The Monetary Policy Committee (MPC) is a pivotal institution within the framework of a nation’s economic governance, particularly in the context of central banking. Established to oversee and implement monetary policy, the MPC plays a crucial role in maintaining economic stability and fostering sustainable growth. Its primary objective is to control inflation while supporting the broader economic goals of employment and growth.

The MPC operates under the auspices of the central bank, which in many countries is tasked with ensuring that monetary policy aligns with the overall economic strategy of the government. The significance of the MPC cannot be overstated, especially in an era marked by global economic interdependence and volatility. The decisions made by the MPC can have far-reaching implications not only for domestic markets but also for international financial systems.

As such, understanding the workings of the MPC is essential for grasping how monetary policy influences various economic indicators, including interest rates, inflation, and employment levels. The committee’s actions are closely monitored by economists, policymakers, and market participants alike, as they provide insights into the future trajectory of a nation’s economy.

Summary

- The Monetary Policy Committee (MPC) is a key decision-making body within the Bank of England responsible for setting monetary policy to achieve the government’s inflation target.

- The MPC’s role and responsibilities include setting the official interest rate, influencing the supply of money and credit in the economy, and providing guidance on the future path of monetary policy.

- The MPC is composed of nine members, including the Governor of the Bank of England, two Deputy Governors, and four external members appointed by the Chancellor of the Exchequer.

- The decision-making process of the MPC involves regular meetings to assess economic data, discuss policy options, and vote on the appropriate course of action to achieve the inflation target.

- The MPC uses tools such as interest rates, quantitative easing, and forward guidance to influence economic activity and inflation, with the aim of promoting a stable and sustainable economy.

- The decisions of the MPC can have a significant impact on financial markets, consumer spending, business investment, and ultimately the overall health of the economy.

- The MPC has faced criticisms and controversies, including concerns about the effectiveness of its policies, its independence from political influence, and its ability to accurately forecast economic developments.

- The future outlook for the MPC will depend on its ability to navigate the challenges of a post-pandemic recovery, manage inflationary pressures, and adapt to evolving economic conditions and policy priorities.

Role and Responsibilities of the Monetary Policy Committee

The primary role of the Monetary Policy Committee is to formulate and implement monetary policy aimed at achieving specific economic objectives. One of its foremost responsibilities is to set interest rates, which directly influence borrowing costs for consumers and businesses. By adjusting these rates, the MPC can either stimulate economic activity during periods of sluggish growth or cool down an overheating economy characterised by high inflation.

This balancing act is crucial for maintaining price stability, which is often defined as keeping inflation within a target range. In addition to setting interest rates, the MPC is responsible for monitoring and analysing a wide array of economic indicators. This includes assessing inflation trends, employment figures, and overall economic growth.

The committee meets regularly to review these indicators and discuss their implications for monetary policy. Furthermore, the MPC must communicate its decisions and rationale effectively to the public and financial markets. Transparency in its operations helps to manage expectations and build credibility, which are essential for the successful implementation of monetary policy.

Composition of the Monetary Policy Committee

The composition of the Monetary Policy Committee is designed to ensure a diverse range of perspectives and expertise in its deliberations. Typically, the MPC comprises a mix of central bank officials and external members who bring varied experiences from different sectors of the economy. For instance, in the United Kingdom, the MPC consists of nine members: the Governor of the Bank of England, three Deputy Governors, and five external members appointed by the Chancellor of the Exchequer.

This structure aims to balance institutional knowledge with independent viewpoints. The inclusion of external members is particularly significant as it introduces fresh insights and challenges to conventional thinking within the central bank. These individuals often have backgrounds in academia, business, or public service, allowing them to contribute unique perspectives on economic issues.

The diversity in expertise helps to foster robust discussions during meetings and ensures that a wide array of factors is considered when making decisions about monetary policy. This collaborative approach enhances the credibility of the MPC’s decisions and reinforces its commitment to evidence-based policymaking.

Decision-making process of the Monetary Policy Committee

The decision-making process of the Monetary Policy Committee is both systematic and rigorous, reflecting the complexity of economic conditions that influence monetary policy. Meetings are typically held on a regular basis—often monthly—where members convene to review current economic data and forecasts. Prior to these meetings, extensive research and analysis are conducted by staff economists who prepare reports outlining key economic indicators and potential policy options.

