Today, there is growing concern about the number of cars and lorries on the UK’s roads, the amount of time wasted in traffic jams, and the dangers of traffic-related pollution to people’s health and the environment. Britain’s railways provide the opportunity to solve some of the transport and distribution problems individuals and organisations currently face. This case study is designed to encourage students to think about and then set out a good business case for investing in the railway service.

The 1993 Railways Act paved the way for the process of rail privatisation which has rapidly reformed Britain’s railways. The overriding aim of this privatisation was to improve the quality and efficiency of rail services by introducing private sector investment and management. Privatisation was designed to deliver new and improved benefits for passengers and to create opportunities for business.

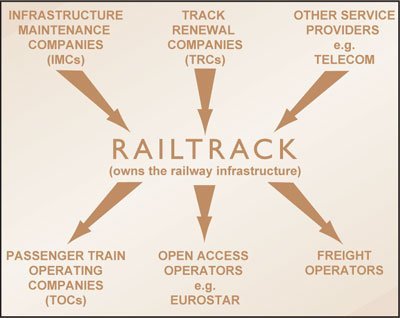

Privatisation in the railway industry involved the creation of nearly 100 different business units, the most significant of which was Railtrack. Railtrack was released from the public sector when it was floated on the Stock Exchange in May 1996 to become Railtrack Group Plc – a privately owned company.

Railtrack owns almost all of Britain’s railway infrastructure, including tracks, signalling, bridges, tunnels, stations and depots. Railtrack plays a pivotal role in the provision of rail services. It is a purchaser of services such as maintenance and track renewal and a seller of access to the UK’s rail infrastructure. Railtrack’s main customers are train operating companies and freight operating companies – not the general public and rail travellers.

Stations are a vital part of the Railtrack network. They should be pleasant, secure and well-lit places with excellent amenities to enhance the start and end of every journey. A £1 billion station regeneration programme was launched in 1997. Work at over 400 of Railtrack’s 2,500 stations has been completed and the programme is on schedule to complete before 2001.

The upgrading of Railtrack’s stations can involve anything from redecorating a platform and canopy, to reroofing or completely rebuilding entire station areas, whilst meeting the heritage challenges. Disability access, passenger security and heritage are top priorities. Good examples of improvements include:

- Euston Station roof – here and throughout the country, over 250,000 panes of glass will be replaced, covering more than 60 acres.

- Birmingham Station platform resurfacing – more than 1,000 platforms throughout the country will be resurfaced or repaired.

- Conservation work at York Station – many stations have heritage value and consultations are made with English Heritage, the Victorian Society and the Royal Arts Commission before work commences.

Creating a business case

In setting out a business case for investing in a new railway or improving an existing railway service, there are a number of questions that need to be considered. These include:

- Who are the key stakeholders in the new railway investment? How can the needs of the stakeholders best be taken into consideration?

- How will other modes of transport work in conjunction with railway?

- What is the market? For example: Is it freight? Is it short distance commuting? Is it long distance?

- How, if at all, will the proposed service fit within the current network?

- What could be done to encourage new customers to use the service? E.g. train operating companies and freight companies.

- How could the railway service be marketed to the widest audience?

- What are the key environmental issues that need to be considered?

- What are the key safety issues to be considered?

- How should the new or improved service be marketed? What is the main point of difference?

Stakeholders and infrastructure

This is an important starting point. Stakeholder groups are collections of individuals and organisations that are involved in and influenced by the actions of an organisation. Typical stakeholders in private sector organisations include:

- shareholders (people who own shares in Railtrack)

- employees (over 1,100 work for Railtrack)

- customers (e.g. the passenger train operating companies and freight operators)

- suppliers (e.g. track renewal companies)

- the Railway Regulator (who acts on behalf of Government and people to ensure that Railtrack operates in a proper and efficient way).

