With COVID-19 restrictions taking place across the world, financial institutions are re thinking their overall strategy in terms of lending money. Almost every sector has been punished over the past few months, specially the banking sector. Therefore, now it is more necessarily than ever to keep a good and healthy credit score.

What does it means to have a good credit score?

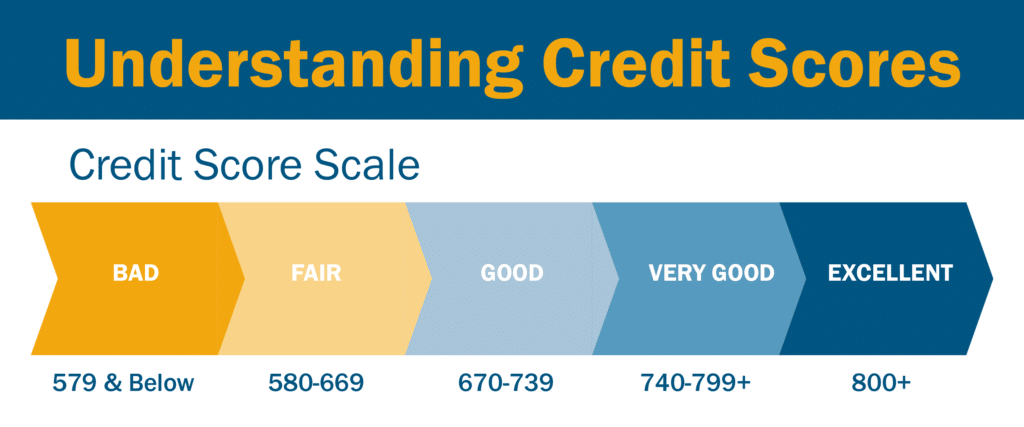

On average, having a credit score between 300 and 800 is considered as being genuinely good. This number is used by money lenders, banks and credit bureaus to asset you a classification if you are considering to apply for any kind of credit (personal, loan, car loan, mortgage loan. Your credit score is, therefore, an essential factor that will determine their decisions.

All your information will then be available to bureaus in the form of credit reports, which will be in your records up to seven years.

On the other hand, if financial institutions make the decision of not to offer you a certain kind of credit, there are some other options you can always qualify for. Unsecured borrowing options are a good example of that, as you can apply for credit even when you have a bad credit rating.

Here I shed some light on how to improve your credit score:

- Pay your bills on time

This is one of the most important factors that will help you when building up some credit. Paying your bills on time and therefore not accumulating debts will prove that you are able to manage your finances adequately.

- Review your credit report

You can apply for one free credit report each year, which is a fantastic idea to spot any mistakes or errors you might find. If you ever find them, do not forget to report it to your credit bureau as soon as you can.

- Call your creditors

Contact your creditors and set up payments plans.This could be a handy idea if you have missed some payments, as this factor won’t affect negatively your credit score again.

- Do not close too many credit accounts at once

This is an extremely harmful practice for your credit score. If you close too many credit accounts at the same this will negatively impact your credit score. Your credit history matters, so if you have to close any accounts, it is best for you to close new ones.

- Review your account type and fees

It might be worth to check on your bank account type and see if this is the right option for your finances. Banks always give their customers various options regarding account types, so you should check if you are paying too many fees or interest. Your current account can offer you different options based on your finances goals.

- Make a list of your expenses

This is a basic top tip that will help you boost your finances quickly. Make a list of your monthly expenses (gas, light bills, groceries, etc.) and try to withdrawal all those luxuries that you cannot afford.

- Pay two times a month

Making two different payments per month and it will be easier for you to be on time ahead of the closing date. Ideally, make a payment at the beginning of the month, and then make a second one right before the closing date. This is a smart option that will assure that you have enough money to cope with your payments or debts.

- Lift your credit limits

This will help you out to keep expenses ratios low, therefore it is the perfect option if you are always expending more than you can afford. However, this could be detrimental if you have missed any payments with your issuer.

- Low your credit utilization rate

Your credit utilisation rate is how much credit you do have available for use. For example, if you have a credit limit of 400$ but you have spent 200$, your credit utilisation will be 50%.

- Ask for help

Last but not least, if you see that you cannot are not able to build upon your credit rate, you can always ask for expert advice. Having a healthy credit score will have a positive impact on your overall finances and on your credit history.