A public offering refers to the process through which a company offers its shares or securities to the general public for the first time. This is typically done through an Initial Public Offering (IPO), where a private company transitions into a publicly traded entity by selling its shares on a stock exchange. The primary objective of a public offering is to raise capital, which can be used for various purposes such as funding expansion, paying off debt, or investing in new projects.

By making shares available to the public, companies can tap into a broader pool of investors, thereby increasing their financial resources and enhancing their market visibility. Public offerings are governed by stringent regulations to ensure transparency and protect investors. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US, require companies to disclose detailed information about their financial health, business model, and risks associated with the investment.

This information is typically presented in a prospectus, which serves as a critical document for potential investors. The prospectus not only outlines the terms of the offering but also provides insights into the company’s operations, management team, and future growth prospects.

Summary

- A public offering is the process of offering shares of a company to the public for the first time, allowing them to become shareholders.

- Types of public offerings include initial public offerings (IPOs), follow-on offerings, and rights issues.

- The process of public offering involves selecting underwriters, preparing a prospectus, filing with regulatory authorities, and marketing the offering to potential investors.

- Benefits of public offering include raising capital, increasing liquidity, and enhancing the company’s public profile.

- Risks of public offering include dilution of ownership, increased regulatory requirements, and potential for stock price volatility.

Types of Public Offerings

Public offerings can be categorised into several types, each serving different purposes and catering to various investor needs. The most common type is the Initial Public Offering (IPO), which marks the first time a company sells its shares to the public. An IPO allows a company to raise significant capital while providing early investors an opportunity to realise gains from their investments.

Companies often pursue IPOs when they have reached a certain level of maturity and are ready to expand their operations or enhance their market presence. Another type of public offering is the Follow-on Public Offering (FPO), which occurs when a company that is already publicly traded issues additional shares to raise more capital. FPOs can be used for various reasons, such as funding acquisitions, paying down debt, or financing new projects.

Unlike IPOs, FPOs may not generate as much excitement in the market since they involve companies that are already established. However, they can still be an effective way for companies to access additional funds while providing existing shareholders with an opportunity to increase their stake in the company. Additionally, there are rights offerings, where existing shareholders are given the right to purchase additional shares at a discounted price before they are offered to the general public.

This type of offering allows companies to raise capital while giving current investors the chance to maintain their proportional ownership in the company. Each type of public offering has its unique characteristics and implications for both the issuing company and potential investors.

Process of Public Offering

The process of conducting a public offering is intricate and involves several key steps that require careful planning and execution. Initially, a company must decide whether it is ready to go public and assess its financial health and market conditions. This decision often involves consultations with financial advisors and legal experts who can provide insights into the potential benefits and challenges of going public.

Once the decision is made, the company typically forms a team that includes investment bankers, legal counsel, and accountants to guide it through the process. The next step involves preparing the necessary documentation, including the prospectus, which must comply with regulatory requirements. The prospectus serves as a comprehensive disclosure document that outlines the company’s business model, financial statements, risk factors, and details about the offering itself.

This document is crucial for attracting potential investors and must be filed with regulatory authorities for approval before any shares can be sold. Following this, a roadshow is often conducted where company executives present their business case to institutional investors, aiming to generate interest in the upcoming offering. Once regulatory approval is obtained and investor interest is gauged through the roadshow, the company sets a price range for its shares and determines how many shares will be offered.

The final pricing is typically established just before the shares begin trading on the stock exchange. On the day of the offering, shares are officially listed, and trading commences, marking a significant milestone for the company as it transitions into a publicly traded entity.

Benefits of Public Offering

Public offerings present numerous advantages for companies seeking to raise capital and enhance their market presence. One of the most significant benefits is access to substantial financial resources. By selling shares to the public, companies can raise millions or even billions of pounds, depending on their size and market demand.

This influx of capital can be instrumental in funding expansion projects, research and development initiatives, or strategic acquisitions that can drive future growth. Moreover, going public can enhance a company’s visibility and credibility in the marketplace. Being listed on a stock exchange often increases brand recognition and can attract new customers and business partners.

Additionally, public companies are generally perceived as more stable and trustworthy due to their adherence to regulatory standards and transparency requirements. This perception can lead to improved relationships with suppliers and customers alike. Another notable benefit is that public offerings provide liquidity for existing shareholders.

Early investors or employees holding stock options can sell their shares on the open market once the company goes public, allowing them to realise gains from their investments. This liquidity can also serve as an incentive for attracting top talent, as employees may be more inclined to join a company that offers stock options as part of their compensation package.

Risks of Public Offering

While public offerings offer numerous benefits, they also come with inherent risks that companies must carefully consider before proceeding. One significant risk is market volatility; share prices can fluctuate dramatically based on market conditions, investor sentiment, or external economic factors. A company’s stock may experience sharp declines shortly after going public if investor expectations are not met or if broader market trends turn unfavourable.

Additionally, becoming a publicly traded company subjects an organisation to increased scrutiny from analysts, investors, and regulatory bodies. This heightened level of scrutiny can place pressure on management teams to deliver consistent financial performance and meet quarterly earnings expectations. Failure to do so may result in negative publicity or loss of investor confidence, which can adversely affect share prices.

Furthermore, public companies face ongoing compliance costs associated with regulatory requirements. These costs include expenses related to auditing financial statements, filing reports with regulatory authorities, and maintaining corporate governance standards. For smaller companies in particular, these costs can be burdensome and may divert resources away from core business operations.

Requirements for Public Offering

To successfully conduct a public offering, companies must adhere to specific regulatory requirements that vary by jurisdiction but generally encompass similar principles aimed at protecting investors. In the UK, for instance, companies must comply with regulations set forth by the Financial Conduct Authority (FCA) and adhere to the rules outlined in the Prospectus Regulation. This includes preparing a detailed prospectus that provides comprehensive information about the company’s financial status, business operations, risk factors, and use of proceeds from the offering.

