a business is able to raise funds for expansion by selling shares which are traded on the Stock Exchange.

Of course, not all companies ‘go public’. Many small and medium sized enterprises (SMEs) stay as private companies in which shares can be traded only with the permission of the Board of Directors. The UK tax system treats all businesses alike, regardless of their legal form. All businesses including sole traders need to register for tax purposes. Which taxes they pay, and how much, varies with the business’s turnover.

Growth of business and taxation

From the day that a business starts up it will engage with the tax system.

- As soon as a business employs its first member of staff it will be involved in deducting Pay As You Earn (income tax) and National Insurance payments from their wages. If it employs other people, it needs to keep full records of what it’s paid them, including wages, payments and benefits. Business owners are responsible for deducting tax and Class 1 National Insurance contributions from their employees’ pay and declaring it to the Inland Revenue. In addition the employer is responsible for payment of Class 1 employers’ National Insurance contributions.

- Self employed people must pay Class 2 National Insurance contributions. These contribute towards providing cover for eventualities such as injury leading to incapacity, and help to pay for a state pension.

- If business owners move from working in an office at home to hiring business premises they will have to pay business rates (collected by the local authority, not by Inland Revenue/Customs and Excise).

- Businesses that import parts, materials, goods or services from abroad will pay an import duty on certain items. A firm buying goods from outside the European Union will pay VAT and import duties at the goods’ point of entry. All firms importing and exporting goods must declare these transactions to Customs and Excise.

- When a businesses taxable turnover reaches the Value Added Tax (VAT) registration threshold (currently £58,000) the business must register for VAT. Businesses trading below the registration threshold can register voluntarily. This is normally done where a business incurs more VAT on its purchases than its sales (meaning that there is VAT to be reclaimed), where a customer will deal only with VAT registered suppliers or to provide business credibility. Businesses registered for VAT will charge this tax on many goods and services they supply to customers in the UK and the Isle of Man. These are known as taxable supplies. There are different VAT rates (17.5standard rate, 5reduced rate, 0zero rate) depending on the goods or services being supplied. Some items are classed as exempt from VAT.

Sole traders and partners must pay income tax on profits. Companies pay Corporation Tax on profits. To run a business as a company, shares need to be issued and directors appointed. There are a number of legal requirements. For example, all business must keep records so that they can complete tax returns.

Helping business

Government plays a key role in providing business with advice and support. For example, the government organisation Business Link gives advice and support to new businesses (see www.businesslink.gov.uk). Regional Selective Assistances, a system of government grants, also provide help on new business projects. For people new to running a business, the taxation system may seem daunting. Inland Revenue/Customs and Excise therefore provides a range of useful support services, including advice on:

- The taxes a business has to pay. The Inland Revenue/Customs and Excise have Business Support staff; websites and Advice Lines that provide specific advice e.g. how to register for VAT, Income Tax requirements for small businesses, Corporation Tax obligations for companies.

- Total tax liability. Self employed people must complete a self-assessment income tax form in which they declare their income for the year and claim allowable expenses. The Inland Revenue will then help the business owner to calculate their tax liability for the year, providing they have filled in their form by a specified date. The Inland Revenue has a self-assessment helpline (0845 9000 444) open from 8am to 8pm daily.

- Methods of payment. There are a number of arrangements for paying tax e.g. by direct debit, or some other agreed regular instalment payment system.

- Claimable benefits. There are various allowances against taxation. The tax authorities provide clear guidance on how businesses can benefit from these e.g. tax relief in the form of capital allowances for expenditure on business vehicles, machinery, equipment etc.

- Required documentation. The Inland Revenue/Customs and Excise advise all businesses to maintain a record system and update their records regularly. All records must be kept for five or six years from the latest date for sending back a tax return.

Reducing Costs

The tax authorities also provide businesses with help so that both they and businesses can save time and hence costs when dealing with tax issues. Online returns are an example of this approach. Nowadays, businesses can complete their tax returns and make payments online, thereby cutting costs and saving time. The tax authorities open a tax account for everyone who receives a tax return form. The Inland Revenue regularly dispatch statements setting out what has been paid, when and any outstanding balance.

Customs and Excise makes life easier for small businesses (turnover under £150,000 per annum) by letting them pay VAT as a set percentage on total turnover rather than their having to account for every transaction made at the standard rate (as is the case with larger businesses). Businesses with a turnover less than £150,000 in the first year of registration and those with a turnover of less than £660,000 after the first year can submit one annual return rather than quarterly returns and businesses with a turnover of less that £660,000 per annum can wait until they have been paid by customers before paying VAT to Customs and Excise.

Communications

To best serve the UK economy it is important for the Inland Revenue/Customs & Excise to communicate with the wider public about tax collection issues in an efficient way. There are a range of communications methods available. Clear communication helps to reduce the cost of tax collection, which leaves additional money available for other government spending projects – e.g. on schools. The tax collection authorities must communicate with businesses and with their accountants, who handle their tax affairs. Frequently used communications methods include:

The top 1000 UK companies have account managers, and meetings often take place on business premises. The Inland Revenue (www.inlandrevenue.gov.uk) has enquiry centres to deal with clients’ queries and regularly runs seminars to explain tax matters. The Inland Revenue/Customs & Excise runs Business Advice Open Days around the country with other national government departments and local business support agencies (e.g. the Small Business Service/Business Links) that are particularly useful for new business start-ups.

The mail is an important means of sending out tax forms. Nowadays, however, many business people prefer to complete their tax forms online as this is the fastest and cheapest method of communication. Queries can also be dealt with online is some cases. Telephone services provide the opportunity for advice lines. Television, newspapers and radio communication are widely used to convey messages about deadlines for self assessment and other key information. The tax authorities also use a range of ambient methods of communication such as petrol pump nozzles and even beer mats.

Conclusion

In healthy economies, businesses prosper and co-operate closely with government. The Inland Revenue/Customs and Excise play an important role not only in helping businesses to understand the tax system and pay their taxes on time with the minimum of effort. The Inland Revenue/Customs & Excise play a key role in helping new and existing businesses to create a more vibrant economy. Providing help, guidance and clear communications are important parts of this partnership process.