These reports serve as foundational documents that guide discussions among committee members. During meetings, members engage in thorough debates regarding the appropriate course of action based on prevailing economic conditions. Each member has an opportunity to express their views, which fosters an environment of open dialogue and critical examination of different perspectives.

Following these discussions, a vote is taken on proposed policy measures, such as changes to interest rates or other monetary tools. The outcome of this vote determines the official stance of the MPC, which is subsequently communicated to the public through press releases and reports. This structured approach not only ensures that decisions are well-informed but also enhances accountability within the committee.

Tools used by the Monetary Policy Committee

The Monetary Policy Committee employs a variety of tools to implement its monetary policy effectively. The most prominent among these is the adjustment of interest rates, specifically the benchmark rate that influences borrowing costs across the economy. By raising or lowering this rate, the MPC can either encourage or discourage spending and investment, thereby impacting overall economic activity.

In addition to interest rate adjustments, the MPC may utilise other instruments such as quantitative easing (QE) or open market operations. Quantitative easing involves purchasing government bonds or other financial assets to inject liquidity into the economy, thereby lowering long-term interest rates and stimulating investment. Open market operations refer to the buying and selling of government securities in order to regulate money supply and influence short-term interest rates.

These tools are particularly useful during periods of economic downturn when traditional interest rate adjustments may be insufficient due to already low rates.

Impact of the Monetary Policy Committee’s decisions

The decisions made by the Monetary Policy Committee have profound implications for various aspects of the economy. One immediate effect is on consumer behaviour; changes in interest rates can influence borrowing costs for mortgages, loans, and credit cards. For instance, a reduction in interest rates typically encourages consumers to borrow more due to lower repayment costs, which can lead to increased spending on goods and services.

Conversely, higher rates may deter borrowing and lead to reduced consumer spending, impacting overall economic growth. Moreover, the MPC’s decisions also affect business investment decisions. Lower interest rates can incentivise businesses to take on new projects or expand operations due to cheaper financing options.

This can lead to job creation and increased productivity within sectors that are sensitive to interest rate changes. On a broader scale, the MPC’s actions can influence exchange rates; for example, lower interest rates may lead to depreciation of a currency as investors seek higher returns elsewhere. This can have mixed effects on trade balances and inflationary pressures.

Criticisms and controversies surrounding the Monetary Policy Committee

Despite its critical role in managing monetary policy, the Monetary Policy Committee has faced various criticisms and controversies over time. One common critique revolves around its perceived lack of transparency in decision-making processes. While efforts have been made to communicate decisions clearly, some argue that complex economic jargon can obscure understanding among the general public.

This lack of clarity may lead to mistrust or misinterpretation of policy intentions. Another point of contention is related to the effectiveness of monetary policy itself. Critics argue that relying heavily on interest rate adjustments may not be sufficient in addressing structural issues within an economy, such as income inequality or productivity stagnation.

During periods of prolonged low interest rates, some economists contend that diminishing returns set in, rendering further cuts ineffective in stimulating growth. Additionally, there are concerns about potential asset bubbles forming as a result of prolonged low rates, which could pose risks to financial stability.

Future outlook for the Monetary Policy Committee

Looking ahead, the future outlook for the Monetary Policy Committee will likely be shaped by several evolving economic challenges and global trends. One significant factor is the increasing complexity of global financial markets and their interconnectedness. As economies become more intertwined through trade and investment flows, decisions made by one central bank can have ripple effects across borders.

This necessitates greater coordination among central banks worldwide to address shared challenges such as inflationary pressures or financial instability. Furthermore, as economies grapple with issues such as climate change and technological disruption, there may be a growing need for monetary policy frameworks that incorporate sustainability considerations. The MPC may need to adapt its tools and strategies to address these emerging challenges while still fulfilling its core mandate of price stability and economic growth.

This could involve exploring innovative approaches such as green finance initiatives or integrating climate risk assessments into monetary policy decision-making. In conclusion, while the Monetary Policy Committee has established itself as a cornerstone of economic governance, its future will depend on its ability to navigate an increasingly complex landscape while remaining responsive to both domestic and global economic dynamics.

