Business valuation is a critical process that determines the economic value of a business or company. This process is essential for various reasons, including mergers and acquisitions, investment analysis, financial reporting, and taxation. Understanding the value of a business can provide insights into its financial health, operational efficiency, and market position.

The methods employed in business valuation can vary significantly, depending on the purpose of the valuation and the nature of the business itself. There are several established approaches to business valuation, each with its own set of methodologies and applications. These approaches can be broadly categorised into four main types: market approach, income approach, asset-based approach, and cost approach.

Each method offers unique insights and is suited to different types of businesses and circumstances. For instance, a start-up may be valued differently than a well-established corporation due to their differing financial histories and market positions. Understanding these methods is crucial for business owners, investors, and stakeholders who seek to make informed decisions based on accurate valuations.

Summary

- Business valuation methods are essential for determining the worth of a business and are used by investors, stakeholders, and business owners.

- Market approach valuation methods involve comparing the business to similar businesses that have been sold recently to determine its value.

- Income approach valuation methods focus on the potential income and cash flow of the business to determine its value.

- Asset-based valuation methods calculate the value of a business based on its tangible and intangible assets.

- Cost approach valuation methods determine the value of a business by calculating the cost to replace its assets.

Market Approach Valuation Methods

The market approach to business valuation is predicated on the principle of supply and demand, assessing how similar businesses are valued in the marketplace. This method typically involves comparing the subject business to other businesses that have recently been sold or are currently for sale. The most common techniques within this approach include the guideline public company method and the comparable transactions method.

In the guideline public company method, analysts look at publicly traded companies that are similar in size, industry, and operational characteristics to derive a valuation multiple. For example, if a technology firm is being valued, analysts might examine other publicly traded tech companies to determine an appropriate price-to-earnings (P/E) ratio or enterprise value-to-EBITDA (EV/EBITDA) multiple. By applying these multiples to the subject company’s financial metrics, a valuation range can be established.

This method is particularly useful for businesses in industries with a robust number of comparable firms, as it provides a market-driven perspective on value. Conversely, the comparable transactions method focuses on historical sales data of similar businesses. This involves analysing recent transactions within the same industry to identify trends in pricing and valuation multiples.

For instance, if several small retail businesses were sold for an average of three times their annual earnings, this multiple could be applied to a similar retail business to estimate its value. This method can be particularly effective in industries where market conditions fluctuate frequently, as it reflects real-time data on what buyers are willing to pay.

Income Approach Valuation Methods

The income approach centres on the idea that a business’s value is fundamentally linked to its ability to generate future income. This method is particularly relevant for businesses with stable cash flows and predictable earnings. The two primary techniques within this approach are the discounted cash flow (DCF) analysis and the capitalisation of earnings method.

The discounted cash flow analysis involves projecting the future cash flows that a business is expected to generate over a specific period, typically five to ten years. These cash flows are then discounted back to their present value using an appropriate discount rate, which reflects the risk associated with those cash flows. For example, if a company is projected to generate £1 million in cash flow next year, £1.2 million in the following year, and so forth, these figures would be discounted back to present value using a rate that accounts for market risk and the company’s specific risk profile.

This method provides a detailed insight into the intrinsic value of a business based on its future earning potential. On the other hand, the capitalisation of earnings method simplifies this process by taking a single measure of earnings—often adjusted for non-recurring items—and dividing it by a capitalisation rate that reflects the expected return on investment. For instance, if a business has adjusted earnings of £500,000 and an appropriate capitalisation rate of 20%, its estimated value would be £2.5 million (£500,000 divided by 0.20).

This method is particularly useful for businesses with stable earnings patterns but may not capture fluctuations in cash flow as effectively as DCF analysis.

Asset-Based Valuation Methods

Asset-based valuation methods focus on the tangible and intangible assets owned by a business. This approach is particularly relevant for companies with significant physical assets or those undergoing liquidation. The two main types of asset-based methods are the book value method and the liquidation value method.

The book value method calculates a company’s value based on its balance sheet assets minus its liabilities. This involves taking the total assets listed on the balance sheet—such as property, equipment, inventory, and accounts receivable—and subtracting total liabilities like loans and accounts payable. For example, if a manufacturing company has total assets worth £5 million and total liabilities of £2 million, its book value would be £3 million.