In addition to preparing a prospectus, companies must also undergo due diligence processes conducted by underwriters and legal advisors. This involves scrutinising financial statements, assessing business operations, and ensuring compliance with applicable laws and regulations. The due diligence process helps identify any potential issues that could affect investor confidence or lead to legal complications down the line.

Moreover, companies must meet specific financial thresholds to qualify for listing on stock exchanges such as the London Stock Exchange (LSE). These thresholds often include minimum market capitalisation requirements and standards related to revenue or profit margins. Meeting these criteria ensures that only financially sound companies are allowed access to public markets, thereby protecting investors from potential losses associated with investing in underperforming firms.

Role of Underwriters in Public Offering

Underwriters play a pivotal role in facilitating public offerings by acting as intermediaries between issuing companies and potential investors. Typically investment banks or financial institutions, underwriters assist companies in navigating the complexities of going public by providing expertise in pricing shares, marketing the offering, and ensuring compliance with regulatory requirements. Their involvement is crucial in determining how many shares will be offered and at what price.

One of the primary responsibilities of underwriters is conducting due diligence on behalf of both the issuing company and potential investors. They assess the company’s financial health, evaluate market conditions, and analyse investor demand to establish an appropriate price range for the shares being offered. This process helps mitigate risks associated with mispricing shares or failing to attract sufficient investor interest during the offering.

Additionally, underwriters often engage in marketing efforts known as roadshows where they present information about the company to institutional investors. These presentations aim to generate interest in the offering and gauge demand before finalising pricing decisions. Once shares are sold during the offering process, underwriters may also provide stabilisation support by purchasing shares in the open market if prices fall below expectations shortly after trading begins.

Examples of Successful Public Offerings

Several high-profile public offerings have garnered significant attention over recent years due to their scale and impact on both markets and industries. One notable example is that of Alibaba Group Holding Limited’s IPO in September 2014 on the New York Stock Exchange (NYSE). The Chinese e-commerce giant raised approximately $25 billion in its initial offering—making it one of the largest IPOs in history at that time.

The success of Alibaba’s IPO not only underscored investor appetite for technology stocks but also highlighted China’s growing influence in global markets. Another prominent example is that of Beyond Meat Inc., which went public in May 2019 on NASDAQ. The plant-based meat alternative company raised around $240 million through its IPO while achieving an impressive first-day trading gain of over 160%.

Beyond Meat’s successful public offering reflected increasing consumer demand for sustainable food options and positioned it as a leader within its industry. In Europe, Deliveroo’s IPO in March 2021 was met with mixed reactions but remains significant due to its implications for tech-driven food delivery services. Although Deliveroo’s share price fell below its initial listing price shortly after debuting on the London Stock Exchange (LSE), it nonetheless represented a landmark moment for tech IPOs in London amid growing competition from other European markets.

These examples illustrate how successful public offerings can not only provide substantial capital for companies but also shape industry trends while influencing investor behaviour across global markets.

A public offering, also known as an initial public offering (IPO), is the process by which a company offers its shares to the public for the first time. This allows the company to raise capital by selling ownership stakes to investors. In a recent article on Business Case Studies, the concept of risk-taking in the business world is explored, highlighting the importance of understanding the potential downsides of public offerings. This article sheds light on the complexities involved in such financial transactions and the need for careful planning and consideration before going public.

FAQs

What is a public offering?

A public offering, also known as an initial public offering (IPO), is the process by which a company offers its shares to the public for the first time, allowing individuals to become shareholders in the company.

How does a public offering work?

In a public offering, a company works with investment banks to underwrite and sell its shares to the public. The company typically files a registration statement with the relevant regulatory authorities, such as the Securities and Exchange Commission (SEC) in the United States, outlining details about the offering and the company’s financials.

Why do companies do public offerings?

Companies conduct public offerings to raise capital for various purposes, such as funding expansion, paying off debt, or allowing early investors and founders to cash out their investments. Going public also provides the company with increased visibility and access to public markets for future fundraising.

What are the benefits of a public offering?

Going public through a public offering can provide a company with access to a larger pool of capital, increased liquidity for existing shareholders, enhanced credibility and visibility, and the ability to use its shares as currency for acquisitions and employee compensation.

What are the risks of a public offering?

Public offerings can be complex and costly, and companies may face increased regulatory and reporting requirements, as well as the need to manage shareholder expectations and market volatility. Additionally, going public can result in a loss of control for the company’s founders and early investors.

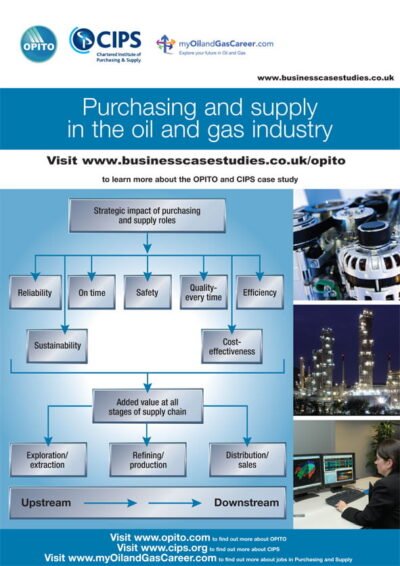

OPITO A3 ePoster Edition 17 "Purchasing and supply in the oil and gas industry"

OPITO A3 ePoster Edition 17 "Purchasing and supply in the oil and gas industry"  CMC A3 ePoster Edition 14 "Enterprise in the fast lane"

CMC A3 ePoster Edition 14 "Enterprise in the fast lane"