The Monetary Policy Committee (MPC) is a key component of the Bank of England’s decision-making process when it comes to setting interest rates and managing the economy. To understand the importance of the MPC’s role in the UK economy, it is essential to consider how businesses like Argos are affected by changes in monetary policy. Argos, a popular British retailer, relies on consumer spending and economic stability to drive sales and growth. Changes in interest rates can impact consumer confidence and spending habits, ultimately affecting companies like Argos. To learn more about how businesses can navigate economic challenges, check out this insightful article on Argos.

FAQs

What is the Monetary Policy Committee (MPC)?

The Monetary Policy Committee (MPC) is a committee of the Bank of England responsible for setting the official interest rate in the United Kingdom.

What is the role of the Monetary Policy Committee?

The primary role of the MPC is to set the official interest rate to achieve the government’s inflation target, which is currently set at 2%.

How often does the Monetary Policy Committee meet?

The MPC meets regularly, typically every month, to assess economic conditions and make decisions on the official interest rate.

Who are the members of the Monetary Policy Committee?

The MPC is made up of nine members, including the Governor of the Bank of England, the Deputy Governor for Monetary Policy, and other appointed external members with expertise in economics and finance.

How does the Monetary Policy Committee’s decisions affect the economy?

The decisions made by the MPC can have a significant impact on the economy, as changes in the official interest rate can influence borrowing and saving behaviour, investment decisions, and overall economic activity.

Developing an effective organisational structure (MP3)

Developing an effective organisational structure (MP3)  Intellectual Property Office A3 ePoster Edition 13 "Intellectual property rights and entrepreneurship"

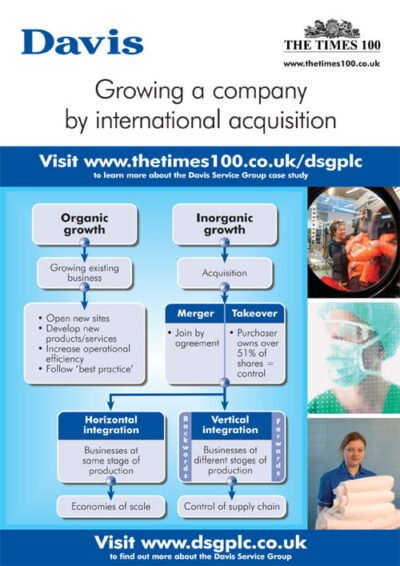

Intellectual Property Office A3 ePoster Edition 13 "Intellectual property rights and entrepreneurship"  Davis Service Group A3 ePoster Edition 13 "Growing a company by international acquisition"

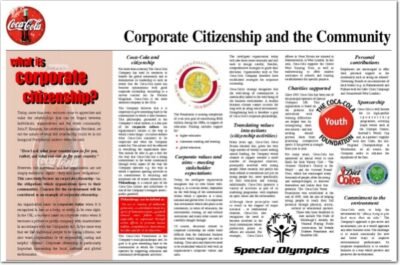

Davis Service Group A3 ePoster Edition 13 "Growing a company by international acquisition"  Corporate Citizenship and the community (PDF)

Corporate Citizenship and the community (PDF)  Financial management in a retail setting (PDF)

Financial management in a retail setting (PDF)  Tesco A3 ePoster Edition 16 "Developing appropriate leadership styles"

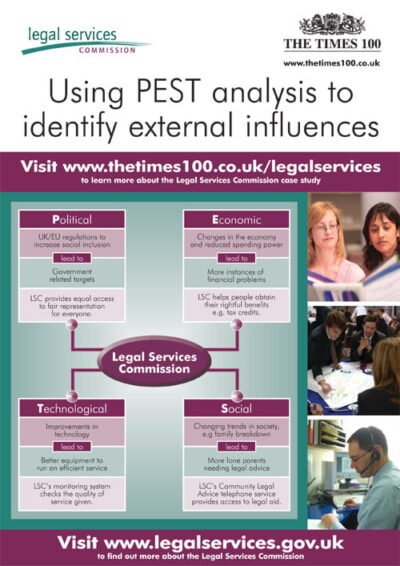

Tesco A3 ePoster Edition 16 "Developing appropriate leadership styles"  Legal Services Commission A3 ePoster Edition 13 "Using PEST analysis to identify external influences"

Legal Services Commission A3 ePoster Edition 13 "Using PEST analysis to identify external influences"  Morrisons A3 ePoster Edition 16 "Developing competitive advantage through customer service"

Morrisons A3 ePoster Edition 16 "Developing competitive advantage through customer service"