Zurich Insurance Group is a leading global provider of insurance services. Zurich’s mission is to help customers understand and protect themselves from risk. The company employs 60,000 staff and serves customers in 170 countries around the world.

Zurich offers General Insurance and Life Insurance products, for example:

- General Insurance: car insurance, home buildings and contents insurance

- Life assurance: life insurance, investment and pension plans.

Zurich offers its products to retail customers (mainly individuals) and corporate customers (i.e. businesses).

Life is full of uncertainty. The building you work in could catch fire. Your computer could be stolen. You may have an accident. These are all risks with a small but real probability that they may occur. Insurance provides protection against that risk. In return for a fee (a premium) it provides a financial payment in the event of financial/personal loss.

Supporting the brand

So what makes Zurich one of the leading insurance companies? It starts with Zurich’s brand, reputation for quality customer service and solid financial strength. The insurance industry is tightly regulated, requiring strict standards and highly skilled finance professionals. Zurich, therefore, aims to attract the best graduates. Zurich’s ethos is underpinned by its core values:

A key component of Zurich’s values is corporate responsibility. Being a responsible company is fundamental to Zurich’s long-term sustainability. For example, Zurich Community Trust in the UK actively helps over 600 charities make a difference to the lives of thousands every year.

Insurance is an extremely competitive market. Customers will obtain quotes to find the best value either from Zurich directly or through a financial adviser. This case study shows how Zurich’s careful approach to budgeting is a contributory factor in gaining a competitive advantage.

What is a budget?

An organisation must earn enough revenue so that after all costs have been subtracted, there is a profit remaining. One of the most useful financial tools is the budget. A budget is a business plan expressed in financial terms. Budgets can be drawn up for sales, costs or investment spending. A budget will include a degree of prediction of performance which

is usually based on past data, e.g. sales.

It is important that it is a realistic financial plan that the business can fulfil. Managers at all levels will have their own budget plans, designed to co-ordinate with and contribute to the overall plan or master budget. Therefore, managers need to be involved in contributing information to the budget to which they will be committed.

Budgets should be stretching but achievable. They should enable companies to meet both short and long-term financial and strategic objectives, whilst providing motivational targets (potentially linked to bonus payments) for managers to promote the right behaviours. All budgets must be carefully monitored, reviewed and, if appropriate, re-assessed as internal factors (e.g. a major project costs significantly less or more than expected) and external factors (e.g. regulatory developments) change.

Core business segments

Zurich has three core business segments: General Insurance (e.g. car, home), Global Life (e.g. life assurance, pensions and investments) and Farmers (core North-American business). These segments are divided into regions, for example, Europe, and then into business units, for example, UK Life. Through discussion with various stakeholders, budgets are set for each business unit, with the combined budgets supporting Zurich’s overall corporate aims.

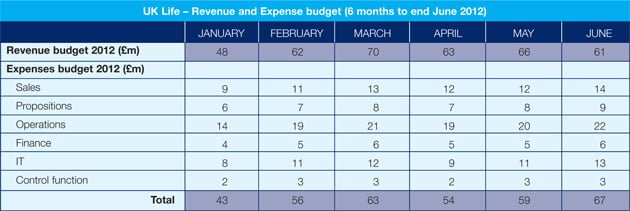

For example, the table below shows the revenue and expense budgets for UK Life. The expenses budget is broken down by function. (All figures are for illustration only.)

Benefits of budgeting

Budgets are a financial representation of an organisation’s strategy. The process of budgeting requires managers to plan ahead, for example, to identify the resources required to meet targets. This is particularly important in the insurance industry due to the complex nature of the products offered. Insurance generally addresses medium- and long-term needs of customers. Decisions taken now are likely to have financial implications for many years to come.

For example, in the UK, Zurich offers a protection product which provides a payment in the event of the death of the policyholder to pay off an outstanding mortgage. Typically, this product offers protection for 15 to 25 years. Zurich guarantees a price to the policyholder for the whole term. If the outcome is different to that which was assumed when the price was set (e.g. fewer or more deaths occur or fewer or more policies are cancelled than expected), Zurich will either make a profit or a loss on that product. Due to the long-term nature of these products any profit will emerge over many years.

Analysing variances

The budgeting process can be used for monitoring and control of financial performance. Results can be reviewed as frequently as necessary against budgets to identify good and poor performance areas. Managers need to investigate the difference or variance between budgeted and actual results.

Where actual figures are worse than budgeted, these are called adverse variances. Adverse variances may suggest problems. Where budgets are not being met, action can be taken. Budget targets can be highly motivational and staff who meet or exceed budgeted targets may be rewarded with bonuses.

Challenges of effective budgeting

Suppose sales volume, prices and costs were all projected to rise annually by 10% (incremental budgeting). This would make budgeting easy, but it is highly unlikely. Increasing sales may require price reductions and discounts. Successive rises in sales volume might bring economies of scale but might need investment to expand production in order to meet that demand.

Effective budgeting is full of challenges. Whilst financial accounts relate to the past, budgets are about the future. All data is therefore planned rather than actual, probable rather than definite.

Assumptions

Budgets are based on a number of assumptions. Some of these are explicit, such as what the cost of labour and raw materials will be or what market research results indicate about likely customer demand. Others are more implicit. A change in leadership in the sales team, a good relationship with a new supplier or changes in the organisation’s external environment could all affect budget projections.