Creating an efficient railway infrastructure is of major importance to each group of stakeholders. An organisation like Railtrack cannot simply operate to maximise profits. It must respond to the needs and demands of its stakeholders. For example, Railtrack makes sure that its stations have suitable disability access. Another example of stakeholder concern is shown by the way in which Railtrack has a formal employee review process which looks after the training and development needs of its employees. A key criterion for any investment decision, therefore, should be that adequate attention is given to the range of key stakeholders.

The integration of transport systems has a high priority on the agenda for the development of modern economies. Whilst it makes economic sense for providers of transport services to compete against each other, it is also essential that the transport systems are integrated. For example, children going to school need to be able to use transport links which are convenient, cheap, safe and reliable. Their journey may involve several modes of transport – getting the bus to the station and then taking the train to school – and therefore efficient links between bus services, rail and roads are vital.

Wise investment in railways involves working closely with other providers of transport to provide a high quality service. Railtrack is strongly behind the Government’s decision to develop an integrated transport policy. A recent example is the Heathrow Express. This service, operated by BAA, runs from Paddington to Heathrow Airport and was launched in January 1998.

Another system which is key to developing integrated local transport plans is the Light Rapid Transit System (LRT). LRT has a broad definition which includes variants from almost heavy rail systems through to very lightweight guided vehicles. One of the benefits of LRT is that it is cheaper to construct than conventional heavy rail. Many LRT systems involve an element of on-street running as well as dedicated infrastructure for part of their operation.

Modern train protection systems can allow joint running with heavy rail on the same track. Railtrack currently has systems under construction in the West Midlands and Croydon. In addition, Railtrack has been involved in studies of variants of LRT in a number of cities including Oxford, Bristol, Cardiff, Portsmouth and Nottingham, as well as the extension of the Tyne and Wear Metro system.

The market

In order to invest intelligently in rail provision to meet increasing demand, it is necessary to understand how demand will change over time and the factors that will contribute to this change. Railtrack is therefore developing a number of models which will enable the organisation to understand both the overall level of demand for transport services and rail’s potential within that demand.

Passenger transport

The passenger transport market has grown in line with the growth in economic prosperity. In Britain, total passenger miles travelled have increased by 250% since 1960. The rail market, however, has shown little overall growth (the lion’s share of the market increase has been car transport). Government and industry forecasts show that the demand for passenger transport will increase substantially over the next 25-30 years. The critical factor for Railtrack is what element of this demand will be for travel by rail.

In the years leading up to 1998, the rail passenger industry experienced a period of very substantial growth with rates of increase of 10% a year. However, optimism associated with this figure needs to be weighed against the fact that the mid 1990s was a period of economic boom in which growth would be expected.

Currently, Railtrack’s central forecast is that rail passenger demand will increase by around 15% over the next ten years. However, figures ranging from 5-30% are possible. The higher figure would be associated with Government policies such as taxes on workplace parking and steadily increasing fuel prices.

London is a very important part of the passenger transport market – around 48% of all peak time journeys to central London on public transport are by rail. Increasing use is being made of rail for off-peak journeys for leisure and shopping. Railtrack believes there is a considerable opportunity for growth in the use of rail travel in and around London.

Freight transport

Currently, three-quarters of all rail freight lifted (measured in tonnes) and carried (tonne kilometres) is linked to just four industrial activities – coal-fired electricity generation, the production and distribution of iron and steel products, petroleum products distribution and the construction sector. However, for the first time in many years, rail freight value is growing, with a 5% increase in tonne kilometres in 1997/98 in comparison with 1996/97. Intermodal and international traffic is growing by 12% and 20% per year, respectively.

Business organisations are beginning to recognise that they will need to seek alternatives to road transport for an increasing proportion of activities. The Government is expecting private industry to pay the full environmental cost of distribution, e.g. by increasing fuel taxes and possibly, in the future, through road pricing. Railtrack estimates future growth scenarios of 80% in rail tonne kilometres, with alternative figures ranging from 40% to nearly 200%.