While this method provides a straightforward calculation of value based on recorded financial data, it may not accurately reflect current market conditions or the true economic value of intangible assets such as brand reputation or intellectual property. In contrast, the liquidation value method estimates how much a company’s assets would fetch if sold off individually in a distressed sale scenario. This approach is often used when a business is facing bankruptcy or significant financial distress.

For instance, if a company has assets that could realistically be sold for £4 million in a liquidation scenario but has liabilities amounting to £3 million, its liquidation value would be £1 million. This method provides a more conservative estimate of value and is particularly relevant for stakeholders assessing potential recovery in adverse situations.

Cost Approach Valuation Methods

The cost approach values a business based on the costs incurred to create or replace its assets. This method is particularly useful for valuing businesses with significant tangible assets or those in industries where replacement costs are critical for determining value. The two primary techniques within this approach are the replacement cost method and the reproduction cost method.

The replacement cost method estimates how much it would cost to replace an asset with a similar one at current market prices. For example, if a company owns machinery that could be replaced for £200,000 today, this figure would be used in determining the overall asset value of the business. This method is particularly relevant in industries such as manufacturing or construction where physical assets play a crucial role in operations.

Conversely, the reproduction cost method goes one step further by estimating how much it would cost to reproduce an exact replica of an asset using current materials and labour costs. This method can be particularly useful for valuing unique or specialised assets that may not have direct market comparables. For instance, if a company owns custom-built equipment that would cost £300,000 to reproduce exactly as it currently exists, this figure would be factored into the overall valuation.

While both methods provide valuable insights into asset values, they may not fully account for intangible factors such as brand equity or customer relationships.

Choosing the Right Valuation Method for Your Business

Selecting the appropriate valuation method for a business requires careful consideration of various factors including industry characteristics, financial performance, and specific circumstances surrounding the valuation purpose. Each valuation approach has its strengths and weaknesses; thus, understanding these nuances is essential for achieving an accurate assessment. For instance, businesses operating in rapidly changing industries may benefit from using market approach methods due to their reliance on current market data and trends.

Conversely, companies with stable cash flows might find income-based methods more suitable as they provide insights into future earning potential. Additionally, asset-based methods may be more appropriate for businesses with significant tangible assets or those undergoing liquidation scenarios where asset values are paramount. Moreover, it is often beneficial to employ multiple valuation methods to triangulate an accurate estimate of value.

By comparing results from different approaches—such as combining income and market methods—business owners can gain a more comprehensive understanding of their company’s worth. This multi-faceted approach can also help mitigate biases inherent in any single valuation method.

Common Mistakes in Business Valuation

Business valuation is fraught with potential pitfalls that can lead to inaccurate assessments if not carefully navigated. One common mistake is relying solely on one valuation method without considering others that may provide additional insights or context. Each approach has its own limitations; thus, using multiple methods can help validate findings and provide a more rounded perspective on value.

Another frequent error involves failing to adjust financial statements for non-recurring items or anomalies that may distort true performance metrics. For example, if a company experienced an unusual spike in revenue due to one-time contracts or events, failing to adjust for this could lead to inflated earnings projections in an income-based valuation. Similarly, overlooking liabilities or contingent liabilities can result in an overly optimistic assessment of net asset values.

Additionally, not accounting for market conditions or industry trends can lead to significant miscalculations in valuations derived from market approaches. Analysts must remain vigilant about changes in economic conditions that could impact comparable sales or market multiples used in valuations.

Importance of Business Valuation Methods for Investors and Stakeholders

Business valuation methods play an integral role not only for business owners but also for investors and stakeholders who seek to make informed decisions regarding their investments or involvement with a company. Accurate valuations provide critical insights into potential risks and rewards associated with investing in or acquiring a business. For investors considering equity stakes or acquisitions, understanding a company’s true worth helps them negotiate better terms and avoid overpaying for an investment.

Furthermore, accurate valuations can assist stakeholders in assessing whether their investments align with their financial goals and risk tolerance levels. Moreover, business valuations are essential during strategic planning processes as they inform decisions related to mergers and acquisitions, divestitures, or capital raising efforts. Stakeholders rely on these assessments to evaluate potential synergies from mergers or determine fair pricing during negotiations.

In conclusion, mastering various business valuation methods equips stakeholders with essential tools for navigating complex financial landscapes while making informed decisions that drive growth and success.