Zurich may face unanticipated changes in legal or financial regulations or a change in market dynamics brought about by economic factors or the actions of competitors. An insurer needs to predict the risks its insurance policies protect against, both short-term risks, such as floods and earthquakes and longer-term risks, such as mortality rates. Budgets also need to reflect the business’ need to invest in specific projects or long-term improvements.

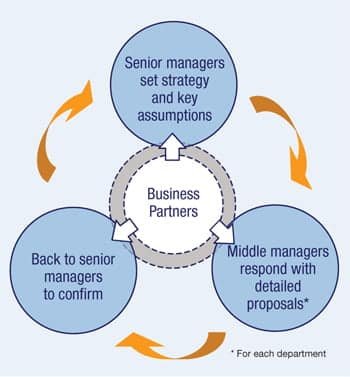

Zurich Business Partners

Budgets may also cause conflict between departments. For example, the allocation of additional budget to sales and marketing could result in operational areas receiving a reduced budget. Within Zurich, conflict between departments is resolved with the help of Business Partners. These work with the different departments to achieve an appropriate and fair division of the budget, in line with the business’ and senior management’s objectives.

Analysing budgeting data may uncover opportunities that would otherwise have remained hidden. Therefore budgets must be set using the best information available but have flexibility in order to respond to the changing business environment.

Setting and using budgets

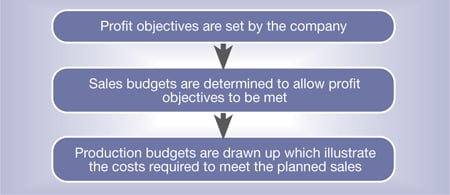

Having established the core financial objectives, often referred to as key performance indicators, the strategies to achieve them can be set in one of two main ways. The budgeting process can be:

- ‘top-down’ – i.e. set by senior managers and directed downwards, often based on previous results

- ‘bottom-up’ – i.e. evolving upwards from middle managers, through the use of detailed analysis, for confirmation by senior management.

In practice, at Zurich there are elements of both approaches. Senior management undertakes the topdown ‘ambition setting’. This gives the strategic context. Managers then consider historical data, prevailing trends and any new drivers in order to formulate proposed budgets.

Zurich Business Partners help to ensure ‘joined-up budgeting’ between areas of the business:

- Revenue centres generate income. They prepare sales budgets.

- Cost centres generate expenses. They prepare operating or production budgets.

- The profit budget draws together all the budgets for revenues and costs to meet overall financial objectives.

Zero-based budgeting

An alternative approach to incremental budgeting is zero-based budgeting. This means that each expenditure budget starts with a zero allocation each year. Managers must justify each element of the budget they propose. This has the advantage of making managers think proactively about what funds they need. It also avoids the tendency simply to add a percentage of the previous year’s budget or assume that expenditure will remain the same. However, one major disadvantage of this approach is the increased demand on staff time, which is an expensive resource with an opportunity cost.

Monitoring the budget

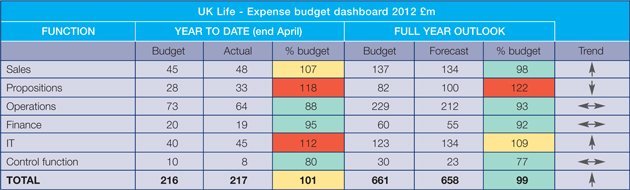

The first results against budget may show that the business is not exactly on target. The budget then becomes a ‘dashboard’ to assess all the factors and make the necessary changes to reach goals. Variance analysis is used to identify differences between budgeted and actual figures. This can be demonstrated using the illustrative expenditure budget for UK Life.

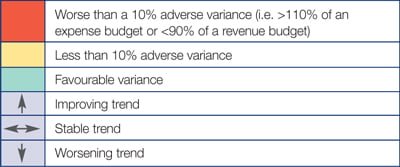

Results better than or on budget are ‘green’ and represent no immediate problem. They may be worth investigation to understand new practices or to exploit new opportunities. Results that are only mildly outside expectations are ‘amber’. These may need attention particularly if there is a worsening trend. Finally, there are the adverse (‘red’) results. Red areas demand immediate investigation and remedial action to bring performance back to budget. All results should be investigated based on the level of risk each deviation poses to meeting the overall business goals, but priority should be given to red areas.

Zurich Business Partners assist managers in understanding and explaining current performance by identifying the root causes of any deviations from the budget. They also look forward – known as forecasting – to assess how those deviations will affect the performance compared to the budget over the remainder of the period and in the context of overall objectives.

A deviation may be explained by an unforeseen event; it may be the beginning of a major adverse trend that requires a counter-strategy. Analysing recent trends can act as an ‘early warning’ system and may indicate how the business’ performance will evolve in the future.

Conclusion

The Zurich brand is associated with trust and reliability. Quality is at the heart of its customer appeal.

However, it is also about innovation and being an industry leader, both in its operations and responding quickly to emerging risks and opportunities. This allows Zurich to deliver what matters when it matters.

The budgeting process is a source of competitive advantage. Effective budgeting requires careful research and realistic planning as well as collaboration. It can help to set high objectives or move the business into new territory. The level of ‘stretch’ or challenge in a budget will depend on an organisation’s culture and ambition. Some businesses may be prepared to accept a higher risk profile for a better return. This in turn will depend on the influence of key stakeholders, such as shareholders.

To ensure the company has the capability to achieve its aims, Zurich employs graduates and finance professionals who are skilled in managing and interpreting budget dashboards.