An important part of any justification of investment in rail development is to show how this development will fit in with the current network. This can be exemplified by Railtrack’s existing objectives for the development of its investment in infrastructural developments and services in London, i.e. to:

- maximise use of the existing network and ensure that the existing network is managed efficiently and used safely

- develop new journey opportunities and new markets including better interchanges with other transport modes

- develop cross-London routes and orbital links to minimise journeys that currently involve crossing central London

- ensure that enhancement schemes are planned to meet the needs of customers, the train operating companies, and their customers.

An example of a key plan to meet these objectives in London is the Thameslink 2000 project, which will provide additional routes through the heart of London by upgrading and installing extra connections to the present Thameslink route. On completion in 2004, the number of train paths through London will be increased from eight each way per hour in the peak to a maximum of 24 each way. The route will be capable of operating 12 car-length trains and cross-London journey times will be reduced.

Attracting customers

Railtrack’s income comes principally from access charges for using its network and facilities, such as stations, depots and other properties, from the 25 new train operating companies, as well as the freight operators who have leases for the occupation and use of freight terminals, sidings and yards. Railtrack has recently invested in track, stations and facilities in order to attract new customers and develop the rail services further.

One example of the way in which Railtrack has encouraged new customers is its investment in the West Coast Main Line. This is Great Britain’s busiest mixed-traffic railway corridor, running from London Euston through Birmingham, Manchester and Liverpool to Glasgow as well as connecting with Edinburgh. Railtrack is spending £2.2 billion on modernising this line to accommodate high speed tilting trains.

Railtrack’s investment in the line has meant that the Virgin Rail Group (the company with the franchise to run trains on the line) has been willing to invest in tilting train technology allowing trains to run at 140mph. The project will reduce journey time and provide increased performance and reliability, and improved customer satisfaction.

Marketing

It makes sound business sense to try to capture a large proportion of the available market. Railtrack’s market consists of the train operating companies and freight companies. In the case of the train operating companies, Railtrack also needs to consider their customers’ needs (i.e. rail passengers’ needs). Marketing involves identifying and anticipating customer requirements and then formulating the right marketing mix (product, price, promotion and place) to satisfy these needs.

Since privatisation, Railtrack has carried out extensive marketing activities and has engaged in communications activities (e.g. advertising, publicity and public relations) to ensure that the messages about rail improvements were reaching the target audience.

Rail investment, therefore, needs to be built on extensive market research and detailed analysis of this research. It is important to devise a marketing mix which supports product improvement.

Environment and safety issues

Railway is one of the most sustainable forms of transport available in the UK today. It is generally accepted as being more ‘environmentally friendly’ than most other forms of transport. For example, rail travel is more energy efficient, creates lower noise levels, fewer emissions and less congestion.

The environment

The environmental impact of new investment projects is a key area requiring control. New procedures have been introduced to ensure that all projects consider environmental issues at the outset and plan to manage any risks identified. Environmental Statements which document the assessment of the environmental effect of new projects such as Thameslink 2000 and the West Coast Modernisation Project have to be submitted to the Government.

Safety

Safety is a priority for any business and even more so in the transport industry. New investments in the rail transport field should always aim for the highest standards of safety. Currently, railway has the enviable record of being the UK’s safest form of land transport (it is now 22 times safer on average to travel by train than by private car), but accidents can and do happen. The most common cause of train collision and derailment is signals being passed at danger.

Railtrack has therefore invested heavily in improving and updating signalling facilities and is constantly seeking ways of eliminating potential sources of risk and danger.

Conclusion

It is essential for business organisations to establish the key points of difference between what they have to offer and what competitors are offering. In the case of the railways, there are a number of possibilities including:

- our railway heritage

- the comfort of rail travel

- the speed of rail travel

- safety

- sustainability

- avoidance of stress.

These and other factors need to be weighed up in supporting the case for new railway investment.