If you are interested in learning more about the role of international SEO in business, you should check out the article The Role of International SEO in Forex Business: Interview with SEO Manager Mark Rushworth. This article discusses how international SEO can play a crucial role in the success of a business operating in the forex industry. Understanding the importance of SEO in a global market can help businesses reach a wider audience and increase their valuation.

FAQs

What is business valuation?

Business valuation is the process of determining the economic value of a business or company. It is commonly used for various purposes such as mergers and acquisitions, financial reporting, taxation, and litigation.

What are the methods used for business valuation?

There are several methods used for business valuation, including the income approach, market approach, and asset-based approach. The income approach includes methods such as the discounted cash flow (DCF) method and the capitalization of earnings method. The market approach includes methods such as the comparable company analysis and the precedent transaction analysis. The asset-based approach includes methods such as the book value method and the liquidation value method.

What is the income approach to business valuation?

The income approach to business valuation focuses on the future earning potential of the business. It includes methods such as the discounted cash flow (DCF) method, which calculates the present value of the business’s future cash flows, and the capitalization of earnings method, which determines the value of the business based on its expected future earnings.

What is the market approach to business valuation?

The market approach to business valuation involves comparing the business to similar businesses that have been sold or are publicly traded. It includes methods such as the comparable company analysis, which compares the business to similar publicly traded companies, and the precedent transaction analysis, which compares the business to similar companies that have been sold.

What is the asset-based approach to business valuation?

The asset-based approach to business valuation focuses on the value of the business’s assets. It includes methods such as the book value method, which calculates the value of the business based on its balance sheet, and the liquidation value method, which determines the value of the business’s assets if they were to be sold in a liquidation scenario.

What factors are considered in business valuation?

Factors considered in business valuation include the business’s financial performance, market conditions, industry trends, competitive landscape, management team, and intangible assets such as intellectual property and brand value. These factors can vary depending on the specific method used for valuation.

Developing an effective organisational structure (MP3)

Developing an effective organisational structure (MP3)  Intellectual Property Office A3 ePoster Edition 13 "Intellectual property rights and entrepreneurship"

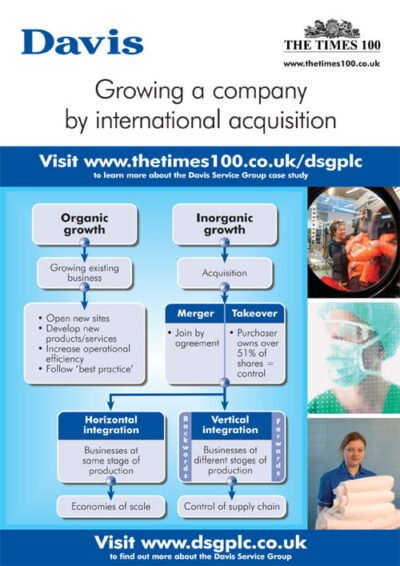

Intellectual Property Office A3 ePoster Edition 13 "Intellectual property rights and entrepreneurship"  Davis Service Group A3 ePoster Edition 13 "Growing a company by international acquisition"

Davis Service Group A3 ePoster Edition 13 "Growing a company by international acquisition"  Corporate Citizenship and the community (PDF)

Corporate Citizenship and the community (PDF)  Financial management in a retail setting (PDF)

Financial management in a retail setting (PDF)  Tesco A3 ePoster Edition 16 "Developing appropriate leadership styles"

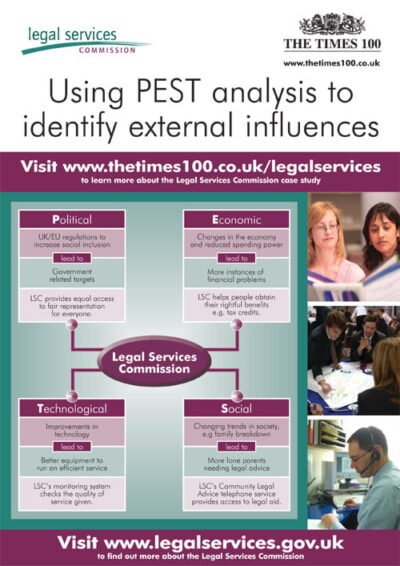

Tesco A3 ePoster Edition 16 "Developing appropriate leadership styles"  Legal Services Commission A3 ePoster Edition 13 "Using PEST analysis to identify external influences"

Legal Services Commission A3 ePoster Edition 13 "Using PEST analysis to identify external influences"